T-bill yield dips to 1.41%. Better than fixed deposits?

Bonds

By Gerald Wong, CFA • 24 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The cut-off yield for the latest 6-month Singapore T-bill on 23 October fell to 1.41% p.a.

What happened?

The results of the latest 6-month Singapore T-bill auction are out.

In the auction on 23 October, the cut off yield for the 6-month Singapore T-bill (BS25121V) fell to 1.41% from 1.44% in the previous auction.

This follows a trend of falling yields on the Singapore T-bills, with the latest 1-year Singapore T-bill yield falling to 1.35%.

For investors still looking at Singapore T-bills as a place to generate passive income. I'll share how it compares to the best fixed deposit rates as a place to park your spare cash.

What we learnt from the latest 6-month Singapore T-bill auction

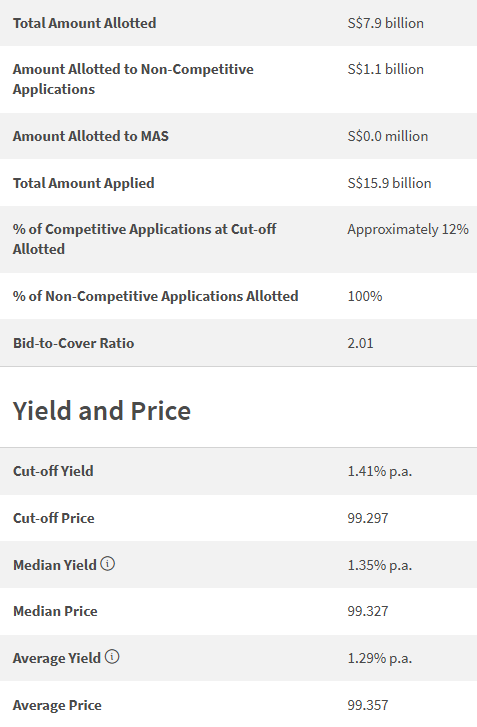

#1 - Demand for the Singapore T-bill increased

Total applications for the 6-month Singapore T-bill increased to S$15.9 billion in the latest auction on 23 October from S$14.8 billion on 9 October.

The increase in applications is likely due to the bounce in yield in recent T-bill auctions, driving higher investor demand.

The amount of competitive bids increased to S$14.8 billion.

If you placed a competitive bid below 1.41%, you would receive 100% of your requested T-bill allocation.

If you bid at exactly 1.41%, the allocation would be around 12%.

However, the amount of non-competitive bids fell to S$1.1 billion.

Since the amount of non-competitive bids was within the allocation limit, all eligible non-competitive bids received full allocation for the T-bill.

#2 - T-bills issued increased

The amount of T-bills issued was at $7.9 billion, which was slightly higher than the previous auction on 9 October at $7.8 billion.

With the higher amount of T-bill applications, the ratio of applications to T-bills issued (bid-to-cover ratio) increased to 2.01x.

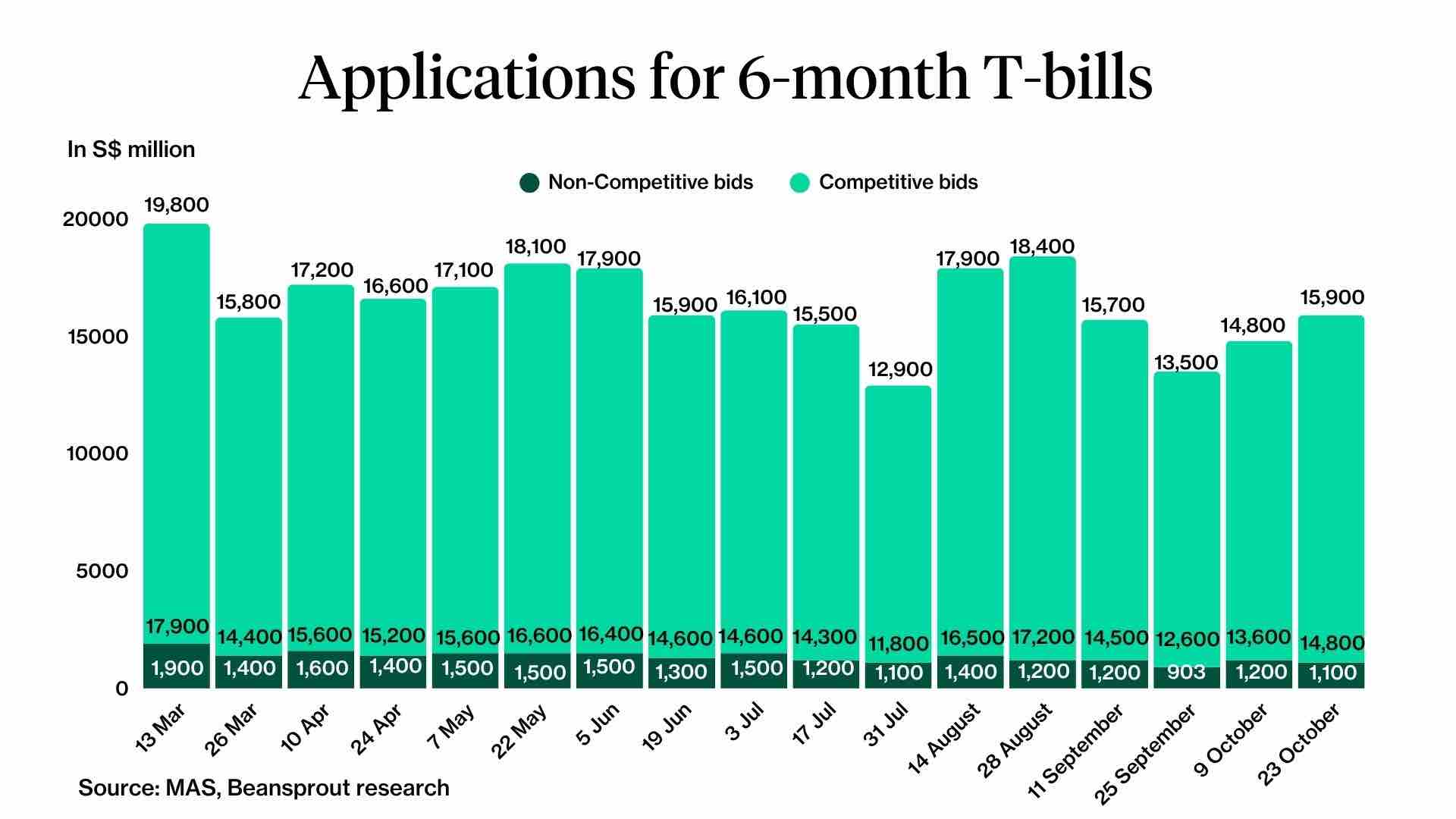

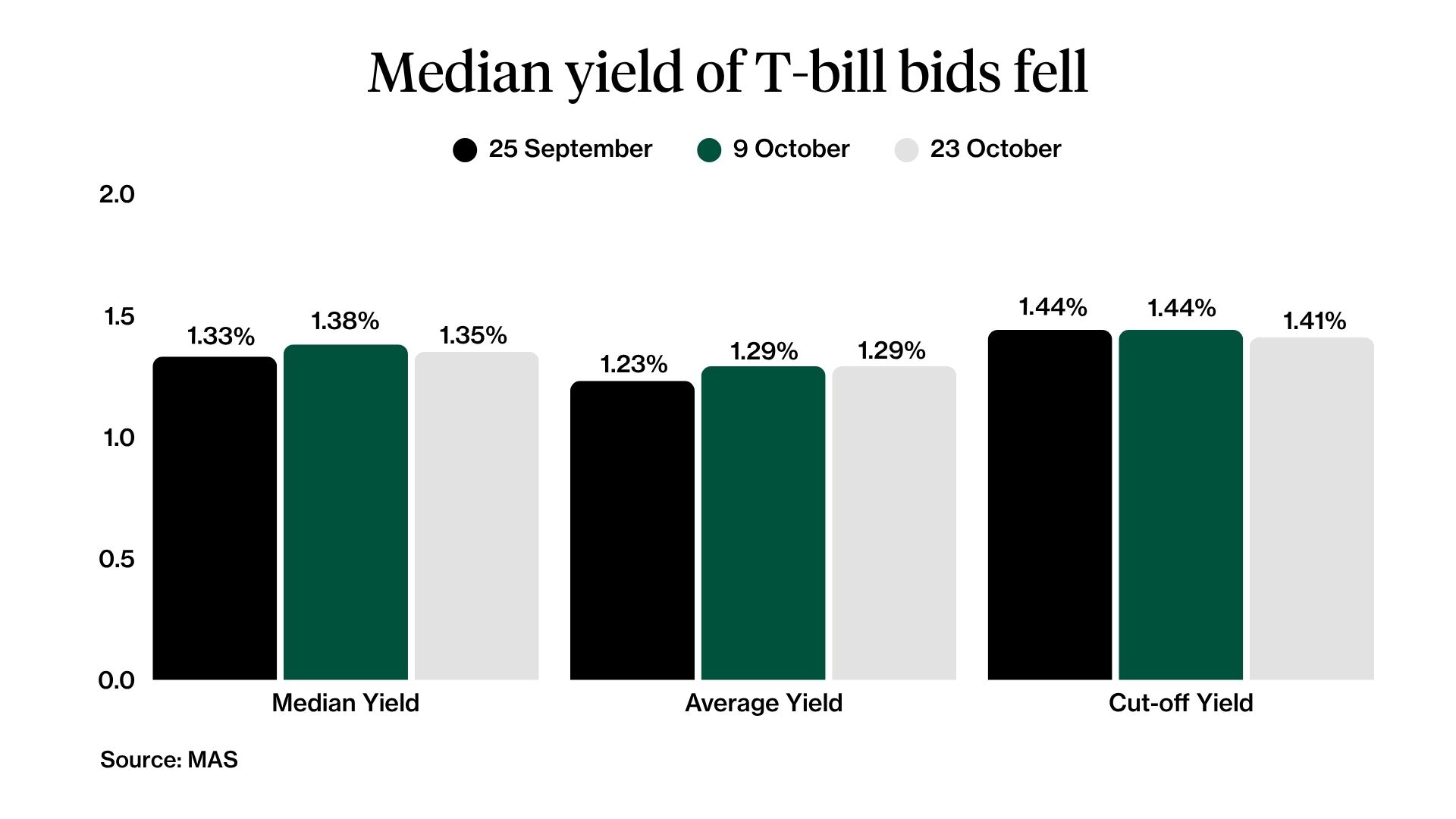

#3 - Median yield of bids submitted fell

The median yield of bids submitted fell slightly to 1.35% from 1.38% in the previous auction.

The average yield of bids submitted remained steady at 1.29%,

The decrease in the median yields of bids submitted would be consistent with the slight decrease in bond yields we have seen in the past two weeks.

Given the median yield and the cut-off yield, this suggests that a substantial number of bids were placed in the 1.35% to 1.41% range, on par with the best 6-month fixed deposit rate in Singapore.

What would Beansprout do?

The lower T-bill yield likely reflects an increase in demand for the T-bill, as well as a decline in bond yields globally over the past two weeks.

The latest cut-off yield for the Singapore T-bill is now close to the best 6-month fixed deposit rate in Singapore of 1.40% p.a.

It would also be quite close to the 1-year return of 1.39% on the latest Singapore Savings Bonds (SSBs).

However, we were still able to find savings accounts in Singapore that offer an interest rate of above 1.44% p.a. For example, the DBS Multiplier promo allows new Multiplier customers to earn up to 2.5% p.a. on the first S$100,000.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

💰[Limited Offer Until 31 Oct] Get bonus S$50 FairPrice voucher within 5 working days, S$18 cash voucher, plus 2x6% p.a. interest boost on S$2,000 with Longbridge Cash Plus for 90 days (worth up to S$60) when you sign up for a Longbridge account via Beansprout. Stand a chance to win 1g gold bar (worth ~$220)! T&Cs apply. Learn more about the Longbridge promotion here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments