T-bill yield falls further to 1.38% despite lower demand

Bonds

By Gerald Wong, CFA • 11 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The cut-off yield for the latest 6-month Singapore T-bill on 11 September fell further to 1.38% p.a.

What happened?

The results of the the latest 6-month Singapore T-bill auction are out.

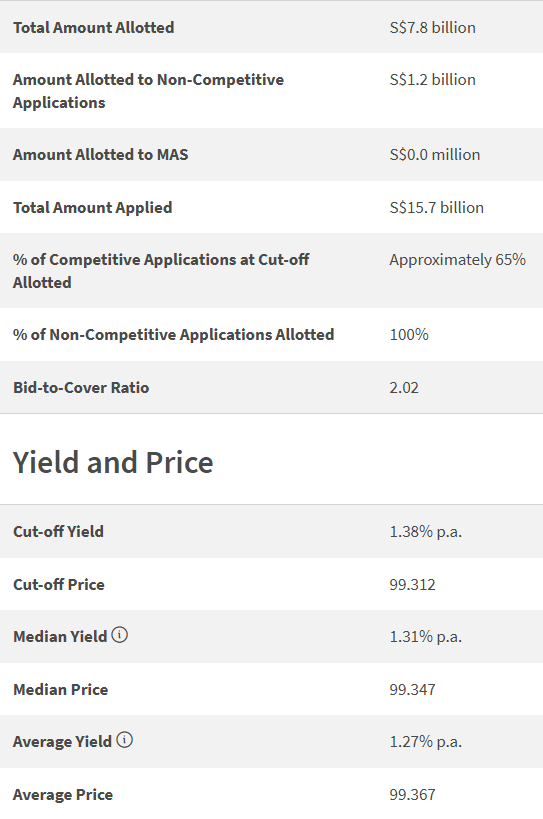

The cut off yield for the 6-month Singapore T-bill (BS25118F) fell to 1.38% in the auction on 11 September 2025.

This continues the trend of a fall in Singapore T-bill yields in recent months, and marks the lowest yield on the T-bill since early 2022.

For investors still looking at Singapore T-bills as a place to generate passive income. I'll share how it compares to the best fixed deposit rates as a place to park your spare cash.

What we learnt from the latest 6-month Singapore T-bill auction

#1 - Demand for the Singapore T-bill declined

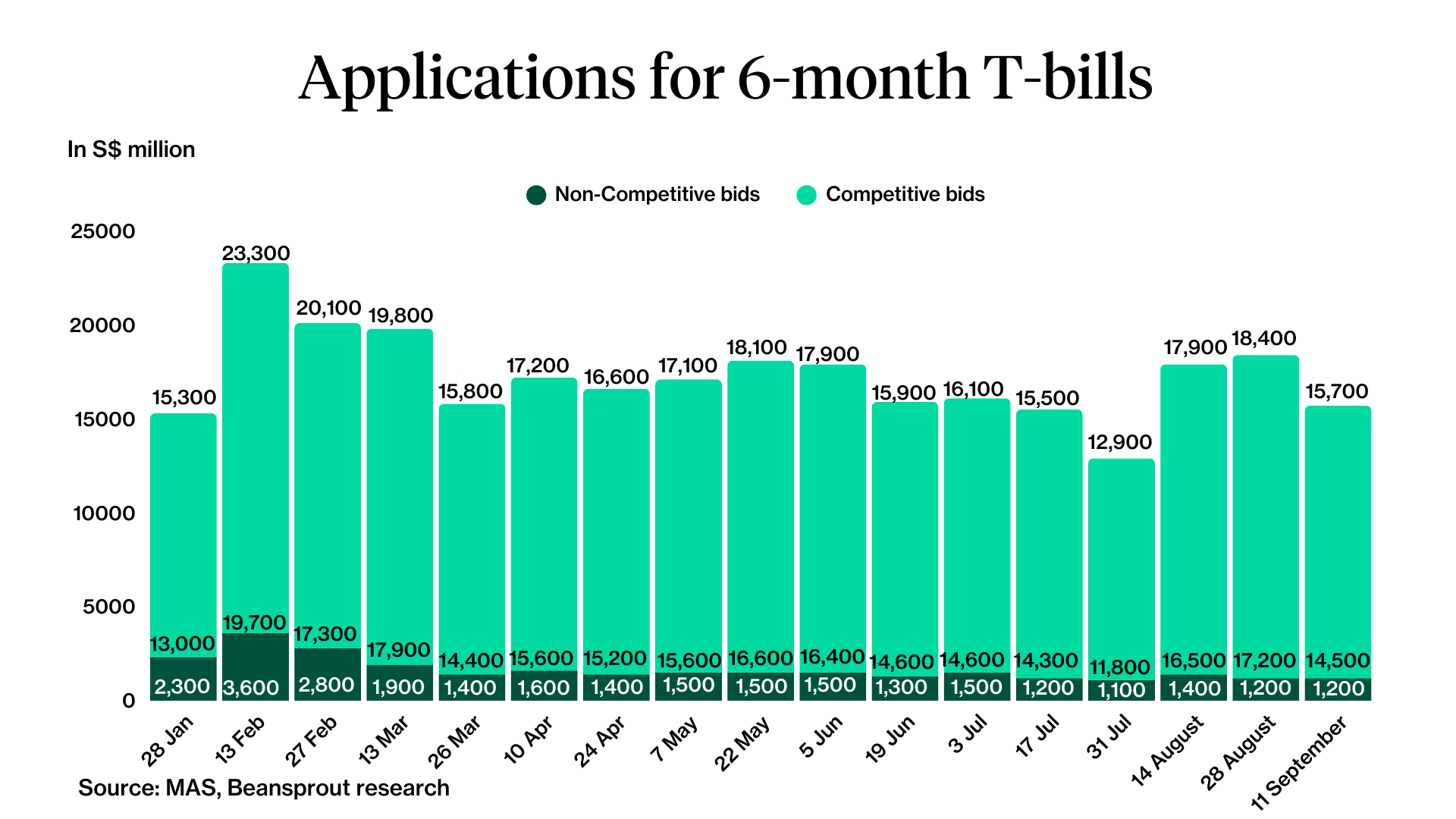

Total applications for the 6-month Singapore T-bill decreased to S$15.7 billion in the latest auction on 11 September from S$18.4 billion on 28 August.

The lower demand is likely due to the lower yield for the T-bill in the recent auction.

The amount of competitive bids decreased to S$14.5 billion.

If you placed a competitive bid below 1.38%, you would receive 100% of your requested T-bill allocation.

If you bid at exactly 1.38%, the allocation would be around 65%.

The amount of non-competitive bids stabilized at S$1.2 billion.

Since the amount of non-competitive bids was within the allocation limit, all eligible non-competitive bids received full allocation for the T-bill.

#2 - T-bills issued increased

The amount of T-bills issued was at $7.8 billion, which was slightly higher than the previous auction on 28 August at $7.7 billion.

With the lower amount of T-bill applications, the ratio of applications to T-bills issued (bid-to-cover ratio) decreased to 2.02x.

#3 - Median yield of bids submitted fell

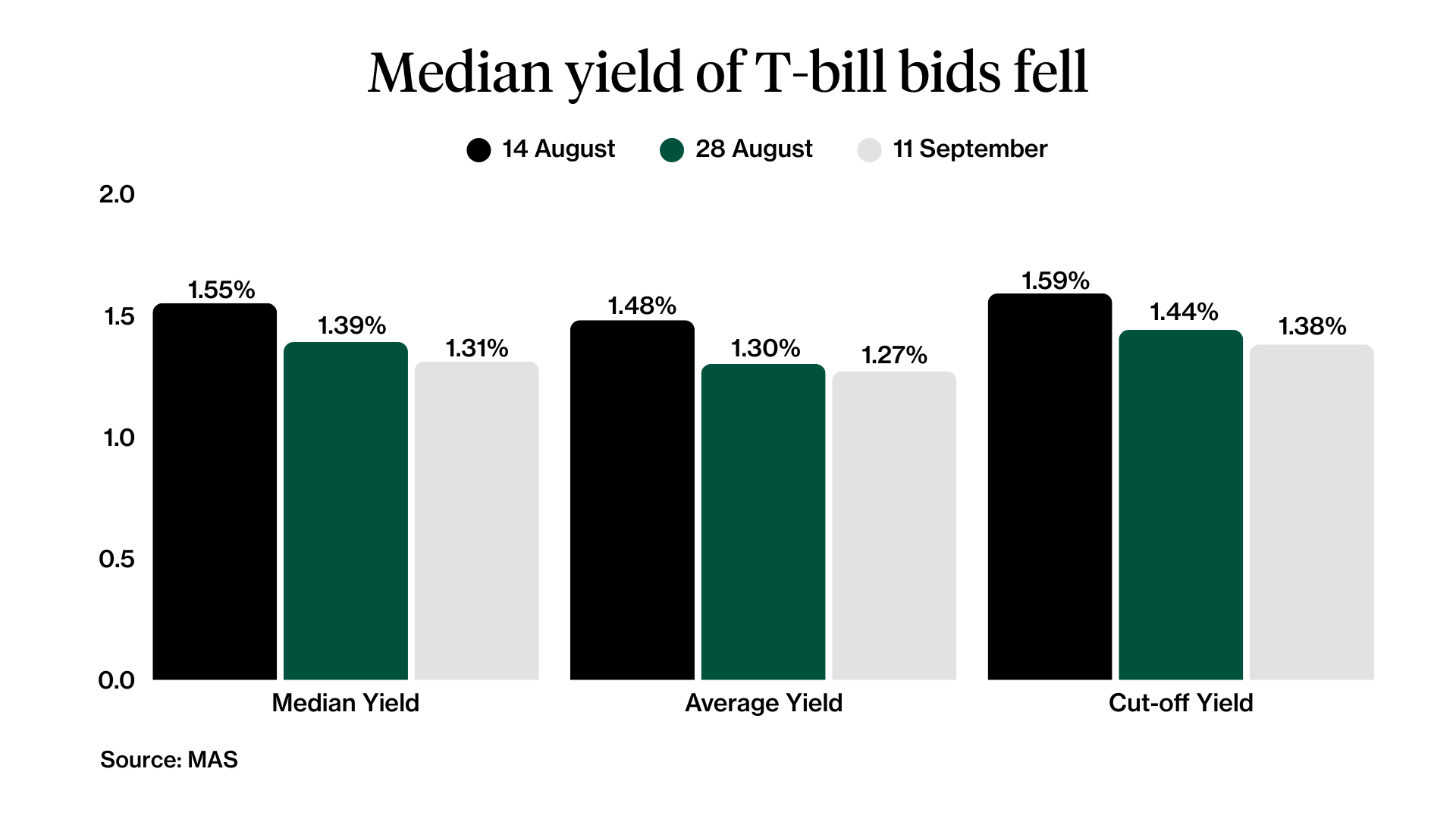

The median yield of bids submitted fell further to 1.31% from 1.39% in the previous auction.

The average yield of bids submitted decreased to 1.27% from 1.30% in the previous auction.

The lower median and average yield of bids submitted is likely due to the fall in bond yields in recent weeks with rising expectations of US Federal Reserve interest rate cuts.

Given the median yield and the cut-off yield, this suggests that a substantial number of bids were placed in the 1.31% to 1.38% range, below the best 6-month fixed deposit rate in Singapore.

What would Beansprout do?

The drop in the T-bill cut-off yield to 1.38% seems to reflect falling short-term government bond yields, as seen in the lower median yield of bids submitted.

Following the decline in T-bill cut-off yields, yields have now dipped below the best 6-month fixed deposit rate in Singapore of 1.60% p.a.

They also fall short of the break-even yield for CPF OA applications, based on calculations using our CPF T-bill calculator.

In light of this, I would consider exploring alternative ways to earn passive income in Singapore.

For example, some savings accounts continue to offer an interest rate of above 1.38% p.a, even though banks have been cutting the interest rates in recent months.

Another popular option amongst investors is money market funds, which aim to provide higher potential returns compared to savings accounts, and greater flexibility compared to fixed deposits.

If you are looking to invest in a money market fund, you can earn an exclusive $50 Fairprice voucher, plus 2 x 6% p.a interest boost coupon (worth up to ~S$60) with Longbridge Cash Plus when you sign up for a Longbridge account via Beansprout. Learn more about the Longbridge promo here.

We can also explore short term bond funds to earn a potentially higher yield with a portfolio of bonds.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments