From burnout to balance: How this 26-year-old built a healthier relationship with work, wealth, and herself—Money Diaries #12

Retirement

By Julian Wong • 25 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

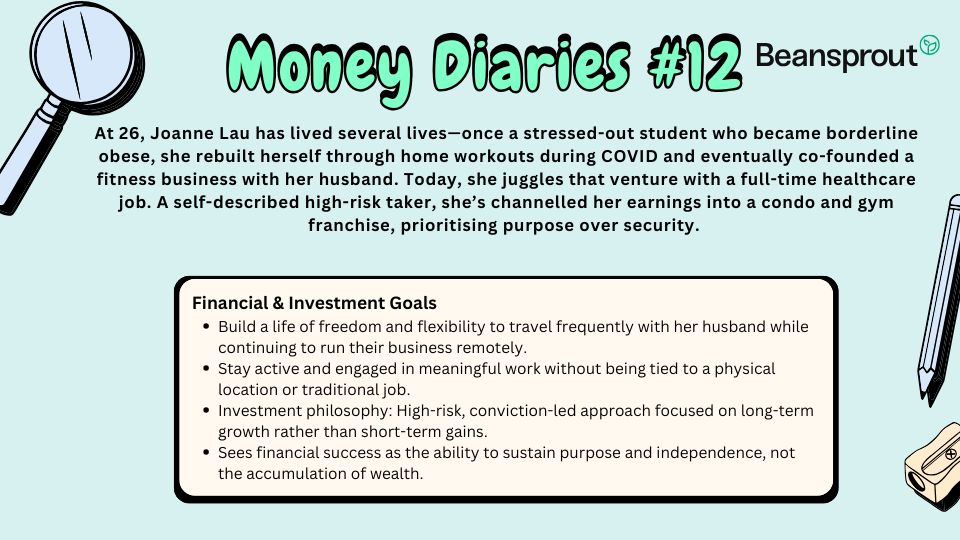

In this week’s Money Diaries, we speak to 26-year-old Joanne Lau, who juggles a full-time job in healthcare while supporting her husband in running 2 side ventures—a content creation studio and a fitness gym.

In this week’s Money Diaries, we speak to 26-year-old Joanne Lau, who juggles a full-time job in healthcare while supporting her husband in running 2 side ventures—a content creation studio and a fitness gym.

The fitness gym—Just A Space SG X S30 Tanjong Pagar—is a new integrated wellness hub that seamlessly fuses high-intensity fitness (S30 Tanjong Pagar) with holistic recovery and mindful movement (Just A Space). Joanne’s goal is to create one sanctuary where you can train hard and recover completely.

Money Diaries #12—From burnout to balance: How this 26-year-old built a healthier relationship with work, wealth, and herself

Joanne shares that her journey with healthcare and fitness has been quite a personal one. When much younger, she had to go through a surgery that impacted the kind of fitness she could have. She then became borderline obese because of stress and multiple jobs, and had to find an outlet, which became fitness.

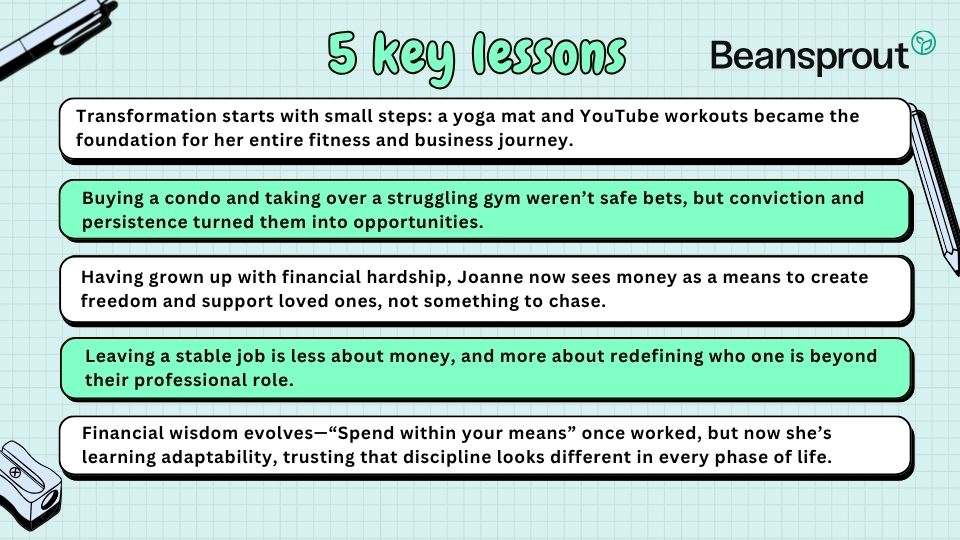

During COVID, she worked out at home with a yoga mat and YouTube videos. Eventually, she achieved what she wanted, which was to slim down and get into a shape where she could go to a gym or class and keep up. That’s how she ended up in the health and fitness space.

Currently, she earns between S$5,000 to S$7,000 per month.

For the 2 side ventures in which she is supporting her husband, she is not currently drawing any additional income due to some of the sensitivities surrounding her full-time work.

How would you describe the life stage you are in at the moment?

I’m in a transitioning-up phase. Waiting to leave my job, but looking for a suitable time—it’ll be soon.

The reason is more about personal identity than money. I’ve tied a lot of my identity to this job, and I’m not sure what becomes of me after I leave. But I also have multiple identities, multiple places that I can call home, so I’m not too worried.

Living situation: are you renting, staying with your parents, or do you own a home, etc?

I own my own place with my husband, which we bought three years ago.

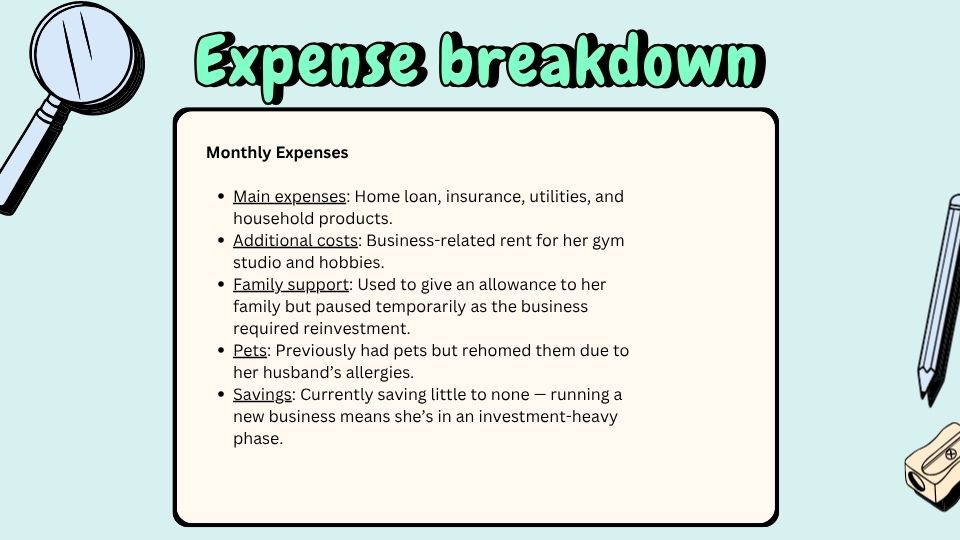

Breakdown of typical weekly expenses: (each day, weekly total, biggest expense)

Insurance, household products, utilities, hobbies, and my home loan. If you include everything—rent, utilities, times two—because we have another studio … yeah.

We used to have pets, but rehomed them because of my husband’s allergies. I used to give an allowance to my family, but since the business picked up, my family told me to stop for a bit until everything settles.

Estimate of how much you save every month:

Nothing, negative. It’s not that I’m bad with money, it’s just that when you’re running a business, especially three months in, it requires investment.”

What are your financial/investment goals?

To be able to travel frequently with my husband, to travel and work at the same time. For example, we can be away for half a year and still have work running locally. The goal is to be active and engaged at work, but not necessarily physically in Singapore.

How close/far would you say you are from your financial goals?

Very close. Very, very close. I expect that by next year I can do that.

Describe your investment approach. What steps have you taken or are taking towards achieving these goals?

I’m a very high-risk taker. I take unconventional paths of investment that have shown some paper profit, but are not fully realised yet. For example, we bought our condo two years ago, which was more of an investment move.

It was risky because our salaries and businesses weren’t stable yet, but we believed in it.

Also, when we took over the franchise business for the gym we currently operate, that was a risk. The business wasn’t stable on paper, but we bought it because we believed in the community and its potential.

What are some challenges you’ve faced?

Sharing with people beyond my family. It’s too much noise. Criticism or guilt-tripping from others made me feel like I was dragging my family with my risky decisions. I’ve learned to keep bigger decisions to myself and talk only to those I trust.”

On the flip side, my family has been my biggest source of support. They should stop me sometimes (laughs), but I always show them logic, numbers, rationale. They listen because they know I’ve made my decision. My family and husband have been emotionally supportive. It’s not just about financial backing, it’s also about emotional and logical understanding.

How would you describe your mindset with regards to money? What are some beliefs you have about money that others may not understand?

When I was in school, I hated money. My family had debt issues. A lot of people had money and I didn’t, so I hated it. But later, I saw money as a friend, as a tool. I started working hard and saving a lot, but I realised I wasn’t living. So now, I spend more to experience things with my family. I don’t chase money anymore. I trust it will come with the right work.

Is there an experience(s) that has shaped your relationship with money? How has it influenced your decisions?

Coming from a middle-income family with some debt issues changed my view. When I finally had more, I felt a responsibility to use it properly: first for my family, then to help others.

I went on mission trips the past two years and realised that if I had more, I could make more sustainable impact. So now, I see money as a means of provision—for loved ones and for causes I believe in.

What is one money habit you struggle with the most?

Spending on food. I like eating things that are novel or interesting. They can be expensive.

I know I should cut down, but I enjoy it. Growing up, I couldn’t afford to eat what I wanted, so now I find joy in that freedom.

Is there a financial decision you wish you could do over?

I’d start investing earlier. If I have a kid, I’ll buy insurance or an investment trust for them from young, something that pays out enough to clear student loans or down payments. But they’d have to pay me back the principal sum. I think that builds a healthy relationship with money.

What are you most concerned about when it comes to personal finances?

Honestly, I’m not concerned. I’m not chasing wealth or status. I’m happy with what I have. If I earn more, great—I can provide for others. But if not, I’ll still be fine.

If you won S$1m in the lottery tomorrow, what would you do with the money and why? How would your spending/lifestyle change?

I’d buy my mum her own place. She’s always wanted one. Something that will also grow in investment value. My lifestyle wouldn’t change, I’d still live simply.

What is one practical financial tip that has been useful in your own financial journey?

Spend within your means—though I’m not following it now (laughs). Find something that works for you. It worked for me at one stage of my life, but as I took on more pursuits, it stopped being realistic. So right now, there isn’t one fixed rule, it’s just about adaptability.

What is a personal finance related lesson you’ve learned that you think others might benefit from?

Personal finance means different things to different people. Even if others give advice, you have to decide what applies to your situation. Be ready to bear the consequences of your decisions. If you’re wise and it works, great. If you take risks and fail, learn from it and move on. At the end of the day, it’s your journey.

Here's what you can do to retire happy:

- Grow your CPF to achieve retirement adequacy. Learn how you can grow your CPF here.

- Grow your retirement fund with the Supplementary Retirement Scheme (SRS). Learn how to use the Supplementary Retirement Scheme (SRS) here.

- Build passive income streams and make your money work harder. Find out the various options to start earning passive income in Singapore here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments