AI fears and Nvidia in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 24 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about Nvidia in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside Nvidia.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

2:09 - Macro Update

The S&P 500 experienced a pullback in the past week, with the Nasdaq falling by 2.7% due to concerns about AI-related spending, while the STI declined by 1.7% but showed relative resilience compared to US markets.

Investor concerned on whether companies are overspending on AI infrastructure, with US hyperscalers including Amazon, Meta, Microsoft, and Alphabet showing sharp increases in capital expenditure over the past year.

AI company valuations have risen significantly, with a record number of fund managers now believing companies are over-investing in AI and should instead focus on improving their balance sheets.

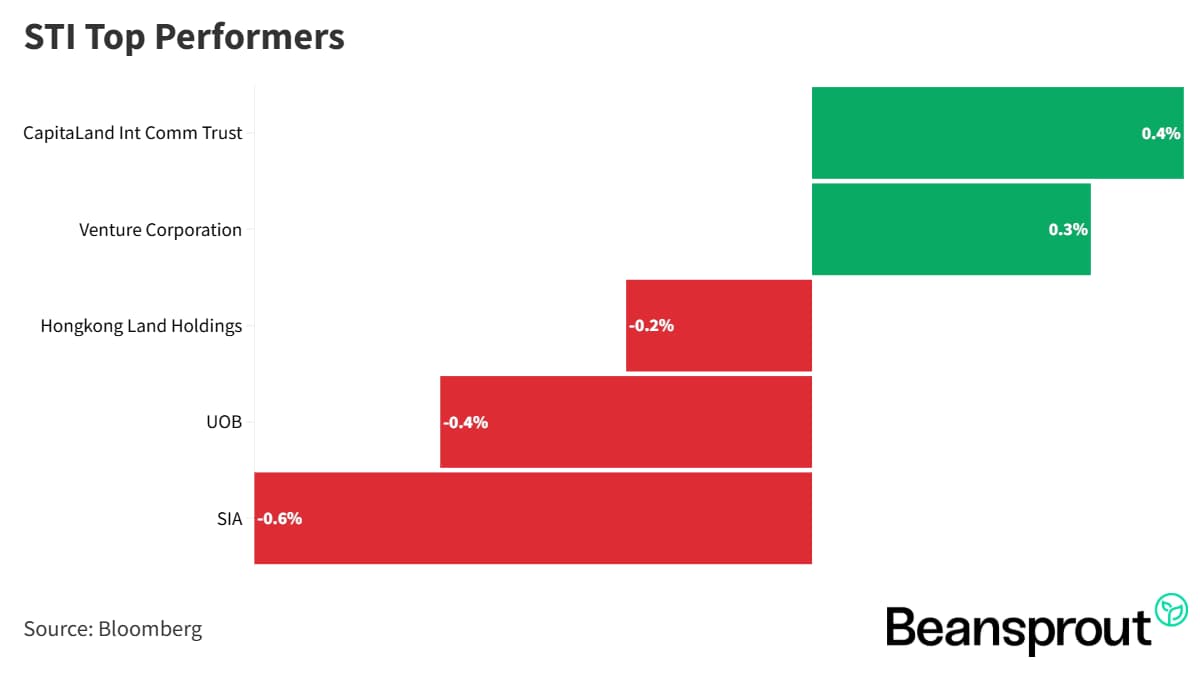

Only two STI gainers emerged during the week: CapitaLand Integrated Commercial Trust and Venture Corp, both with relatively resilient dividends.

The Singapore government unveiled multiple measures to revitalise the local equities market, including the $5 billion Equity Market Development Programme, a SGX-NASDAQ dual listing bridge, and a $30 million Value Unlock Programme.

STI Top Performers:

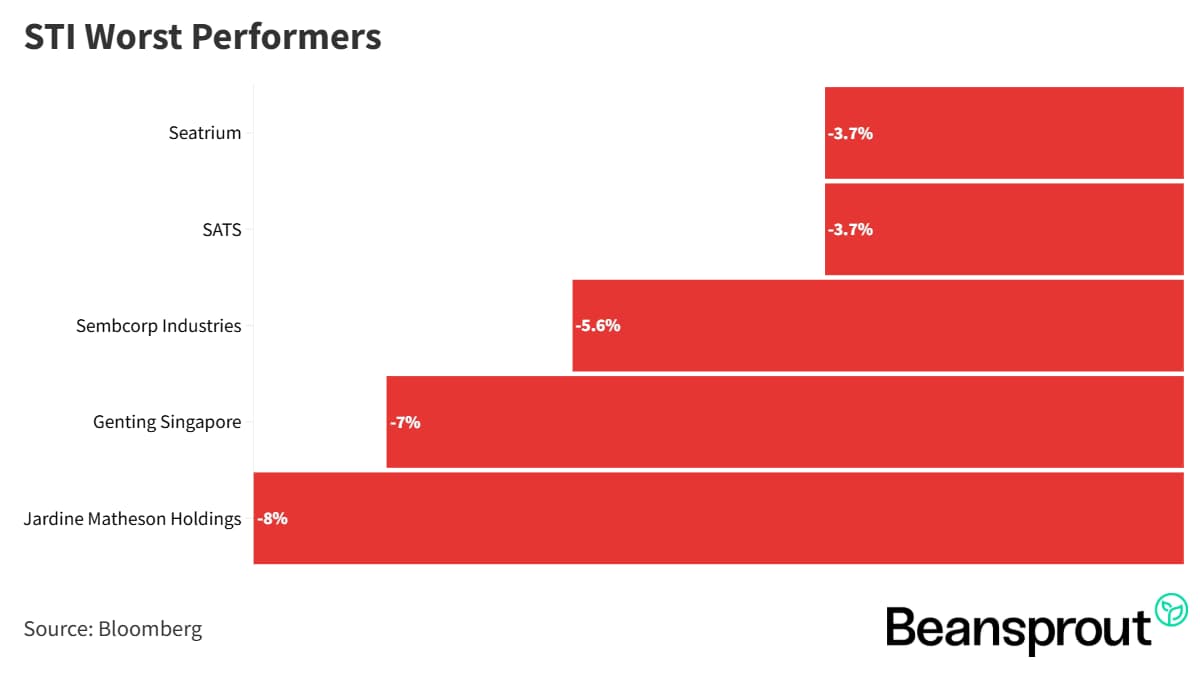

STI Worst Performers:

Nvidia (NASDAQ: NVDA)

Nvidia reported strong 3Q FY26 earnings, with quarterly revenue reaching $57 billion (+22% QoQ and +62% YoY), but the share price declined due to ongoing market concerns about AI spending sustainability.

CEO Jensen Huang provided highly optimistic commentary, stating that Blackwell chip sales are "off the charts" and cloud GPUs are sold out, indicating strong underlying demand.

Nvidia reported net income of $32 billion in Q3 FY26 and a gross margin of 73.6%, while also generating free cash flow of $22 billion, which the company used partly for significant share repurchases.

The company projected revenue of $65 billion and an improved gross margin of 75% for the upcoming quarter, underscoring management's confidence in sustained AI demand despite broader market concerns.

16:19 - Technical Analysis

Straits Times Index (STI)

The STI experienced a pullback, opening Monday morning with a gain of just five points, positioning at the 20-day moving average of 4,487 point.

The next major support at the 50-day moving average of 4,411 points, with the lower Bollinger Band at 4,390 points.

The MACD indicator remains negative with a downward trajectory, suggesting continued bearish momentum.

The RSI indicator sits at 50 points, representing a neutral reading, which offers limited guidance for immediate price movement.

The technical analysis suggests further downside potential toward the 4,400-point support level, with potential for a rebound, but to be updated in upcoming weekly market reviews through December.

Learn more about the Straits Times Index (STI) here.

Dow Jones Industrial Average

The Dow Jones Industrial Average closed at 46,245 points on Friday, down 1.08% and just above the 100-day moving average of roughly 45,730 points.

Technical signals indicate stabilization, with the MACD still negative but showing weakening downside momentum.

The RSI indicator improved, rising to 43 following a 36-point low on Thursday.

The next resistance levels are at the 50-day moving average (around 46,600) and the 20-day moving average (approximately 47,100).

The Dow is consolidating with strong support around 46,000 and would need to surpass 47,000 to shift the technical momentum back to the upside.

S&P 500

The S&P 500 closed the week down nearly 1% but managed to hold above the critical 6,600 psychological level, which coincides with the 100-day moving average.

Key resistance levels are positioned at the 50-day moving average (6,710 points) and the 20-day moving average (6,760 points).

The MACD indicator shows signs of stabilization with weakening downtrend momentum, suggesting that selling pressure is subsiding.

The RSI has improved significantly, ticking up to 41 from Thursday's low of 34 points, indicating reduced oversold conditions.

The technical setup presents a potential opportunity to re-enter the US market ahead of the Christmas period.

Nasdaq Composite Index

The Nasdaq Composite was the most heavily impacted US index due to tech valuation concerns and rate cut uncertainty, gaining only 0.88% on Friday, with the key 100-day moving average support level triggered at 22,050 points.

Resistance levels are identified at the 20-day moving average (23,185 points) and the 50-day moving average (22,880 points).

The MACD indicator shows signs that downtrend momentum has been weakening over the past few weeks, while the RSI ticked up from Thursday's low of 35 points to 39 points.

Market expectations now at nearly 70% for a 25 basis point rate cut in December, which could ease some concerns that drove last week's market pullback.

The outlook suggests a potential rebound in the US market this week, with close monitoring needed to see if the Nasdaq can reclaim the critical 20-day and 50-day moving average resistance levels.

What to look out for this week

Tuesday 25 Nov 2025: Alibaba earnings

Wednesday, 26 Nov 2025: CMC Invest x Beansprout Event: Build a Dividend Portfolio: Strategic Opportunities in the Singapore Market

Thursday, 27 Nov 2025: The Edge Year End Investment Forum, US market closed

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments