UOB reports 72% decline in profit but maintains dividend guidance: Our Quick Take

Stocks

By Goh Lay Peng • 06 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

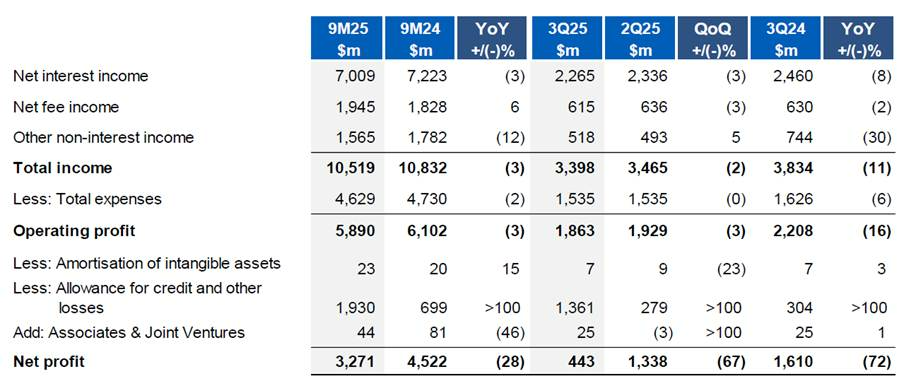

UOB reported net profit of S$443 million in 3Q 2025, a decline of 72% year-on year, as the bank recorded on additional S$615 million in general allowance.

UOB 3Q25 earnings highlights

UOB Group announced its earnings for the third quarter of 2025. Key highlights include:

- Net profit of S$443 million in 3Q 2025, down 72% year-on-year

- Net profit of S$3.27 billion in 9M 2025, down 28% year-on-year

- Allowance for credit and other losses increased by S$1.08 billion as UOB proactively set aside additional general allowance to strengthen its provision coverage.

What you need to know about UOB 3Q25 results

UOB Group has reported net profit of S$443 million for 3Q25. This represents a 72% decrease compared to the previous year.

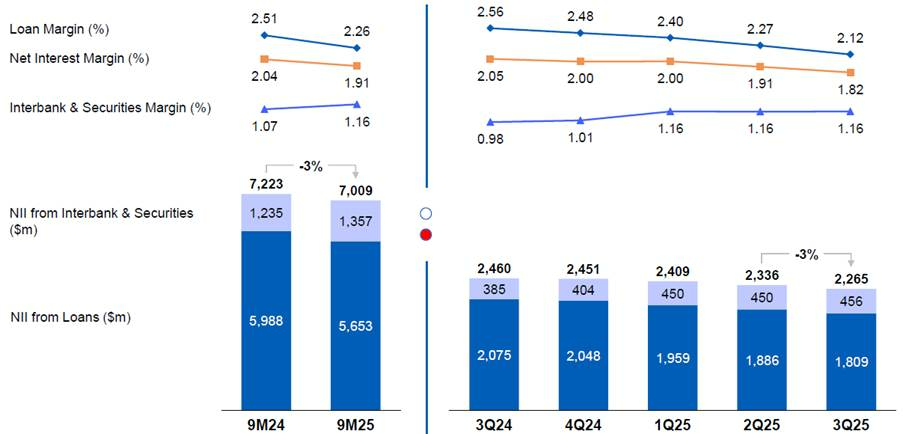

#1 - Further decline in net interest margin

Net interest income fell 8% year-on-year to S$2.3 billion as net interest margin narrowed amid falling benchmark rates. 3-month SORA rate declined by 60 basis points in 3Q25.

Net interest margin narrowed from 1.91% in 2Q25 to 1.82% in 3Q25.

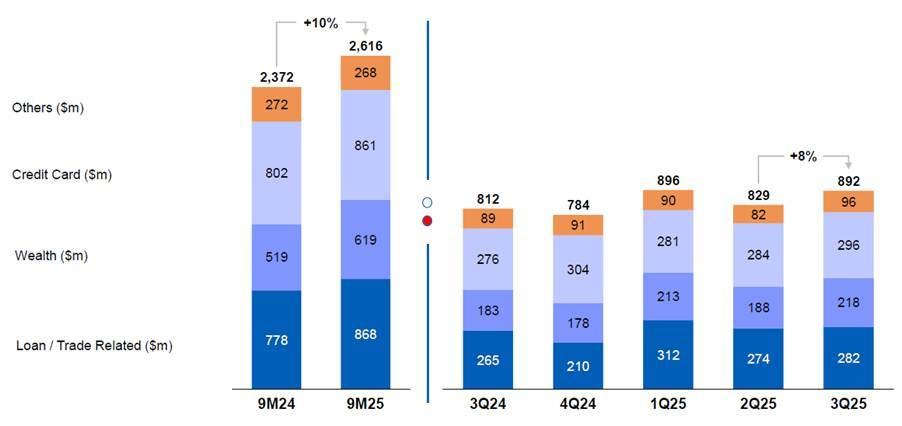

#2 - Fee income grew in 3Q25

Fee Income reached S$892 million in 3Q25, representing a growth of 10% compared to 3Q24. This was fueled by broad-based growth across wealth management fees, loan-related services and credit card fees.

Trading and investment income decreased 32% year-on-year to S$479 million, against the record high levels set in 3Q24.

Record-high customer flow and sustained demand for hedging solutions led to an increase of 16% quarter-on-quarter.

#3 - Additional provisions taken

The decline in UOB's net profit was largely driven by higher provision of S$1.36 billion in 3Q25 million, compared with S$304 miilion in 3Q24. UOB proactively took additional general provisions amid the current macroeconomic uncertainties and sector-specific headwinds.

UOB took S$687 million in general provisions and S$479 million in specific allowance on loans. The specific allowance was related to U.S. and Greater China commercial real estate loans.

With the additional general allowances, the performing loan coverage increased to 1.0% as of end-September 2025, from 0.8% as of end-June 2025.

The asset quality remained healthy as non-performing loan (NPL) ratio at 1.6%, was unchanged from 2Q25. New NPL formation was partly offset by higher recoveries and write-offs during the quarter.

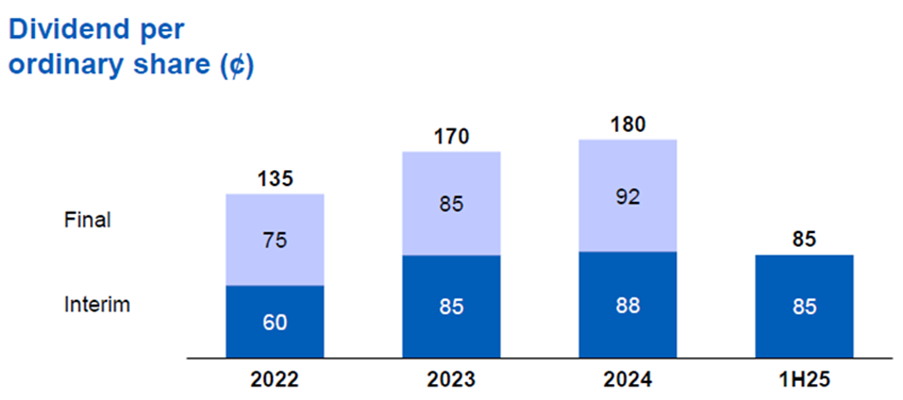

#4 - Final dividend unlikely to be impacted by higher provisions taken in 3Q25

UOB assured investors that the 2025 final dividend will not be impacted by the higher provisions taken in 3Q25.

To recap, UOB paid 1H 2025 dividend of S$1.10 per share which consists interim dividend S$0.85 per share and special dividend S$0.25 per share.

#5 - 2026 outlook

For 2026 outlook, UOB expects low single-digit loan growth, net interest margin of 1.75% to 1.80% and high single to double digit fee income growth.

Operating cost is expected to increase at low-single digit while total credit costs will normalise are expected to be benign in the 25-30 basis points (0.25-0.3%) range.

Beansprout’s Quick Take on UOB earnings

UOB's share price fell by 3% on 6 November 2025, following the announcement of the 3Q 2025 earnings. This likely reflects investor disappointment in the sharp decline in earnings in 3Q25 with the general provisions taken.

This is in sharp contrast to the share price of DBS, which reached a record high following the announcement of its 3Q 2025 results.

This continues a trend we have seen so far this year, where the share price of UOB has lagged DBS and Singapore's benchmark Straits Times Index (STI).

Apart from the general provisions taken, UOB's net interest income has also been declining with the fall in interest rates in recent quarters.

This has been partly offset by the growth in fee income with higher wealth management fees, loan-related services and credit card fees.

This trend is expected to continue into 2026, with UOB expecting a further moderation in net interest margin but continued growth in its fee income.

On a more positive note, UOB has assured investors that the 2025 final dividend will not be impacted by the higher provisions taken in 3Q25.

Annualising the interim ordinary dividend of 85 cents per share, UOB currently offers an annualised dividend yield of 5.0% based on its closing price of S$33.90 on 6 November.

This would be lower than the dividend yield for DBS (including capital return dividend), and above the dividend yield of OCBC.

UOB currently trades at a price-to-book valuation of 1.2x, above its historical average of 1.0x.

The more resilient earnings and higher dividend yield of DBS may continue to make DBS more attractive compared to UOB for income-seeking investors.

Related links:

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in UOB.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments