Standard Chartered Priority Banking Review: Benefits and Eligibility

Private Wealth

By Nicole Ng • 06 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Discover the benefits and requirements of becoming a Standard Chartered Priority Banking customer.

What happened?

If you're seeking a personalised and premium banking experience with a lower entry point, Standard Chartered Priority Banking is worth considering.

It offers wealth management services, investment options, and lifestyle privileges to help you manage and grow your finances effectively.

With a minimum asset requirement of just S$200,000, it’s one of the most accessible ways to enter the world of priority banking in Singapore.

Let’s take a closer look at what it offers and how it could support your financial goals.

What is Standard Chartered Priority Banking?

Standard Chartered Bank offers a priority banking program for clients with at least S$200,000 in deposits and/or investments, or those that maintain a minimum of S$1.5 million in housing loans with the bank - putting it among the lowest entry requirements into the world of priority banking.

It offers a wide range of perks and privileges to those in the program:

- The Wealth $aver account - earn up to 3.30% p.a. on your deposits

- 1% cashback on spending with the Wealth $aver debit card

- Access a full suite of wealth solutions and advice

- Personalised investment planning with myWealth Advisor

- Discounted trading on Standard Chartered Online Trading

- Access to Standard Chartered’s 360° Rewards programme

- Attractive sign up bonuses

In this article, we explore Standard Chartered’s priority banking a little deeper.

What are some key benefits of Standard Chartered’s Priority Banking?

#1 – Receive up to 3.30% p.a. of interest with Wealth $aver account

The Standard Chartered Wealth $aver Account is a priority banking exclusive account where you can receive up to 3.30% p.a. of interest for the first three months on the first S$1.5 million balance.

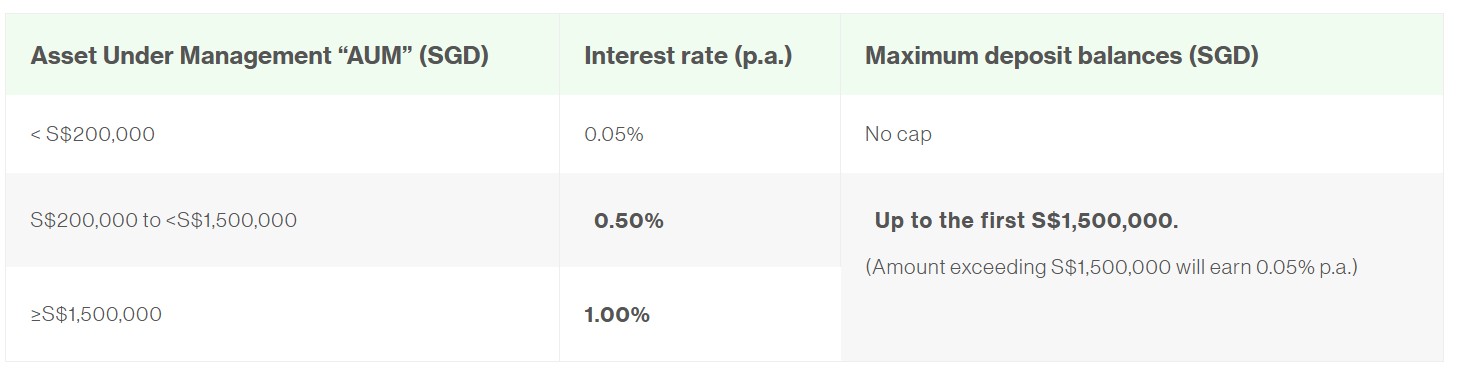

However, while the headline interest rates seem attractive, the interest rate for your Wealth $aver account balances varies according to a few factors, one of them being the amount of deposits you have with Standard Chartered.

It starts with 0.50% p.a base interest for a S$200,000 minimum deposit balance.

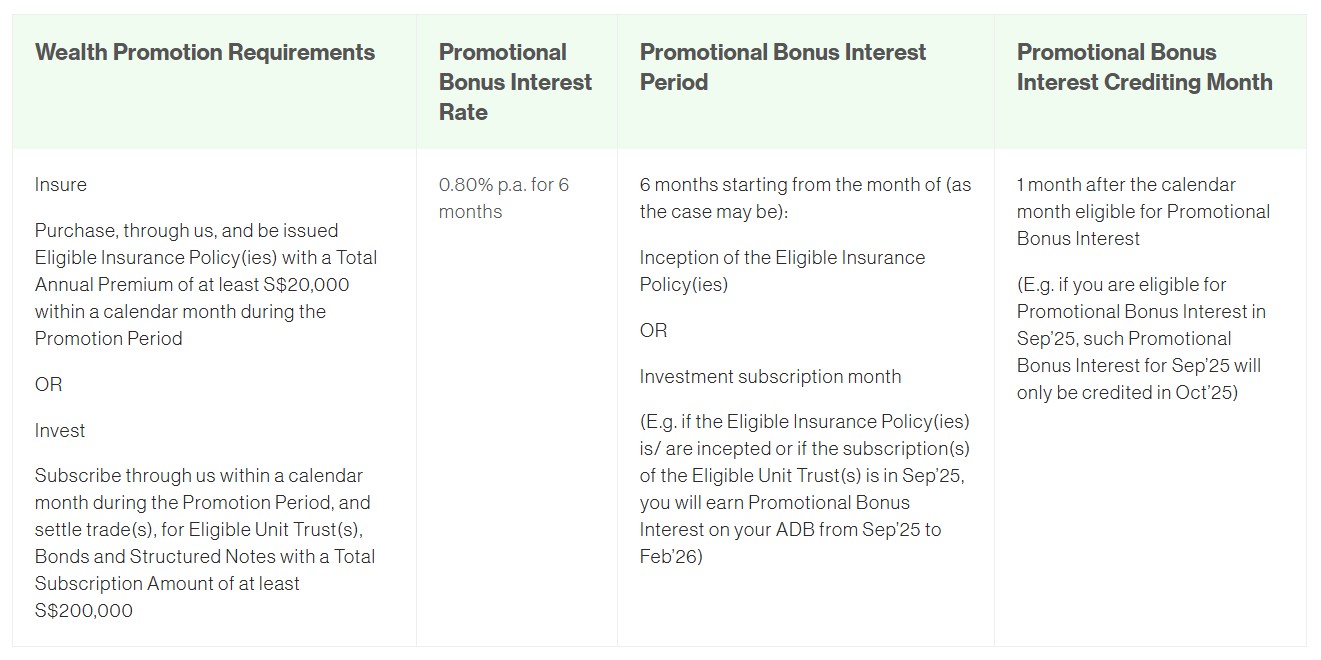

You can also earn a bonus interest of up to 0.80% p.a. for 6 months by investing a minimum of S$200K or insuring a minimum of S$20K in one of the eligible products within a calendar month.

For a limited time only, Priority Banking clients can earn up to an additional 1.50% p.a. bonus interest for three months on incremental fresh funds (minimum S$200,000 up to S$1 million) via Standard Chartered’s ongoing Top-Up Promotion.

You will need to register for the promotion to be eligible for it.

Only by meeting the criteria above will you qualify for the maximum 3.30% p.a interest rate for three months.

Otherwise, the base interest rate is typically closer to 0.50% p.a. (for AUM below S$1.5M).

Check out our guide to the best priority banking options in Singapore.

#2 – Enjoy 1% unlimited cashback on Wealth $aver debit card

In addition to the Wealth $aver account, the Wealth $aver Debit Card that comes with the Wealth $aver account comes with 1% unlimited cash back on your spending.

There is no minimum spend required, no cashback cap and the cashback is applicable for both local and foreign spending.

Priority banking members can also sign up for the Priority Banking Visa Infinite Credit Card and Priority Banking Beyond Credit Card, which come with perks such as complimentary Priority Pass lounge access, 1 mile per dollar rewards program, and participation in Stanchart’s 360 Rewards program.

If you're new to Standard Chartered credit cards, you can receive a Samsonite MODUS Spinner 25” (worth S$610) and S$100 cashback when you apply and spend a minimum of S$800 within 60 days of card approval.

#3 – Access a full suite of wealth solutions and advice

One of the benefits of joining a priority banking program is access to a larger pool of wealth products and services. Stanchart is no different, and they offer a list of services for you to grow your wealth.

- SC Wealth Select: Stanchart’s bespoke wealth advisory service to grow and protect your wealth

- CIO and Market Insights: Access expert and timely financial advice from Standard Chartered’s Chief Investment Office from weekly house view commentaries across asset classes and invitations to webinars by our investment experts on their market perspectives

- Online Unit Trusts: Access Stanchart’s online unit trust platform to access over 300 fund offerings with investment plans from S$100 per month

- Accredited Investor (AI) program: Accredited Investors can access bespoke wealth solutions such as structured products

- Preferred pricing for wealth lending: Access secured overdraft facility at attractive rates

If you’re looking for access to private market investments, you’ll need to be a private banking client with Standard Chartered with a higher minimum deposit.

Alternatively, if you’re looking to access exclusive investment opportunities in private markets at a lower minimum, you can also check out ADDX.

#4 – Personalised investment planning with myWealth Advisor

Priority Banking customers can also get access to myWealth Advisor, a personalised investment planning tool that combines Chief Investment Office house views and expert insights.

As a personalised tool, it allows your Relationship Manager to provide up-to-date investment ideas based on your portfolio with them, and you receive information on your investments and updates on the market outlook.

These ideas and insights are driven by Standard Chartered’s House View and in-house analytics, so you receive timely and actionable updates.

#5 – Discounted trading on Standard Chartered Online Trading

Priority Banking members also receive discounted rates and no minimum brokerage amount on their online trading platform, which gives investors access to 14 major stock exchanges globally with no custody fees.

| Personal Banking | Priority Banking (Online) | |

| Brokerage Rate (SGX) | 0.20% | 0.18% |

| Brokerage Rate (Other Markets) | 0.25% | 0.20% |

| Minimum Brokerage Amount | S$10 | S$0 |

| Source: Standard Chartered, as of 6 October 2025 | ||

Priority banking members also receive discounted rates on select products and services, such as fixed deposits, as well as waivers on most account maintenance fees and charges like account fall-below fees and cheque book fees.

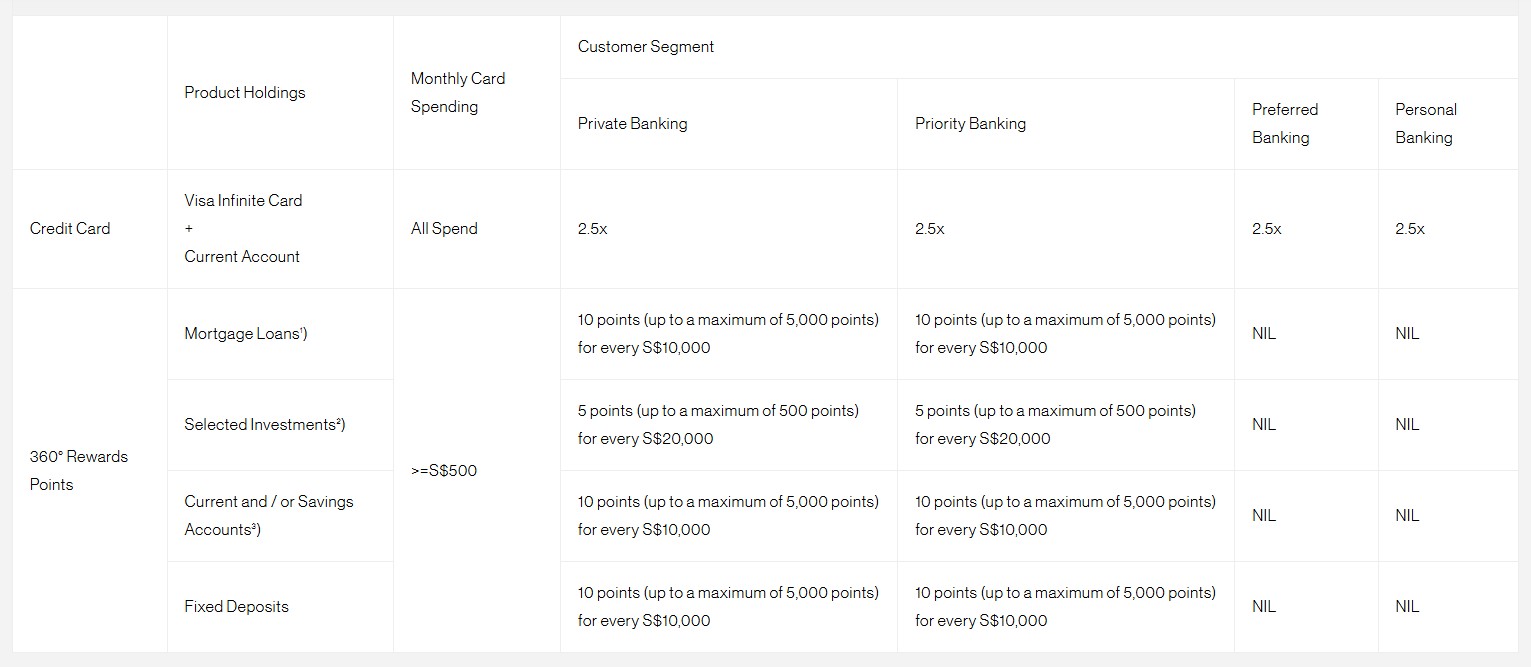

#6 – Access to Standard Chartered’s 360° Rewards programme

Standard Chartered’s 360° Rewards Program allows you to earn rewards points not only on your card spending but also on your existing portfolio of product holdings, including mortgage, selected investments, deposits and online transactions.

For example, priority banking customers can earn up to 10 points for every $10,000 in their current or savings account, and 2.5x points on all spend with the Visa Infinite Card.

What are some potential drawbacks of Standard Chartered Priority Banking?

#1 – Conditional and reduction in airport lounge access

Standard Chartered Priority clients can only receive 12 complimentary lounge visits if they meet multiple conditions, which include maintaining S$200,000 AUM, holding the Priority Visa Infinite card, and having active wealth holdings. This means you'll need to have either an investment or insurance product with them to qualify.

Otherwise, you're limited to just 2 visits per year, making this perk less accessible compared to other priority banking programs.

#2 – Expensive card needed for unlimited lounge visits

If you want to enjoy the unlimited airport lounge access with Standard Chartered Priority, you’ll need to get the Standard Chartered Beyond Credit Card.

However, this card comes with a high, non-waivable annual fee of S$1,500 (excluding GST) for the main card.

While the card comes with great perks, the fee might be a downside for those who don’t make full use of the benefits.

What is the minimum required balance to qualify for Standard Chartered Priority Banking?

To qualify for Standard Chartered Priority Banking in Singapore, you must meet one of the following criteria:

- Maintain a minimum of S$200,000 in deposits and/or investments with Standard Chartered.

- Alternatively, maintain a minimum of S$1.5 million in housing loans with the bank.

What is the current promotion for signing up for Standard Chartered Priority Banking?

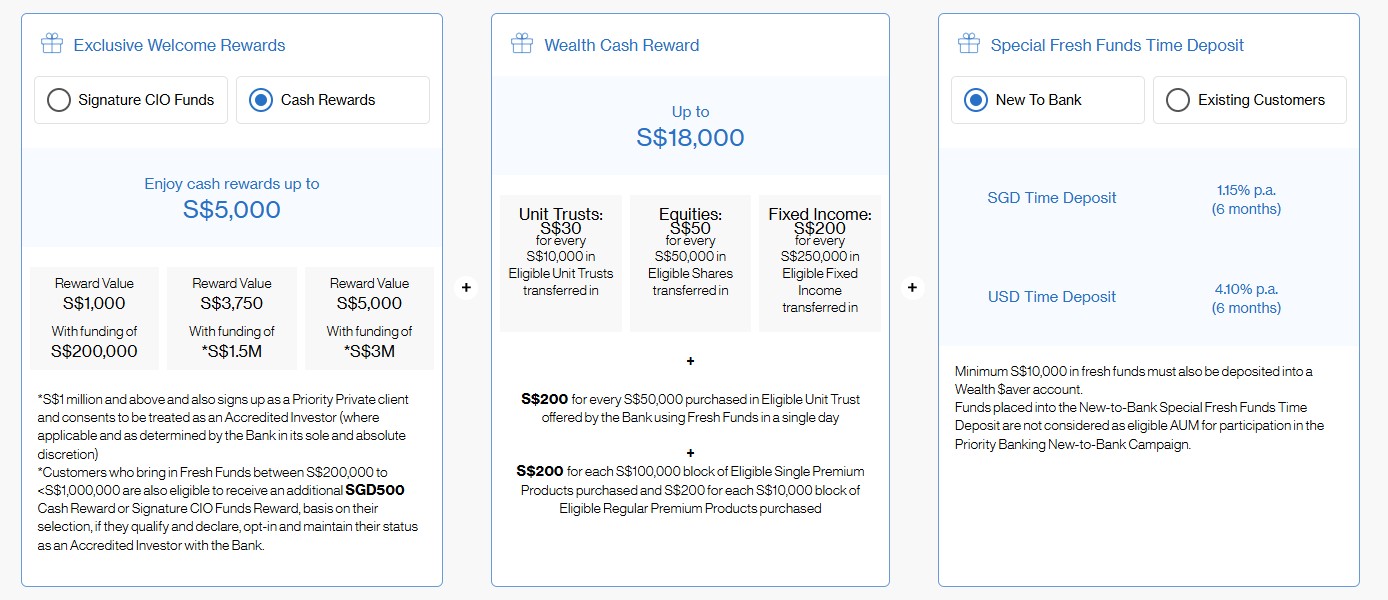

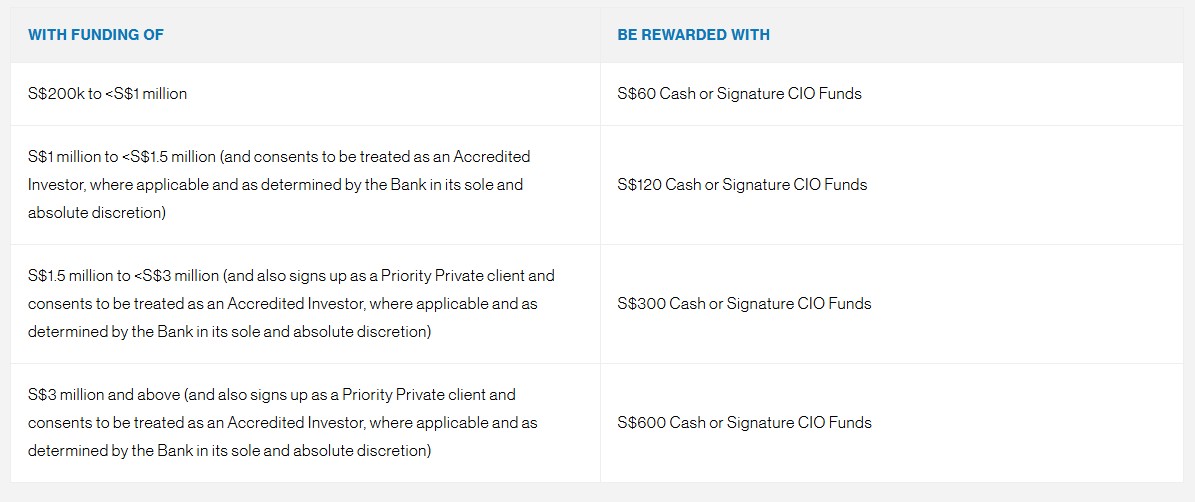

Standard Chartered Priority Banking is offering exclusive welcome rewards of up to S$5,000 in cash for clients who bring in fresh funds starting from S$1,000 for S$200,000, up to S$5,000 for S$3 million.

Accredited Investors who bring in Fresh Funds between S$200,000 to <S$1,000,000 are also eligible to receive an additional S$500 cash or fund reward.

New Priority Banking clients can also enjoy Wealth Cash Reward of up to S$18,000 when they transfer or invest in eligible products.

You can receive S$30 for every S$10,000 in eligible unit trusts, S$50 for every S$50,000 in shares, and S$200 for every S$250,000 in fixed income transferred in, each capped at S$2,000.

In addition, you’ll earn S$200 for every S$50,000 of new unit trust purchases made in a single day (capped at S$6,000), and S$200 for each S$100,000 in single premium insurance plans or every S$10,000 in regular premium plans purchased (each capped at S$3,000).

Also, fresh funds placed in a 6-month Time Deposit earn 1.15% p.a. (SGD) or 4.10% p.a. (USD), with a minimum placement of S$10,000 into a Wealth $aver account.

Do note, however, that funds placed in these time deposits are not counted toward eligible AUM for other Priority Banking campaigns.

In celebration of SG60, you can also stack on more bonus rewards of up to S$600 when you top up fresh funds of up to S$3 million. This promotion runs until 31 December 2025.

How does Standard Chartered Priority compare to DBS Treasures and Citigold

In case you’re wondering how does Standard Chartered Priority compare to DBS Treasures and Citigold, I've compiled them in the table below.

| Priority Banking Programme | Standard Chartered Priority | DBS Treasures | Citigold |

| Total Relationship Balance (TRB) | S$200K or at least S$1.5 million in mortgage with Standard Chartered | S$350K | S$250K |

| Sign-up Rewards |

|

Get additional S$1,000 if you opt in as an Accredited Investor. |

|

| Preferential Fixed Deposit Interest Rate | Earn 1.15% p.a. on 6-month SGD fixed deposit (> S$25K) | N/A |

|

| Savings Account Preferential Interest Rate | Up to 3.30% p.a. interest with Wealth $aver on your first S$1.5mil deposit balance | N/A | Earn up to 7.51% p.a. interest on your Citi Wealth First Account by combining base interest with bonus rewards for spending, investing, buying insurance, taking a home loan, and growing your account balance. |

| Additional rewards |

| Get up to S$8,000 in digiPortfolio investments for the first Unit Trust trade via DBS Online Funds Investing platform |

|

| Source: DBS Treasures, Standard Chartered Priority, Citigold, as of 6 October 2025 | |||

What would Beansprout do?

Standard Chartered Priority Banking offers members a wide range of wealth solutions tailored to their needs.

With one of the lowest entry requirements in the market at just S$200,000 in AUM, it can be an accessible entry point into priority banking.

On top of this, perks such as discounted fees on the online equities platform, the 360° Rewards Programme, and a generous sign-up bonus make it appealing for those looking to grow their wealth with the bank.

That said, if you’re exploring priority banking options, it’s worth comparing with alternatives like DBS Treasures, which also comes with its own benefits.

One limitation of Standard Chartered Priority is the lack of access to private market opportunities for Accredited Investors.

If exclusive private market investments at lower minimums are a priority, platforms like ADDX may be worth considering.

Learn more about the best priority banking accounts to find out how you can earn the most attractive rewards as a priority banking client.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

1 questions

- milo yap • 26 Nov 2025 12:21 PM