She left her 6-figure corporate job to start a skincare business: Money Diaries #10

Retirement

By Julian Wong • 13 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Her biggest investment was in taking the risk to leave her corporate job, and go all-in on her business.

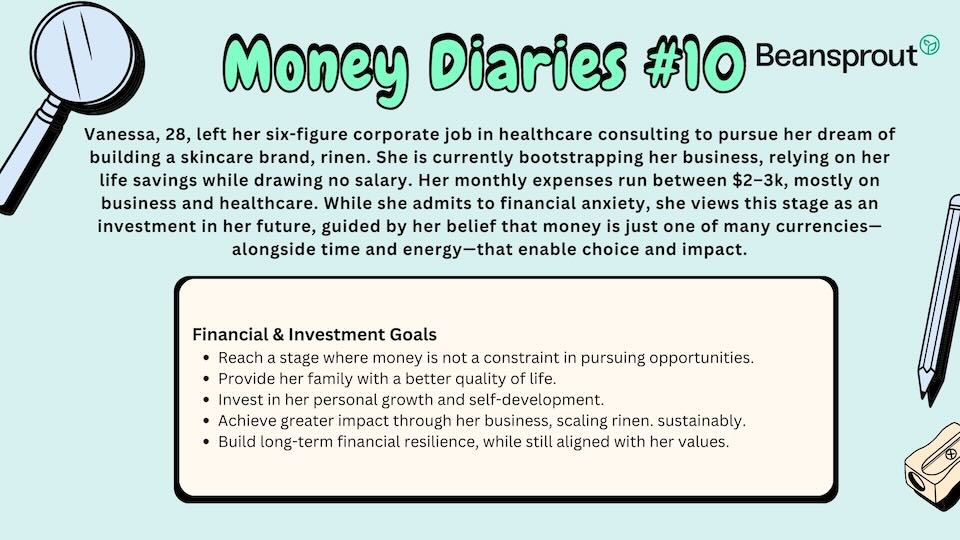

In this week’s Money Diaries, we speak to 28-year-old Vanessa How, an entrepreneur who quit a job in healthcare consulting to start her skincare business, rinen.

Currently, she is not drawing a salary, and is dipping into her life savings to grow rinen. Previously in her corporate role, she earned an annual 6-figure salary.

Interested in Vanessa’s journey? Follow along at her Instagram page.

Money Diaries #10: She left her 6-figure corporate job to start a skincare business

How would you describe the life stage you are in at the moment?

Messy and chaotic, but I guess that’s the price to pay for leaving the typical Singaporean playbook to chase success in the typical way.

I would say I get financially anxious and uncomfortable knowing that I am no longer protected by the benefits and stability of being in corporate (e.g., healthcare coverage, cushy salary), but I’m reminding myself that it’s a passing phase and not an eternal state.

Living situation: are you renting, staying with your parents, or do you own a home, etc?

Living with parents.

Breakdown of typical weekly expenses:

Monthly, I spend anywhere from $2-$3k.

Spread across my business expenses, and subsequently on more personal things like gym, food, healthcare, travel.

My business expenses are definitely the biggest, followed by healthcare costs. Healthcare in Singapore is really expensive if you pay out of pocket (of which, if you do not have corporate insurance to claim from, can really really add up).

Estimate of how much you save every month:

Negatives. Haha.

What are your financial/investment goals:

To reach a point where I will be able to not think of money as a constraint, in anything I want to pursue. Be it being able to provide for my family a better quality of life, investing in my growth, and achieving greater impact through my business.

How close/far would you say you are from your financial goals?

Far from, but hopefully not for too long. When I was still earning 6 figures in corporate, I was able to reach a state where cost was not much of a concern in most of my decision making.

But since I’m entirely bootstrapping my business, and I invest a lot into R&D, it means that I’m dipping into my life savings every day. But I know if we finally get the right product out, then things will slowly take a turn.

I see this current state as an investment for the future.

Describe your investment approach / What steps have you taken or are taking towards achieving these goals?

My biggest investment—a risky one—is leaving my corporate job to go all-in on carving the life that feels right and aligned with my values. Other than that, I’m still signing on to a monthly savings plan.

What are some challenges you’ve faced?

Striking the balance between spending and saving money.

For business expenses, it’s less of a question as I know my priorities are to invest in key aspects of my business so we get the best quality and delivery. But I don’t have deep pockets.

Yet my time and energy is limited. Deciding when to ‘treat’ myself to a Grab ride to conserve time and energy, or to spend on non-essential things like food and travel—even if it could give me the extra boost of energy, is something that I still feel guilty over. This was a no-brainer when I had a cushy salary, but is something that I have to deal with now.

How would you describe your mindset with regards to money? (What are some beliefs you have about money that others may not understand?)

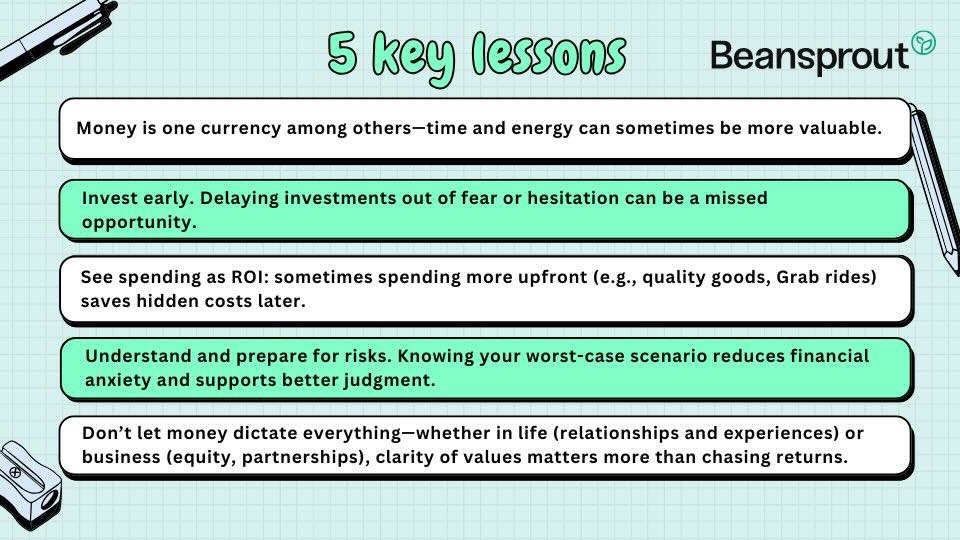

I believe that money is just money. And it’s not always money that we need. Some other currencies that are equally as important could be time and energy. If I can see the ROI of money getting me more time and energy, I’d be more inclined to spend money.

Is there an experience(s) that has shaped your relationship with money? How has it influenced your decisions?

I didn’t grow up wealthy. So I’d scrimp. But over the years, I realised that that was also a hidden cost—simple examples being buying a poorly made t-shirt costing me more since it wears so badly just over a couple washes, causing me to buy more.

Adding on to that, as I socially levelled and interacted with people with the capacity to spend, I realised that money was just a tool you trade for more options in life. I eventually started asking myself what would get me the best long term ROI in the choices I make. And that’s the guiding principle for my decisions today.

What is one money habit you struggle with the most? (Alternatively: What is the expense you find hardest to cut down on?)

I find it hardest to cut down on travel expenses. Travelling on public transport is probably the biggest drainer of my energy. I do not function well in crowded spaces, and my travelling times are usually very long (since I don’t live in central, and my grandparents live 1.5 hours away from me on public transport). To preserve my sanity, I choose when and where to splurge on Grab.

Is there a financial decision you wish you could do over?

I wish I had learned to invest earlier on when I started earning money. I had a nagging feeling in me to start, but I gave myself a lot of excuses like I wasn’t cut out, nor ready for it. But really, I think all I had to do was just start, and learn along the way.

What are you most concerned about when it comes to personal finances?

Healthcare affordability. The worst case scenario for me is not having the money to spend on my health, or my family’s health. I think my past experience in healthcare consulting has really impacted my thinking this way. I saw how expensive good healthcare is, and how many people have been denied access to it because of how unaffordable it is.

If you won S$1m in the lottery tomorrow, what would you do with the money and why? How would your spending/lifestyle change?

I’d definitely prioritise using money to grow my business faster. Things like hiring staff to help with, to exploring scaling quicker through more R&D and testing. I’d also start reinvesting more into conserving my energy and well-being, so I can be my most optimal self and pour back more into my business and life experiences.

What is one practical financial tip that has been useful in your own financial journey?

Learning that money is just another form of currency. Don’t let the chase for money blindside you into trading off things that could be much more important to you. In personal: not letting money take away from the experiences you can have with loved ones. In business: not letting money blindside you from giving up too much equity, control, bringing on the wrong partners etc.

What is a personal finance related lesson you’ve learned that you think others might benefit from?

Always understand the risks involved, and having some sort of idea what you can stomach, or what you’d do if you hit the worst case scenario. I think that takes away some anxiety—and anxiety is probably the thing that can cloud judgement when it comes to things like these - so it’s not something you’d want.

Key Lessons

Here's what you can do to retire happy:

- Grow your CPF to achieve retirement adequacy. Learn how you can grow your CPF here.

- Grow your retirement fund with the Supplementary Retirement Scheme (SRS). Learn how to use the Supplementary Retirement Scheme (SRS) here.

- Build passive income streams and make your money work harder. Find out the various options to start earning passive income in Singapore here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments