3 worst-performing Singapore blue chip stocks in 2025. Can they bounce back in 2026?

Stocks

By Gerald Wong, CFA • 23 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Discover the three worst-performing Singapore blue chip stocks in 2025 and assess whether they offer turnaround opportunities in 2026.

What happened?

2025 was a strong year for the Straits Times Index (STI), which rose by about 22%.

Earlier, we shared 3 top-performing Singapore blue chip REITs and the top 3 Singapore blue chip stocks in 2025.

However, not every blue chip benefited from this improved sentiment in the Singapore market.

Three well-known blue chip stocks saw their shares prices declining in 2025, underperforming the STI.

In this article, we take a closer look at the three worst-performing Singapore blue chip stocks in 2025 and whether there may be a turnaround opportunity for them in the new year.

#1 - Thai Beverage (SGX: Y92)

Thai Beverage, or ThaiBev, is one of Southeast Asia’s largest beverage companies, with a portfolio spanning spirits, beer, non-alcoholic beverages, and food.

ThaiBev’s share price fell by about 15.6% in 2025, ending the year at S$0.460 as of 31 December 2025.

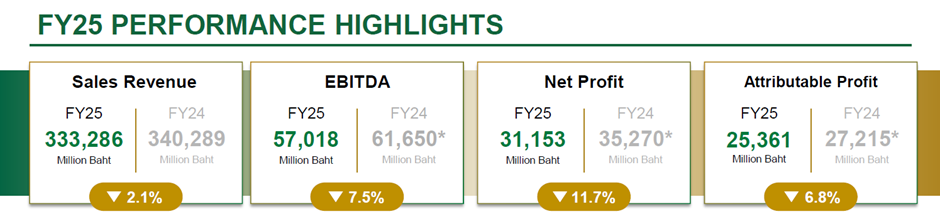

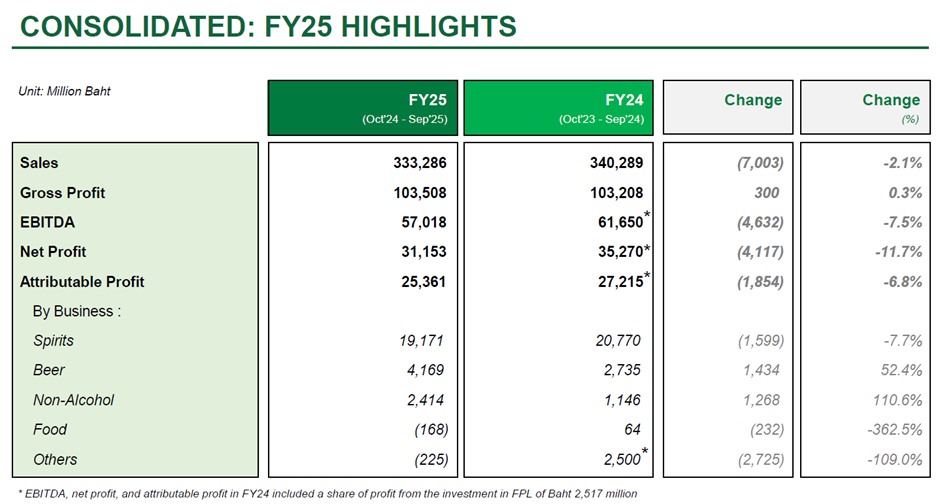

For the 12 months ending September 2025 (FY25), ThaiBev reported a 2.1% decline in revenue to THB 333.3 billion, while net profit fell 11.7% to THB 25.4 billion.

The decline was largely driven by softer consumer demand in its key markets, particularly Thailand and Vietnam, as households remained cautious with discretionary spending.

Sales volumes in the spirits segment, which is typically ThaiBev’s main profit contributor, weakened as consumer sentiment stayed fragile throughout the year.

At the same time, stricter alcohol regulations in Vietnam continued to weigh on beer sales and delayed a meaningful recovery in that market.

Thailand’s alcohol policy turned more uncertain in November 2025, when stricter rules and penalties took effect on 8 November, before authorities introduced a trial relaxation in early December that allowed sales from 11am to midnight.

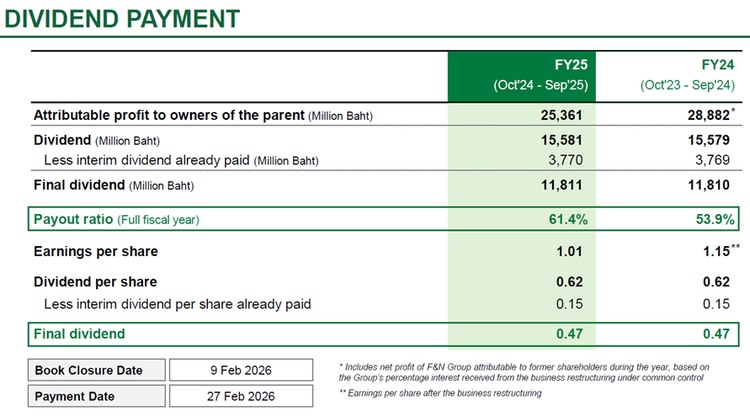

Despite the weaker earnings, the management has declared a final dividend of THB 0.47 per share for the financial year.

Together with the interim dividend of THB 0.15, the total dividend of THB 0.62 represents a payout ratio of 61.4% of profit attributable to shareholders.

This translates to a dividend of roughly S$0.025 per share for FY2025, which represents a dividend yield of about 5.4% based on its share price of S$0.46 as of 14 January 2026.

As of 15 January 2026, Thaibev's consensus share price target is $0.51. This represents a potential upside of about 11% from its current share price of $0.460.

Whether Thaibev is able to bounce back and unlock this potential upside will largely be dependent on the pace of recovery in consumption in Thailand, as well as any progress in listing its beer business.

Related Links:

- Thai Beverage Public Company Limited share price history and share price target

- Thai Beverage Public Company Limited dividend forecast and dividend yield

#2 - Genting Singapore Limited (SGX: G13)

Genting Singapore was among the weakest performers in the STI in 2025.

Its share price declined by 5.2% and ended the year at S$0.725 as of 31 December 2025.

The company was affected by a combination of operational disruption and softer tourism trends.

Ongoing renovation works under the Resorts World Sentosa (RWS) 2.0 transformation, including the temporary closure of the S.E.A. Aquarium and hotel upgrades, reduced non-gaming revenue and weighed on visitor numbers.

At the same time, the post-pandemic “revenge travel” surge seen earlier faded, while the recovery in Chinese tourist arrivals was slower than expected.

Rising labour and energy costs further squeezed margins during the period.

Sentiment was further affected when Singapore’s regulator renewed RWS’ casino licence for a shortened two year term instead of the usual three years, effective 6 February 2025, citing unsatisfactory tourism performance.

This is the first time the Gambling Regulatory Authority (GRA) has issued a casino licence with a tenure shorter than three years.

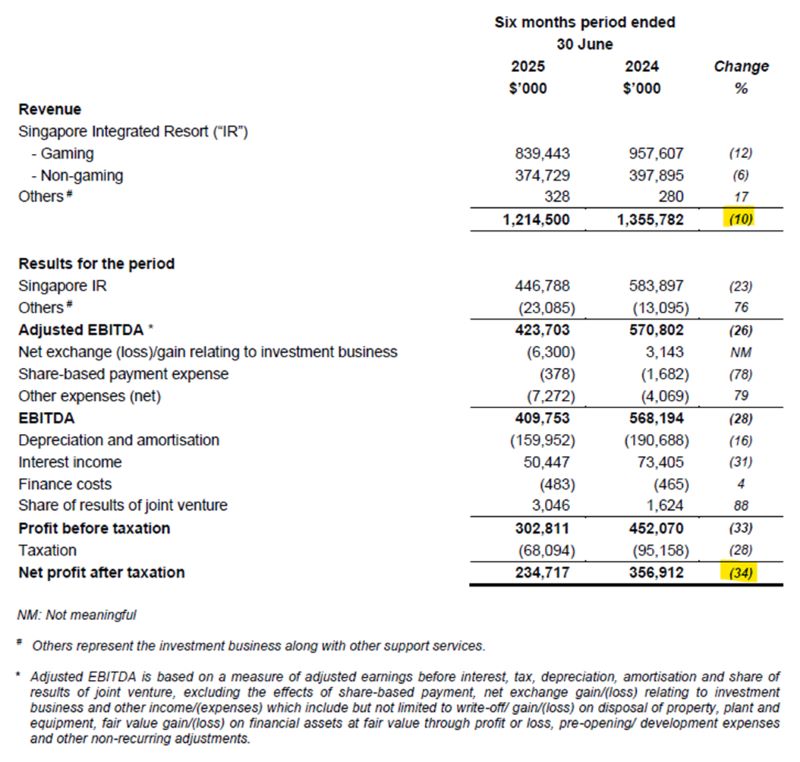

For the first half of 2025, Genting Singapore reported a 10% decline in revenue to S$1.2 billion, while net profit fell 34% to S$234.7 million.

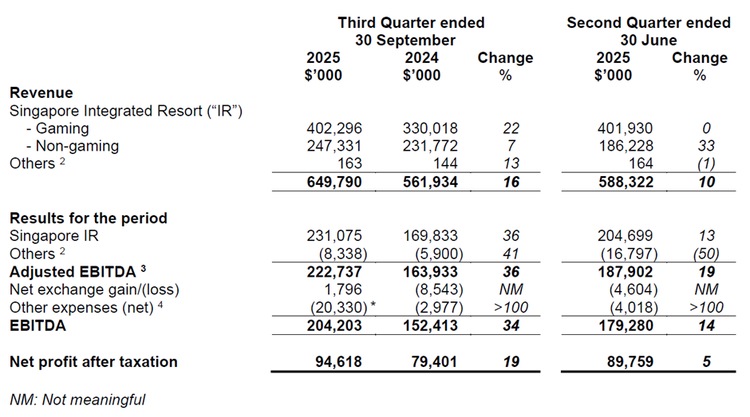

In their latest third quarter results, Genting Singapore reported a 16% year-on-year increase in revenue to S$649 million and net profit rose 19% to S$94.6 million.

This was helped by stronger VIP rolling volume and win rate and continued growth across non-gaming business.

Genting Singapore also implemented a leadership reshuffle in 2025.

This included the appointment of Lee Shi Ruh as President and Chief Operating Officer, moving from his previous role as Chief Financial Officer, alongside a new CFO appointment.

The company said the reshuffle is intended to strengthen operational delivery as it progresses with its transformation pipeline.

For FY2025, Genting Singapore announced an interim dividend of S$0.02 per share. This would bring its trailing twelve months total dividend to S$0.04.

Based on Genting Singapore's share price of S$0.735 as of 14 January 2026, Genting Singapore offers a historical dividend yield of around 5.5%.

As of 15 January 2026, Genting Singapore's consensus share price target is $0.952. This represents a potential upside of about 29.5% from its current share price of $0.735.

To see a turnaround, we will be looking out for whether its gaming revenue can increase with higher visitor numbers.

Genting Singapore’s longer-term outlook is also tied to the completion of its expansion projects, particularly ahead of its next license evaluation expected in 2026.

Related Links:

- Genting Singapore Limited share price history and share price target

- Genting Singapore Limited dividend forecast and dividend yield

#3 - United Overseas Bank Limited (SGX: U11)

United Overseas Bank (UOB) is one of Singapore’s three major local banks, offering retail, corporate, and wealth management services across ASEAN.

UOB share price ended 2025 with down 3.5%, closing at S$35.06 as of 31 December 2025.

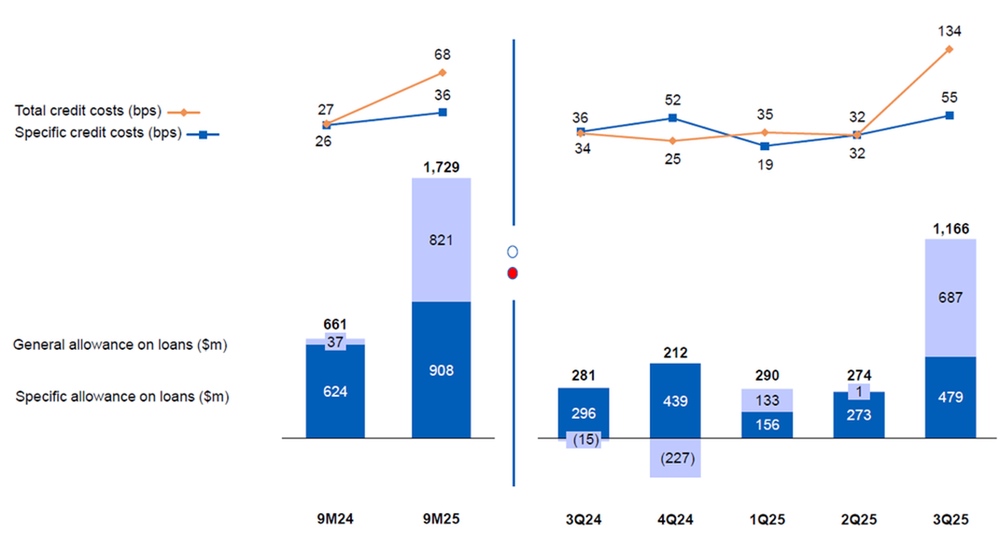

The underperformance was mainly due to a sharp earnings decline reported in the third quarter of 2025, driven by a significant increase in provisions.

During 3QFY25, UOB recorded a 72% year-on-year fall in net profit to S$443 million after setting aside about S$1.1 billion in allowances.

Management described these provisions as a pre-emptive measure to strengthen the balance sheet amid macroeconomic uncertainty and sector-specific headwinds.

At the same time, UOB, like its peers, faced pressure on net interest margins as global interest rates began to ease.

As a snapshot, UOB’s third-quarter results showed a significant spike in allowances alongside the steep decline in reported earnings.

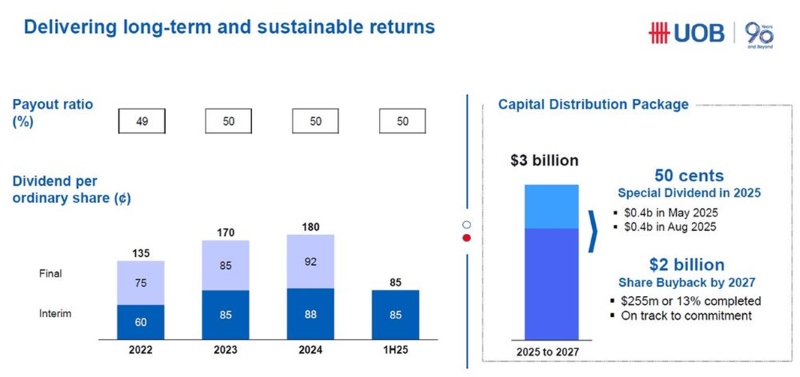

UOB said its capital return plans remain unchanged.

Management noted the 2025 final dividend will not be affected by the pre-emptive general allowances, and reaffirmed its dividend and share buyback commitments.

For FY2025, UOB declared an interim ordinary dividend of 85 cents per share. Investors also received 50 cents per share special dividend that was previously announced.

Based on its annualised ordinary dividend per ordinary share of S$1.70, UOB offers a dividend yield of 4.7% based on its share price of $36.51 as of 14 January 2026.

The bank also continued with its S$2 billion share buyback programme, with around 13% completed as of August 2025.

As of 15 January 2026, UOB’s consensus share price target is $34.57. This represents a potential downside of -5.3% from its share price of $36.51.

This is likely due to concerns about continued pressure on its net interest income, with falling interest rates.

To surprise positively, UOB may have to demonstrate more stable earnings in 2026 with growth in its fee income and moderate credit costs.

Related Links:

- United Overseas Bank Limited share price history and share price target

- United Overseas Bank Limited dividend forecast and dividend yield

- UOB reports 72% decline in profit but maintains dividend guidance

What would Beansprout do?

The weak share price performance of Thai Beverage, UOB and Genting Singapore in 2025 appears to be driven more by company-specific factors that dragged their earnings.

Whether they can turn around in 2026 will ultimately depend on whether underlying fundamentals begin to strengthen.

For Genting Singapore, we will be looking out for whether its revenue can increase with higher visitor numbers and completion of its expansion projects, particularly ahead of its next license evaluation expected in 2026.

For Thai Beverage, we will be looking for a recovery in consumer sentiment in Thailand and Vietnam, as well as and any tangible steps to unlock value from its beer business.

For UOB, we will be looking out for whether it can demonstrate more stable earnings in 2026 with growth in its fee income and moderate credit costs offsetting continued pressure on its net interest income.

For income-focused investors, all three stocks offer dividend yields of above 4.5%.

Genting Singapore offers the highest dividend yield among the three at 5.5%. Thai Beverage follows closely with a dividend yield of approximately 5.4%, while UOB offers a dividend yield of 4.7%.

The dividend yields offered is now above that of the Straits Times Index (STI), which offers a dividend yield of 4.4%.

Singapore stocks have done well in the past one year, supported by improving corporate earnings and measures to boost the Singapore stock market. You can find out what may drive further potential upside in Singapore stocks here.

If you’d prefer broad exposure to the Singapore market, you can also consider learning more about the Straits Times Index (STI), which tracks the performance of Singapore’s largest blue chip companies. Learn more about the STI ETF and how to choose the best STI ETF for your portfolio here.

[Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher within 5 working days, plus 12% p.a. interest boost coupon for 120 days (worth ~S$78) with Longbridge Cash Plus when you sign up for a Longbridge account via Beansprout. Plus, stand a chance to win S$180 CapitaVouchers! Promo ends on 31 January 2026. Learn more about the Longbridge promo here.

Check out the best stock trading platforms in Singapore with the latest promotions to invest in Singapore blue chip stocks.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

2 comments

- Kelvin • 23 Jan 2026 11:47 PM

- Beansprout • 26 Jan 2026 05:56 AM

- Philip • 23 Jan 2026 08:11 PM

- Beansprout • 26 Jan 2026 05:58 AM