iFast and PropNex in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 15 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about iFast and PropNex in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside iFast and PropNex.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:33 - Macro Update

- All major US indices gained more than 1% last week, with the Nasdaq leading on strength in AI-related stocks after Oracle raised its guidance. The S&P 500 climbed 1.6% to 6,584 points, while Singapore’s STI rose nearly 1% to a new record high of 4,344 points.

- US Core CPI increased 3.1% year-on-year, in line with expectations but showing slight acceleration compared to earlier months. The steady reading reinforced confidence that the Federal Reserve will deliver a rate cut at its upcoming meeting.

- Market expectations point to almost certain easing, with around 90% of investors pricing in a 25 bps cut and about 7% seeing scope for a larger 50 bps move.

- US 10-year Treasury yields slipped below 4.1%, while Singapore’s 10-year yield fell further to 1.77%, extending the year’s downtrend as bond markets priced in looser monetary policy.

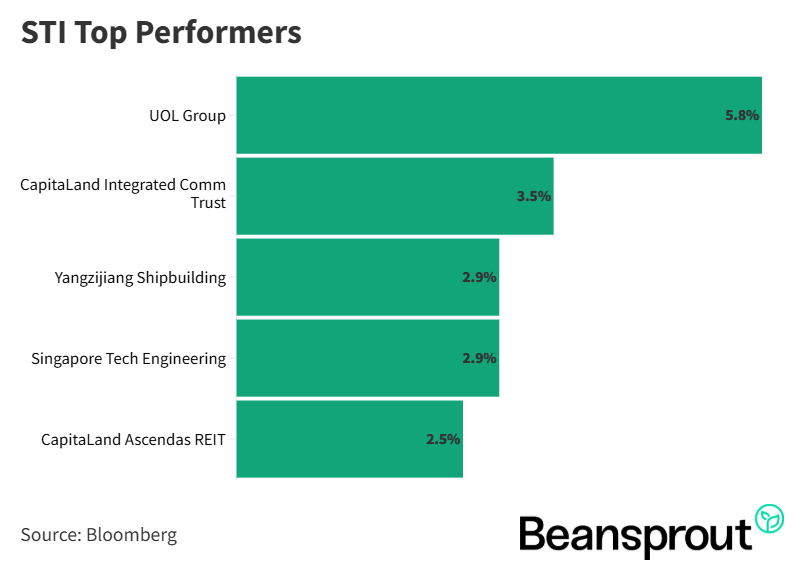

- The Straits Times Index (STI) extended gains, with property stocks and REITs leading the advance. UOL surged 6% on news of a divestment, while CICT and CapitaLand Ascendas REIT also featured among the top performers, supported by lower yields and rate-cut expectations.

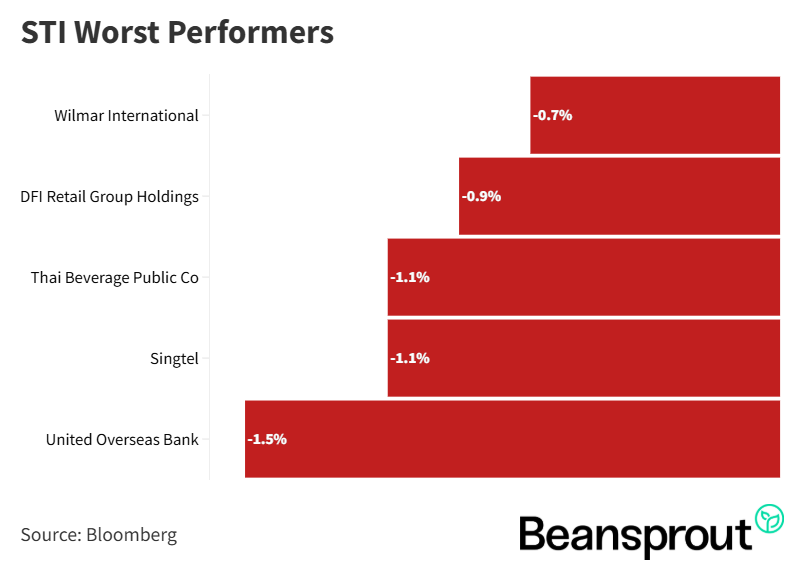

On the downside, UOB lost 1.5% amid concerns that banking sector net interest margins could face pressure in a falling rate environment. Meanwhile, new government initiatives such as the $5 billion Equity Market Development Programme highlighted measures to deepen liquidity and boost interest in Singapore mid-cap names.

5:21 - Singapore stocks hit an all-time high

- Alongside the Straits Times Index (STI) all-time high, the FTSE ST Mid-Cap Index has also performed strongly, supported by improved sentiment towards Singapore equities and rising investor focus on mid-cap names such as iFAST and PropNex.

- Trading activity and institutional participation have grown meaningfully, with over 80% of nearly 120 non-indexed companies seeing higher turnover and more than $100 million in net institutional inflows since May.

- Leading examples of this trend include UOB Kay Hian with $23.1 million of inflows and a valuation rerating from 7x to 10x PE, and CSE Global with $16 million of inflows alongside a rerating from 11x to 16x PE.

- A broader list of companies has benefited from this shift, spanning multiple sectors such as financial services, technology, energy, industrials, and healthcare. Notable names include Rex International, Grand Venture, Q&M Dental, CNMC Goldmine, Hong Leong Asia, and SBS Transit, reflecting broad-based institutional interest across the Singapore mid-cap space.

STI Top Performers:

- UOL Group

- CapitaLand Integrated Commercial Trust

- Yangzijiang Shipbuilding Holdings

- Singapore Tech Engineering

- CapitaLand Ascendas REIT

STI Worst Performers:

iFast

- iFast, the operator of platforms such as FSMOne, continues to attract strong investor interest, benefiting from the structural shift towards digital wealth management and rising fintech adoption among both retail and institutional clients.

- In 1H 2025, the company reported higher revenue and net profit, which fueled a strong rally in its share price. After dipping to about $6 in April, shares surged to nearly $10 post-results, corrected to $8 following a shareholder selldown, and have since recovered to around $8.80.

- The group operates a broad fintech ecosystem, with over 1 million customer accounts, more than 800 B2B partners, and 14,000 wealth advisors spanning five markets.

- Singapore remains its core market, with the bulk of assets under advice (AUA) in the unit trust segment.

- Group AUA rose 21.6% year-on-year to $27.2 billion as of June 30, 2025, driven by $2.2 billion in net inflows during the first half of the year.

- Profit growth has been consistent, with profit after tax expanding from $5 million in 2022 to $66 million in 2024. In 1H 2025 alone, profit reached $41 million, underscoring continued momentum.

Related links:

PropNex

- PropNex is Singapore’s largest property agency, with a network of over 13,000 agents, giving it dominant market share in both agent count and property transaction volumes. Nearly two out of three home transactions in Singapore are closed by a PropNex agent.

- The company is viewed as a key beneficiary of the recovery in new home sales, supported by rising transaction volumes in late 2024 and early 2025, alongside expectations of lower interest rates.

- PropNex’s share price has more than doubled since June 2025, reflecting strong investor optimism and improving housing market sentiment.

- Revenue streams are diversified across new home sales (project marketing), private resale, and HDB resale, giving it broad exposure across the residential property market.

- Financial performance has accelerated, with 1H 2025 revenue up 73% year-on-year and profit after tax more than doubling to $42 million from $19 million in 1H 2024.

- The company maintains a strong dividend track record. Total dividends rose to 7.75 cents in 2024, while the interim dividend in 1H 2025 was raised to 5 cents per share in line with higher profits.

Related links:

13:28 - Technical Analysis

- The Straits Times Index (STI) has logged its fourth consecutive winning week, climbing to 4,347 points on Monday morning after hitting a new all-time high of 4,375 last Friday, firmly breaching the 4,300 level.

- At these highs, the index is trending near the upper Bollinger Band, signaling stretched conditions. The MACD remains positive but has weakened over the past two sessions, reflecting slowing momentum.

- The RSI currently stands at 68, having briefly breached the overbought 70 level late last week. It is now converging with the 14-day RSI average at 65, suggesting moderation in momentum.

- Key resistance levels sit around 4,375–4,400, where technical sell-downs or profit-taking are expected.

- Immediate support lies at the 20-day moving average near 4,282, followed by stronger support at the 50-day moving average at 4,227 and the lower Bollinger Band just below 4,200.

- A pullback toward these support zones may offer accumulation opportunities, given the still-positive year-end sentiment.

Learn more about the Straits Times Index (STI) here.

Dow Jones Industrial Average

- The Dow recorded its first positive week in three, driven by a strong 1.36% gain last Thursday before a mild pullback on Friday.

- The index set a new all-time high of 46,137, breaking above the 46,000 level for the first time. While upside momentum remains, there are no historical levels to guide resistance beyond this point.

- Technical indicators remain constructive: the MACD is positive and the RSI is around 60, a healthy mid-range reading that supports continued strength.

- Despite the elevated levels, the 45,800 region is not seen as an attractive entry point, with some resistance expected near the 46,000 mark.

- Immediate support is at 45,391 (20-day moving average), while stronger support lies between 44,700–44,800, where the 50-day moving average and lower Bollinger Band converge.

- A pullback toward these supports, similar to the consolidation seen in early August, would offer a more favorable entry point with margin of safety.

S&P 500

- The S&P 500 marked its second consecutive winning week, closing at a new all-time high of 6,600 last Friday, underscoring persistent bullish momentum.

- Immediate support sits at 6,472 (20-day moving average), while stronger support is clustered near 6,360–6,380, where the 50-day moving average and lower Bollinger Band converge.

- The index’s near-term trajectory is closely tied to the FOMC meeting this Wednesday, where markets overwhelmingly expect a 25 bps rate cut.

- A confirmed rate cut could serve as a catalyst for the S&P 500 to climb another 100 points toward the 6,700 level, extending its record run.

- Preferred entry points are around the 6,500 region or lower, closer to the 20-day moving average, to provide a margin of safety in case of short-term pullbacks.

Nasdaq Composite Index

- The Nasdaq was the best-performing index last week, rising 2% and closing near an all-time high of 22,182 points, with current levels around 22,131 at the upper Bollinger Band.

- While momentum remains strong, valuations look stretched at record highs, making this not an ideal entry point. Safer re-entry zones lie below 21,500, with key support at the 20-day MA (21,600), the 50-day MA (21,200), and the lower Bollinger Band (21,070).

- A confirmed rate cut by the Fed this week could act as a major catalyst, especially for high-growth, leverage-sensitive tech stocks, potentially propelling the Nasdaq toward 23,000 by year-end.

- A pullback toward the 21,200–21,600 support range would present an attractive buying opportunity for traders looking to position ahead of the next leg higher.

- Technical indicators are supportive: MACD showed a bullish crossover last week, signaling a possible new uptrend, while RSI at 68 suggests strong momentum but also proximity to overbought territory.

- Short-term targets remain around 22,182–22,200, while a sustained uptrend could extend the rally further if macro catalysts align.

What to look out for this week

- Tuesday, 16 September 2025: Riverstone Ex-Dividend, US Retail Sales Data, SGX Academy webinar: Attractive, Adaptable, Affordable: Triple A Magnetism of A Short Duration Bond ETF – Presented by Lion Global Investors

- Thursday, 18 September 2025: US FOMC Meeting

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments