Here's what to expect for the T-bill auction on 29 January

Bonds

By Gerald Wong, CFA • 24 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The closing yield on the 6-month Singapore T-bill was at 1.36% on 22 January 2026.

What happened?

The next 6-month Singapore T-bill auction (BS26102F) will be coming up on 29 January 2026.

In the most recent auction on 15 January, the cut-off yield for the 6-month Singapore T-bill fell to 1.39% from a recent high of 1.60% in the auction on 31 December 2025.

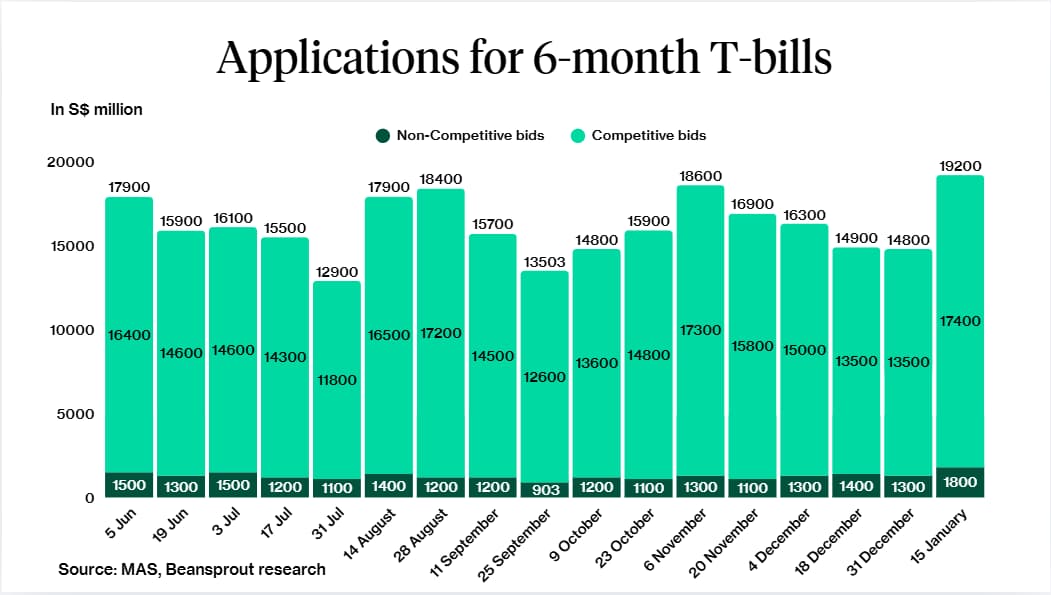

We also saw applications for the 6-month Singapore T-bill reach a record high.

With elevated demand for the T-bill , I’ll look at some of the latest indicators to help us understand what the upcoming cut-off yield might be, and if it will still be worthwhile applying for T-bills as a way to generate passive income.

Here's what to expect for the Singapore T-bill auction on 29 January

#1 – US 10-year government bond yields rose slightly

The 10-year US government bond yield rose to 4.25% as of 23 January 2026, from the yield of 4.17% from two weeks ago.

This is likely driven by renewed concerns on US debt levels, following an escalation in global geopolitical uncertainty with US President Donald Trump's comments about Iran and Greenland.

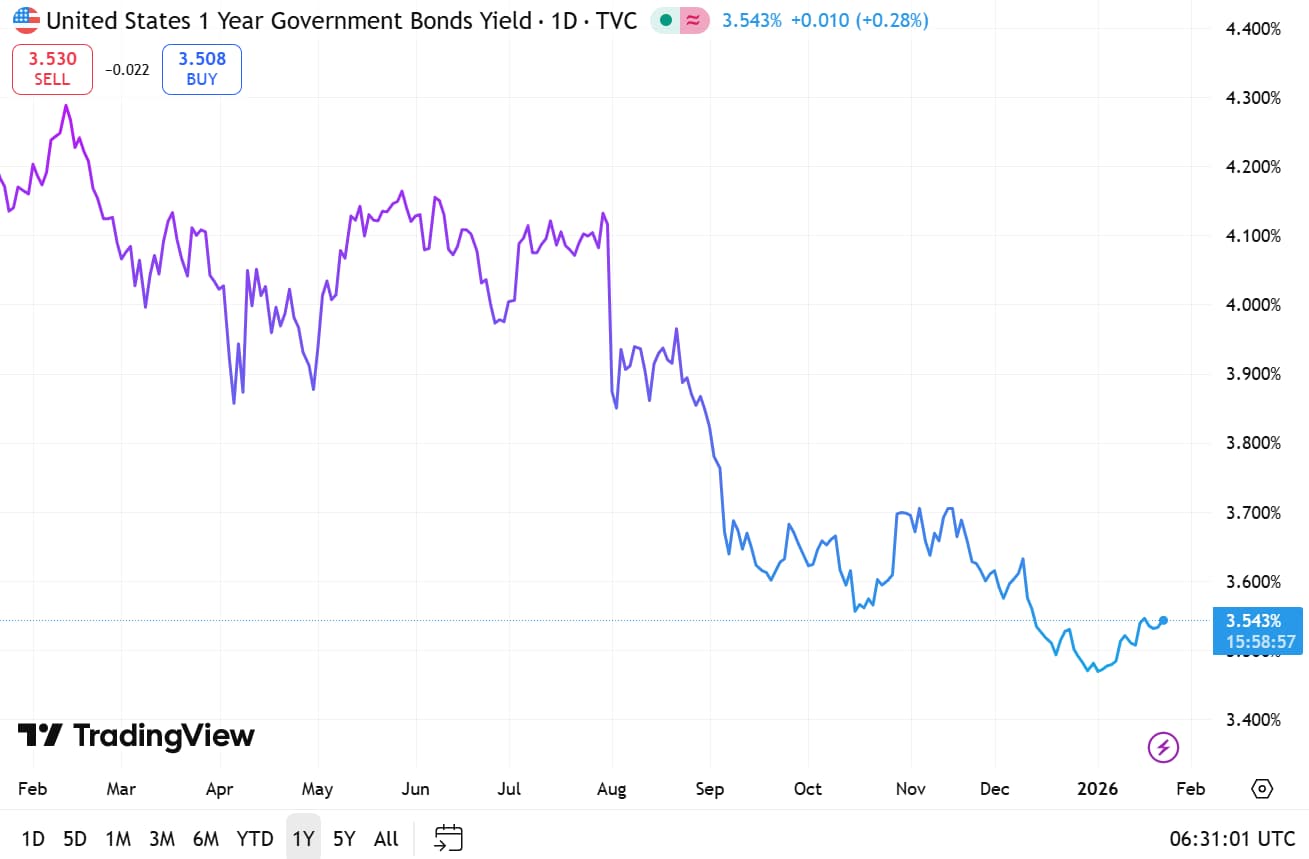

The 1-year US government bond yield was at 3.54% as at 23 January 2026, also rising slightly from 3.50% from two weeks ago.

#2 – Singapore government bond yields decline

In contrast to US government bond yields, the 10-year Singapore government bond yield fell to 2.15% on 23 January from 2.20% from two weeks ago.

This is likely due to increased demand for the Singapore government bond, as investors look for safe haven assets.

The closing yield on the 6-month T-bill was 1.36% on 8 January 2026, also slightly below the cut-off yield of 1.39% in the previous T-bill auction on 15 January.

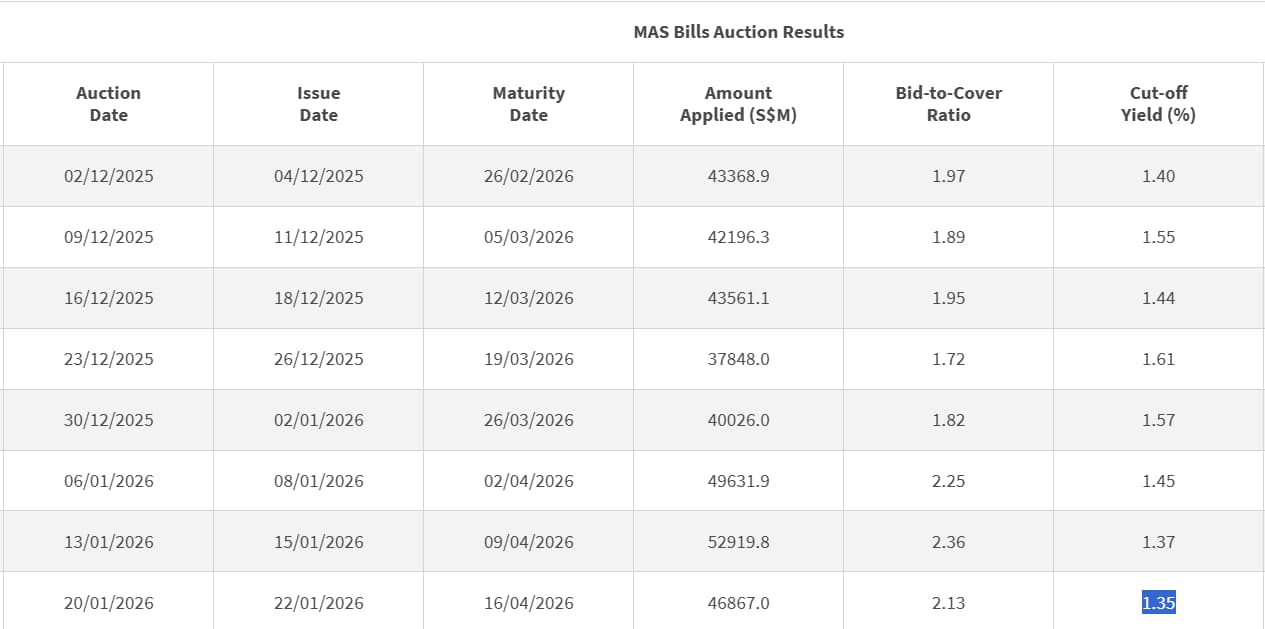

The yield on the 3-month MAS bill can also indicate the yields for shorter-maturity Singapore government bonds.

The cut-off yield was at 1.35% in the auction on 20 January 2026, falling slightly from the yield of 1.37% in the auction on 13 January 2026.

#3 – Issuance size larger than the previous auction

The issuance size of the upcoming 6-month Singapore T-bill is $8.1 billion, larger than the previous auction size of $7.9 billion.

This represents the highest level of 6-month Singapore T-bills being issued.

We saw a sharp increase in the amount of T-bill applications at S$19.2 billion in the auction on 15 January 2026, from $14.8 billion in the auction on 31 December 2025.

If demand for the T-bill continues to rise with the larger issuance size, we may see further downward pressure in the cut-off yield on the T-bill.

What would Beansprout do?

The closing yield on the 6-month Singapore T-bill was at 1.36% on 23 January 2026, below the cut-off yield in the previous auction.

This follows a trend of declining Singapore government bond yields in recent weeks, reflecting Singapore's status as a safe haven amidst an escalation in global geopolitical uncertainty.

In addition, the cut-off yield on the T-bill may also face downward pressure with the large issuance size in the latest auction.

The closing yield on the 6-month Singapore T-bill is now slightly below the best 6-month fixed deposit rate of 1.45% p.a.

While banks have been cutting the interest rates on savings accounts, we were still able to find savings accounts in Singapore that offer an interest rate of above 1.36% p.a.

We compare T-bills with fixed deposits, savings accounts and SSBs to find out the best place to park your cash in January 2026 here.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

[Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher within 5 working days, plus 12% p.a. interest boost coupon for 120 days (worth ~S$78) with Longbridge Cash Plus when you sign up for a Longbridge account via Beansprout. T&Cs apply. Learn more about the Longbridge promotion here.

The 6-month Singapore auction will be held on 29 January (Thursday). We would need to put in our cash applications for the T-bills by 9 pm on 28 January (Wednesday).

Applications for the T-bills using CPF-OA will close 1-2 business days before the auction date, and the dates differ across the three local banks.

- Applications for T-bills online using CPF OA via DBS close at 9pm on 28 January (Wednesday).Read our step-by-step guide to applying via DBS.

- Application for T-bills online using CPF OA via OCBC close at 9pm on 28 January (Wednesday). Read our step-by-step guide to applying via OCBC

- Applications for T-bills online using CPF OA via UOB close at 9pm on 27 January (Tuesday). Read our step-by-step guide to applying via UOB.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments