Keppel DC REIT and Mapletree Logistics Trust in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 28 Jul 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about Keppel DC REIT and Mapletree Logistics Trust in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside Keppel DC REIT and Mapletree Logistics Trust

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

2:00 - Macro Update

- The US S&P 500 and NASDAQ hit all-time highs, while Singapore’s STI outperformed with a 1.7% weekly gain to 4,261 points.

- STI rebounded strongly from April lows of 3,400 points, driven by easing trade tensions and investor interest in safe haven markets like Singapore.

- MAS announced revitalisation measures for the Singapore market focused on supply, demand, and connectivity, including improving listing attractiveness and cross-border partnerships.

- Key development was the $5 billion Equity Market Development Programme (EQDP), with $1.1 billion allocated to three fund managers to invest in local stocks.

- Additional measures were introduced to enhance research, investor confidence, and recourse avenues, supporting stronger market performance.

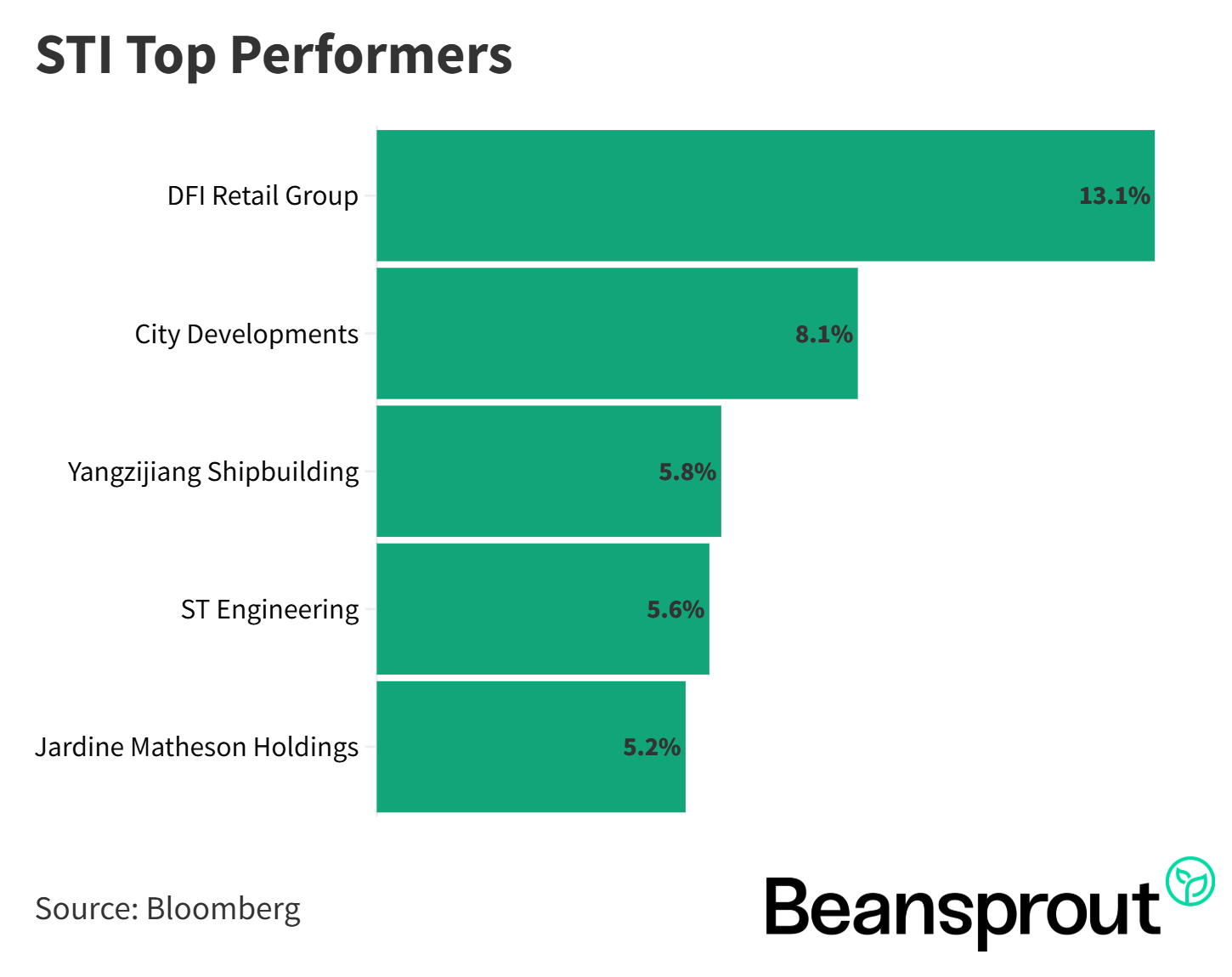

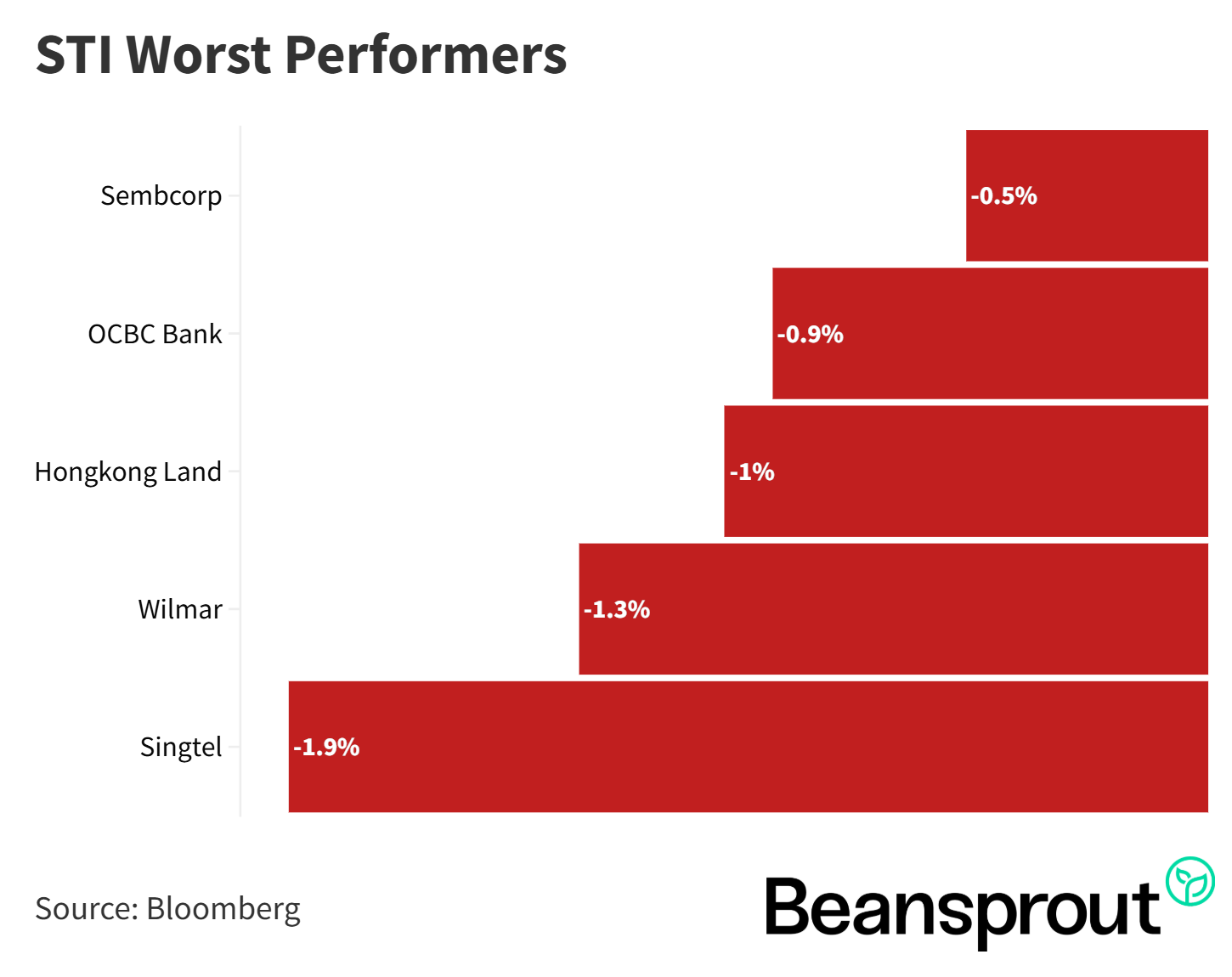

- Top gainers were DFI Retail Group (+13%) on strong earnings and dividend, and City Developments (+8.1%) on property optimism, while Singtel, Samcom, and Hong Kong Land saw profit-taking.

STI Top performers:

STI worst performers:

6:17 - Keppel DC REIT

- Keppel DC REIT reported strong results, with its distribution per unit rising 12.8% to 5.133 cents, pushing its share price to close to a 52-week high.

- It is a pure-play data center REIT with 24 data centres worth nearly $5 billion across 10 countries, with 66% of assets in Singapore.

- Gross revenue rose 34% and net property income increased 38%, driven by acquisitions completed in Q4 2024.

- Finance costs dropped 5.3% due to lower interest rates, contributing to a 57% rise in distributable income to $127 million.

- Rental reversions and strong demand from AI users and hyperscalers are fueling structural growth in the data centre market, especially in Asia-Pacific and Europe.

- Keppel DC REIT maintains a healthy balance sheet with 30% leverage and 3% average cost of debt

Read also:

10:12 - Mapletree Logistics Trust

- Mapletree Logistics Trust reported weaker Q1 results, with gross revenue and net property income declining, leading to a 12% drop in distribution per unit to 1.812 cents.

- Borrowing costs rose to $39.3 million from $38.4 million, contributing to an 11% decline in distributable income compared to the previous year.

- Singapore occupancy fell to 93.9%, dragged down by the newly completed Joo Koon Logistics Hub with only 42.4% occupancy as of June 2025.

- Portfolio rental reversions slowed to 2.1%, down from 5.1% in the previous quarter, mainly due to negative reversions of 7.5% in China.

- The asset enhancement initiative at Joo Koon cost $205 million and reached 60% committed occupancy, with 25% more space under active negotiations.

- Gearing increased to 41.2%, interest rate remained at 2.7%, and the REIT trades at 0.9 times price to book with a dividend yield above 6%.

Read also:

15:51 - Technical Analysis

Straits Times Index

- The STI index is the top global performer year-to-date with a 12% gain, outperforming US indices which rose about 5% to 8%.

- Singapore's safe haven status, strong dividend yields, and easing trade tensions have attracted investor interest and supported market gains.

- Recent earnings reports have been positive and contributed to STI’s rise, though a slight pullback of 16 points (0.4%) was seen on Monday.

- Upcoming earnings from banks like OCBC and DBS could be potential catalysts to push STI above the recent high of 4,274 points.

- The next resistance is at the psychological 4,300 level, but MACD convergence and RSI above 81 suggest the index may be peaking and heading into consolidation.

- Key support levels are the 20-day moving average at 4,123 points and the 50-day moving average near the 4,000 mark, a level likely to attract technical traders.

Dow Jones Industrial Average

- The Dow Jones is up 5.2% year-to-date and is about 173 points away from its all-time high of 45,073 reached in December.

- The index is currently supported by the 20-day moving average at 44,400, with key resistance at the 45,000 level, aligning with the upper Bollinger band.

- On the downside, support levels include the lower Bollinger band at 43,878 and the 50-day moving average at 43,254.

- The MACD remains slightly negative, trending below the signal line for the past two weeks, indicating the index is awaiting a new catalyst.

- RSI has declined to 63 from early July highs, suggesting healthy but moderating momentum as earnings season progresses.

- The Dow Jones is likely to continue consolidating at current levels, with traders watching for a breakout past 45,000 or a pullback to key support zones for reentry.

S&P 500

- The S&P 500 has been hitting all-time highs daily, with the latest peak at 6,395 points.

- There is no clear resistance above this level, but support is expected at 6,162, the lower Bollinger band and previous high from early 2024.

- The 50-day moving average is approaching 6,100, reinforcing that zone as a strong support in case of a pullback.

- MACD is neutral to slightly negative, with the MACD and signal lines intertwining, indicating a lack of directional momentum.

- RSI is elevated at 76, above the 70 overbought threshold, signaling caution for investors considering new entries.

- A better entry point may be at the 20-day or lower Bollinger band support, rather than chasing the current highs.

Nasdaq Composite Index

- The NASDAQ Composite hit a high of 21,159 points, driven by strong Alphabet earnings, with more momentum expected as Meta, Microsoft, Apple, and Amazon report this week.

- Near-term resistance is at 21,200 points, with potential to reach 22,000 by year-end if results from the Magnificent Seven remain strong.

- Key support levels include the 20-day moving average at 20,669, the lower Bollinger band at 20,140, and the 50-day moving average near 19,950.

- The MACD indicator is currently neutral, showing no clear momentum or trend direction.

- RSI is above 70, signaling overbought conditions and suggesting caution when entering mega-cap tech stocks.

- Much of the recent upside may already be priced in, so earnings results will need to meet or beat expectations to sustain current levels.

What to look out for this week

- Monday, 28 July: SIA, Mapletree Industrial Trust, Lippo Malls Indonesia Retail Trust, Great Eastern, Raffles Medical earnings

- Tuesday, 29 July: Starhill Global REIT, Keppel Pacific Oak US REIT, First REIT, ESR REIT, CapitaLand Ascott Trust earnings.

- Wednesday, 30 July: Mapletree Pan Asia Commercial Trust, Keppel REIT, Far East Hospitality Trust, CDL Hospitality Trust, CapitaLand India Trust, CapitaLand China Trust, FOMC interest rate decision.

- Thursday, 31 July: Seatrium, Netlink Trust, Keppel, Frasers Logistics & Commercial Trust, Elite UK REIT, AIMS APAC REIT earnings, 6-months Singapore T-bill auction, Apple, Amazon earnings

- Friday, 1 August: OCBC Bank Earnings

Get the full list of stocks with upcoming dividends here.

Join our Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments