She pivoted from engineering to tech and banking, and tripled her salary: Money Diaries #11

Retirement

By Julian Wong • 27 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Grow your income, adapt your strategy to your life stage, focus on your own path, and see money as just a tool to living a fuller life.

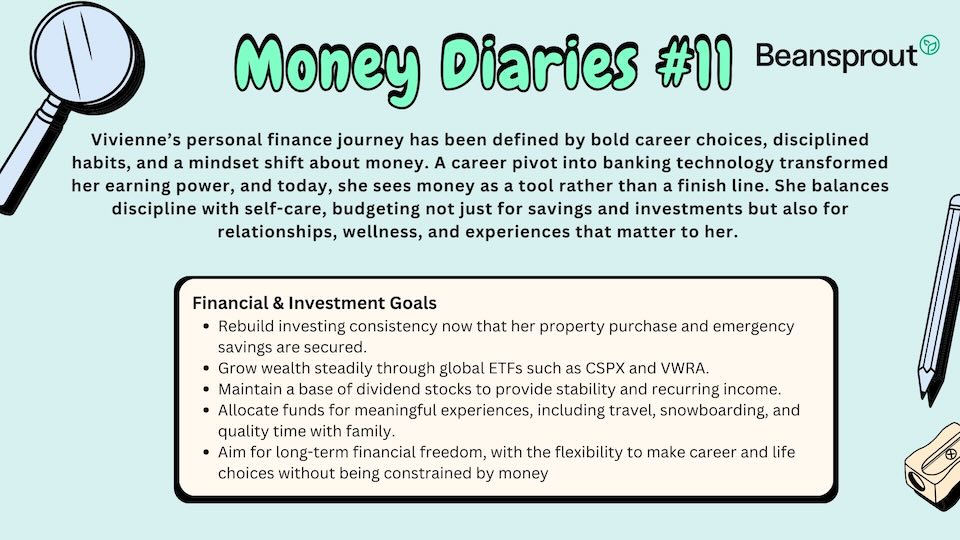

In this week’s Money Diaries, we speak to 33-year-old Vivienne Khoo, who works in the tech and banking sector.

After making a career pivot 3 years ago, she now makes around 6-figures per year.

Money Diaries #11: Pivoting from engineer to tech and banking, and tripling her salary in the process

How would you describe the life stage you are in at the moment?

I’m at a transitional but exciting stage of life. My boyfriend (34) and I (33) just purchased our first home in March 2025. For now, we still live separately with our families, but we’re preparing for the next phase of moving in together.

Career-wise, I pivoted from Railway Engineering into Technology in Banking three years ago, and that decision has more than tripled my salary. It feels like I’ve laid a strong foundation in both career and personal life, and now I’m focused on building long-term stability and growth in all aspects including financially.

Breakdown of typical weekly expenses: (each day, weekly total, biggest expense)

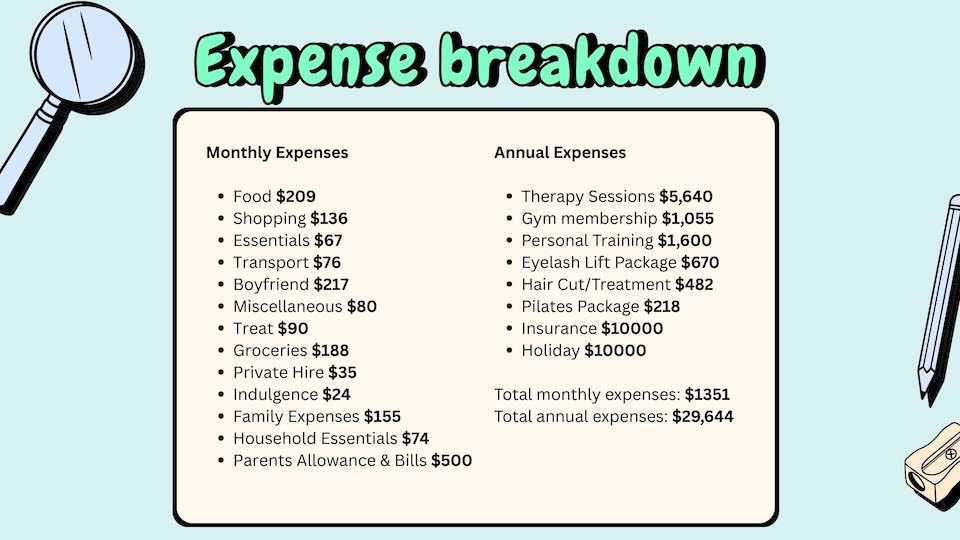

On average, my weekly spending comes to about $1,351/month or ~$312/week.

- Biggest expense categories: Parents’ allowance & bills ($500/month) and groceries/food.

- I also budget for “relationship spending” with my boyfriend ($217/month) and treats for family and friends like paying for their meals and the occasional gifts.

Annual expenses such as therapy, insurance, gym, and holidays total about $29,600: which I prefer to track separately to get a clearer picture of my cash flow.

This structured approach helps me know exactly where my money goes and reduces anxiety around spending. My monthly savings vary depending on lumpy expenses (like annual insurance premiums or holidays), so instead of a fixed number, I set an annual savings target.

Estimate of how much you save every month:

- In 2024, I saved about $47,000.

- By the end of 2025, I expect to save about $50,000.

Even during years where I slowed down on investing, I have managed to achieve my end-of-year goals.

Amount invested each year:

2018: $6700

2019: $12,331

2020: $25,708

2021: $3400

2022: $2312

2023: $0

2024: $2400

I have since liquidated most of these and have calculated that I have a realised overall gain of 20% despite investing into crypto and have lost quite a significant sum. These went into cash to buy my EC.

The remaining lot was liquidated in June 2025 when the portfolio was green to further cash out the profits for a longer runway of emergency savings. I used 2024 annual expenses as a benchmark and I have about 15 months of emergency savings

What are your financial/investment goals? How close/far would you say you are from your financial goals?

My near-term goal is to rebuild consistency in investing now that I’ve bought my EC and built up 15 months of emergency savings. Longer term, my goals are:

- To grow my wealth steadily through mutual funds and global ETFs like CSPX and VWRA

- Maintain a diversified base of dividend stocks for stability, and

- Allocate funds for experiences I value — travel, snowboarding, and quality time with family.

I have yet to figure out my long-term goals but essentially, the principle is to have the freedom to make any career and make career and life decisions without being constrained by money.

Describe your investment approach / What steps have you taken or are taking towards achieving these goals?

My approach has shifted over the years.

2018–2019: I was just starting out with a modest $3,400 salary but invested $1,000/month into DBS, STI, and global ETFs. My strategy then was simple: get started, even without an emergency fund. Now in hindsight, it was overly aggressive.

2020: I ramped up my investments to $25,708 as my salary grew. My focus was to build a larger portfolio quickly, still prioritising equities and ETFs while experimenting with some individual stocks.

2021–2022: I slowed down investments ($3,400 in 2021, $2,312 in 2022) to redirect cash flow. I was transitioning in between phases in life and also have moved out of my family home to rent a home so I could better focus on my new career switch.

2023: I stopped investing entirely and shifted strategy towards liquidity. I opened high-yield savings accounts like UOB One and parked cash there, knowing I would soon need flexibility.

2024: With an EC or resale property in mind, I focused almost exclusively on cash savings to ensure I had sufficient funds for downpayment and fees. My strategy was to minimise risk, keep money accessible, and hit my savings target (~$47,000 that year).

2025 onwards: After buying the EC and securing 15 months of emergency savings, my strategy is to return to consistent, long-term investing. With a stronger base and higher salary, I’ll focus on global ETFs (VWRA, CSPX) for growth and dividend stocks for stability, while continuing to keep some liquidity for flexibility.

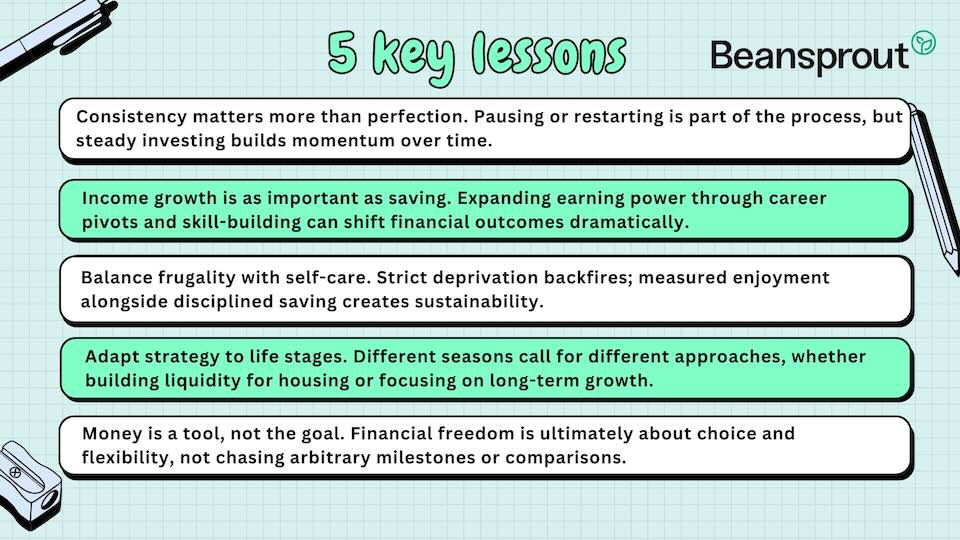

The biggest step for me has been learning to adapt my strategy to different life stages while making financially informed decisions. Years of expense tracking have given me clarity on my savings and spending, which allows me to make data-driven choices.

What are some challenges you’ve faced?

Some of the challenges I have faced were

- Lack of Consistency: I stopped investing at times due to lack of liquid savings or major life decisions such as housing. I kept switching between growing my savings and investing instead of being focused and doing things step by step.

- Lack of Knowledge: When I started, I didn’t know about diversification or compounding. I just bought local bank stocks and the STI.

- Emotional discipline: Crypto losses were tough, but they taught me to focus on long-term, diversified assets.

Despite these, I’ve learned to see money as a tool that supports my growth, rather than something to chase rigidly.

How would you describe your mindset with regards to money? (What are some beliefs you have about money that others may not understand?)

There will be phases in our life where we have more time than money and more money than time.

In my twenties, I have more time on hand than money so I took this time to invest in myself, pivot into different careers and try out different roles to utilise my strengths better. This did help to increase my earning power.

In my thirties, I am in a position to ‘outsource’ or be more willing to spend on better luxuries in my life to save ‘time’. An example would be taking a taxi instead of taking the public transport to shave off 15-20 minutes for the journey.

While I see frugality as an important virtue, it needs to be balanced with self-care. Being overly strict with yourself can backfire. Constant deprivation not only creates lingering “what if” thoughts, but may also lead to burnout, resentment, or even impulsive overspending later on. In the long run, a healthier approach is to allow yourself measured enjoyment while still keeping sight of your financial goals.

Is there an experience(s) that has shaped your relationship with money? How has it influenced your decisions?

During my tertiary education, I took an elective module on personal finance. One of the projects required analysing family finances, and my family was selected. I was appalled to discover that our household was spending around $10,000 a month, yet had little to no savings.

The realisation hit me hard: we were living paycheck to paycheck, and a single unfortunate accident could leave us struggling to put food on the table, as my father was the sole breadwinner.

That experience deeply shaped my outlook. When I landed my first job out of university in 2018, I immediately began tracking my expenses. Seven years on, this habit has stayed with me and continues to guide how I manage money today.

What is one money habit you struggle with the most? (Alternatively: What is the expense you find hardest to cut down on?)

One money habit I struggle with is spending on big purchases. I tend to feel anxious whenever I make them, which is why I track my expenses diligently every 2–5 days. For example, even a $200 purchase from Love, Bonito requires me to pause and make sure it fits within my budget.

At the same time, I don’t want this caution to turn into being stingy, especially when it comes to relationships. To balance it out, I intentionally budget for treating friends and family, so I can spend on them freely without second-guessing. This way, I reduce my anxiety while still aligning my money habits with my values.

Is there a financial decision you wish you could do over?

If I could redo one financial decision, it would be to start investing earlier and with more consistency. When I was younger, I played it safe by only putting money into DBS and the STI. Looking back, I realize I could have afforded to take more risk and should have diversified into broader markets like the S&P 500.

Had I started earlier, even modest contributions would have had years to compound, which could have significantly grown my portfolio by now. What I lacked back then was knowledge, I didn’t fully understand the power of compounding or the importance of global diversification.

This hindsight has shaped how I invest today: I stay consistent, diversify beyond my home market, and place a strong emphasis on continuous learning so I don’t miss out on opportunities simply because I didn’t know better.

What are you most concerned about when it comes to personal finances?

I think both income size and savings rate are equally important. You can only save so much if your essential expenses are already streamlined, so the other lever is to grow your income. For me, that means continuously investing in oneself whether through courses, building new skills, or taking on more responsibilities at work. These are to expand earning power. At the same time, keeping a close eye on savings rate to ensure lifestyle doesn’t creep up faster than earning power.

To me, financial security comes from balancing both: growing the pie while making sure enough of it is set aside for the future.

If you won S$1m in the lottery tomorrow, what would you do with the money and why? How would your spending/lifestyle change?

If I won S$1 million in the lottery tomorrow, I think I would initially feel overwhelmed and probably wait about three months before making any major decisions, just to think through the best way to use it. I would likely start by topping up my emergency savings, fixing or repairing existing appliances at home, and hiring professional help to reorganise my family home so my parents can live more comfortably in a clutter-free environment. I’d also set aside some funds for occasional treats for my family and loved ones.

I would likely invest the bulk of it (~90%) gradually, dollar-cost averaging into a diversified mix of mutual funds and ETFs over a five-year period. At the same time, I would set aside a portion for family and maybe a small treat for myself, but my overall lifestyle wouldn’t change drastically. For me, the windfall would be a way to accelerate my financial goals rather than dramatically change my day-to-day lifestyle.

What is one practical financial tip that has been useful in your own financial journey?

One practical financial tip that has been most useful in my journey is awareness; not just tracking my expenses, but also keeping an eye on my overall net worth. This gave me a clear picture of my financial health and helped me realize that while frugality is valuable, focusing solely on cutting costs (e.g. walking instead of taking a bus) has limited impact. Instead, growing my income turned out to be far more effective in improving my financial position.

What is a personal finance related lesson you’ve learned that you think others might benefit from?

A personal finance lesson I’ve learned, which I think others can benefit from, is that change takes time. While some people may hit milestones like $100K in savings by age 30, it took me longer and that’s perfectly fine. Setting goals is important, but constant comparison is the thief of joy. The key takeaway is to make informed financial decisions based on your own habits and circumstances, rather than measuring yourself against others.

Key Lessons

Here's what you can do to retire happy:

- Grow your CPF to achieve retirement adequacy. Learn how you can grow your CPF here.

- Grow your retirement fund with the Supplementary Retirement Scheme (SRS). Learn how to use the Supplementary Retirement Scheme (SRS) here.

- Build passive income streams and make your money work harder. Find out the various options to start earning passive income in Singapore here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments