ST Engineering in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 19 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about ST Engineering in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside ST Engineering.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:33 - Macro Update

S&P 500 decline 0.4% to 6,940 and the STI outperforming with a 2.2% gain to 4,849 points.

- US market weakness stems from political rhetoric and Fed rate uncertainty. With December 2025 Core CPI rising a subdued 2.6%, a January rate cut is effectively ruled out, pushing expectations for easing to June and December.

The divergence in market performance is primarily driven by rising geopolitical tensions, specifically US measures targeting countries trading with Iran and disputes involving Greenland and its trade partner

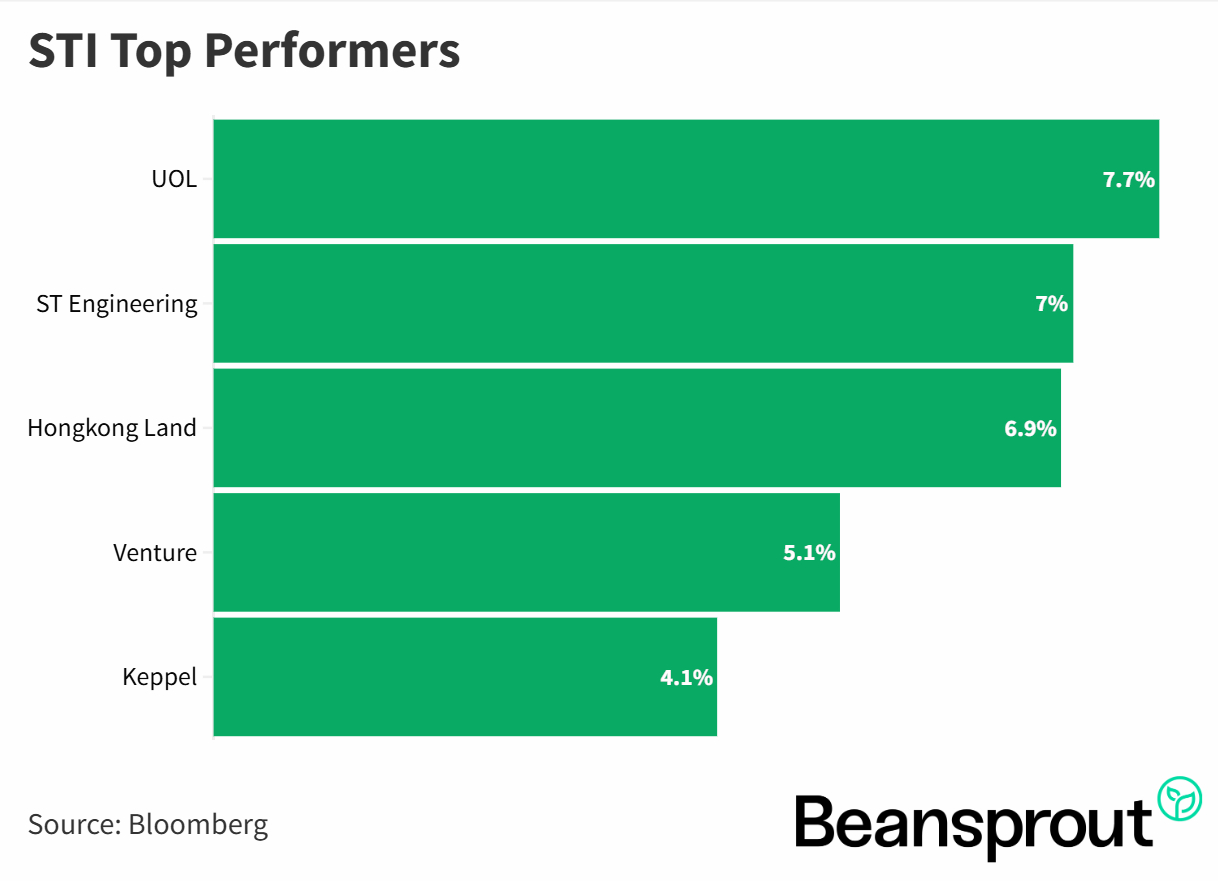

Within the STI, the standout performers were UOL and Hongkong Land. ST Engineering also climbed amid geopolitical tensions.

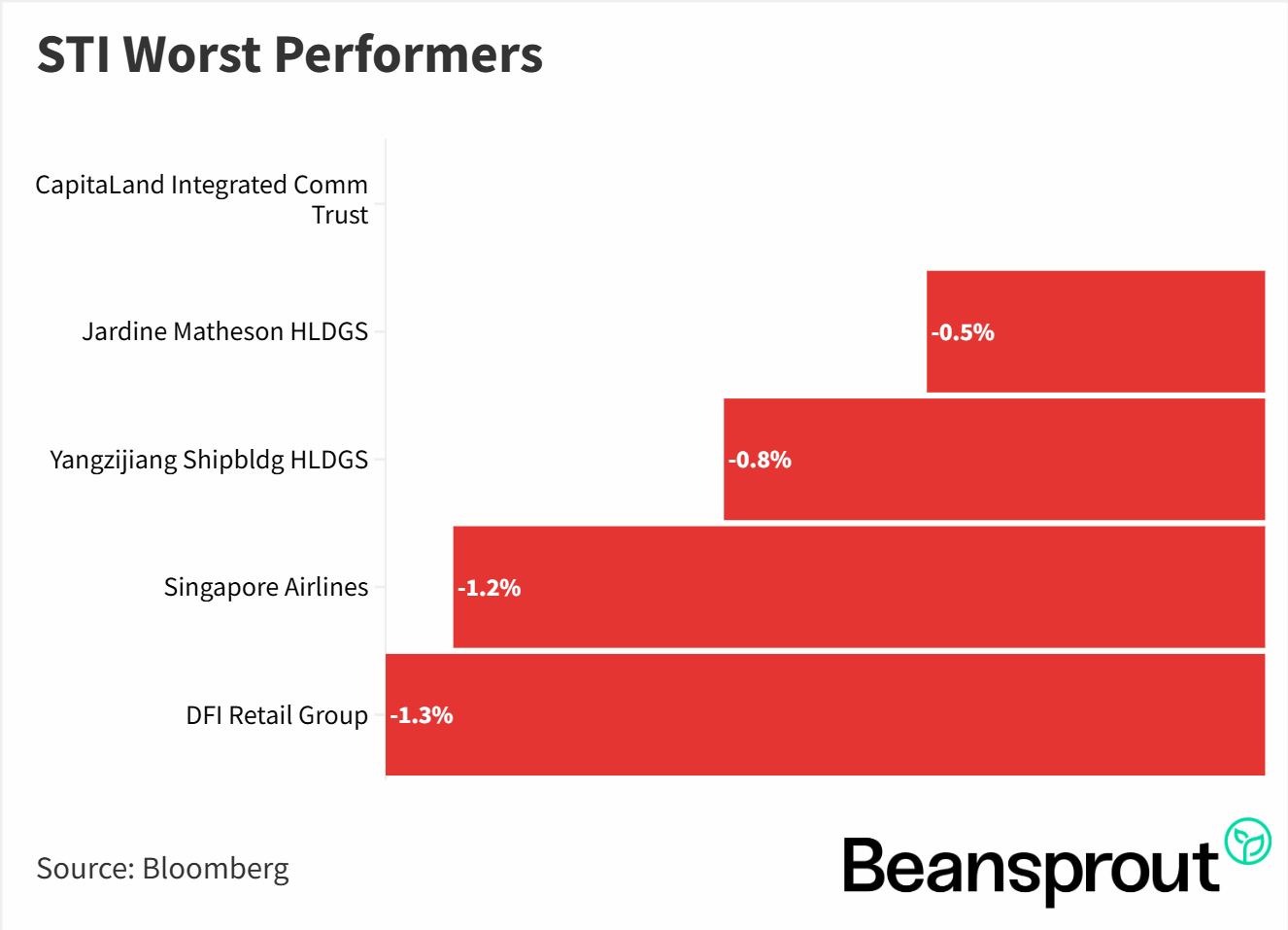

Cyclical and transport linked stocks has pullback due to ongoing geopolitical tensions, with SIA down by 1.2% and Yangzijiang Shipbuilding down by 0.8%.

STI Top Performers:

STI Worst Performers:

- CapitaLand Integrated Comm Trust

- Jardine Matheson

- Yangzijiang Shipbuilding

- Singapore Airlines

- DFI Retail Group

ST Engineering (SGX: S63)

- ST Engineering continues to be a standout blue chip, extending its 2025 momentum to approach the $10.00 level. Optimism is underpinned by strong tailwinds in its Defense and Public Security segment due to global trade tensions.

- The group's order book stands at $32.6 billion, with $6.6 billion in defense orders secured in the first 9 months of 2025.

- Management aims to grow revenue from $11.3 billion (2024) to $17 billion by 2029, with the defense segment expected to contribute over $7.5 billion.

- The FY2025 total dividend is projected at 23 cents per share (including a 5-cent special dividend). However, due to the sharp price increase, the yield has compressed to about 2%.

Read also: Top 3 Singapore blue chip stocks in 2025. Is there more upside?

Related Links:

Technical Analysis

Straits Times Index (STI)

- The STI closed at a new all-time high of 4,849 points last Friday, showing a distinct decoupling from US markets with a 2.2% weekly gain.

- Indicators show strong uptrend momentum on the MACD, though the RSI hit an extreme overbought level of 86 last Friday before cooling to 77, suggesting a potential technical pullback toward the mean.

- Immediate resistance lies at the psychological and Bollinger Band level of 4,900, with a stretch target of 5,000 by year-end.

- Any pullbacks will likely find support around the 4,750 level, aligning with previous trendline support from October and December.

Learn more about the Straits Times Index (STI) here.

Dow Jones Industrial Average

- The Dow Jones has been range-bound, capped by political rhetoric despite strong earnings results from its major banking constituents.

- The index is targeting its recent all-time high of 49,633, with the 50,000 psychological level serving as the key resistance barrier ahead.

- Technical indicators show the MACD moving horizontally as earnings news was priced in early, while the RSI remains healthy at 60 points, offering headroom before reaching overbought levels.

- Firm support is established at the December 31 low of approximately 48,050

S&P 500

- The S&P 500 remains in a holding pattern near its all-time high of 6,986, struggling to break the 7,000 psychological barrier due to Fed rate uncertainty.

- Momentum indicators (MACD) are flatlining, suggesting the market is awaiting a fresh catalyst such as Nvidia’s late-season earnings in February to drive the next leg up.

- The RSI is reading at 56, slightly above the neutral 50 mark, indicating positive but moderate momentum with room to run before hitting overbought territory.

- Key support levels to watch include the December 31 low at 6,850 and further downside protection around 6,750.

Nasdaq Composite Index

- The tech-heavy Nasdaq Composite is showing resilience, targeting the 24,000 handle and its October 29 all-time high of 24,019.

- Sentiment was buoyed by strong business updates from TSMC, which justified AI valuations and signaled that tech stocks are not in a bubble.

- The RSI stands at a neutral 50, implying significantly more headroom for upside compared to the S&P 500 or Dow.

- While current momentum is weak, any positive earnings surprise from the "Magnificent Seven" could provide the catalyst needed to test new highs.

What to look out for this week

Tuesday, 20 January 2026: Netflix earnings

Wednesday, 21 January 2026: US President Donald Trump speaks at the World Economic Forum Annual Meetings

Thursday, 22 January 2026: Singapore 1-year T-Bill Auction, Suntec REIT Earnings, Intel earnings,

Friday, 23 January 2026: URA Quarterly Property Data Release

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments