T-bill yield falls to 1.77% as demand declines sharply

Bonds

By Gerald Wong, CFA • 31 Jul 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The cut-off yield for the latest 6-month Singapore T-bill on 31 July fell further to 1.77% p.a.

What happened?

If you've been eyeing Singapore T-bills as a place to generate passive income, the latest numbers might be disappointing.

The cut off yield for the 6-month Singapore T-bill (BS25115V) fell to 1.77% in the auction on 31 July 2025.

This follows the decline in the 1-year Singapore T-bill yield earlier.

With the decline in the T-bill yield, I'll share how it compares to the best fixed deposit rates as a place to park your spare cash.

What we learnt from the latest 6-month Singapore T-bill auction

#1 - Demand for the Singapore T-bill fell sharply

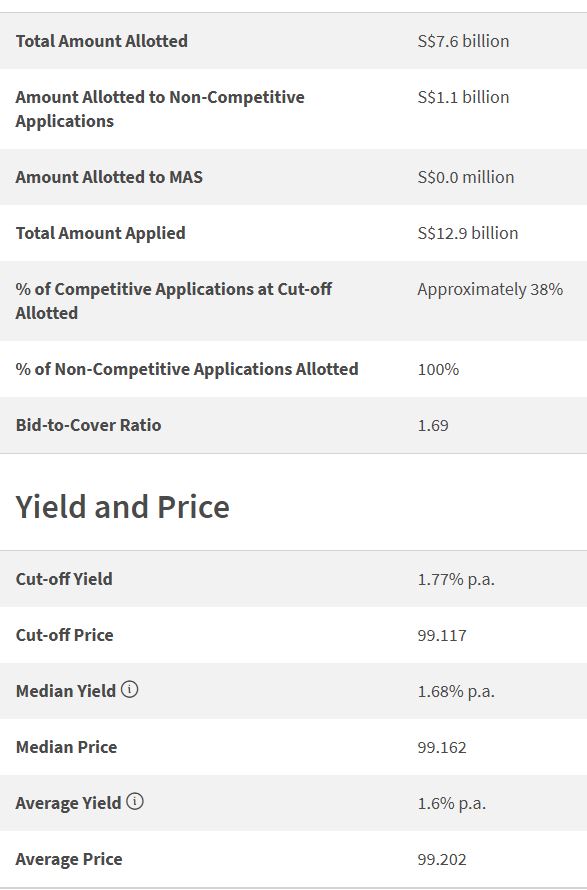

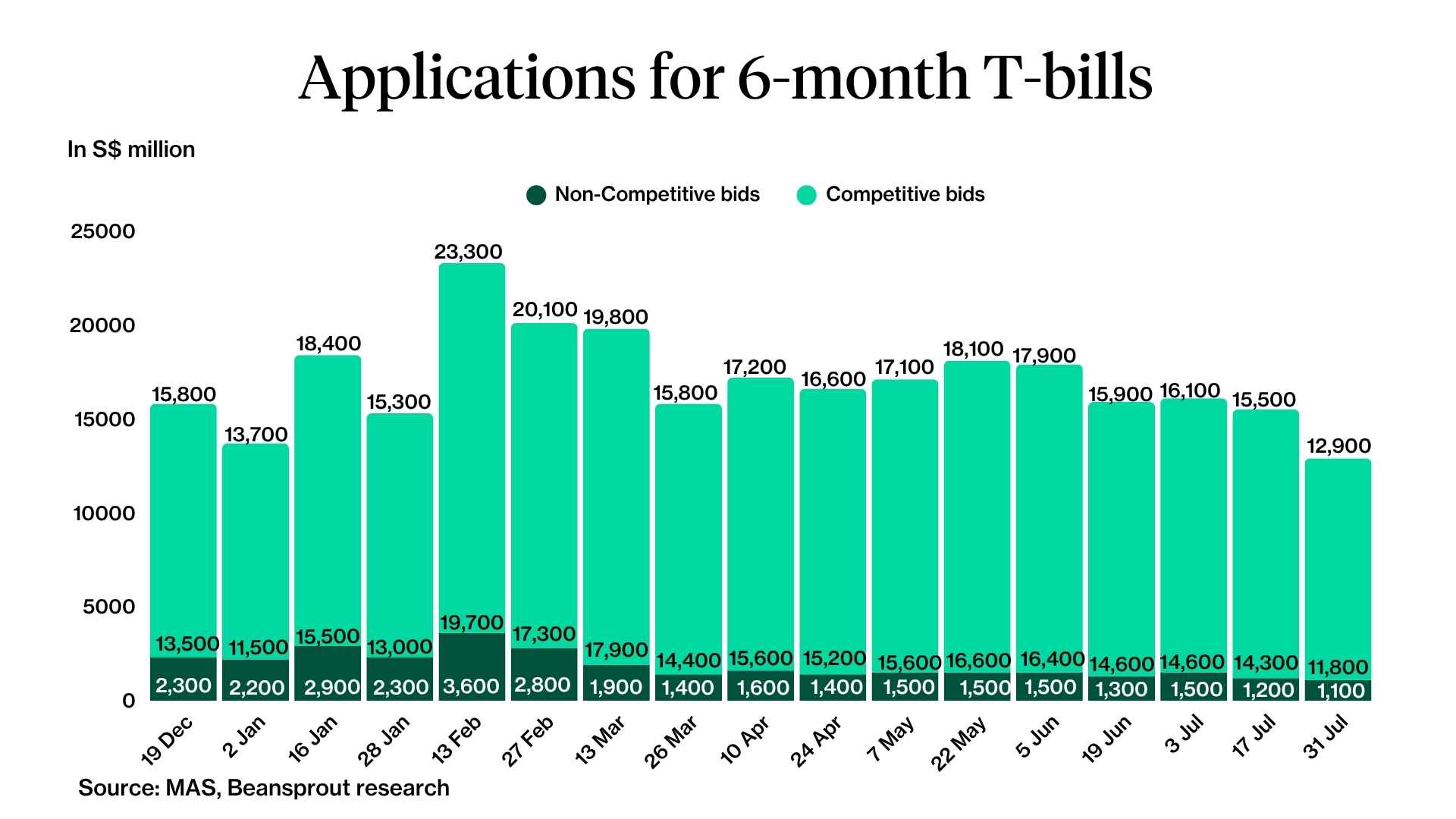

The total applications for the 6-month Singapore T-bill decreased to S$12.9 billion in the latest auction on 31 July from S$15.5 billion on 17 July.

This represents a significant decline from the recent peak of S$23.3 billion on 13 February 2025, as yields have come down by a fair bit in recent months.

In fact, it would mark the lowest levels of T-bill applications since the start of the year.

The amount of competitive bids decreased to S$11.8 billion.

If you placed a competitive bid below 1.77%, you would receive 100% of your requested T-bill allocation.

If you bid at exactly 1.77%, the allocation would be around 38%.

The amount of non-competitive bids also decreased to S$1.1 billion.

Since the amount of non-competitive bids was within the allocation limit, all eligible non-competitive bids received full allocation for the T-bill.

#2 - T-bills issued remained the same

The amount of T-bills issued was at $7.6 billion, which was the same as the previous auction.

With total applications decreasing from S$15.5 billion in the previous auction to S$12.9 billion in this latest auction, the ratio of applications to T-bills issued (bid-to-cover ratio) decreased from approximately 2.04x to 1.69x.

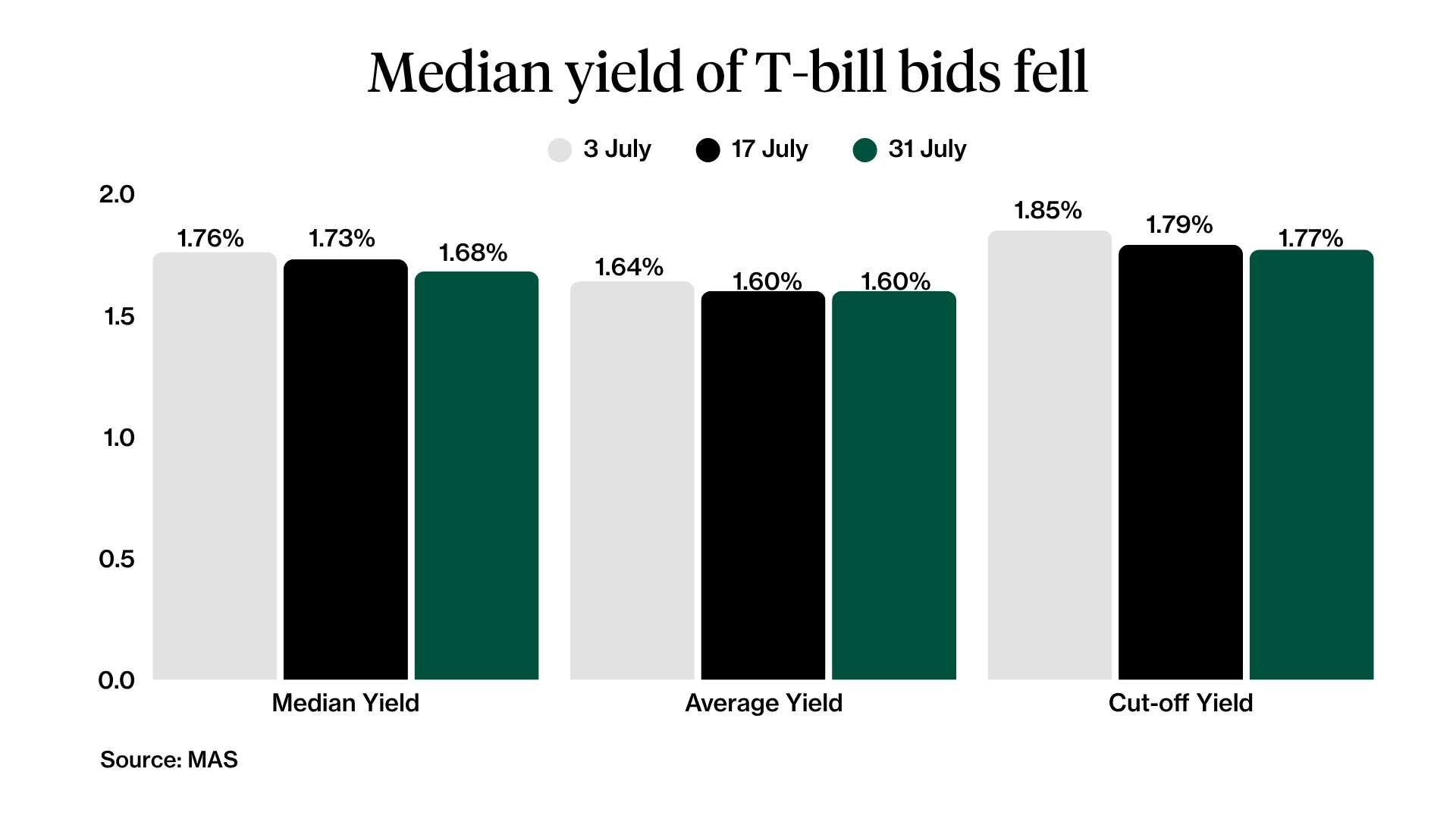

#3 - Median yield of bids submitted fell

The median yield of bids submitted fell further to 1.68% from 1.73% in the previous auction.

The average yield of bids submitted remained the same at 1.60%.

The fall in the median yield of bids submitted would be consistent with the fall in short term bond yields we have seen in recent weeks.

Given the median yield and the cut-off yield, this suggests that a substantial number of bids were placed in the 1.68% to 1.77% range, below the best 6-month fixed deposit rate in Singapore.

What would Beansprout do?

The drop in the T-bill cut-off yield to 1.77% seems to reflect falling short-term government bond yields, as seen in the lower median yield of bids submitted.

Following the decline in T-bill cut-off yields, yields have now dipped below the best 6-month fixed deposit rate in Singapore of 2.15% p.a.

They also fall short of the break-even yield for CPF OA applications, based on calculations using our CPF T-bill calculator.

In light of this, I would consider exploring alternative ways to earn passive income in Singapore.

For example, some savings accounts continue to offer an interest rate of above 1.77% p.a, even though banks have been cutting the interest rates in recent months.

Another popular option amongst investors is money market funds, which aim to provide higher potential returns compared to savings accounts, and greater flexibility compared to fixed deposits.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments