The lowest cost way to invest in Singapore stocks with lifetime commission-free trading

Brokerage Account

Powered by

By Nicole Ng • 25 Jun 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Longbridge offers lifetime commission-free* trading for Singapore, US, and Hong Kong stocks.

This post was created in partnership with Longbridge Singapore. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

I’ve tried quite a number of broker platforms over the years.

When choosing a broker, I don’t look for anything fancy.

I’m mainly after something simple, cost-effective, and easy to use, especially for trading Singapore, US, and Hong Kong stocks without getting buried in fees or overwhelmed by complicated tools.

Recently, I gave Longbridge a try.

What stood out almost immediately was its lifetime commission-free trading for Singapore stocks, paired with low overall costs for US and HK markets.

Combined with a clean interface and useful research tools, it felt like a platform built with everyday investors in mind.

In this post, I’ll share my experience using Longbridge, what stood out to me, and why it may be worth considering if you’re focused on building a portfolio across Singapore, US, and Hong Kong stocks.

Why Longbridge may be great for trading Singapore, HK, and US stocks

#1 – Lifetime commission free trading in Singapore stocks

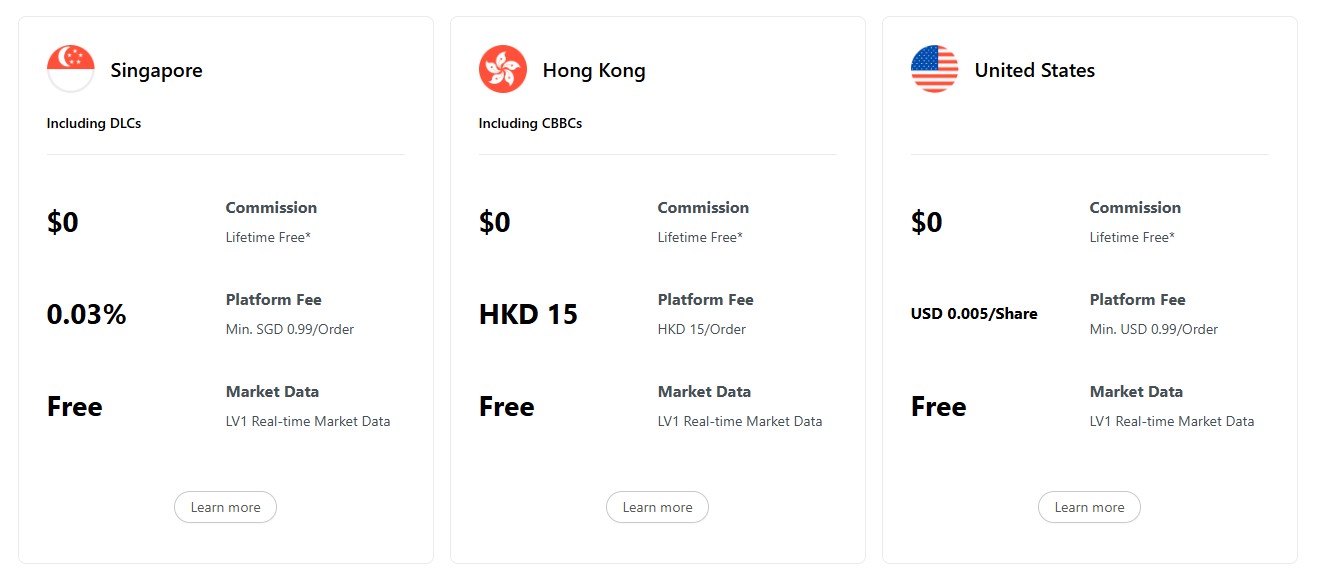

The first thing that immediately stood out to me is Longbridge's lifetime zero-commission* trading on Singapore, US, and Hong Kong markets.

Longbridge’s zero-commission* policy is not time-bound, unlike other platforms that offer promotional free trades for a limited period.

For trades in Singapore stocks, I will just be paying the platform fee of 0.03%, with a minimum fee of S$0.99 per order, in addition to the prevailing SGX fees and taxes.

This makes Longbridge Singapore the trading platform that offers the lowest total fees amongst all the brokers, which usually charge both platform fees and commission fees.

| Broker | Minimum Fees | Commission fee | Platform fee |

| Longbridge | S$0.99 | 0% (Lifetime) | 0.03% |

| Other Low-cost brokers | S$1.60 to S$1.99 | 0.025% to 0.03% | 0.03% |

| Source: Longbridge, various broker platforms, as of 27 January 2026. | |||

#2 – Low cost trading for US and Hong Kong stocks

For US stocks and HK stocks, Longbridge also offers one of the lowest total fees with the zero commissions* for life.

For US stocks, we will just be paying the platform fee of US$0.005 per share, subject to a minimum of US$0.99, in addition to prevailing exchange fees and taxes.

| Broker | Minimum Fees | Commission Fee | Platform Fee |

| Longbridge | US$0.99 | 0% (Lifetime) | US$0.005 / share |

| Other low-cost brokers | US$0.50 to US$1.99 | 0% to 0.005% / share | US$0.99 to US$1.00 |

| Source: Longbridge, various broker platforms, as of 27 January 2025. | |||

For HK stocks, we will just be paying the platform fee of HK$15 per order, in addition to prevailing exchange fees and taxes.

| Broker | Minimum Fees | Commission Fee | Platform Fee |

| Longbridge | HK$15 | 0% (Lifetime) | HK$15 / order |

| Other low-cost brokers | HK$15 to HK$18 | 0.03% to 0.05% or HK$3 | HK$8 to HK$15 / order |

| Source: Longbridge, various broker platforms, as of 27 January 2025. | |||

#3 – Simple and easy to use with multi-currency account

Opening an account was straightforward, I could complete the entire process in just a few minutes using Singpass, with no paperwork or document uploads required.

Funding the account was just as easy, with multiple options like PayNow, Internet Bank Transfer (FAST), and WISE Transfer for SGD, HKD, and USD.

It also has a multi-currency account, so I could easily hold USD, SGD, and HKD while waiting to buy stocks.

When I first downloaded the Longbridge app, the clean design immediately stood out.

The interface is simple, even for someone who doesn’t consider themselves tech-savvy.

#4 – Robust features to make informed trades

Longbridge also has features that help investors move beyond price charts and tickers, and really understand the business behind the stocks.

The Overview feature gives you a simplified snapshot of any company. It shows you the fundamentals, key financial data and analyst ratings, all nicely laid out so you do not feel overwhelmed:

Once you get the overview, you can take a deeper dive into financial statements and performance metrics in the Financial tab, making it easier to understand earnings, balance sheets, and cash flow:

One standout feature is the Industry Chain Map.

Instead of analysing companies in isolation, you get a visualised map that shows how companies fit into the broader economy and supply chain.

For example, when I looked into Nvidia, I was able to see a breakdown of its revenue streams across datacentres, gaming, professional visualisation, and automotive tech.

Longbridge doesn’t just present raw data; it transforms complex financial information into intuitive visuals, helping investors cut through the noise and make informed decisions.

#5- Using PortAI to make investment decisions

One feature I did not expect to use so much was PortAI.

It provides convenient access to research tools and information.

You can ask it for market summaries, financial data, or stock comparisons, and it gives you clear, structured answers within seconds.

This was incredibly helpful for time-constrained investors because it removed much of the guesswork and manual searching I would typically need to do across different websites or platforms.

It also helps with spotting market trends, which was something that would have taken me hours to figure out on my own:

I tested PortAI one day by asking for an update on Nvidia.

In seconds, it pulled up financial metrics, the latest news, analyst ratings, and even compared it with competitors.

For time-strapped investors, it streamlines the research process so you can focus on making smarter decisions.

To learn more about these features, read our review of Longbridge Singapore here.

#6 - Longbridge is regulated and licensed by MAS

Longbridge is licensed by the Monetary Authority of Singapore (MAS) and holds a Capital Markets Services License, ensuring it operates under strict regulatory standards.

To safeguard client assets, securities are held separately through authorised third-party custodians, while DBS Bank acts as the custodian for client funds.

This segregation ensures that client money is kept apart from Longbridge’s own operational funds.

Established in 2019 and headquartered in Singapore, Longbridge is a mobile-first, zero-commission* brokerage that combines financial expertise with tech talent from leading companies like Alibaba and ByteDance.

The company has raised over US$150 million in funding from investors, including PhillipCapital Singapore, and secured an additional US$100 million in late 2024 to support its growth.

What would Beansprout do?

For anyone looking to trade Singapore, HK, and US stocks efficiently, Longbridge’s lifetime commission-free trading stands out as a clear differentiator.

Longbridge checks a lot of boxes: competitive fees, a user-friendly platform, useful trading tools, and operates under recognised regulatory standards.

Its clean interface and competitive fee structure make it ideal for both long-term investors and more active traders.

If you're focused on SG, HK and US stocks and want a cost-effective, easy-to-use broker with strong features, Longbridge is worth a look.

Account opening is fast, commission fees are waived on key markets, and you’ll have access to advanced research tools as you build your investing strategy.

Sign up for a Longbridge Singapore account here and enjoy attractive welcome rewards.

Learn more about the Longbrige Singapore promo here.

*Other fees apply. Check out Longbridge’s full T&Cs here

Disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore. The content and information contained all general information and data (“Information”) for reference only and does not constitute an offer or a solicitation for sale or recommendation of any investments, trading strategies or investment products. You must make your own independent judgment with respect to any matter contained in this article. Your investment is subject to investment risk, including loss of income and capital invested.

This article contains affiliate links. Beansprout may receive a share of the revenue from your sign-ups to keep our site sustainable. You can view our editorial guidelines here.

Enjoy a S$50 FairPrice voucher for new Longbridge users

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions