DBS Treasures Priority Banking: Is it worth signing up?

Private Wealth

By Nicole Ng • 06 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Discover the benefits and requirements of becoming a DBS Treasures priority banking customer.

What happened?

If you’re looking for a more exclusive banking experience, DBS Treasures might have caught your eye.

With a range of wealth management solutions, investment opportunities, and lifestyle perks, it’s catered to affluent individuals who want more from their banking relationship.

But is it really worth the S$350,000 minimum requirement?

Let’s break down what DBS Treasures offers and whether it’s worth signing up.

What is DBS Treasures?

DBS Treasures is a priority banking service tailored for clients who want personalised wealth management, and exclusive investment opportunities.

Clients can expect a dedicated relationship manager, investment advisory services, and priority access to banking that go beyond standard retail banking.

What are the benefits of DBS Treasures?

Other priority banking services attract clients by providing preferential deposit rates.

But DBS Treasures has taken a different approach.

It positions its value by offering investment guidance, market expertise, and access to curated investment opportunities.

#1 – Personalised wealth management and expert advice

As a DBS Treasures client, you get personalised insights from a dedicated Chief Investment Officer (CIO) team on your investment portfolio.

The team provides market research, asset allocation frameworks, and recommendations to help you achieve your investment objectives.

You also get a dedicated relationship manager who will take a holistic view of your financial goals and offer customised investment strategies at every stage of your life.

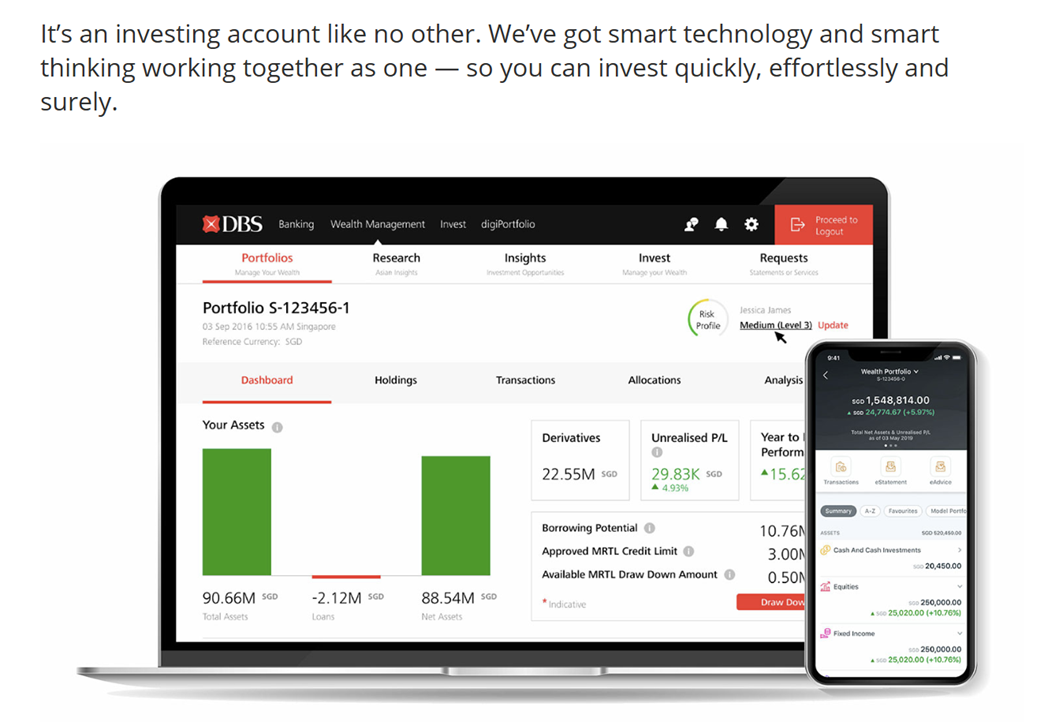

In addition to the personalised investment experience, clients also gain access to the Wealth Management Account, a digital platform integrated within the digiBank app.

It offers a consolidated view of your portfolio, along with market insights from the CIO team and tools to support more informed investment decisions.

#2 – Exclusive investment opportunities

As a DBS Treasures client, you gain access to investment products and opportunities not typically available to retail investors.

This includes a curated selection of investments such as structured deposits, currency-linked investments and other institutional-grade products.

And if you qualify and sign up as an Accredited Investor, you unlock access to more sophisticated products such as private assets, structured notes, and bonds.

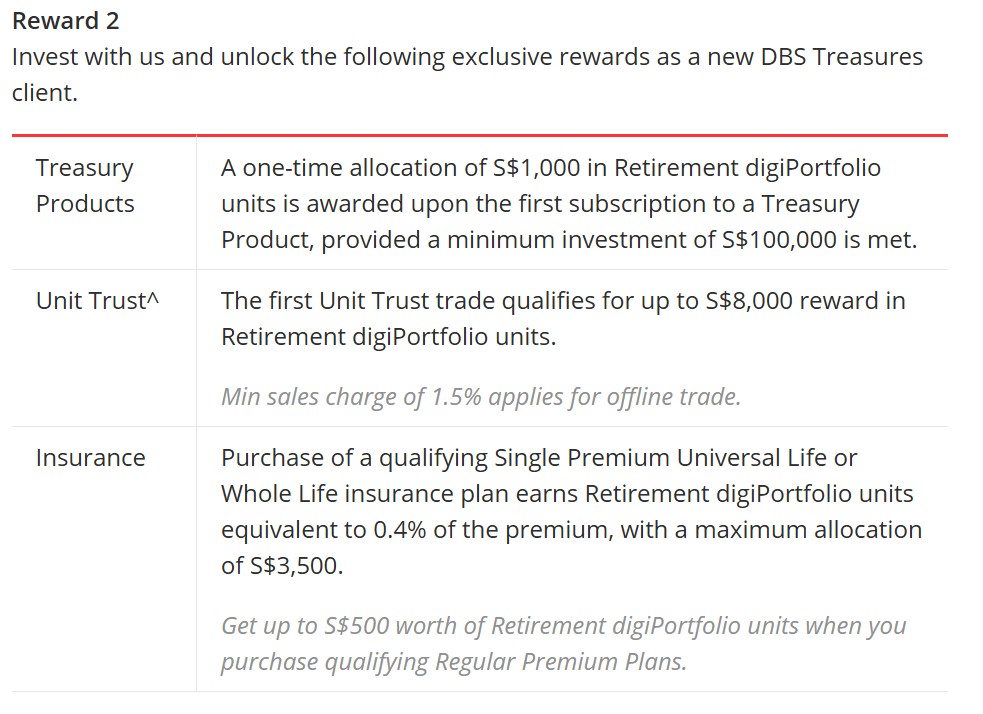

On top of that, new DBS Treasures clients can enjoy additional rewards when investing in select products such as Treasury Products, Unit Trusts, and Insurance.

Beyond investment products, DBS Treasures also offers exclusive access to investment events and webinars, featuring insights from top wealth experts.

These sessions cover market trends, opportunities, and practical strategies to grow your wealth.

Past topics include Navigating Crypto & Digital Assets and the Inaugural Wealth Symposium at Marina Bay Sands.

#3 – Global banking privileges

If you’re someone who has an international lifestyle or financial needs, DBS Treasurers also provide solutions for global banking such as same-day International fund transfers at zero fees with DBS Remit.

#4 – In-person banking perks

You can also skip the queues and enjoy priority service in a comfortable banking environment at the DBS Treasures Centres and ATM lobbies.

In addition, DBS Treasures also provides exclusive safekeeping services if you’d like to secure important documents and valuables.

What are some potential drawbacks of DBS Treasures?

While DBS Treasures offers a range of exclusive privileges and investment opportunities, it may not be the right fit for everyone.

#1 – High entry requirement

One of the main considerations is the relatively high entry requirement.

To qualify for DBS Treasures, you’ll need to maintain a minimum of S$350,000 in assets under management (AUM) with DBS.

In comparison, other priority banking options such as Standard Chartered Priority Banking and Citigold, which require just S$200,000 and S$250,000 respectively, have a lower barrier to entry.

#2 – No preferential fixed deposit rate

Unlike some other priority banking programs, DBS Treasures does not offer significantly higher fixed deposit rates.

If your primary goal is to maximise returns on cash through preferential deposit interest, other banks may offer more competitive rates in that specific area.

These factors are worth weighing against the broader range of benefits offered, especially if you're considering DBS Treasures for its investment focus and global banking privileges.

What is the minimum required balance to qualify for DBS Treasures?

To qualify for DBS Treasures, you’ll need to maintain a minimum of S$350,000 in deposits and/or investments with DBS.

This can include a combination of:

- Cash held in your DBS/POSB savings or current accounts

- Fixed deposits

- Unit trusts

- Other eligible investment products with DBS

What is the current promotion for signing up for DBS Treasures?

DBS Treasures sweetens the deal with generous sign-up rewards for new clients who open an account, deposit fresh funds, and invest in eligible products.

Below are the requirements for the various sign-up rewards:

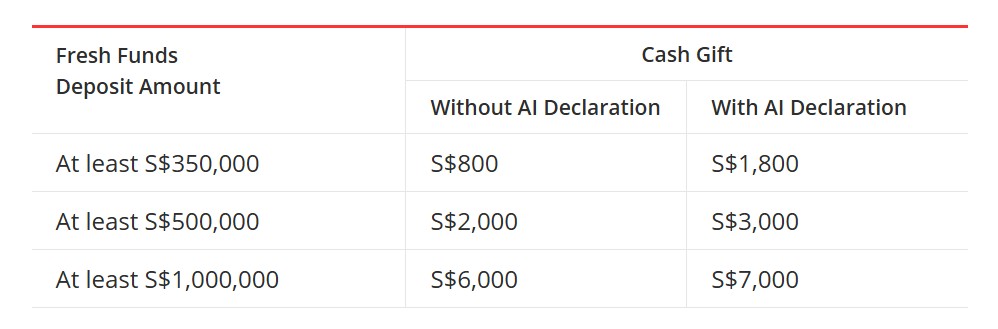

Reward 1: Welcome Rewards (Up to S$6,000)

Earn cash rewards when you open a DBS Treasures account, deposit fresh funds, and make qualifying investments. The tiered rewards are as follows:

- S$800 cash gift

- Deposit at least S$350,000

- Invest at least S$100,000 in eligible products (e.g. stocks, bonds, unit trusts)

- Complete your Investment Objective Setting (IOS) with your Relationship Manager

- Maintain assets for at least 3 months

- S$2,000 cash gift

- Deposit at least S$500,000

- Same conditions as above

- S$6,000 cash gift

- Deposit at least S$1,000,000

- Same conditions as above

Reward 2: Accredited Investor ($1,000)

Get an additional S$1,000 cash gift when you opt in as an Accredited Investor.

Reward 3: Investment Offer (Up to S$8,000 in Retirement digiPortfolio units)

Invest in the following products to get Reward 3:

- Treasury products: S$1,000 in Retirement digiPortfolio units on your first Treasury Product subscription with a S$100,000 minimum investment

- Unit Trust: Up to S$8,000 in Retirement digiPortfolio units on your first Unit Trust trade

- Insurance: Retirement digiPortfolio units of 0.4% of premium (max S$3,500) with purchase of qualifying Single Premium Universal Life or Whole Life insurance plans.

Reward 3 is stackable with other tier rewards.

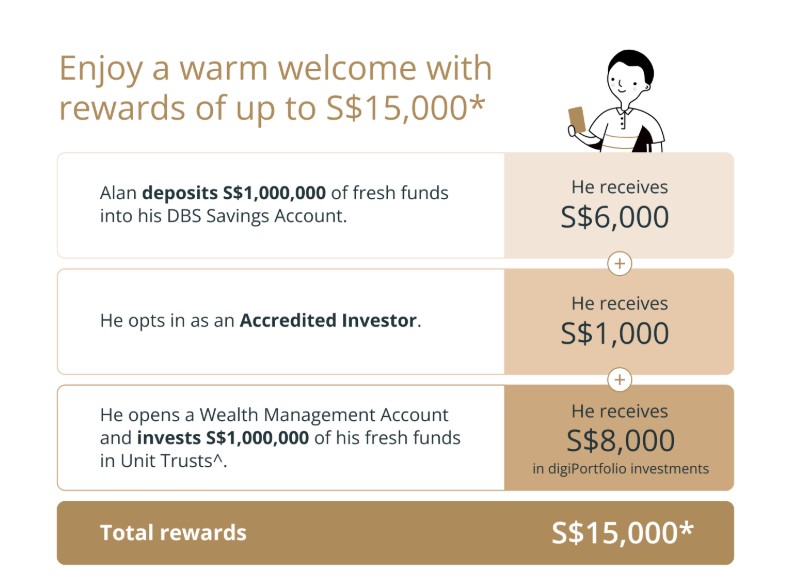

If you go all in with S$1,000,000 in fresh funds and invest S$1,000,000 in unit trusts, here’s what you could receive:

- Reward 1 (Welcome) – S$6,000

- Reward 2 (Accredited Investor) – S$1,000

- Reward 3 (Unit Trust Offer) – S$8,000

Total: S$15,000 in rewards.

This means your cash reward of S$15,000 on a S$1 million deposit and investment over 3 months is equivalent to earning an annualised return of 6.0%—excluding any potential returns on your unit trust investment and Retirement digiPortfolio units.

Do note that offline Unit Trust subscriptions are subject to sales charges of at least 1.5%.

What would Beansprout do?

If your financial goals center around growing your wealth through personalised investment advice, exclusive access to institutional-grade products, and seamless global banking privileges, DBS Treasures stands out as a strong contender.

It focuses on investment expertise and curated opportunities for high-net-worth individuals who want more than just preferential interest rates.

Find out how the DBS CIO team is positioning for volatile markets here.

That said, if your primary objective is to maximise savings interest or you prefer a lower entry point, it’s worth comparing DBS Treasures with other priority banking options that may offer more competitive deposit rates or lower qualifying thresholds.

If you’re looking to access exclusive investment opportunities in private markets at a lower minimum, you can also check out ADDX.

Thinking about signing up? Visit the DBS Treasures website for full details.

Compare other priority banking services to see which best aligns with your financial goals.

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions