Singapore Treasury Bills (T-bills): A Complete Guide

bonds-101

By Beansprout • 08 Oct 2025

Learn how Singapore Treasury Bills work, including what they are, how to apply, as well as their benefits and risks before you invest.

What happened

T-bills, or Treasury Bills, have drawn growing attention from Singaporeans in recent years.

They became popular when interest rates were high, offering potentially better returns than leaving money in a regular savings account.

Singapore T-bill yields have since come down to about 1.4% in September 2025 from above 2% earlier this year.

Many people still use Singapore T-bills to park spare funds for short periods.

In this guide, we explain how Singapore T-bills work, how you can invest, and what to consider before applying.

What are Singapore T-bills (Treasury Bills)?

T-bills are short-term debt securities issued by the Monetary Authority of Singapore (MAS) on behalf of the government.

“Debt securities” simply means you are lending money to the government.

They are called short-term because they mature quickly, usually within 6 months or 1 year, unlike longer-term government bonds such as SGS bonds that mature over a longer period.

There are two main types available:

Tenor | Duration |

| 6-month T-bill | About 182 days |

| 1-year T-bill | About 365 days |

Because they are issued by the Singapore government, T-bills are considered to have a high level of credit quality.

Singapore’s government debt has been rated AAA, which is the highest credit rating possible by major global credit rating agencies such as Moody’s, S&P, and Fitch.

An AAA rating means the likelihood of the government not repaying its debt is regarded as low.

As a result, many investors view T-bills as a relatively stable option for short-term savings.

What is the difference between T-bill to SGS Bonds?

SGS bonds have a maturity of 2 to 30 years, while T-bills have a shorter maturity of 6 or 12 months.

SGS bonds pay interest every 6 months. T-bills do not have coupon payments; instead they are issued at a discount to the face value of the bond.

Essentially, to decide between a Singapore T-bill and SGS bond, you just need to think about whether you would want to hold on this bond for a short period of time (6 months/1 year), or for a longer period of time.

| SGS bonds | T-bills | |

| Available tenor | 2, 5, 10, 15, 20, 30 or 50 years | 6 months or 1 year |

| Type of interest rate payment | Fixed coupon | No coupon; issued and traded at a discount to the face (par) value |

| How often interest is paid | Every 6 months, starting from the month of issue | At maturity |

| Secondary market trading | At DBS, OCBC or UOB main branches; on SGX through brokers | At DBS, OCBC or UOB main branches |

How do Singapore T-bills work?

T-bills don’t pay monthly or yearly interest like savings accounts or bonds.

Instead, you make money because they are sold at a discount to their face value.

The face value is the amount you will get back when the T-bill reaches its end date, usually S$1,000 per unit.

When you buy a T-bill, you pay less than S$1,000 upfront.

When it matures, meaning it reaches the end of its 6-month or 1-year term, you get back the full S$1,000.

The difference between the amount you paid and the amount you get back is your return.

Example:

- You buy a 6-month T-bill with a face value of S$1,000

- The issue price is S$985 and you pay S$985 today

- Six months later, you receive S$1,000 back

The yield is the return you earn on your T-bill investment.

Returns from T-bills are tax-exempt for individual investors in Singapore.

How Singapore T-bills auctions work and how yields are set

T-bills are issued through regular auctions run by the Monetary Authority of Singapore (MAS).

MAS uses the auction to decide what return (or “yield”) investors will get. Here’s what happens at each auction:

- Announcement: MAS announces an upcoming T-bill issue, including the auction date and amount on offer.

- Bidding: Investors submit bids through their banks.

- Auction: MAS collects all the bids and decides how to allocate the T-bills.

- Cut-off yield: The highest yield that still gets accepted becomes the cut-off yield which is the final interest rate decided at the auction, everyone who gets T-bills from that round will receive this same rate.

- Allotment: Successful applicants receive their T-bills on the issue date, which is usually a few days after the auction.

You then simply hold the T-bill until it matures, either 6 months or 1 year later, and receive back the full face value of $1,000 per unit.

You can check the full calendar of upcoming auctions as well as the latest and past cut-off yields on the MAS website.

Now that you know how T-bills are issued through auctions and how the cut-off yield is decided, the next step is to understand how your own application fits into this process.

Singapore T-bill auction mechanics: Competitive vs non-competitive bids explained

When you submit an application for T-bills, you must choose a bid type.

There are two types of applications for T-bills: competitive bids and non-competitive bids.

This choice affects how likely you are to get T-bills and at what yield, so it’s important to understand the difference before you apply.

Non-competitive bid

With a non-competitive bid, you do not specify the yield you want.

You agree to accept whatever the cut-off yield turns out to be.

Non-competitive bids are guaranteed to get allocated, as long as the total non-competitive bids do not exceed 40% of the total issue size.

Competitive bid

With a competitive bid, you state the minimum yield you are willing to accept.

If your bid is lower than or equal to the cut-off yield, you will get T-bills.

If your bid is higher than the cut-off yield, you will not get anything.

Example

If the cut-off yield is 1.40%:

- A competitive bid at 1.20% will get allotted

- A competitive bid at 1.50% will get nothing

- A non-competitive bid will get allotted at 1.40%

For beginners, many people start with non-competitive bids because they are simpler and ensure you get at least some allocation.

If you are unsure about what yield to expect and want a guaranteed allocation, then you may also consider going with non-competitive bids.

To find out how to make a competitive bid, you can check our guide to T-bill auction here.

After you submit your bid, MAS will carry out the auction and release the results.

These results show how much demand there was for the T-bills and whether your application was successful.

Learning how to read these auction results will help you understand the cut-off yield, how much you were allotted, and what your return will be.

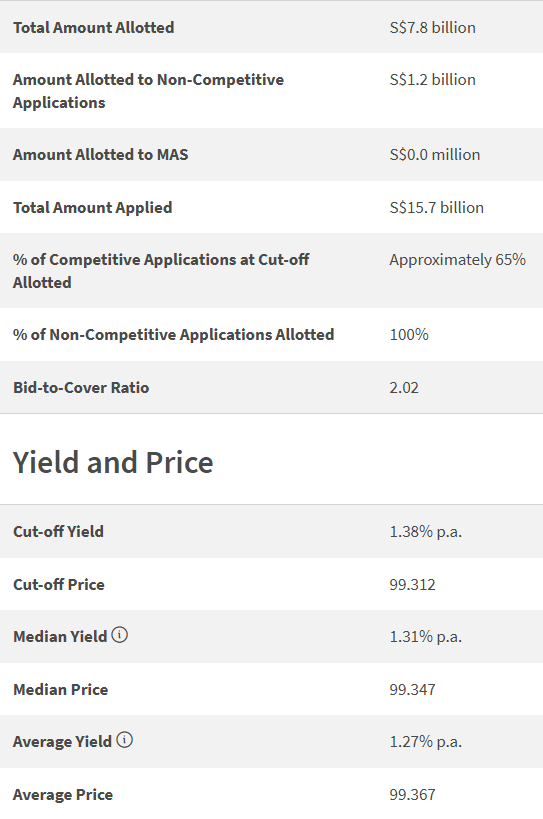

How to read Singapore T-bill auction results and allotment

MAS publishes the auction results on its website shortly after each auction.

The results include several key figures that tell you how strong demand was and what return you will receive.

Total amount of bids received: Shows how much demand there was for the T-bill.

Cut-off yield: This is the final interest rate for that auction. Everyone who is allotted T-bills in that round will receive this same yield.

Cut-off price: This is the price you pay for each $100 of T-bill face value, based on the cut-off yield. Because T-bills are sold at a discount, the price is usually slightly below $100. For example, if the cut-off price is 99.312, you will pay about $993.12 for each $1,000 T-bill and receive back the full $1,000 at maturity.

Median and average yields: These figures give a sense of how investors bid overall. They are useful for understanding sentiment, but they do not affect your own return.

Bid-to-cover ratio: This measures demand compared to supply. For example, if MAS offers $5 billion and receives $10 billion in bids, the bid-to-cover ratio is 2.0. That means investors applied for twice as much as was available.

A higher bid-to-cover ratio usually means stronger demand and lower cut-off yields.

A lower ratio usually means weaker demand and higher cut-off yield, which would attract buyers.

Here’s an example of a 6-month T-bill auction:

- Investors submitted S$15.7 billion of bids for S$7.8 billion on offer

- The bid-to-cover ratio was 2.02, meaning total demand was 2.02x the amount of T-bill auctioned.

- The cut-off yield settled at 1.38% p.a.. This was the final interest rate for this auction. Everyone who successfully got T-bills in this auction will receive this same yield.

- All non-competitive bids were fully allotted. But the competitive bids were only partially filled. Those who bid exactly at the cut-off yield got about 65% of the amount they applied for.

- Based on the cut-off yield of 1.38% p.a., the issue price was about S$99.312 per S$100 of face value. This means if you were successful, you would pay about $993.12 and get back the full $1,000 at maturity for each S$1,000 T-bill at maturity 6 months later, earning $6.88 in return.

Once you understand how to interpret the auction results, you’ll be able to see what yield you are getting and how much you were allotted.

If you are planning to take part in an upcoming auction, the next step is to make sure you are eligible to invest and have the right accounts set up.

Who can invest and how to fund your Singapore T-bill purchase

Most individuals in Singapore can invest in T-bills. You just need to have the right accounts set up.

There are three ways to apply for T-bills:

Cash: Apply through your internet banking or ATM with DBS, OCBC, or UOB

If you are using cash, you will need a Central Depository (CDP) account linked to your bank account. This is where the T-bills will be credited.

Make sure your CDP account has Direct Crediting Service (DCS) activated. This allows the money from your T-bills to be paid directly into your bank account when they mature.

CPF Ordinary Account (CPF OA): Use the CPF Investment Scheme (CPFIS)

You can use your CPF Ordinary Account (CPF OA) funds to invest in T-bills under the CPF Investment Scheme (CPFIS). When you apply, the money will be deducted from your CPF OA and sent back to your account when the T-bill matures.

Do note that the use of CPFIS funds for investing in T-bills in Singapore is subject to CPF investment guidelines.

Before using your CPF OA funds, it is useful to consider a few things.

- Once your CPF OA funds are deducted, they stop earning CPF interest until they are returned.

- CPF OA funds used for T-bills also cannot be used for housing during this period

- There may be small service charges by CPF or your bank for using CPF OA to buy T-billsIt is useful to weigh the potential extra return against the interest you will forgo and any other plans you have for your CPF OA money.

If you are interested, read here and learn how to buy T-Bills in Singapore using your CPF.

You can also read our step-by-step CPFIS application guides for DBS, OCBC, and UOB, and our analysis on whether it makes sense to invest in T-bills using your CPF.

Supplementary Retirement Scheme (SRS): Use funds from your SRS account

You can read our analysis on why and how to invest using your SRS account here.

Strategies for using Singapore T-bills

Once you know how T-bills work, you can consider different ways to use them as part of your savings plan.

1. Parking spare cash

You can place funds you do not need for the next 6 to 12 months into T-bills. This lets your money earn a return while taking on low credit risk.

2. Building a T-bill ladder

You can also consider building a T-bill ladder by applying for smaller amounts at regular auctions. This way, your T-bills will mature at different times and can provide a steadier stream of passive income.

If you’d like to explore how laddering works in more detail, check out our full guide on how to build an SSB and T-bill bond ladder.

3. Timing around known expenses

Some people use T-bills to hold money they will need at a fixed date, such as for school fees or a home renovation. The funds can earn a return while waiting to be used.

4. Using CPF OA funds

If T-bill yields are higher than CPF OA interest, you could explore using your CPF OA funds. Do weigh this against the CPF interest you will forgo and whether you may need your OA funds for housing during this period.

5. Using SRS funds

T-bills can be bought using SRS funds for the same low risk, while helping you maximise your SRS contributions for tax relief.

Pros and cons of buying Singapore T-bills

Like any financial product, T-bills come with their own advantages and limitations.

It can be helpful to understand these before deciding whether to apply.

Pros:

- Low credit risk: They are backed by the Singapore government, which is rated AAA by global credit agencies.

- Predictable returns: You know your return upfront once the cut-off yield is set.

- Short-term commitment: The 6- and 12-month tenors make them easier to plan around than long-term SGS bonds.

- Low minimum amount: You can start from just $1,000.

- Tax-exempt returns: Interest from T-bills is not taxed for individuals in Singapore.

Cons:

- Less flexibility than SSBs: You may face interest rate risk if you sell before maturity. T-bills also cannot be redeemed early, unlike Singapore Savings Bonds.

- Harder to buy or sell in the secondary market after issuance: Trading T-bills before maturity requires visiting a bank branch, making it less convenient than other investments.

- No regular payouts: There are no monthly or quarterly interest payments during the holding period.

- Uncertain yield at application: The final yield is decided only at the auction, so your actual return depends on market demand at that time.

- Allocation uncertainty: You might not get any allocation if demand is high and your bid is too high.

How to apply for Singapore T-bills (step-by-step)

You can apply for T-bills using cash, CPF OA funds (via CPFIS), or SRS funds.

No matter which option you choose, the overall application process works the same way.

Here is the step-by-step process.

Step 1: Check the MAS auction calendar

Visit the MAS website to see the upcoming auction schedule.

Each auction notice will state the auction date, issue size, and issue date.

Step 2: Decide on your bid type

Choose between a competitive or non-competitive bid.

The minimum amount you can invest is $1,000, and applications must be in multiples of $1,000.

Step 3: Submit your application

Log in to your bank or SRS portal and go to the “Singapore Government Securities (SGS) / T-bills” section.

Fill in the amount you want to apply for and select your bid type.

Applications are usually open about a week before the auction and close one or two days before the auction.

It is a good idea to submit your application at least one to two days before your bank’s cut-off time, as some banks close applications earlier to process them before the auction.

Step 4: Wait for the auction results

MAS will announce the results on the auction date, usually in the afternoon. The announcement will include the cut-off yield and the total amount of bids received.

Step 5: Check your allotment and settlement

On the issue date, you can check your CDP or bank account to see how much T-bills you received.

The amount you pay will be deducted from your account, and you will get back the full face value at maturity.

How do I know if my T-bill application is successful

After an auction closes, you can check the aggregate results of the auction about an hour later on the issuance calendar.

The T-bills in Singapore are issued 3 business days after the results are announced.

If your bid is successful, the securities will be reflected in your respective accounts after the issuance date.

- For cash applications: You can check your CDP statement

- For SRS application: You can check the statements from your SRS Operator (DBS/POSB, OCBC and UOB are SRS operators)

- For CPFIS-OA application: You can check the CPFIS statement sent by your agent bank (DBS/POSB, OCBC and UOB are CPFIS agent banks)

- For CPFIS-SA application: You can check your CPF statement

The amount you need to pay will be deducted automatically from your account.

If your application was not successful or only partially allotted, the unspent amount will be refunded to your account.

What would Beansprout do?

T-bills can be a simple way to park spare cash for a short period of 6 months or 12 months.

They also offer a sound way for you to diversify your investment portfolios, while providing a predictable return over a fixed period.

However, they may not be the best choice if you need access to your money quickly or want regular monthly or quarterly income.

Alternatively, you can also find out what are the other ways to generate passive income.

If you want the flexibility of redeeming your investment in any given month, you may consider the Singapore Savings Bonds as an alternative. Read our SSB guide to know more.

If you are just starting out, you could try applying for a small amount with a non-competitive bid. This helps you learn how the process works without committing too much of your money.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments