How to buy gold from UOB: A step-by-step guide (2026)

alternative asset 101

By Gerald Wong, CFA • 11 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn how to buy gold from UOB in Singapore, from purchasing physical gold bars at UOB Main Branch to opening a Gold Savings Account in 2026.

What Happened?

Gold prices have continued to break new highs.

This has sustained strong investor interest in gold, evident from the buzzing discussion in the Beansprout community.

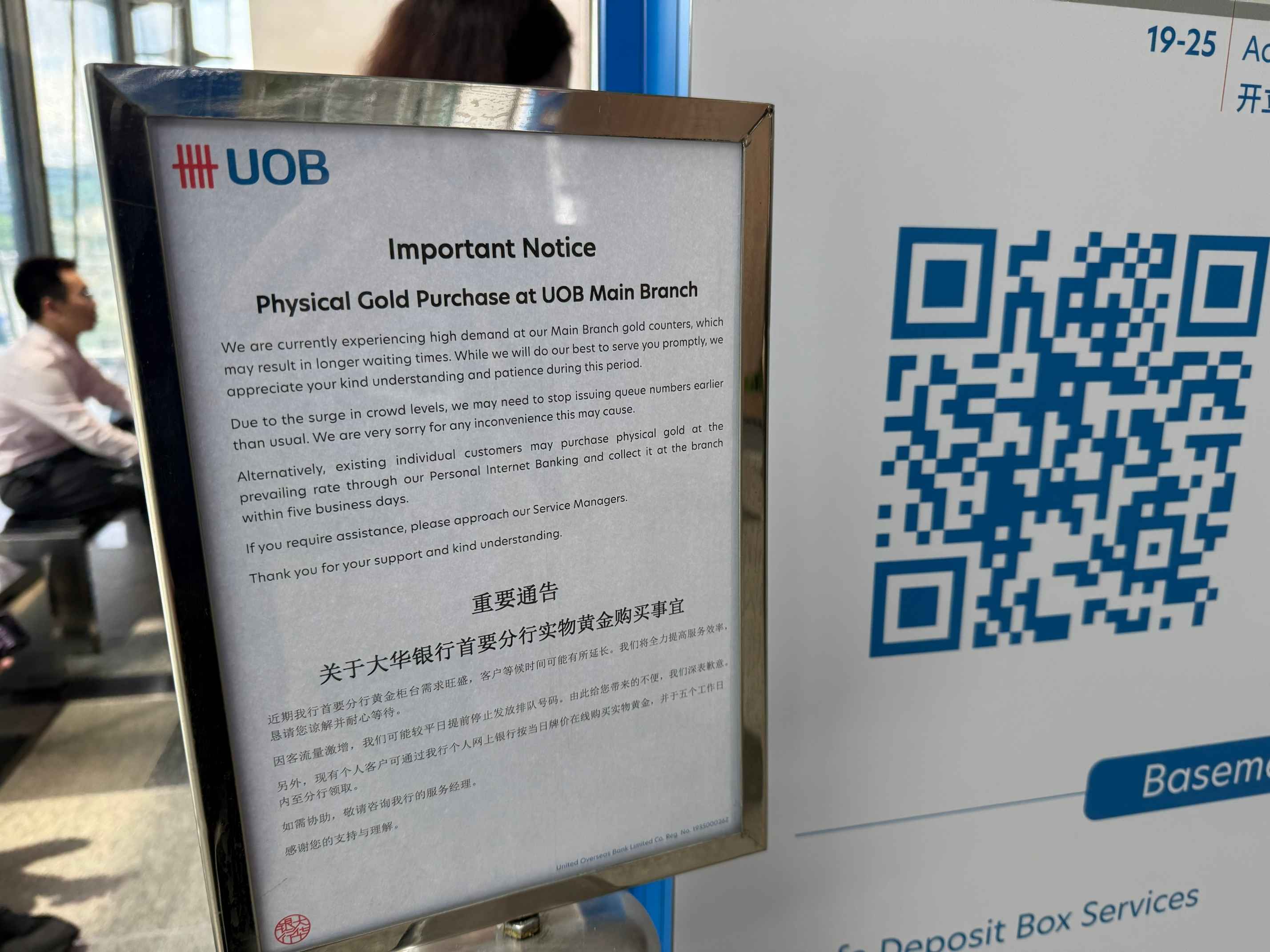

Even during a recent pullback in prices, demand for physical gold remained robust, with long queues forming at United Overseas Bank’s Main Branch Gold Counter.

Due to strong demand, UOB will move to an appointment-only system for physical gold purchases and conversions from 13 February 2026.

In this article, I will share a step-by-step guide to help you understand how to buy gold from UOB, including how to purchase physical gold bars and investing through a Gold Savings Account (GSA), as well as the latest changes to note if you’re planning to purchase gold from UOB.

How to buy gold from UOB

UOB offers two main ways to invest in gold: by purchasing physical gold bars or through a Gold Savings Account.

UOB’s gold prices are quoted based on 99.99% fineness in Singapore dollars per kilogram.

Prices may differ from international quotes due to exchange rates and local market conditions. You may refer to the gold prices at UOB here.

Physical gold purchases are exempt from GST, so no additional tax is charged.

Other alternatives include Gold Certificates, XAU trading, and structured products, though the latter two are only available to UOB Privilege Banking customers.

#1 - How to buy physical gold from UOB

If you prefer to own and hold gold as a tangible asset, you may buy physical gold directly with UOB.

They are available for purchase only by UOB account holders.

If you don’t already have one, you can open a UOB One Savings Account and UOB Stash Savings Account to get started.

To buy physical gold from UOB, you can choose either to:

- Buy in person at the Gold Counter, UOB Main Branch or

- Buy online via UOB Personal Internet Banking or the UOB TMRW app and collect your gold in person

Due to high demand for physical gold, UOB has announced several changes effective 13 February 2026:

- All physical gold purchases and GSA-to-physical conversions are now by appointment-only

- Walk-in purchases and conversions are no longer accepted

- UOB Main Branch Gold Counter operating hours have been extended to 6:00pm.

Gold can be sold back to UOB without an appointment (with original sealed packaging and receipt), from 9:30am to 4:30pm, Monday to Friday, excluding public holidays.

Step-by-step guide on how to buy physical gold from UOB - Gold Counter, UOB Main Branch

Gold bars or bullion coins can be purchased at the UOB Main Branch (Gold Counter) from Monday to Friday, 9.30am to 6.00pm, after your appointment is confirmed.

You may check UOB physical gold stock availability here.

From 13 February 2026 onwards, UOB has shared that due to strong demand for physical gold, customers who wish to buy physical gold, or convert their Gold Savings Account (GSA) holdings into physical gold must make an appointment in advance.

Walk-in purchases and conversions are no longer accepted from 13 February 2026 onwards.

Appointments can be booked via UOB’s website, with booking slots opening from 6pm on the previous working day for appointments on the next working day.

Step 1: Be a UOB account holder

Only existing UOB account holders can buy or sell physical gold through the bank.

Open a UOB One Savings Account and UOB Stash Savings Account to get started easily.

Step 2: Book your appointment online

From 13 February 2026 onwards, you'll need to book an appointment for all physical gold purchases and conversions via UOB’s website before visiting the Gold Counter.

Online bookings open from 6pm on the previous working day for slots on the next working day. Walk-ins are no longer accepted for these transactions.

Before booking, you may check UOB physical gold stock availability here.

Meanwhile, customers could obtain a queue number for UOB Main Branch through the UOB website or via the UOB TMRW app and choose gold transaction or collection options before visiting the Gold Counter. However, this system will soon be replaced by the appointment-only booking process from 13 February 2026 onwards.

For reference, here were the steps required to obtain a queue number under the previous system:

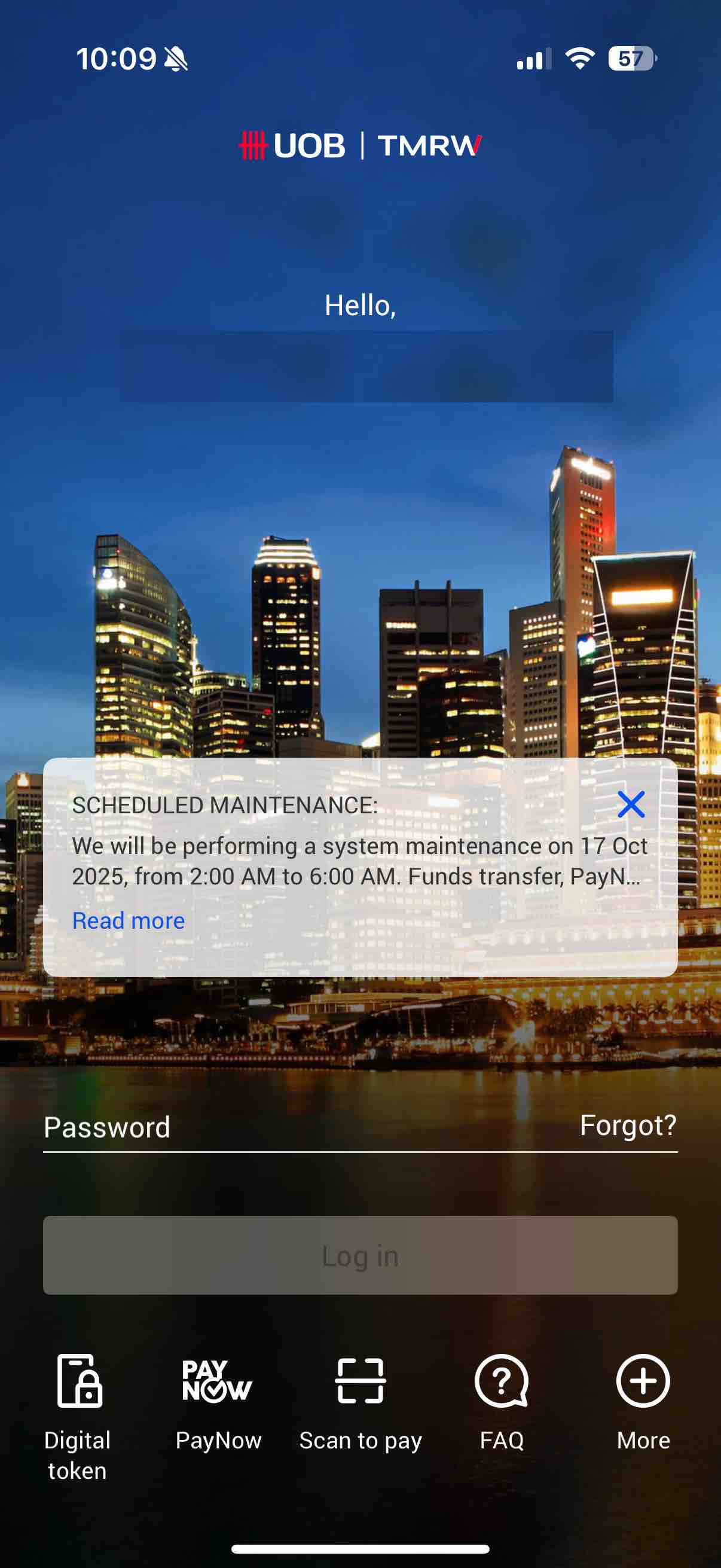

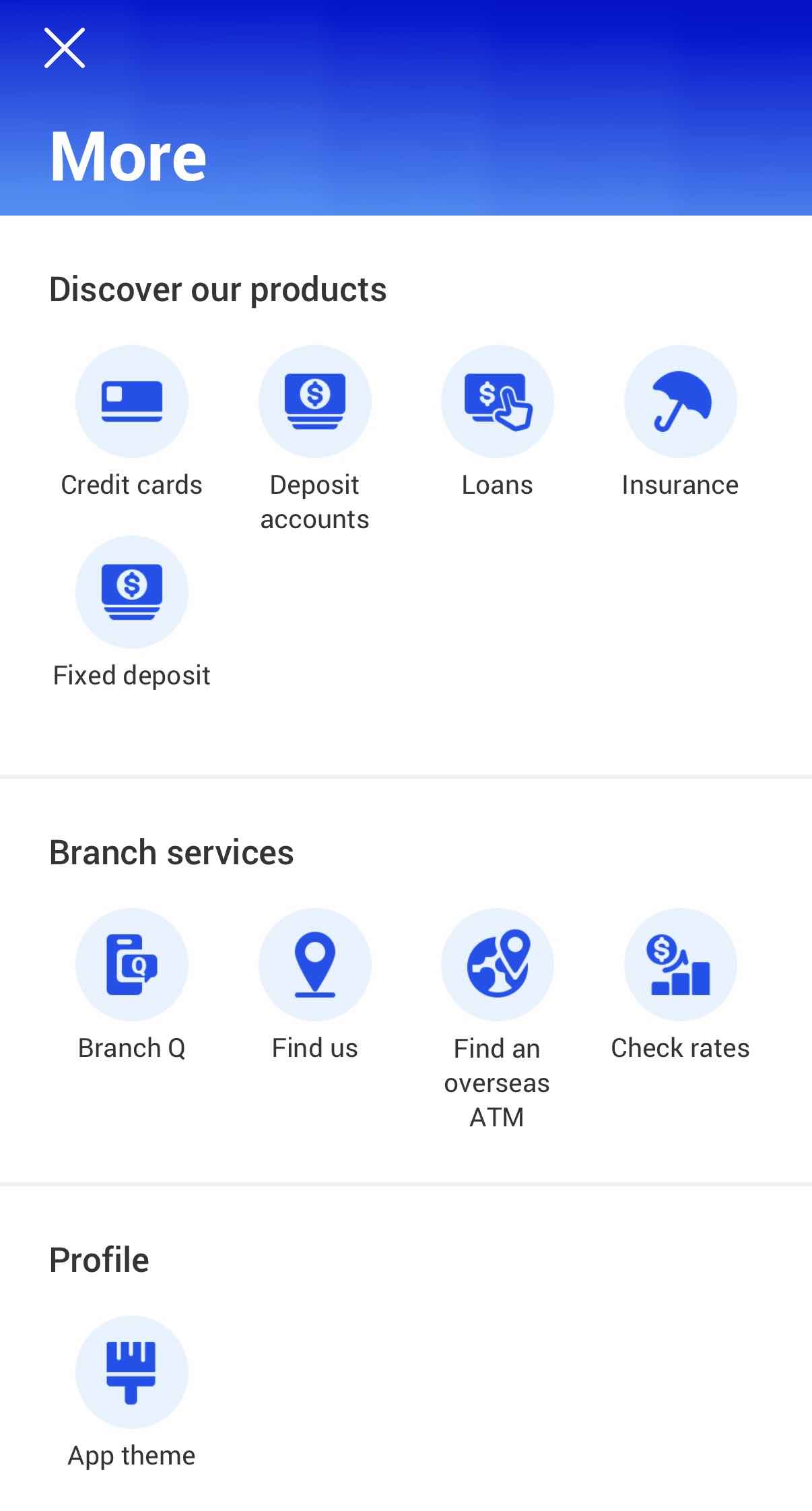

To get a queue number for UOB Main Branch using the UOB TMR app, select 'More' at the bottom right of UOB TMRW app.

Next, select 'Branch Q' under Branch Services.

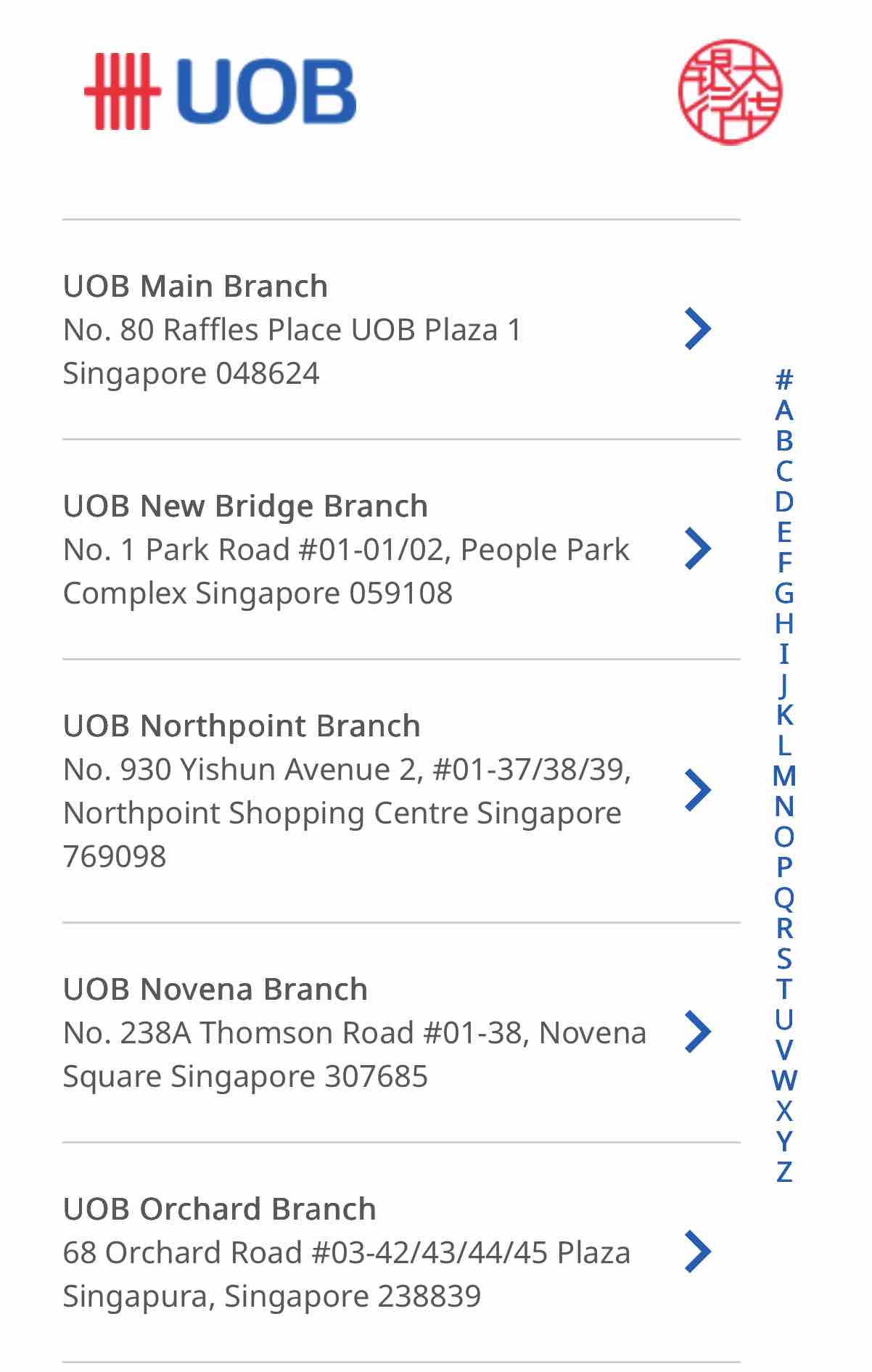

Select UOB Main Branch from the list of UOB branches

Next, select Gold.

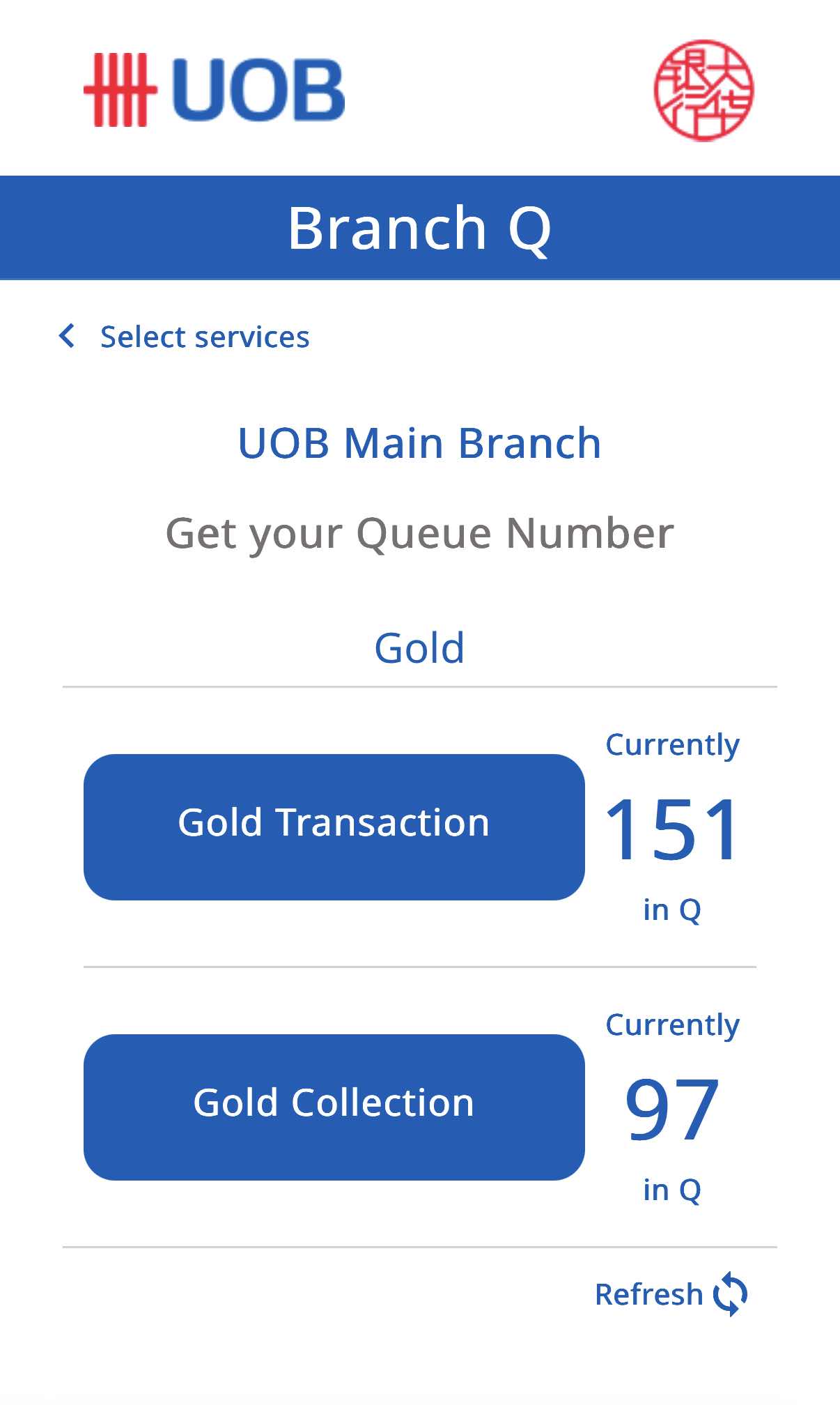

Note that UOB Branch Q service is available from 10am to 4pm from Monday to Friday, and 10am to 12pm on Saturday.

The opening hours of the Gold Counter at the UOB Main Branch is Monday to Friday, 9.30am to 4.30pm. This will be extended to 6.00pm on 13 February 2026 onwards.

Select either gold transaction or gold collection.

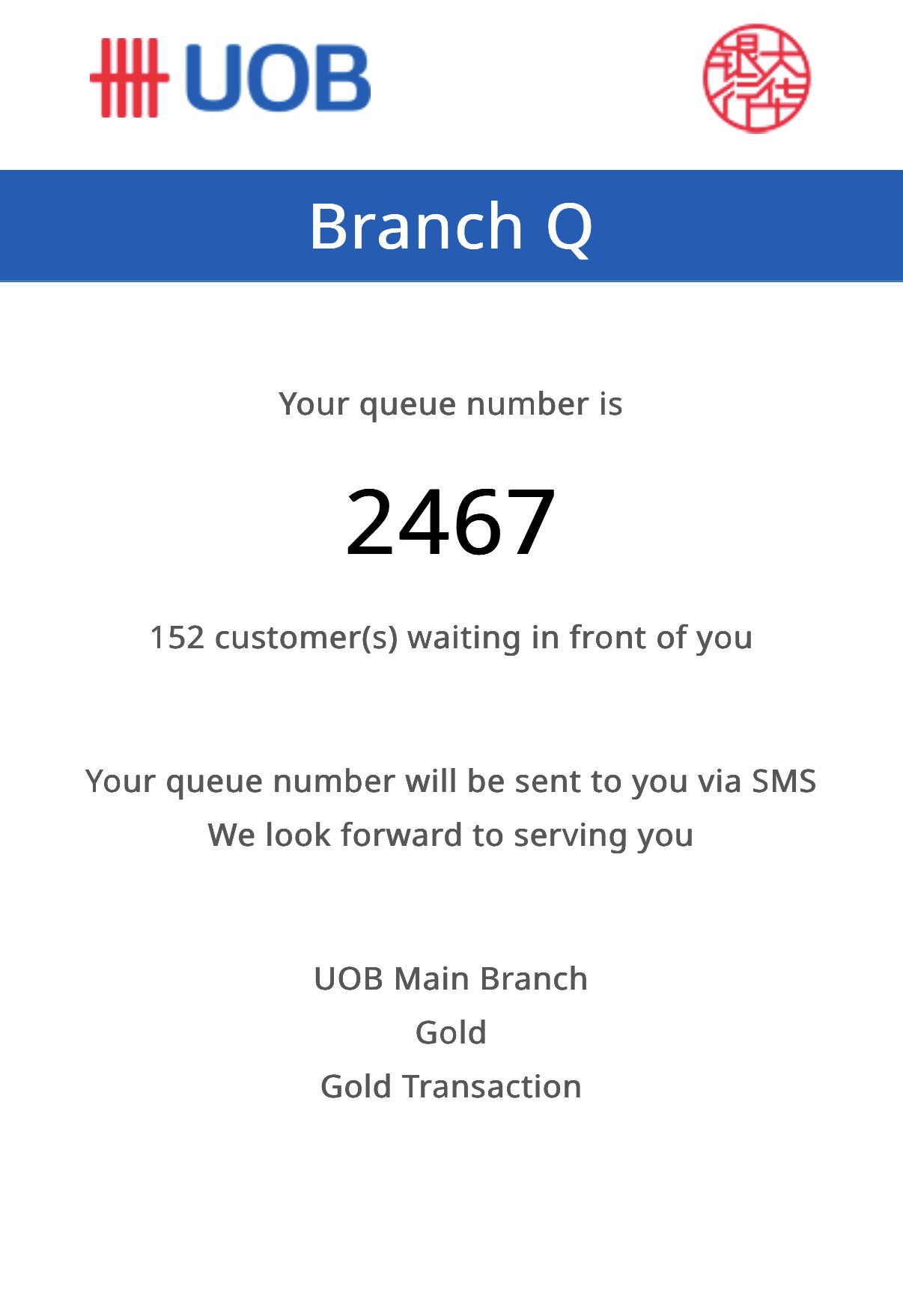

You will then receive a confirmation of your queue number and the number of customers in front of you.

Step-by-step guide on how to buy physical gold from UOB - UOB Personal Internet Banking and collect them from the Gold Counter.

If you would like to remove the uncertainty of not being able to purchase physical gold bars after making a trip down to the main branch, you may also place orders online via UOB Personal Internet Banking or the UOB TMRW app and then collect in person from the next working day up to within ten working days (excluding weekends and public holidays).

Step 1: Be a UOB account holder

Only existing UOB account holders can buy or sell physical gold through the bank.

Open a UOB One Savings Account and UOB Stash Savings Account to get started easily.

Step 2: Place your order and make payment

You can pay using:

- Your UOB savings or current account (via direct debit)

- A UOB credit card

- A UOB CPF Investment Account

Step 3: Make an appointment to collect your gold

Gold purchased online can be collected from the next working day and you have up to 10 working days to collect your gold.

From 13 February 2026, the collection must also be done via a pre-booked appointment via UOB website.

Collection can be made at the UOB Main Branch Gold Counter.

📍 Address: 80 Raffles Place, UOB Plaza 1 (Basement, Banking Hall)

The opening hours of the Gold Counter at the UOB Main Branch is Monday to Friday, 9.30am to 4.30pm.

Note that if collection is delayed beyond 10 working days, there will be late collection fees.

#2 - Open a UOB Gold Savings Account (GSA)

If you prefer flexibility and easy online transactions, the Gold Savings Account is a convenient way to start investing in gold.

A Gold Savings Account (GSA) is a type of investment account that allows you to buy, hold, and sell gold in a paper or statement form without needing to handle the physical gold.

Your gold holdings are recorded in grams in your account.

This option offers flexibility if you prefer to invest in gold without having to handle or store physical gold.

The minimum holding requirement and transaction is 5 grams of gold in the GSA. This means you must retain at least 5 grams after any conversion. For example, to convert 100 grams into a physical bar, your balance must be at least 105 grams.

The GSA Physical Gold Conversion feature allows you to convert GSA holdings into 100g Argor Heraeus physical gold bars. Do note that you will also need to make an appointment via the UOB website if you wish to convert the gold.

However, GSA holdings bought with CPF funds cannot be converted to physical gold.

Also, UOB charges a small monthly service fee for the Gold Savings Account. This is the higher of 0.12 grams of gold per month or 0.25% per year based on your highest gold balance for the month. The fee is deducted in grams of gold at the end of the year or when you close the account, and GST applies.

There is also an early account closure fee of S$30 (subject to GST) if the account is closed within six months of opening.

Step-by-step guide on how to open a UOB Gold Savings Account (GSA)

Step 1: Prepare your documents

For Singaporeans and Permanent Residents:

- NRIC or valid passport

For foreigners:

- Valid passport

- Proof of residency such as a work permit, student pass, or utility bill

- Banker’s reference letter or letter of introduction

Step 2: Visit a UOB branch

Go to any UOB branch to open a Gold Savings Account. Remember to get a queue number through the UOB website or with the UOB TMRW app before heading over to the branch. You can check the crowd situation here before visiting.

Step 3: Start buying gold

Once your account is set up, the minimum purchase is 5 grams.

You can buy or sell gold conveniently through:

- UOB Personal Internet Banking

- UOB TMRW mobile app

- Any UOB branch during operating hours

Once set up, you can view your gold holdings, check prices, and transact online anytime.

Converting from Gold Savings Account to physical gold

If you already hold gold in your Gold Savings Account (GSA) that was purchased with non-CPF funds, you may convert it into a 100g physical gold bar under the GSA Physical Gold Conversion Programme.

This can only be done at the UOB Main Branch Gold Counter during 9.30am to 4.30pm, Monday to Friday.

Starting from 13 February 2026, GSA-to-physical conversions are now strictly appointment-only. Walk-in conversions are no longer accepted.

Online bookings open from 6pm on the previous working day for slots on the next working day. Walk-ins are no longer accepted for these transactions.

You must also book an appointment via UOB’s website before visiting and secure a slot (online bookings open from 6pm on the previous working day for appointments on the next working day).

Only Argor Heraeus Swiss 100g bars are offered under this programme.

If you wish to convert your entire GSA to physical bars, you must leave at least 5g in your after conversion.

Payments for the conversion must be made using your UOB account or card.

Once converted, those physical bars may be sold back to UOB, which will be further subjected to UOB buyback terms.

What you need to know before buying gold from UOB

Before you start buying gold, here are some key things to keep in mind:

- Gold prices fluctuate: The value of your holdings will move in line with global gold prices.

- Market risk: Gold prices can move sharply in the short term.

- No interest or dividends: The Gold Savings Account does not pay interest as gold is not a deposit product.

- Deposits not insured: Gold accounts are not covered under Singapore’s Deposit Insurance Scheme.

- GSA service fees: UOB charges a monthly fee based on your gold balance and also a nominal fee for each buy or sell transaction under the Gold Savings Account.

- Storage and insurance: For physical gold, you are responsible for safekeeping and insurance after collection.

What would Beansprout do?

If I want a simple and convenient way to gain exposure to gold, I may start with the UOB Gold Savings Account. It allows me to buy and sell gold online in small quantities without worrying about storage.

For investors who prefer holding physical assets, buying gold bars from UOB can still be an option, but it’s now important to plan ahead due to appointment requirements and to consider storage and liquidity.

If you don’t already have a UOB account, you can consider opening the UOB One Savings Account and UOB Stash Savings Account to earn higher interest on your cash while managing your gold transactions.

In addition, UOB is currently running a Leap of Fortune Savings Promotion offering up to S$380 guaranteed cash when you top up an eligible UOB savings account and register. Learn more about the UOB Leap of Fortune Savings Promotion here.

Apart from UOB’s Gold Savings Account and physical gold, investors can also gain exposure through other products such as gold ETF.

Read our complete guide to how to buy gold in Singapore to learn more about the different options.

You may also want to consider the role gold plays in your overall portfolio, including how much allocation makes sense based on your risk profile and investment objectives.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

2 comments

- ch • 14 Nov 2025 01:38 PM

- Mary Kuah • 24 Oct 2025 11:25 AM