Singapore stocks and gold rally to new highs: Weekly Market Recap

By Gerald Wong, CFA • 18 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

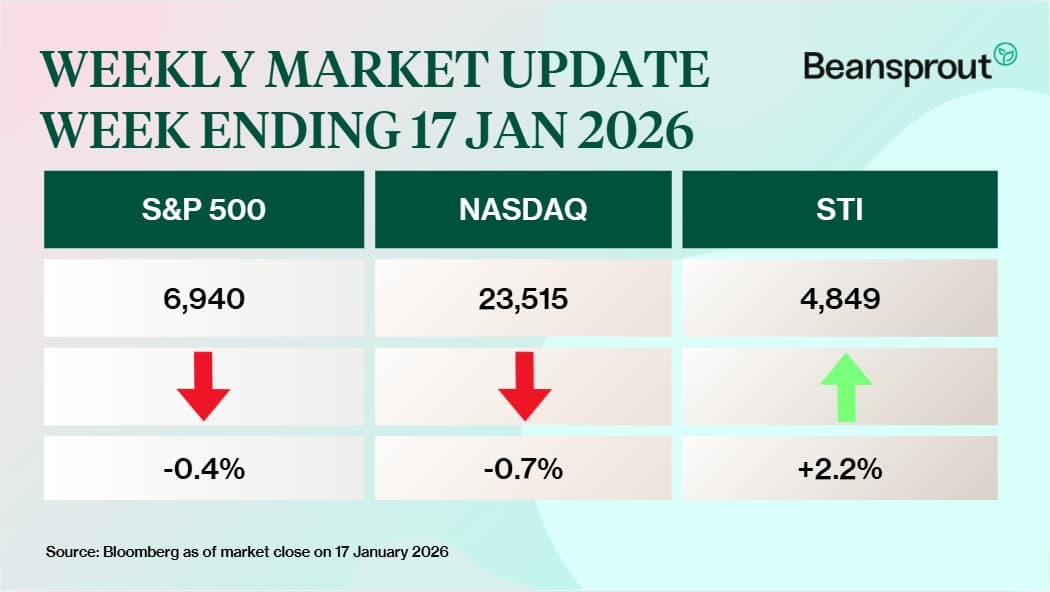

The Straits Times Index (STI) climbed to record highs, while gold extended its rally.

At the FSM Invest Expo this week, there was one question that kept coming up.

“How should we invest now with markets at all-time highs?”

And almost inevitably, that was followed by another very Singaporean question: “DBS still can buy now? Or time to sell?”

It is easy to see why. The Straits Times Index (STI) has climbed to new highs, with local banks such as DBS and OCBC reaching record levels, while several property stocks have delivered double-digit gains year-to-date.

My answer was simple. I choose to invest in a way that gives me peace of mind, instead of chasing returns or following what others are doing.

Take gold, for example, which reached also hit a new high this week. To feel confident about any investment, I first try to understand what the asset actually does and what role it plays in a portfolio. Then I ask myself a basic question. Why am I buying it?

That is why this week, we take a closer look at gold. We explore why investors include gold in their portfolios, and examine what is driving the recent rally and whether it can be sustained.

For many investors, low-risk options can also provide a sense of stability. That may explain why demand for Singapore T-bills surged in the latest 6-month auction, pushing the cut-off yield down to 1.39% from 1.6% previously. We break down whether the upcoming 1-year T-bill could be more worthwhile compared to the 6-month T-bill.

At the end of the day, the best portfolio for me is the one that lets me sleep soundly at night. And as you think about your own investments, I hope you’ll build one that gives you the same peace of mind.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🚀 Singapore stocks rally

What happened?

A series of political and trade developments put renewed attention on safe-haven assets this week.

US President Donald Trump announced plans for a proposed 25% tariff on imports from countries doing business with Iran.

Separately, reports that the Department of Justice was investigating Federal Reserve Chair Jerome Powell over his congressional testimony sparked fresh worries among investors about the independence of the US central bank.

What does this mean?

These headlines led investors to take a more cautious stance, even though underlying economic data and corporate earnings remained broadly positive.

In the US, the core consumer price index (CPI), which excludes food and energy costs, rose 2.6% year on year in December. This came in below market expectations and marked the slowest annual pace since March 2021.

On the corporate front, Taiwan Semiconductor Manufacturing (TSMC) reported a strong jump in fourth-quarter profits, reflecting sustained demand driven by the ongoing artificial intelligence boom.

Why should I care?

In Singapore, the Straits Times Index (STI) notched consecutive record highs, supported by growing optimism around efforts to revitalise the Singapore equities market.

Gains were once again led by property stocks, while DBS and OCBC both reached new record highs as well.

Precious metals also continued their strong run, with gold and silver climbing to fresh record highs, surpassing the peaks reached just in December.

In contrast, US markets pulled back slightly. Shares of JPMorgan Chase and Citigroup declined after both banks reported lower quarterly profits, weighing on broader sentiment.

Learn more about why investors include gold in their portfolios, and examine what is driving the recent rally and whether it can be sustained.

🚗 Moving This Week

- SIA Group reported a 1.9 per cent year-on-year rise in passenger traffic in December 2025, marking a new monthly record as its two carriers carried about 3.8 million passengers. Passenger traffic reached nearly 14.2 billion for the month, up from 13.9 billion in December 2024, the group said on Thursday (Jan 15). Passenger load factor slipped slightly to 87.9 per cent, down 0.6 percentage point from a year earlier. Read more here.

- Singapore Exchange (SGX)’s value of securities traded rose 29 per cent year on year in December, underpinned by what the bourse described as sustained stock market momentum. Total securities market turnover reached S$25.8 billion for the month, while turnover volume climbed 26 per cent to 24.5 billion shares. Read more here.

- City Developments Ltd (CDL) is set to begin previews for its long-awaited freehold luxury project Newport Residences, with prices starting from just under S$1.3 million for one-bedroom units, or above S$3,012 per square foot. Read more here.

- Keppel said on Jan 15 it secured a 720MW “power bank” and phased lease rights to a 123-hectare site near Morwell, Victoria for an AI data-centre campus near Melbourne, lifting its APAC data-centre pipeline from over 300MW to over 1GW of gross power capacity. Read more here.

- Keppel Reit’s preferential offering closed with 76.9% valid acceptances and total applications of 97%, the manager said on Tuesday (Jan 13). The Reit received valid acceptances for 709.4 million of the 923.2 million units offered, with excess applications amounting to 185.7 million units. Proceeds of S$886.3 million will fund the purchase of an additional one-third stake in Marina Bay Financial Centre Tower 3, with new units to be listed from Jan 19. Read more here.

- CapitaLand Integrated Commercial Trust (CICT) has agreed to divest Bukit Panjang Plaza for S$428 million in cash to an unrelated third party, according to a bourse filing by its manager on Wednesday (Jan 14). The transaction involves the sale of 90 strata lots, along with the associated plant, mechanical and electrical equipment within those units. Read more here.

- CapitaLand Integrated Commercial Trust (CICT) said it will develop and fully own the commercial component of the mixed-use Hougang Central site secured in a recent government land tender. The commercial portion will comprise about 300,000 square feet of net lettable area, making it potentially the largest commercial development in Hougang. Read more here.

- CapitaLand India Trust secured its second long-term deal with a global hyperscaler for Tower 2 of CapitaLand DC Navi Mumbai (planned IT load 37MW; gross power 55MW), which it says is among the region’s largest single-tower liquid-cooling implementations and has strong design power usage effectiveness. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Is the 1-year T-bill better than the 6-month T-bill and fixed deposits?

The closing yield on the 1-year Singapore T-bill of 1.37% is on par with the 6-month T-bill yield. However, investors of the 1-year T-bill may face lower re-investment risks.

🤓 What we're looking out for next week

- Tuesday, 20 January 2026: Netflix earnings

- Wednesday. 21 January 2026: US President Donald Trump speaks at the World Economic Forum Annual Meetings

- Thursday, 22 January 2026: Singapore 1-year T-Bill Auction, Suntec REIT Earnings, Intel earnings,

- Friday, 23 January 2026: URA Quarterly Property Data Release

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments