Stocks soar to new highs: Weekly Market Recap

By Gerald Wong, CFA • 11 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US and Singapore stocks reach record levels despite mounting geopolitical tensions.

One small ritual I have at the start of every year is checking my CPF Yearly Statement of Account.

CPF interest is credited once a year, so it’s always very satisfying to see how the balance has quietly grown in the background.

For me, having CPF as a retirement safety net gives me much greater peace of mind when investing the rest of my savings. It’s one of the reasons I prioritise building towards the Full Retirement Sum (FRS).

This year, the FRS has increased for those reaching 55 years old in 2026, and we break down the latest numbers and what they mean for your retirement planning.

The same logic applies to emergency cash. Once that buffer is in place, I don’t have to worry about selling investments at the wrong time just because life happens.

This month, we’ve also seen another round of cuts to savings account interest rates in Singapore. With the 6-month T-bill yield rising to 1.6% in the previous auction, we look at what to expect for the upcoming T-bill auction on 15 January. We also compare where it might make sense to park your cash in January 2026, whether it’s T-bills, SSBs, or fixed deposits.

When it comes to investing, I find it helpful to have ways to track my progress, stay informed through research and insights, and know where to turn when I need guidance. This week, we explore how platforms like DBS digiWealth can support investors in these areas.

All these little things may not be exciting, but they help me invest with a lot more confidence and peace of mind. As you start the year, this could be a good time to ask yourself what simple steps might help you feel more confident about your money too.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🚀 Good start to the year

What happened?

Over the January 3 weekend, the U.S. military carried out a mission in Venezuela that resulted in the capture of President Nicolás Maduro and his wife.

The U.S. administration has since indicated that it will oversee Venezuela on a temporary basis until a safe and judicious transition of power can take place.

In addition, U.S. leaders have signalled plans to bring in major U.S. energy companies to help rebuild Venezuela’s oil infrastructure.

What does this mean?

Investors largely looked past the developments in Venezuela, given that the country makes up less than 1% of global GDP.

While Venezuela holds about 17% of the world’s oil reserves, years of underinvestment and weak infrastructure mean it accounts for only around 1% of global oil production.

As a result, markets have remained focused on the bigger picture. Expectations for U.S. earnings growth in 2026 have been revised higher, while overall economic momentum continues to hold up well.

Why should I care?

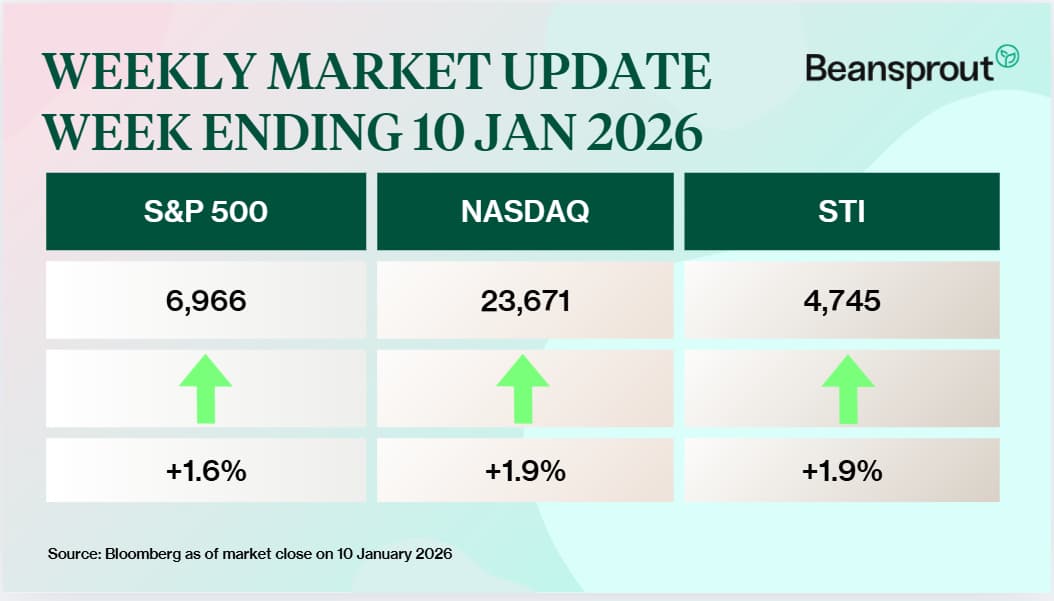

Global stocks rallied in the first full trading week of the year, as investors largely looked past rising geopolitical tensions and pushed major indices to new highs.

The S&P 500 closed at a fresh record, gaining 1.6% over the week.

Back home, Singapore’s Straits Times Index (STI) also hit a new all-time high. Gains were led by property stocks, as City Developments (+10.6%), HongKong Land (+9.6%) and UOL (+7.5%) soared. DBS and OCBC both reached new record highs as well.

🚗 Moving This Week

- CapitaLand Investment Limited (CLI) has unveiled two initiatives to deepen its logistics capabilities and accelerate growth across Asia Pacific, underscoring its confidence in the sector’s long-term prospects. Read more here.

- iFast said that it has conditionally agreed to buy a 30 per cent stake in financial advisory firm Financial Alliance Corporation for S$19.6 million, to be funded through a mix of internal resources and external borrowings. Read more here.

- PropNex said that a lawsuit against its subsidiary PropNex Realty and two other defendants over alleged misconduct has been withdrawn. The group had disclosed on Feb 11 last year that a claimant filed a suit in the Singapore High Court seeking damages linked to the alleged misconduct of one of PropNex Realty’s salespersons and the advice purportedly given. Read more here.

- Mapletree Investments is sharpening its focus under its fourth Five-Year Plan, with plans to pursue more strategic acquisitions and step up development activity to deliver high, sustainable returns. Mapletree is targeting returns of between 9 per cent and 12 per cent by FY2028/29, compared to an average return on invested equity of 10.9 per cent over the past decade.

- Marco Polo Marine’s subsidiary Marco Polo Shipyard has secured a guarantee facility with a tenor of up to six years to support the construction of an advanced research vessel. The facility was provided by Cathay United Bank’s Singapore branch, with support from Enterprise Singapore. Read more here.

- UI Boustead Reit is preparing for a potential listing in Singapore as early as March, with a target to raise at least S$900 million, according to sources familiar with the matter. The Boustead Singapore-sponsored Reit is expected to start sounding out investor demand as soon as next month. Discussions are ongoing, and the size and timing of the offering could still be adjusted, the sources said.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Where to park your cash for higher yield? T-bills vs Fixed Deposit vs SSB (Jan 2026)

We share the best ways to earn a yield on your cash through fixed deposits, Singapore T-bills, SSBs and money market funds in January 2026.

🤓 What we're looking out for next week

- Tuesday, 13 January 2026: US CPI Data, JP Morgan Earnings

- Wednesday, 14 January 2026: US PPI Data, Wells Fargo, Citigroup Earnings

- Thursday, 15 January 2026: 6 Month Singapore T-Bill Auction, Morgan Stanley, Goldman Sachs, Blackrock Earnings

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments