CICT - Acquisition of CapitaSpring to deepen Singapore presence

REITs

By Gerald Wong, CFA • 06 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

CICT will buy the remaining 55% stake in CapitaSpring for S$1,045 million, and has raised S$600 million through a private placement to fund the acquisition.

What happened?

Singapore REITs have been on an acquisition spree recently.

With interest rates falling, many REITs have started buying assets to boost their distributions once again.

In the past year, we have seen Keppel DC REIT buying data centres in Singapore, CapitaLand Ascendas REIT expand its portfolio in Singapore, and CapitaLand Integrated Commercial Trust (CICT) buying ION Orchard.

CICT has just announced another acquisition for the remaining 55% stake in CapitaSpring, a Grace A office tower in Raffles Place for S$1,045 million.

Let us dive deeper in the acquisition and find out what it means for unitholders.

What you need to know about CICT's acquisition of CapitaSpring

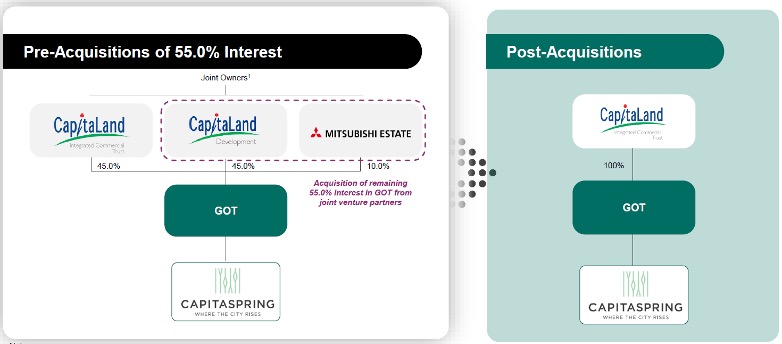

CICT announced that it will acquire the remaining 55.0% interest in CapitaSpring from CapitaLand Development Limited (45%) and Mitsubishi Estate Co., Ltd (10.0%) for S$1,045 million.

The acquisition amount is based on the property being valued at S$1.9 billion.

CapitaSpring is a 51-storey integrated development located at 86 and 88 Market Street at Raffles Place, Singapore’s Central Business District.

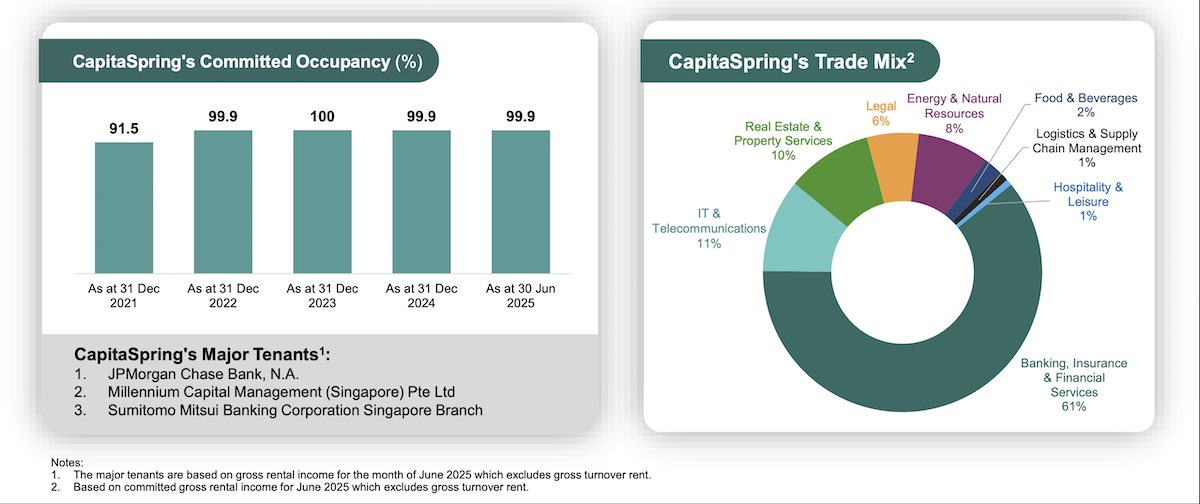

The office building has 30 tenants, and a committed occupancy of 99.9% as of 30 June 2025.

Completed in November 2021, the integrated development comprises 29 floors of premium Grade A office, ancillary retail units and a 299-unit serviced residences.

The serviced residences was divested to external parties in May 2025 for S$280.0 million, at an exit yield of approximately 3.6%.

Acquisition rationale

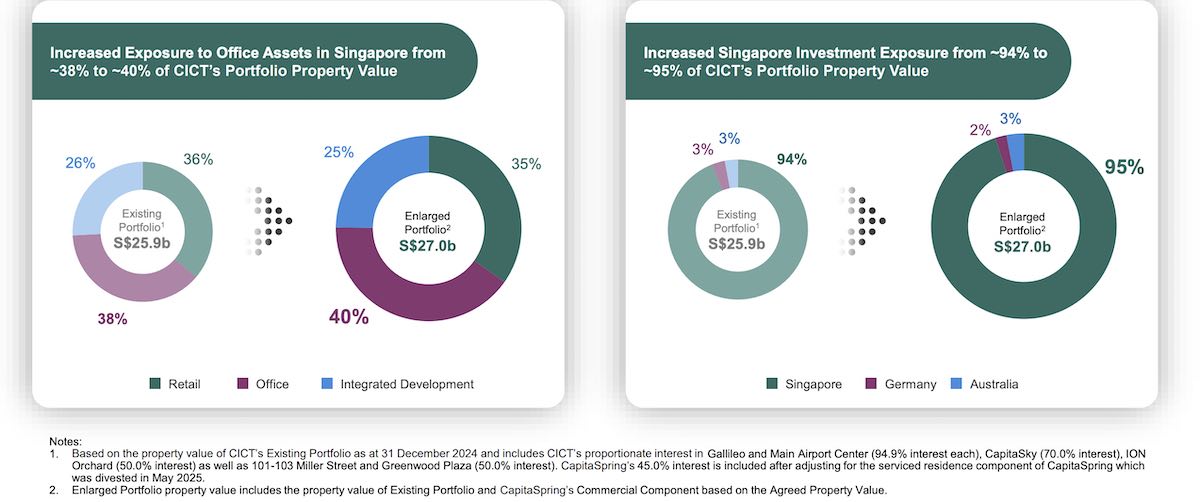

According to CICT, the acquisition is expected to increase the REIT's exposure to Singapore office assets and offer distribution per unit (DPU) accretion to unitholders.

#1 - Value creation and growth strategy

CapitaSpring comprises approximately 661,400 sq ft of office Net Lettable Area (NLA), among the best premium Grade A office assets in Singapore’s CBD.

The agreed property value represents an entry yield of low 4%.

In comparison, the serviced residence component of CapitaSpring was divested at an exit yield of approximately 3.6%, or S$280.0 million.

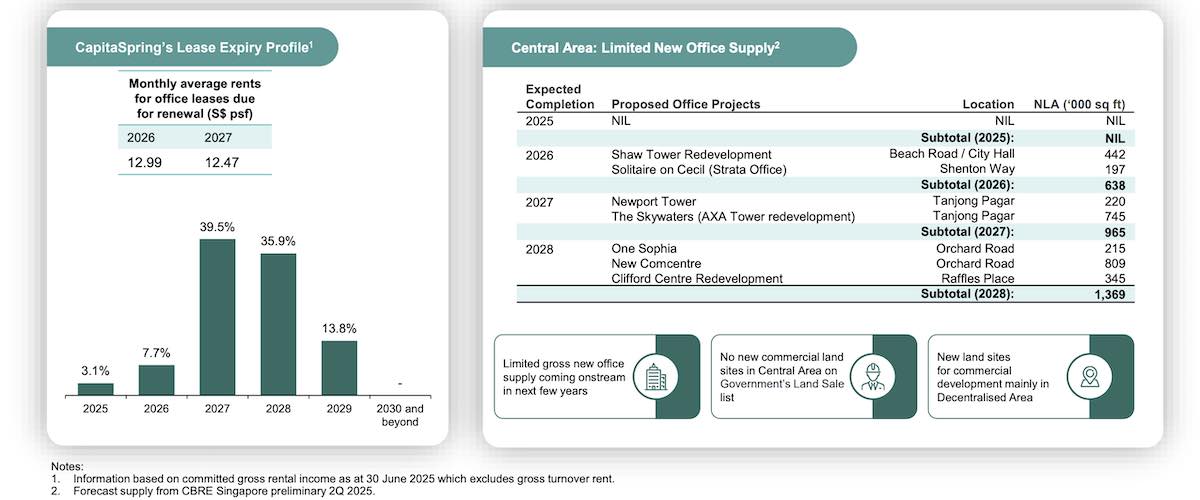

With no major additions of new premium Grade A offices in core CBD until 2028, CICT believes CapitaSpring is poised to benefit from income upside from lease renewals and new leases.

Based on Q2 2025 data, market rent of Singapore core CBD Grade A office increased 0.4% quarter-on-quarter and 1.3% year-on-year.

Vacancy rate of core CBD office market tightened to 5%. CapitaSpring’s weighted average lease term to expiry (WALE) is approximately 2.4 years.

Average rents of office leases due for renewals in 2026 and 2027 are S$12.99 per sq ft per month and S$12.47 per sq ft per month, respectively.

#2 - Strengthen portfolio resilience

CapitaSpring’s premium Grade A office and ancillary retail have consistently achieve stellar performance with near full committed occupancy over the last three years.

In addition, the good quality and tenants from diverse trade sectors, underpinned a stable cashflow for CICT.

Post acquisition, CICT’s portfolio remains well-diversified with top 10 tenants contributing 16.9% in total gross rental income, from 15.1% pre-acquisition.

#3 - Singapore-focused and high quality commercial real estate

CICT remains Singapore-focused with 95% of the portfolio property value from Singapore.

Post transaction, CICT’s portfolio property value is expected to increase to S$27.0 billion, from S$15.9 billion pre-acquisition.

#4 - DPU accretion while maintaining healthy balance sheet

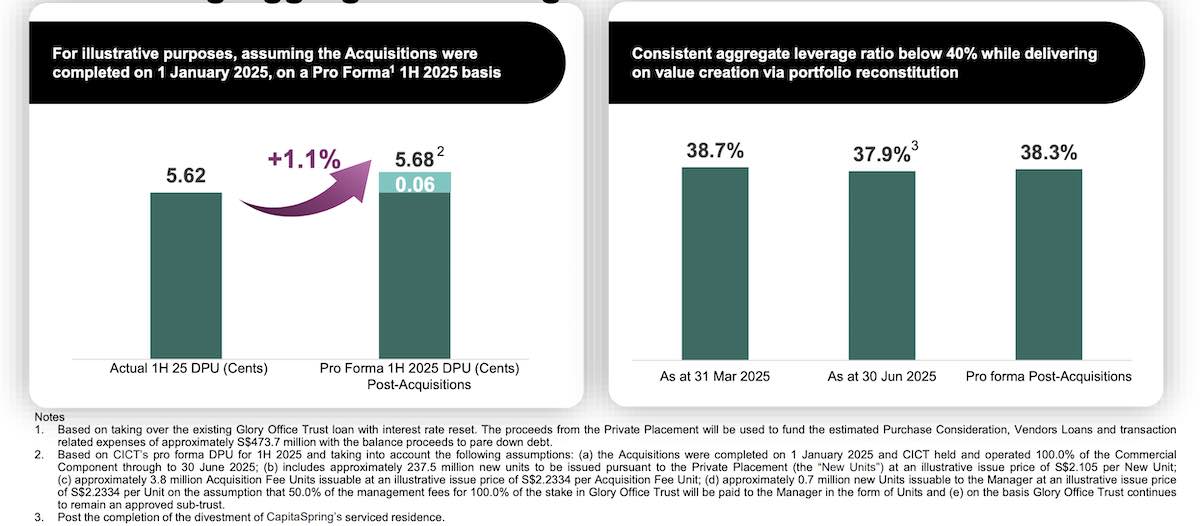

According to CICT, the acquisition is expected to be 1.1% DPU accretive to unitholders on a pro forma 1H 2025 basis, assuming S$500 million of gross proceeds from the private placement.

The aggregate leverage is expected to be approximately 38.3%, compared with 37.9% pre-acquisition, assuming S$500 million of gross proceeds from the private placement.

Transaction summary

CICT will acquire the remaining 55.0% interest in CapitaSpring’s commercial component from CapitaLand Development Limited (45%) and Mitsubishi Estate Co., Ltd (10.0%) for S$1,045 million.

The acquisition amount is based on the property being valued at S$1.9 billion.

Post acquisition, CICT owns 100% interest in CapitaSpring’s office and ancillary retail components.

The total acquisition outlay of approximately S$482.3 million, consists the estimated purchase amount of S$296.1 million, repayment of Vendor loans of S$166.7 million, acquisitions fees of S$10.5 million and S$9.0 million in other expenses.

On 6 August 2025, CICT raised S$600.0 million in gross proceeds through a private placement of 284,361,000 new units at the issue price of S$2.11 per unit.

This represents an additional gross proceeds of around S$100 million compared to the initial estimated gross proceeds of S$500 million to be raised.

The issue price of S$2.11 per unit, represents 5.53% discount to the volume weighted average price (VWAP) of S$2.2334 per unit for trades done on 4 August 2025.

The gross proceeds of approximately S$600 million will be used to fund the above acquisition (S$466.5 million); for debt repayment and/or capital expenditure (S$125.9 million) and to pay transaction-related expenses (S$7.6 million).

The acquisition is expected to complete in 3Q 2025.

What would Beansprout do?

CICT's acquisition of the remaining 55% stake in CapitaSpring will deepen its presence in Singapore, which will represent 95% of its portfolio upon completion.

It is expected to be slightly accretive to CICT's distribution per unit (DPU).

CICT recently reported a 3.5% increase in DPU in 1H 2025, supported by the contribution from its acquisition of ION Orchard in 2024.

Based on the 1H 2025 DPU of 5.62 cents declared on 5 August 2025, CICT offers an annualised dividend yield of 5.0%, close to its historical average.

At the current unit price S$2.24, CICT is trading at a price-to-book ratio of 1.08x.

To learn more about investing in Singapore REITs, check out our comprehensive review of Singapore REITs.

Check out our Singapore REITs screener to find the best Singapore REIT with the highest dividend yield.

Related links:

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in CICT.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments