What are DLCs and how to use them to trade volatile Singapore stocks?

Trading

Powered by

By Gerald Wong, CFA • 07 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Explore Daily Leverage Certificates (DLCs) on Singapore blue chip stocks such as DBS and SIA.

This post was created in partnership with SGX. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What Happened?

The Singapore market has garnered renewed investor interest recently, with the benchmark Straits Times Index (STI) reaching record highs.

However, as we enter the earnings season, I have received some questions on how traders can tap on opportunities with the volatility in share prices.

For example, we have seen fairly sizeable moves in the share prices of several Singapore blue chip stocks such as SIA and Keppel after their results announcements.

In this article, I will share more about Daily Leverage Certificates (DLCs) and how they can be used as an instrument for traders looking to position for the earnings season.

What Are Daily Leverage Certificates (DLCs)?

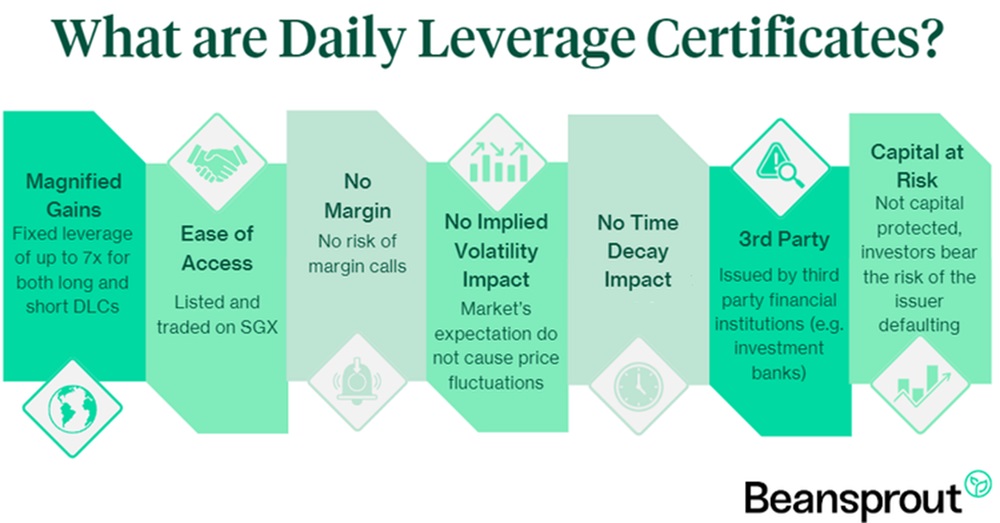

DLCs offer you with leveraged exposure to the daily performance of an underlying stock or index, it also allows you to long or short the stock or index.

They are listed on SGX, typically with predefined leverage factors like 3x, 5x, 7x. This means that investors' returns are amplified by the respective multiplier indicated.

As shown in the example above, the naming convention of a DLC follows this format:

- BYD - Underlying asset (BYD CO., LTD)

- 3x Long- Leverage type (3 times long exposure)

- SG - Issuer (Societe Generale)

- 271125 - Expiry date in YYMMDD format (25 November 2027)

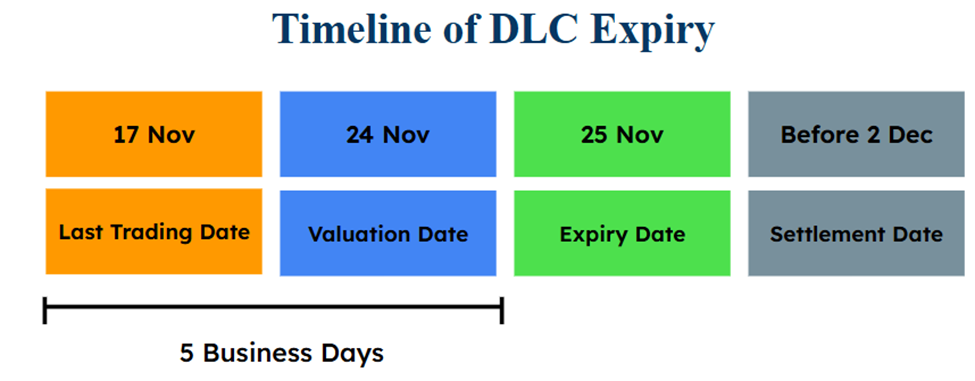

You will need to be aware of the following naming convention because each DLC comes with an expiry date — typically three years from its launch. This expiry date is important because the last trading day occurs five business days before the expiry date. After this last trading day, investors will no longer be able to trade the DLC.

But don’t worry — even after the DLC expires, its intrinsic value will still be returned to you during the designated settlement period.

However, do note that DLCs are generally designed for short-term trading to gain leveraged exposure to brief market movements, and are not intended to be held over extended periods until expiry.

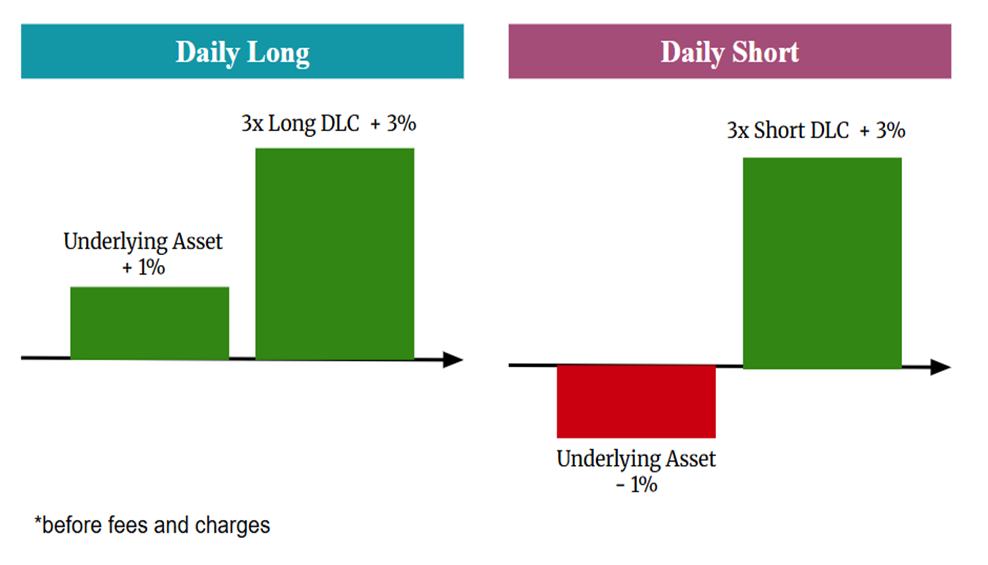

As for the leverage type, here’s how it works: A 3x Long DLC means that if the underlying stock (for example, BYD) goes up by 1% in a day, your DLC is designed to return 3% (before costs and fees). On the flip side, if BYD drops by 1%, your long DLC would reflect a 3% loss. So it’s a tool that amplifies both gains and losses — useful if you have a strong short-term view of the market.

There are usually two types of DLCs: Long and Short.

- A Long DLC lets you profit when the underlying stock or index goes up.

- A Short DLC lets you profit when the underlying goes down.

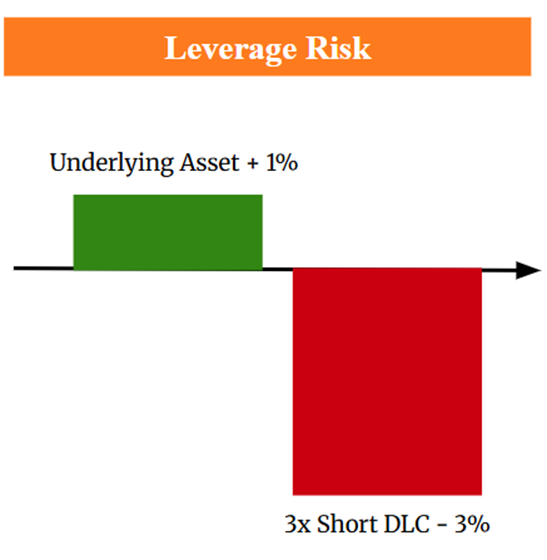

This means you can take a position regardless of market direction — whether it's rising or falling — but keep in mind that leverage works both ways, amplifying not only your potential gains but also your losses.

For example, if I hold a 3x Short DLC and the underlying asset rises by 1%, my DLC would drop by 3%. This means that while potential gains are amplified, so are the losses. That's why proper risk management is essential when trading leveraged products.

It's also important to note that DLCs are not capital guaranteed — your entire investment is at risk, though losses are limited to the amount you’ve invested.

Why DLCs Are Meant for Short-Term Trading

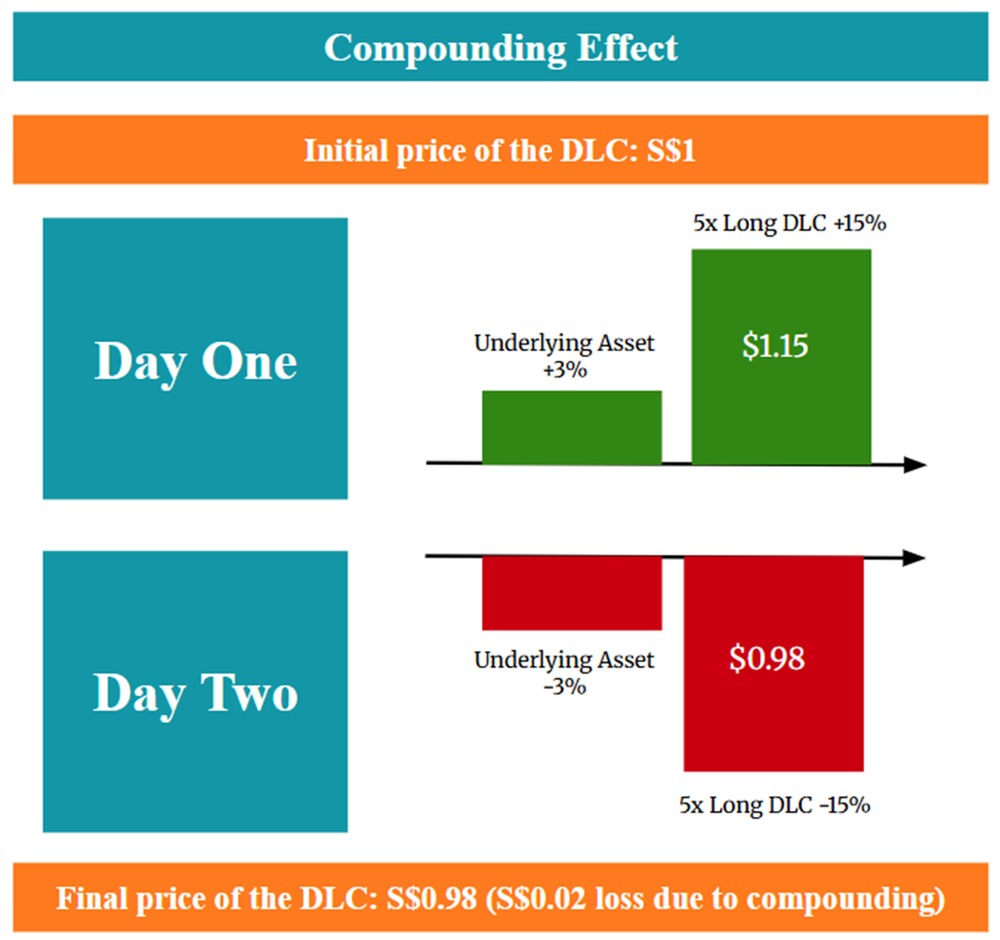

Since DLCs reset daily, the biggest challenge is the compounding effect — the leverage applies only to that day’s price movement, not over multiple days. But fret not, I’ll walk you through it — I’ve been there myself and learned it the hard way when I first started on DLCs.

The simplest way to explain it is this: if the share price goes up by 5% one day and then drops by 5% the next day, you’ll still end up with a loss — and that’s because of the compounding effect.

That’s why DLCs are generally not suitable for long-term holding and are better suited for active traders looking to capture short-term price movements or respond to new events.

Now, let’s go through a few examples to see how you can use DLCs effectively during earnings season.

Real-Life Examples: trading Earnings with DLCs

Example 1: SIA 5x Short DLC

SIA released its earnings report on July 28, 2025, with high expectations as air travel had recovered to levels even better than before COVID-19. However, if you had expected the stock to drop due to rising inflationary pressures and bought a SIA 5x Short (ZDBW) DLC, here’s how that would have played out.

| Date | SIA (C6L) Share Price | SIA 5x Short (ZDBW) Price |

|---|---|---|

| 28-Jul-25 | S$7.6 | S$0.347 |

| 29-Jul-25 | S$7.04 (-7.37%) | S$0.474 (36.6%) |

| 30-Jul-25 | S$6.9 (-1.99%) | S$0.520 (9.7%) |

| 31-Jul-25 | S$6.8 (-1.45%) | S$0.558 (7.31%) |

Over a three-day period, the SIA 5x Short DLC could have delivered a return of 60.81%, assuming your bearish outlook was correct and the market reacted as expected following the earnings announcement. This illustrates how DLCs can offer significant short-term returns — but only if the timing and market direction are on your side.

Example 2: Keppel DLC

Let me walk you through another example of how DLCs can work in your favor when used correctly and with good timing.

Keppel Corporation released its earnings on 31 July 2025. If you’re a close follower of Keppel and had strong conviction that the results would be positive, you might have taken a Long DLC position in anticipation of a price rally.

| Date | Keppel (BN4) Share Price | Keppel 5x Long (DKZW) Price |

|---|---|---|

| 30-Jul-25 | S$8.18 | S$0.455 |

| 31 July 2025 (High) | S$8.74 (+6.85%) | S$0.615 (+35.16%) |

| 31 July 2025 (Close) | S$8.47 (+3.55%) | S$0.549 (+20.66%) |

By entering a 5x Long DLC position on Keppel (DKZW) just before its earnings release and closing the position the next day, you could have potentially gained 20.66% to 35.16% — compared to the underlying share’s gain of only 3.55% to 6.85%.

This example highlights how, with the right timing and market insight, a leveraged DLC position can significantly amplify your returns — making DLCs a powerful tool for short-term trading around key events like earnings announcements.

What Are the Risks of Using DLCs?

#1 - Issuer Risk

DLCs are unsecured structured products issued by third-party financial institutions such as Societe Generale, UBS, and others. This means they are not backed by any collateral or protected by investor insurance schemes. If the issuer experiences financial difficulties, defaults, or goes bankrupt, investors could lose part or even all of their capital — regardless of how well the underlying stock or index has performed.

#2 - Compounding Effect from Daily Reset

As mentioned in the earlier example, the compounding effect happens on a daily basis because DLCs reset every day. This means that each day's return is calculated based on the latest DLC value, not your original investment amount.

If you hold 1,000 shares, a small loss — say $0.02 per share — can quickly add up, especially if the market moves sideways like in the earlier example. Over time, these small daily losses can compound and erode your investment significantly. That’s why DLCs are generally not suitable for long-term holding, particularly in flat or choppy markets.

Who Can Invest in DLCs?

To invest in DLCs, you must first be qualified to trade Specified Investment Products (SIPs) — a category of financial instruments that have more complex structures and higher risk, requiring greater investor knowledge and understanding.

To assess your eligibility, your broker will conduct a Customer Account Review (CAR), which evaluates factors such as:

- Relevant educational qualifications

- Work experience in finance

- Prior investment experience in similar products

If you do not meet the criteria, you’ll need to complete the SGX SIP Online Learning Module to demonstrate your understanding before you can begin trading DLCs.

What Would Beansprout Do?

Daily Leverage Certificates (DLCs) allow active traders flexibility in capturing magnified gains (or losses) on daily market fluctuations.

However, due to the leverage involved in DLCs, we will need to make sure that we understand the product features before we invest in them.

You will also need to be qualified to transact in Specified Investment Products (SIPs) to buy DLCs.

Here are a few key dates to take note of for upcoming earnings reports by Singapore blue chip companies:

Thursday, 7 August 2025: DBS, UOB, Genting Singapore earnings

Friday, 8 August 2025: Sembcorp Industries, SGX earnings

If you are keen to find out more about DLCs, learn more at the SGX product page here or Beansprout’s guide to DLCs.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Daily Leverage Certificates (DLCs) on the SGX.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments