Tiger Brokers CPF and SRS Investing Guide for Singapore Investors

Brokerage Account

Powered by

By Gerald Wong, CFA • 26 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Tiger Brokers now allows you to trade eligible SGX stocks and ETFs using your CPF or SRS balance with the Cash Boost account.

This post was created in partnership with Tiger Brokers Singapore. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

Investing for retirement is a big financial goal for me.

I’ve been looking to invest a portion of my CPF Ordinary Account (OA) savings, as well as my SRS funds, in recent years as I explore different ways to earn a potentially higher return on my savings.

Part of that journey has also been about finding ways to generate passive income through my investments.

So when Tiger Brokers Singapore launched a new feature on 11 August 2025 that makes it easier to invest CPF-OA and SRS funds into SGX-listed stocks and ETFs, it caught my attention.

Here’s how it works, and why it could be a useful addition to your CPF or SRS investing strategy.

Should you invest your CPF-OA funds?

Before investing your CPF-OA funds, it's important to understand the eligibility and trade-offs involved.

The CPF-OA currently offers an interest rate of 2.5% p.a., and is seen to be effectively risk-free as it is backed by the Singapore government.

You can invest your CPF-OA funds through the CPF Investment Scheme if you have more than S$20,000 in your Ordinary Account.

However, your first S$60,000 of combined CPF savings earns an extra 1% interest on top of the base interest rates, so investing this portion means giving up these risk-free returns of up to 3.5% on the OA portion.

That said, there are trade-offs.

Investing your CPF-OA in SGX-listed stocks or ETFs means forgoing the guaranteed 2.5% interest.

While stocks may offer higher potential returns, they carry the risk of market volatility and no guaranteed gains.

Your portfolio value may rise or fall depending on market conditions, and returns aren’t guaranteed.

Should you invest your SRS funds?

You can contribute up to S$15,300 per year (for Singaporeans and PRs) or S$35,700 (for foreigners) in Cash to your SRS account, and contributions are eligible for tax relief, subject to the overall personal income tax relief cap of S$80,000 per Year of Assessment.

If you’ve been contributing to your SRS account for the tax savings, but left it idle at 0.05% p.a., you’re not doing your future any favours, especially with the elevated inflation in recent years.

As SRS funds are meant for retirement savings, which typically involve a long time horizon, you may invest it to take advantage of compounding returns over time.

Depending on your time horizon and risk appetite, you may choose to allocate part of your SRS to growth-oriented assets like ETFs or blue-chip stocks to help build your retirement nest egg.

What is Tiger Broker’s latest CPFIS-OA and SRS investing feature?

Tiger Brokers’ newest feature lets me trade eligible SGX stocks and ETFs using my CPFIS-OA or SRS balance directly through the Cash Boost account.

Here are some key reasons to consider using Tiger Brokers for CPFIS-OA and SRS investing:

#1 – Low fees

Compared to other brokers that offer CPFIS and SRS investing, Tiger Brokers offers competitive fees for trading Singapore stocks and ETFs using your CPF and SRS funds.

| Brokerage | Tiger Brokers | Other CPFIS brokers |

|---|---|---|

| Commission fee | 0%* | 0.08% to 0.28% |

| Platform fee | 0.12% | Nil |

| Minimum Fee | S$5 | S$0 to S$25 |

| Other Broker Fees | Waived | S$2 to S$15 custody fee (may or may not be waived) |

| Source: Tiger Brokers, and other CPFIS broker platforms. *Zero commission fee applicable for the first 180 days after linking CPFIS/SRS account, thereafter a 0.10% commission (min. S$4.99) applies. | ||

Tiger Brokers has a platform fee of 0.12% (minimum S$5), compared to other CPFIS brokers with commissions and platform fees ranging from 0.08% to 0.28%.

By linking your CPFIS or SRS account to Cash Boost, you’ll enjoy zero commission* for the first 180 days—available to both new and existing users.

This means that if you’re investing S$1,000 in an SGX-listed stock in the first 180 days after linking your CPF/SRS, you’ll pay as little as S$5 in total fees with Tiger.

After that, a commission fee of 0.10% (min. S$4.99) applies.

Some brokers could charge up to S$15 in custody fees, which may not be waived.

But starting 23 July 2025, the SGX custody fees will be waived on Tiger.

This waiver is automatically applied to all eligible accounts, including Cash Boost Accounts, so you don’t need to make any additional steps.

*T&Cs apply. Please refer to Tiger Broker's website for other applicable fees.

#2 – CDP linkage

If you have a CDP account for your Singapore stocks, the Tiger Brokers CDP-linked feature allows you to sell Singapore stocks in your CDP account at a lower cost.

#3 – All-in-one investing platform

Whether you’re investing with cash, CPF, or SRS, you can manage it all in one place through the Tiger Cash Boost Account.

#4 – Broad market access

Aside from being an all-in-one platform for investing cash, CPF, or SRS, you can also invest in a wide variety of assets such as US stocks, HK stocks, options, bonds, and funds on Tiger Brokers.

If I’m considering investing for passive income in Singapore dividend stocks or REITs, I can consider using Tiger Brokers to do so.

Hence, foreign assets aren’t eligible for CPF and SRS investing on Tiger Brokers. Eligible counters in the app show a CPF or SRS icon.

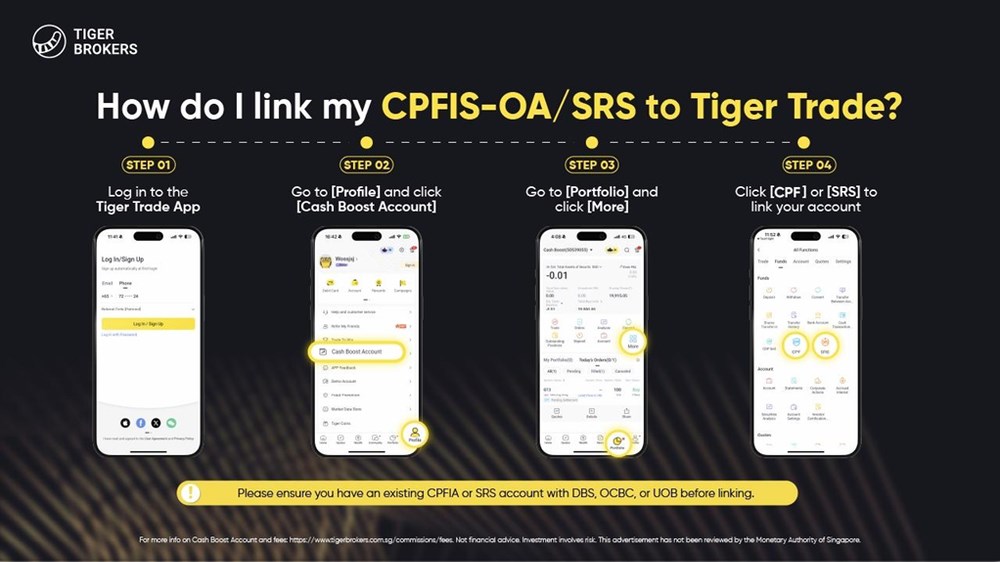

Step-by-step guide to Tiger Brokers’ CPFIS-OA and SRS investing feature

To use this feature, I had to first set up a CPF Investment Account (CPFIA) or an SRS account with one of the agent banks: DBS, OCBC, or UOB.

Once linked, CPF/SRS trades work just like cash trades, except the funding and settlement come from CPF/SRS funds instead of my cash balance in my Tiger account.

It took just a few minutes using the Tiger Trade mobile app after signing up for a Tiger Brokers account. Here’s what I did:

- Open the Tiger Trade app and switch to Cash Boost Account.

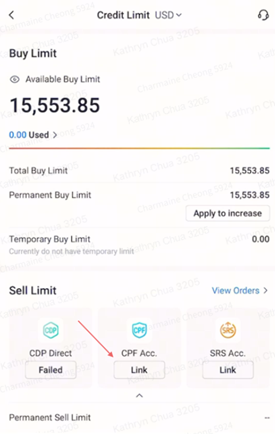

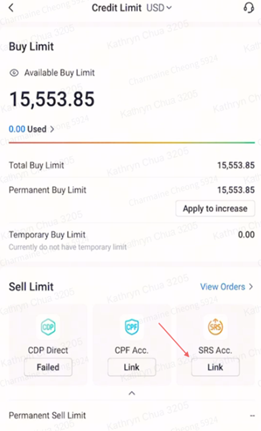

- Go to the Portfolio tab and select Total Buy Limit.

- Tap Link CPF Account (or Link SRS Account). Follow the on-screen instructions to enter my CPFIS-OA or SRS account details.

The app will prompt me to ensure my CPFIA or SRS account is already open with DBS/OCBC/UOB.

After I submit the link request, my Tiger app will show “Linking in Progress”.

In practice, it usually takes about 10 to 30 minutes on a business day to complete.

Once it shows “Successfully Linked”, I can immediately start placing CPF or SRS trades on eligible SGX-listed stocks and ETFs through my Cash Boost account, subject to my trading limit.

|  |

| Source: Tiger Brokers Singapore | CPF | Source: Tiger Brokers Singapore | SRS |

All CPF and SRS trades must be fully funded using the funds in my linked CPF Investment Account or SRS account, so there’s no leverage or contra trading.

What you need to know before investing your CPFIS-OA and SRS funds with Tiger Brokers

#1 – Trades must be fully funded

Trades must be fully funded and follow the standard T+2 settlement cycle as required by the CPF Board and MAS.

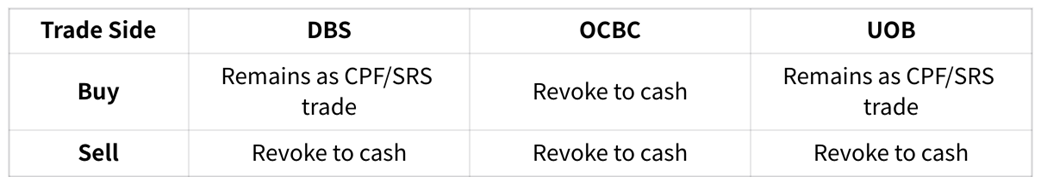

If I try to place a buy and sell order on the same day without having the actual shares in my account, the outcome depends on the agent bank:

The bank will only affirm a buy order if I have sufficient investible CPF or SRS funds.

If I don’t have enough funds, the bank may revoke or partially cancel the order.

For buy trades with insufficient funds, the shortfall may appear as an "Unsettled Buy," and I’ll need to top up my Cash Boost account before the T+2 deadline.

Otherwise, Tiger may be forced to sell the shares on my behalf to recover the shortfall.

You can’t trade on unsettled positions using CPF or SRS funds, if I place a sell order without having the required stock holdings in my CPFIS or SRS account, the trade may be revoked.

This could result in SGX buy-in penalties if I don’t meet the delivery obligations.

To be safe, it’s best to double-check with your agent bank if you’re unsure.

#2 – No short selling

Likewise, if you try to sell more shares than you actually hold in your CPF or SRS account, things can get tricky.

The agent bank will notify Tiger of how many shares you do have, and the trade may be partially or fully revoked.

If there’s a shortfall, Tiger will try to settle it by checking if you have enough of the stock in your Tiger sub-account.

If there are insufficient shares in both your CPF or SRS and Tiger sub account to fulfill the sell trade, the remaining sale is treated as a short-sell, which may trigger SGX buy-in penalties and fees.

To avoid all this, it’s good practice to check your investible amount beforehand.

I always check my available balance.

For CPF-OA, I log into the CPF website or app under "My Statement > Investments."

For SRS, I check my balance via internet banking with DBS, OCBC, or UOB.

This ensures you have enough to trade and meet your buy or sell obligations without running into issues.

What would Beansprout do?

If you’ve already decided to invest your CPFIS-OA or SRS funds, the next step is finding a platform that’s cost-efficient, easy to use, and CPFIS/SRS-enabled.

Through Tiger’s new feature, you can invest directly in SGX-listed ETFs and stocks using your CPFIS-OA or SRS funds.

You can do all this within the same app you might already be using for your cash investments.

Whether you’re a new or existing user, SGX trades via the Cash Boost account come with zero commission* for the first 180 days if you link your CPFIS or SRS account, and the SGX custody fee is waived until further notice.

It’s a simple, accessible way to expand your CPF or SRS investing without unnecessary fees.

You can learn more about CPF or SRS investing with Tiger Brokers here.

Sign up for a Tiger account and link your CPFIS-OA/SRS to trade eligible SGX ETFs and shares directly from your Tiger account.

*T&Cs apply.

Disclaimer

The information expressed herein is current and does not constitute an offer, recommendation or solicitation, nor does it constitute any prediction of likely future stock performance. Investment involves risk. The price of investment instruments can and do fluctuate, and any individual instrument may experience upward or downward movements, and under certain circumstances may even become valueless. Past performance is not a guarantee of future results. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any person or affiliated companies. Before making an investment decision, you should speak to a financial adviser to consider whether this information is appropriate to your needs, objectives and circumstances. Tiger Brokers assumes no fiduciary responsibility or liability for any consequences financial or otherwise arising from trading in securities if opinions and information in this document may be relied upon.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Get S$50 Fairprice voucher within 5 working days, and up to S$1,000 welcome rewards.

Sign up nowRead also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

1 questions

- THAM Hoe Meng Alan • 26 Aug 2025 01:22 PM