Top 3 Singapore blue chip stocks in 2025. Is there more upside?

Stocks

By Gerald Wong, CFA • 01 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We look at the top 3 Singapore blue chip stocks with the best year-to-date price performance in 2025 and see if their rally can be sustained.

What happened?

The Singapore stock market has performed well in 2025.

Earlier, we shared 3 top-performing Singapore blue chip REITs as well as the 3 Singapore REITs with the best year-to-date performance in 2025.

The Straits Times Index (STI) climbed around 22.40% over the past year (as of 29 December 2025).

In this article, we highlight three blue-chip stocks with the highest year-to-date price gains that helped boost the Straits Times Index (STI).

We also assess whether their dividend yields are sustainable with the rally in their share prices.

3 Top-performing Singapore blue-chip stocks in 2025

#1 - Singapore Technologies Engineering Ltd (SGX: S63)

ST Engineering is a global technology, defence, and engineering group with a diverse portfolio across commercial aerospace, defence & public security, and urban solutions & satcom.

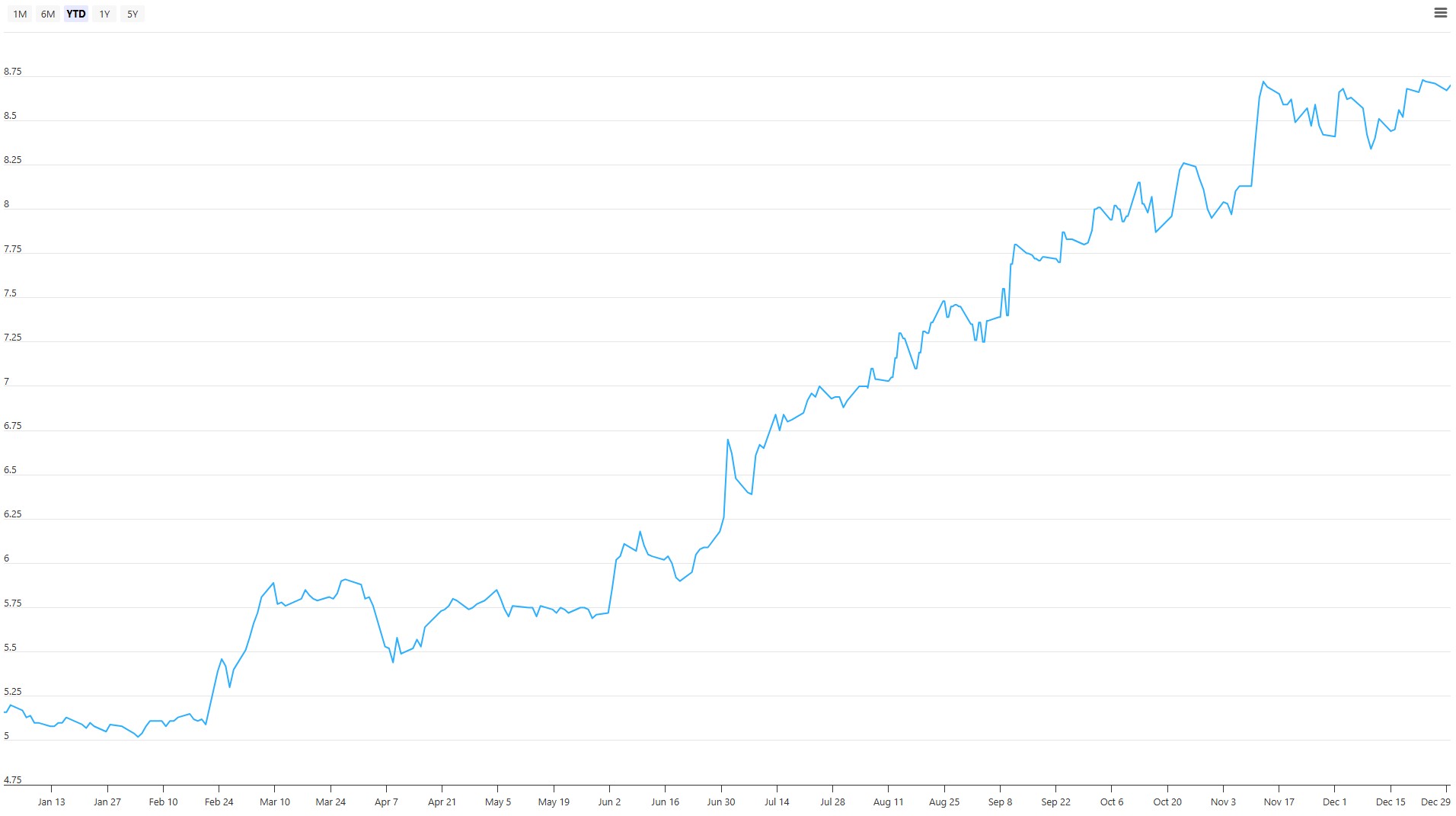

As of 26 December 2025, its share price has climbed about 79.6% year-to-date in 2025.

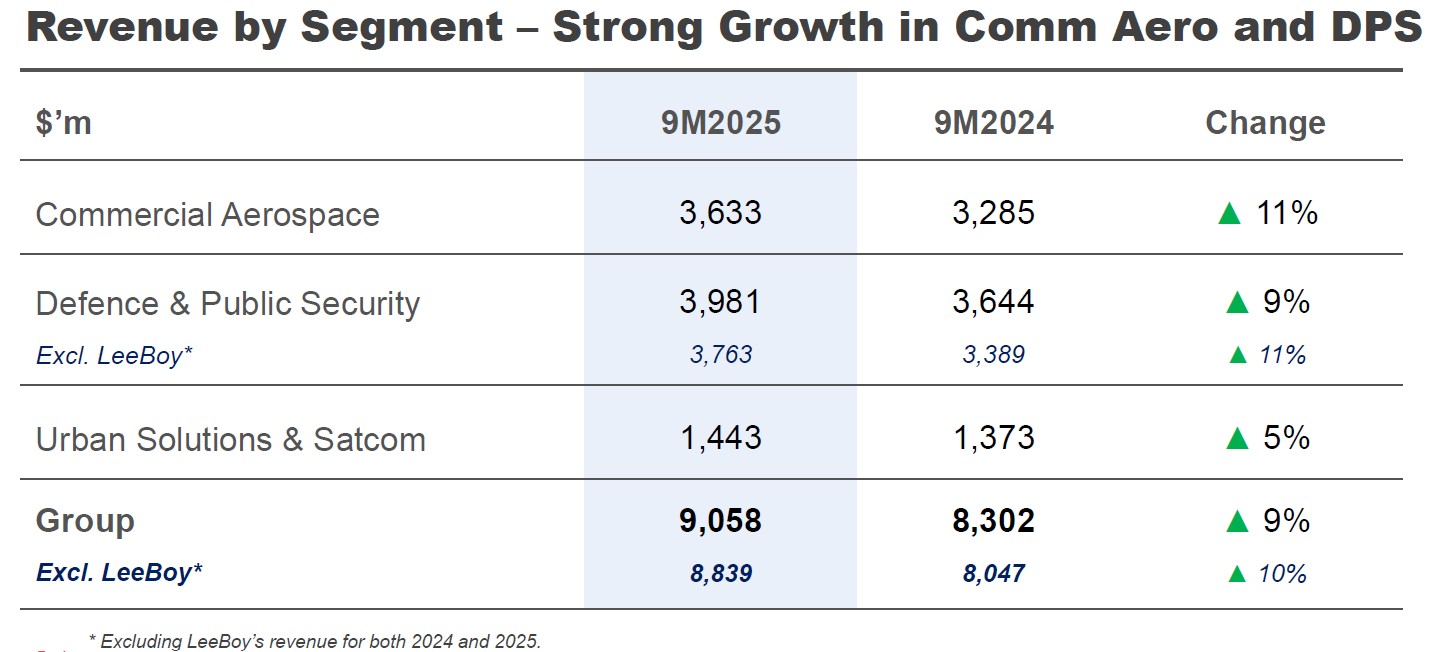

For the first nine months of 2025 (9M2025), ST Engineering reported a 9% year-on-year increase in revenue to S$9.1 billion, with growth accelerating in the third quarter where revenue rose 13% to S$3.1 billion.

Revenue for the commercial aerospace segment grew 11% to S$3.6 billion in 9M2025, driven by strong engine MRO and nacelles performance.

The defence & public security segment saw 9M2025 revenue rise 9% to S$4.0 billion, whereas urban solutions & satcom segment increased 5% to S$1.4 billion, supported by a 15% growth in 3Q2025.

The group secured S$14.0 billion in new contracts in the first nine months of 2025, lifting its order book to a record S$32.6 billion as of 30 September 2025.

Notable wins in 3Q2025 included a multi-year Airbus A380 maintenance contract and international defence orders for ammunition and hybrid electric vehicles.

Portfolio management remains a key focus.

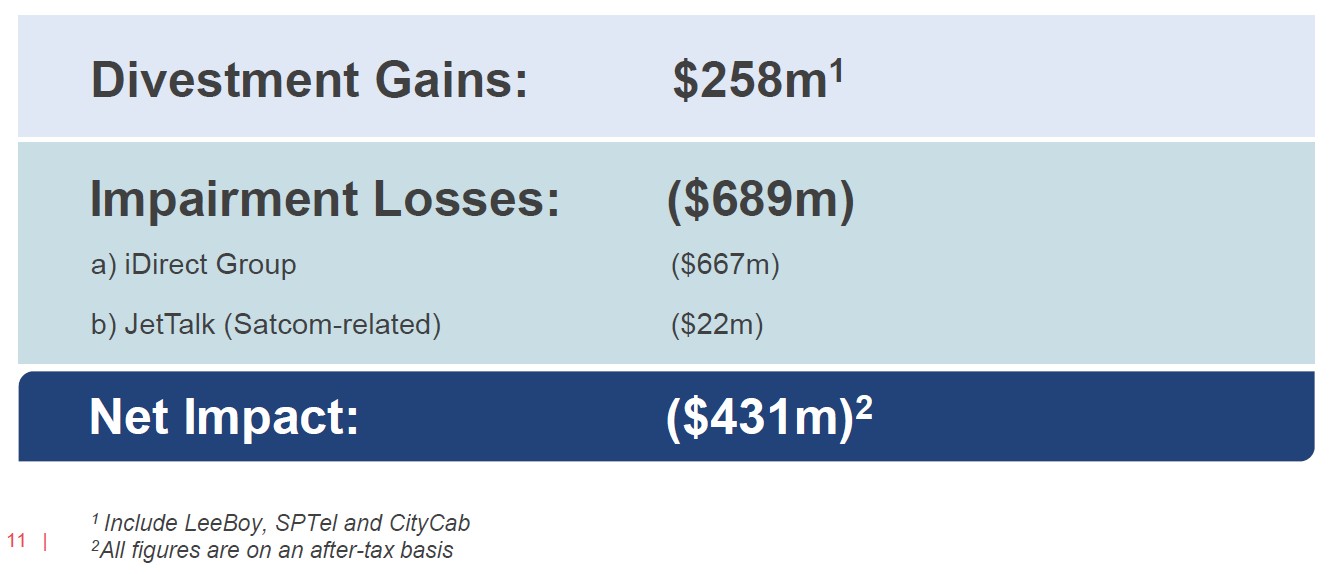

The Group completed divestments of LeeBoy, SPTel, and CityCab, raising S$594 million in cash proceeds.

However, these gains were offset by non-cash impairment losses of S$689 million related to its iDirect Group and JetTalk businesses.

In light of the cash proceeds from divestments, the group announced a proposed Special Dividend of 5.0 cents per share for FY2025, in addition to a proposed Final Dividend of 6.0 cents.

Including the interim dividends, the total planned dividend for FY2025 is 23.0 cents per share.

This implies a total yield of approximately 2.7% based on its S$8.37 share price (as of 26 December 2025).

Also, from 2026, the company has committed to distributing one-third of any increase in net profit as additional quarterly dividends.

As of 26 December 2025, ST Engineering's consensus share price target is S$8.77. This represents a potential upside of about 5% from its current share price.

Related Links:

- ST Engineering Ltd share price history and share price target

- ST Engineering Ltd dividend forecast and dividend yield

#2 - DFI Retail Group Holdings Ltd (SGX: D01)

DFI Retail Group is a leading pan-Asian retailer operating brands such as Mannings, Guardian, Wellcome, Cold Storage, 7-Eleven, and IKEA across Hong Kong, Southeast Asia, and China.

It holds leading market positions, including No.1 in Hong Kong health and beauty, No.2 in Singapore and Malaysia health and beauty, No.1 in Hong Kong and Cambodia food retail, and No.1 in convenience stores across Hong Kong, Singapore and Macao.

The stock has run up 71.4% year-to-date to US$3.96 as of 26 December 2025.

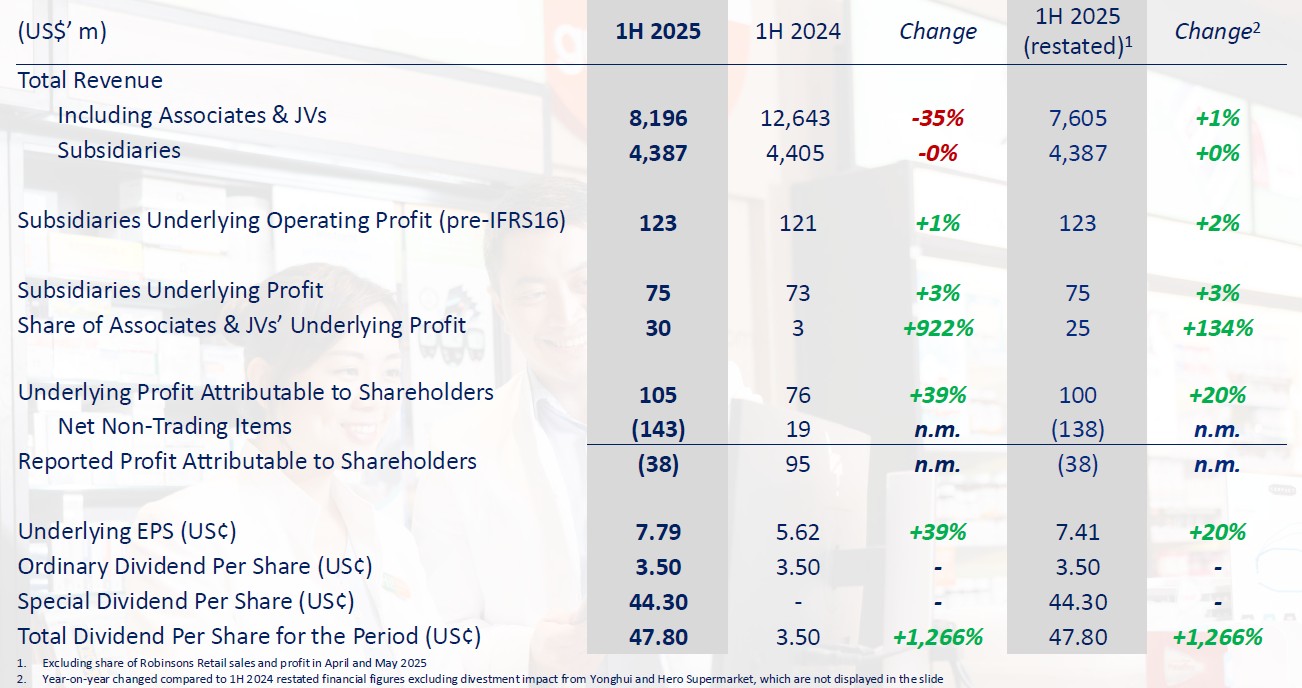

In 1H2025, DFI Retail Group reported underlying profit attributable to shareholders of US$105 million, a 39% increase compared to the previous year.

While total subsidiary revenue remained flat at US$4.4 billion, profitability has improved slightly.

Health & Beauty delivered single-digit sales and profit growth year-on-year, while the Food division achieved robust profit growth driven by disciplined cost control and a profit turnaround in Singapore.

Although the Convenience division’s profitability was impacted by the absence of a one-off windfall gain from cigarettes recorded in the first half of 2024, resilience in IKEA Taiwan and effective cost savings further supported the underlying earnings recovery.

Additionally, contributions from associates surged to US$30 million from US$3 million in the previous year, supported by higher earnings from Maxim’s and Robinsons Retail. Although Robinsons Retail was divested in May 2025, it contributed to the first-half results as the Group recognised its share of profits for the period leading up to the sale.

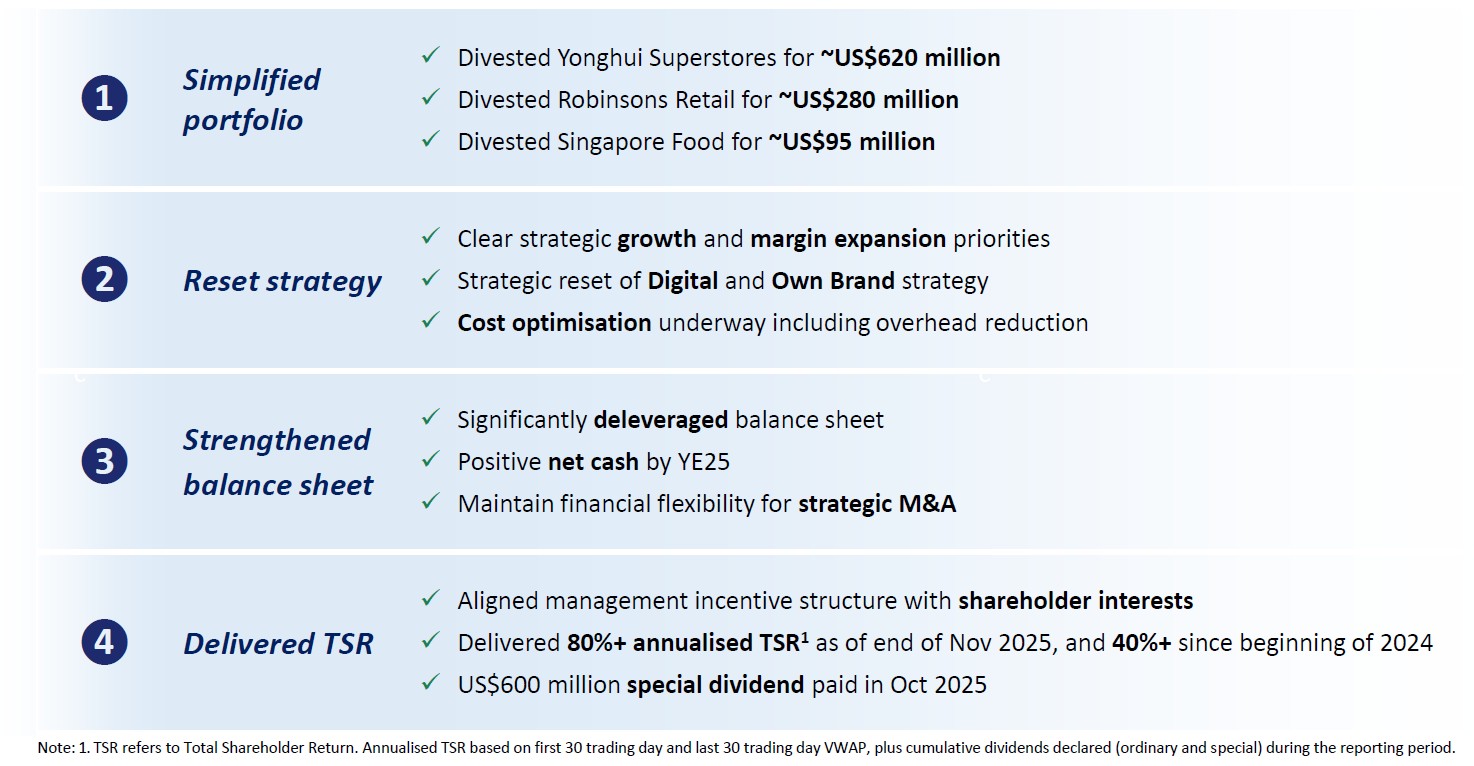

With that, the group is executing a strategic pivot from a portfolio investor to an operating company, marked by significant divestments.

It has completed some divestments by selling minority stakes in Yonghui Superstores and Robinsons Retail as mentioned, raising gross proceeds of approximately US$900 million. It has also announced its planned divestment of the Singapore Food business (Cold Storage, Giant) for approximately US$95 million.

DFI is now in net cash position of US$648M as of October 2025 post completion of Yonghui and Robinsons Retail divestments.

Additionally, the Group raised its full-year underlying profit guidance to between US$250 million and US$270 million.

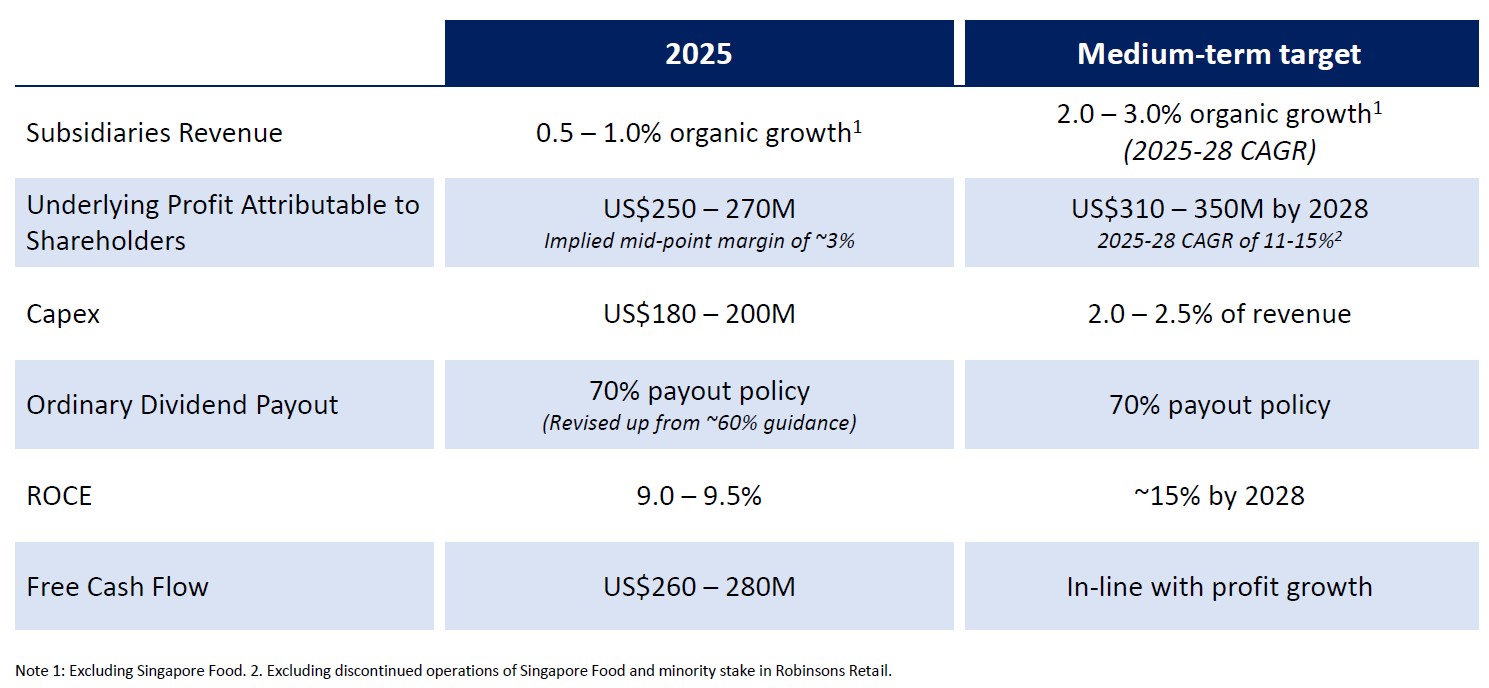

The Group has set clear medium-term targets at its 2025 Investor Day, aiming for a revenue CAGR of 2-3% from 2025 to 2028, reducing SG&A as a percentage of revenue from 1.5% in 2024 to 1.1% by 2028, translating to a $30-35 million cost savings and an underlying profit attributable to shareholders of US$310-350 million by 2028, implying 11-15% CAGR.

Following the divestments, DFI declared a special dividend of 44.30 US cents per share, in addition to an interim dividend of 3.50 US cents per share. The total declared payout for 1H2025 is 47.80 US cents.

The Group has also updated its dividend policy, revising the ordinary dividend payout ratio guidance up to 70% from ~60%.

According to consensus share price forecast, DFI is expected to offer a total dividend of 11 cents per share. This represents a dividend yield of about 2.8% based on its share price of US$3.96

As of 26 December 2025, DFI's consensus share price target is US$4.24. This represents a potential upside of about 7% from its current share price.

Related Links:

- DFI Retail Group Holdings Limited share price history and share price target

- DFI Retail Group Holdings Limited dividend forecast and dividend yield

#3 - UOL Group Ltd (SGX: U14)

UOL Group is a leading property and hospitality group with a portfolio of development and investment properties, hotels, and serviced suites.

Its hotel subsidiary, Pan Pacific Hotels Group, owns brands such as "Pan Pacific" and "PARKROYAL".

The share price has rallied significantly, recording a 68.8% gain year-to-date as of 26 December 2025.

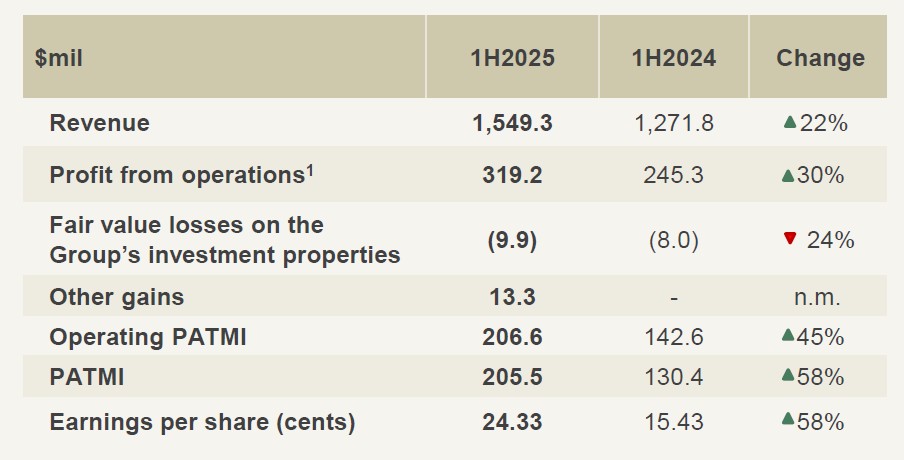

For the first half of 2025 (1H2025), UOL Group’s revenue rose 22% to S$1.55 billion.

Operating profit after tax and minority interests (Operating PATMI) increased 45% to S$206.6 million, while group pre-tax profit grew 30% to S$319.2 million.

The group continues to see robust sales momentum across its residential launches.

As of October 2025, UpperHouse at Orchard Boulevard which was launched in July 2025 is 68% sold, while Parktown Residence and MEYER BLUE are 92% and 70% sold respectively.

UOL Group is also actively recycling capital and diversifying its portfolio.

In terms of divestment, UOL Group announced the proposed sale of KINEX mall for S$375 million, unlocking value above its latest valuation. It has previously completed the divestment of PARKROYAL Yangon in May 2025.

It has also made multiple acquisitions throughout the year.

Domestically, the group replenished its landbank by acquiring a 50% JV stake in Thomson View Condominium for S$810 million and placing the top bid for the Dorset Road Government Land Sales site.

UOL Group also made its first foray into the UK student accommodation sector with the £43.5 million acquisition of Varley Park in Brighton.

In addition, it acquired a 10% stake in Jinmao Pu Yuan, a prime residential site in Shanghai earlier in February 2025.

The group maintains a healthy balance sheet with a net gearing ratio of 0.25x, positioning it well for future dividend sustainability.

UOL Group typically declares dividends annually at the rate of approximately 20-50% of the profit after tax and minority interest (PATMI).

Based on the previous financial year (FY2024), the group paid a first and final dividend of S$18.0 cents per share.

Based on the current share price of S$8.71, the trailing dividend yield is approximately 2.1%.

As of 26 December 2025, UOL's consensus share price target is S$9.35. This represents a potential upside of about 7% from its current share price.

Related Links:

- UOL Group Ltd share price history and share price target

- UOL Group Ltd dividend forecast and dividend yield

What would Beansprout do?

The strong year-to-date performance of these three blue-chip stocks highlights a resurgence of interest in Singapore blue-chip stocks.

A common theme driving the outperformance of these three companies is active capital management.

All three have been divesting non-core or mature assets to unlock value for shareholders.

This capital recycling has allowed them to either reward shareholders with special dividends, as seen with DFI and ST Engineering, or reinvest into higher-growth areas such as UOL Group’s entry into UK student accommodation.

Following the strong share price gains, these three stocks offer a dividend yield of about 2% to 3%, below the dividend yield of the Straits Times Index. Investors looking for income may potentially look for other Singapore stocks that may offer a potentially higher dividend yield using our Singapore DIvidend Stock Screener.

However, analysts are still expecting potential upside of 5-10% for these stocks, based on the latest consensus share price target.

Across the three names, analysts are expecting a higher potential upside for DFI and UOL. For DFI, this may be driven by the ongoing initiatives to grow its medium term profit. For UOL, this may be driven by continued recovery in the Singapore property market, together with initiatives to unlock value.

You can find out what may drive further potential upside in Singapore stocks here.

If you’d prefer broad exposure to the Singapore market, you can also consider learning more about the Straits Times Index (STI), which tracks the performance of Singapore’s largest blue chip companies. Learn more about the STI ETF and how to choose the best STI ETF for your portfolio here.

Check out the best stock trading platforms in Singapore with the latest promotions to invest in Singapore blue chip stocks.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments