UOB and ThaiBev in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 26 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about UOB and Thai Beverage in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside UOB and Thai Beverage.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:33 - Macro Update

- Global markets saw a divergence in performance this week. While the S&P 500 and Nasdaq declined by 0.4% and 0.1% respectively due to elevated geopolitical tensions, the Straits Times Index (STI) rallied 1.0%, reaching a new all-time high close to 4,900 points.

- A similar decoupling occurred in the bond market, where US 10-year Treasury yields spiked above 4.2% on debt concerns, while Singapore 10-year yields fell to 2.1% as investors sought safe-haven assets.

- All eyes are on the upcoming Federal Reserve meeting on 28 January, where rates are expected to remain unchanged, with investors keenly watching for guidance on potential rate cuts in 2026.

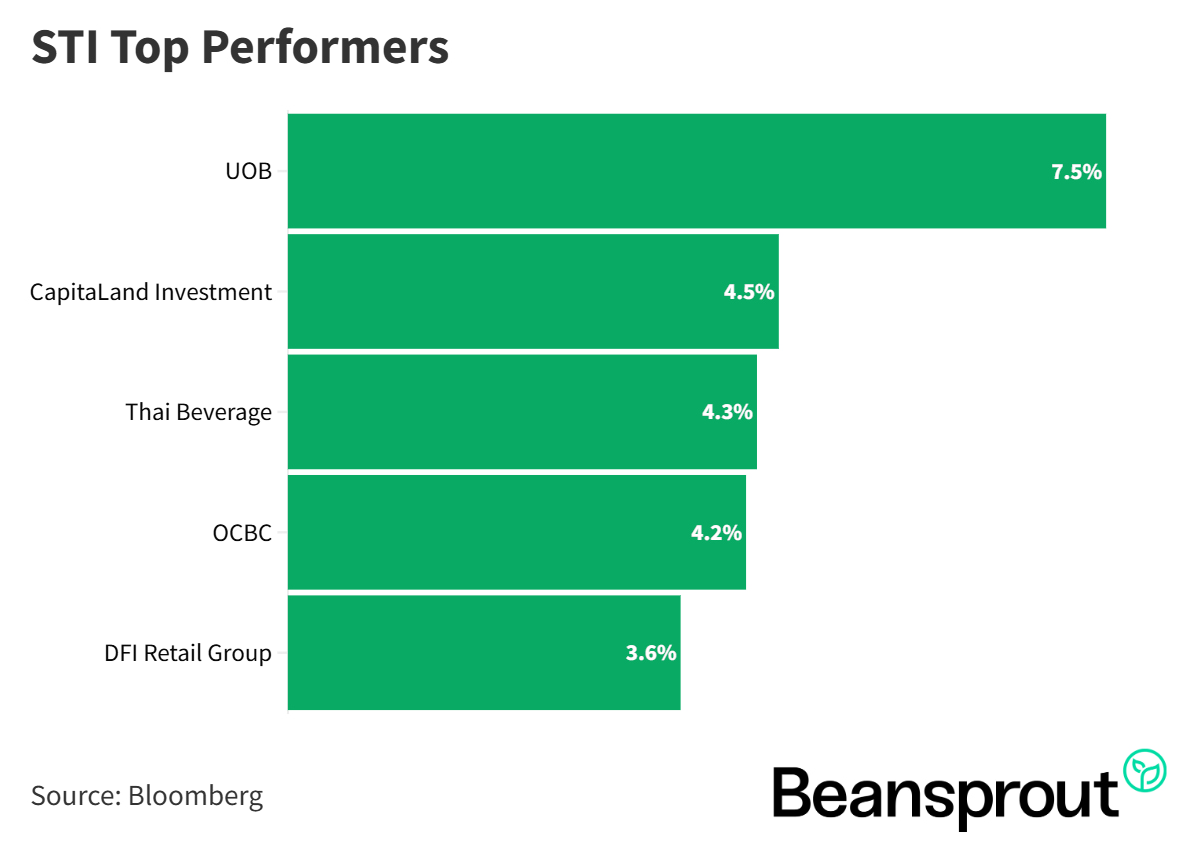

- Within the STI, UOB led the gains, surging 7.5% to a multi-year high, while Thai Beverage and CapitaLand Investment also saw strong momentum, with both climbing more than 4%.

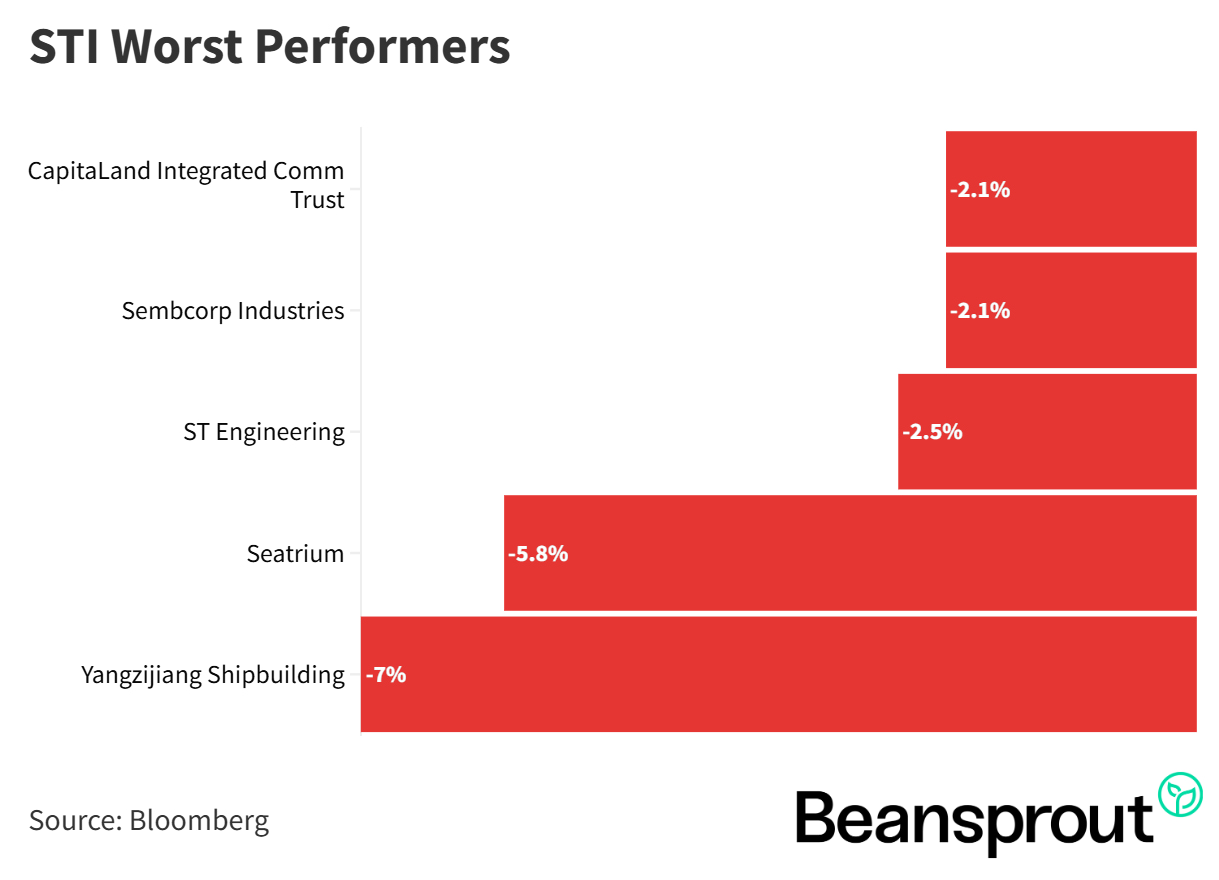

Conversely, cyclical stocks faced heavy selling pressure due to heightened global geopolitical uncertainty, with Yangzijiang Shipbuilding down by 7% and Seatrium down by 5.8%

STI Top Performers:

STI Worst Performers:

United Overseas Bank Limited (SGX: U11)

- UOB shares spiked 7.5% last week to reach approximately $39.50, recovering sharply from November lows of ~$34.

- The bank underperformed its peers in 2025 due to a 67% decline in Q3 net profit, largely driven by higher allowances for credit losses linked to exposure outside of Singapore..

- Net Interest Margin (NIM) continues to be under pressure, compressing to 1.82% amid falling interest rates.

- On a positive note, fee income grew 10% in the first 9 months of 2025, largely supported by strong wealth management activities.

- Despite earnings pressure, UOB paid a $0.50 special dividend in 2025 and launched a $2 billion share buyback program (13% completed so far). Management expects to maintain dividend payouts.

- For 2026, management forecasts modest low single-digit loan growth and stronger high single-to-double-digit fee income expansion, with credit costs projected at 25-30 basis points.

Read also: 3 worst-performing Singapore blue chip stocks in 2025. Can they bounce back in 2026?

Related Links:

Thai Beverage Public Company Limited (SGX: Y92)

- Thai Beverage, one of the underperformers throughout 2025, saw renewed interest this week as its share price rebounded; this marks a turnaround after a challenging year where the stock drifted from highs above $0.50 to hit a low of $0.45 per share.

- Its financial performance was weighed down by weak consumer sentiment in Thailand and Vietnam, leading to an 11.7% YoY fall in FY2025 net profit and a 7.7% decline in the spirits business.

- Despite weaker earnings, the company maintained its dividend at 0.62 Thai Baht per share, which translates to a yield of >5% in Singapore dollar terms.

Read also: 3 worst-performing Singapore blue chip stocks in 2025. Can they bounce back in 2026?

Related Links:

What to look out for this week

Monday, 26 January 2026: Mapletree Logistics Trust, OUE REIT earnings

Wednesday. 28 January 2026: Mapletree Industrial Trust earnings, Beansprout webinar: Investing in the Living Sector: A growing real estate asset class, Microsoft, Meta, Tesla earnings

Thursday, 29 January 2026: CapitaLand Ascott Trust, Starhill Global REIT earnings, 6-month Singapore T-bill auction, Apple earnings

Friday, 30 January 2026: Keppel DC REIT, CDL Hospitality Trusts, Mapletree Pan Asia Commercial Trust earnings

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments