Higher CPF retirement sums in 2026. How much CPF LIFE payout can you get?

Retirement

By Gerald Wong, CFA • 23 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Find out how much monthly CPF LIFE payout you could receive under the latest retirement sums in 2026, with updated figures and payout comparisons.

What happened?

Several key changes to the Central Provident Fund (CPF) came into effect in 2026.

This would include CPF contribution changes from 1 Jan 2026, updated retirement sums, and new matched schemes.

With the increase in CPF Retirement Sums in 2026, as well as the closure of the CPF Special Account (SA) at age 55 in 2025, retirement planning has become an active topic of discussion among Beansprout community members.

One area that attracted significant attention is CPF LIFE.

In this article, we explore CPF LIFE in depth, including the available plans, estimated monthly payouts in 2026 under the new retirement sums, and key considerations to help you decide on the CPF LIFE plan that best suits your retirement needs.

What is the CPF LIFE?

The CPF LIFE, or Lifelong Income For The Elderly, is a national insurance scheme that provides you with a monthly payout regardless of how long you live.

CPF LIFE is an insurance product that protects you against the uncertainty of outliving your savings and running out of your retirement funds.

It is not an investment product intended to help you grow your wealth.

How does the CPF LIFE work?

At the age of 55, your Retirement Account is created with savings from your CPF Special Account and Ordinary Account, up to the Full Retirement Sum.

The savings in your Retirement Account will be used as the premium for CPF LIFE to provide you lifelong payouts.

You’ll be automatically included in CPF LIFE if you’re:

- A Singapore Citizen or Permanent Resident;

- Born in 1958 or after; and

- Have at least S$60,000 in your retirement savings when you start your monthly payouts

What are the CPF LIFE plans available?

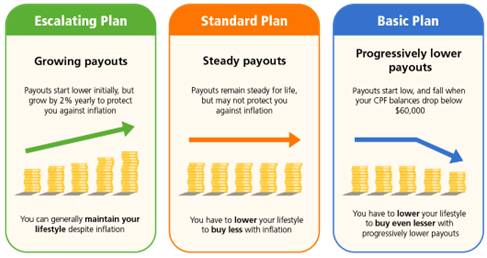

At the age of 65, you can choose from the three CPF LIFE plans that are available.

CPF LIFE Standard Plan

The Standard Plan is the default plan for CPF members who do not choose a plan when enrolled into CPF LIFE.

It offers a steady monthly payout which is higher than the Basic plan.

CPF LIFE Basic Plan

The Basic Plan offers progressively lower payouts than the Standard Plan, and will get progressively lower when your combined CPF balances eventually fall below $60,000.

With the Basic Plan, about 10-20% of your RA savings will be deducted as CPF LIFE premium when you join CPF LIFE.

As you will be receiving lower payouts with the Basic Plan, you will then be able to leave a larger inheritance to your loved ones.

CPF LIFE Escalating Plan

The Escalating Plan is designed for those who are concerned about the rising cost of living, and would like their payouts to hedge against inflation.

Unlike the Standard and Basic plans which offer steady monthly payouts, the Escalating Plan’s payouts will increase at a fixed annual rate of 2%, in return for a lower initial payout.

For example, if you start with a monthly payout of $1,000 at age 65, it will reach around $1,500 when you turn age 85. The 2% increase takes place every year in the same month that you receive your first payout.

How much monthly payment would you receive under CPF LIFE in 2026?

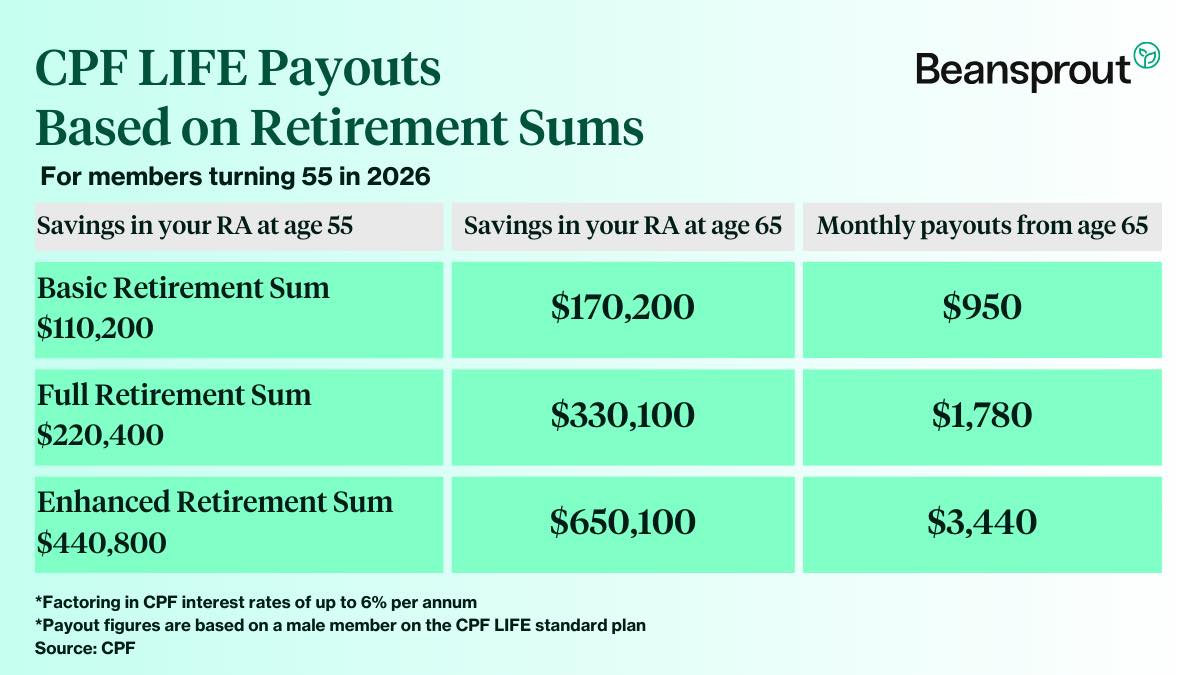

The BRS, FRS, and ERS have increased by 3.5% from 2025 levels to account for long-term inflation and standard of living improvements.

For those turning 55 years old in 2026, the estimated payout based on the CPF LIFE Standard plan is as follows.

- With the BRS of $110,200, you will receive an estimated payout of $950 per month from the age of 65.

- With the FRS of $220,400, you will receive an estimated payout of $1,780 per month from the age of 65.

- With the ERS of $440,800, you will receive an estimated payout of $3,440 per month from the age of 65.

Learn more about the CPF retirement sums here.

To get a better idea of your estimated monthly payouts, one helpful tool is the Retirement Payout Planner provided by the CPF Board.

What to consider in deciding which CPF LIFE Plan to choose?

To decide on your CPF LIFE plan, you will first need to consider the retirement lifestyle you want.

Next, you can estimate the amount of monthly payouts you will need to support the retirement lifestyle you want. Your desired monthly payouts should also take into consideration the impact of inflation.

Based on the illustrative example below, if you have a desired monthly payout of $950 from the age of 65, you will need to achieve savings of $110,200 at the age of 55, which is equivalent to the BRS for those turning 55 years old in 2026.

If you have a desired monthly payout of $1780 from the age of 65, you will need to achieve savings of $220,400 at the age of 55, which is equivalent to the FRS for those turning 55 years old in 2026.

These monthly payouts are estimates based on the CPF LIFE Standard Plan, for members who turn 65 in 2036, computed as of 2026. Do note that payouts may be adjusted to account for long-term changes in interest rates or life expectancy.

| Desired Monthly Payout from 65 | CPF LIFE Premium at 65 (Savings You Need at 65) | Savings You Need at 55 |

| $490 | $82,400 | $50,000 |

| $950 | $170,200 | $110,200 (BRS for members turning 55 in 2026) |

| $1,250 | $227,900 | $150,000 |

| $1,780 | $330,100 | $220,400 (FRS for members turning 55 in 2026) |

| $2,380 | $445,600 | $300,000 |

| $3,440 | $650,100 | $440,800 (ERS in 2026) |

| Source: CPF ^Payout figures are based on a male member and may also be adjusted to account for long-term changes in interest rates or life expectancy. Such adjustments (if any) are expected to be small and gradual. | ||

How much CPF LIFE premium balance will your loved ones receive when you pass away?

After you pass away, your loved ones will receive your CPF LIFE premium balance. This is calculated as the total CPF LIFE premium that you have paid minus the total payouts you have received.

For example, if you paid a CPF LIFE premium of $100,000 and pass away after receiving a monthly payout of $500 for 10 months, your loved ones will receive a CPF LIFE premium balance of $95,000, based on $100,000 minus 10 months of $500.

The CPF LIFE premium balance will be paid out in addition to any CPF savings to your loved ones.

Does your CPF LIFE premium continue to earn interest?

Your CPF LIFE premium will continue to earn the interest rate floor of 4% per annum, as well as extra interest of up to 2% per annum on the first $60,000 of your combined CPF balances.

CPF members aged 55 and above earn an extra 2% interest on the first $30,000 of their combined CPF balances, and an extra 1% on the next $30,000.

The interest earned is factored into your monthly payouts, and you will receive a higher monthly payout compared to a scenario where the interest is not earned.

In the illustrative example above, you will require an amount of $$110,200 set aside in your RA at the age of 55, to be able to grow your RA savings to $170,200 at the age of 65, and receive a monthly payout of $950 per month.

This is because the CPF interest rates of up to 6% per annum will help to grow your savings through compound interest.

However, do note that your loved ones will only receive your CPF LIFE premium balance when you pass away, and this will exclude any interest earned.

This is because the interest earned will be pooled to the CPF LIFE annuity to ensure that CPF LIFE members will receive monthly payouts for as long as they live.

How do you increase your CPF LIFE payouts?

Top up your RA

If you do not have sufficient CPF savings to pay the premiums required for your preferred CPF LIFE plan, you can choose to make a cash top-up or CPF transfer to your Retirement Account.

For eligible individuals, the Matched Retirement Savings Scheme (MRSS) provides a dollar-for-dollar grant (up to an annual cap of $2,000, with a lifetime cap of $20,000 for each eligible member) for every top up made to their Retirement Account.

Defer your CPF LIFE payouts

You can defer your CPF LIFE payouts to a later age, up until the age of 70, to increase the amount that you will receive later on.

For each year that you defer your payouts, your subsequent monthly payouts will increase by up to 7%.

This means that if you choose to defer until the age of 70, your monthly payouts will increase by up to 35%.

How is the CPF LIFE different from the Retirement Sum Scheme (RSS)?

The Retirement Sum Scheme (RSS) was the default scheme for CPF members before it was replaced by CPF LIFE.

Like CPF LIFE, the RSS provides CPF members with monthly payouts from the time they reach retirement age at 65.

However, CPF members under RSS will only receive payouts until their RA savings run out or when they reach 90 years, whichever is earlier.

The RSS will apply to those who are:

- Born before 1958

- Born in 1958 or after and have less than S$60,000 in your RA when your monthly payouts start OR

- Are a non-Singapore citizen or non-permanent resident.

Can you choose to join CPF LIFE voluntarily?

You can still choose to join the CPF LIFE scheme if you are a Singapore Citizen or Permanent Resident, and are not automatically included in CPF LIFE.

You can enrol yourself to the CPF LIFE scheme any time from 65 to one month before you reach 80 years old.

Can you opt out of CPF LIFE?

If you already have a pension or private annuity plan that pays the same or higher monthly payouts than CPF LIFE, you can choose to opt out.

What would Beansprout do?

CPF LIFE provides a stable foundation for retirement income, and the key for me is to focus on the retirement lifestyle I desire rather than just the plan itself.

I will start by looking at the monthly income needed to support living expenses, healthcare, travel, and other retirement goals, and whether my retirement savings are sufficient to meet these goals. Check out the Retirement Payout Planner by CPF Board to find out if your savings are enough for retirement here.

I will also consider different ways to grow our CPF retirement savings.

One of the options is to transfer funds from our CPF Ordinary Account (OA) to your CPF Special Account (SA) to earn a higher interest rate. We discuss the pros and cons of transferring to your SA here.

I can consider a Retirement Sum Top-Up (RSTU), which will also allow me to enjoy tax relief.

Alternatively, I may also choose to invest my CPF funds. We look at the different investment options eligible for the CPF Investment Scheme here.

Deferring CPF LIFE payouts until a later age, up to 70, is another strategy that can meaningfully boost monthly income, particularly if other sources of retirement income are available in the meantime.

Outside of the CPF, I will also be looking at other ways to generate passive income to strengthen my reitrement nest egg. Learn more about the different ways to generate passive income.

Finally, retirement goals and financial circumstances can change over time, so reviewing your plan periodically is a prudent approach.

[Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher within 5 working days, plus 12% p.a. interest boost coupon for 120 days (worth ~S$78) with Longbridge Cash Plus when you sign up for a Longbridge account via Beansprout. T&Cs apply. Learn more about the Longbridge promotion here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

1 comments

- Michael Koh • 28 Jan 2026 02:04 AM