Stocks hit new highs as T-bill yield falls further: Weekly Market Recap

By Gerald Wong, CFA • 20 Jul 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US and Singapore stocks reached new record highs, while the T-bill yield declined

This week’s Money Diaries guest Jalyn shared a goal that struck a chord with me—achieving financial freedom.

Her approach? Keep it simple. Save aggressively, invest in boring index funds, and build a portfolio that could one day support her without needing a full-time job.

It worked. Jalyn became financially free at just 36.

For most of us, the first step starts with putting our savings to work.

This week, the 6-month T-bill yield fell further to 1.79%. While that may seem discouraging, it doesn’t mean there are no good options left. We compare T-bills, fixed deposits, and Singapore Savings Bonds (SSBs) to help you find the best place to park your savings.

We also highlight what to expect from the upcoming 1-year T-bill auction.

If you’re looking to invest for the long term like Jalyn, index funds are a great way to start. We’ve previously covered popular ETFs like the S&P 500 ETF and STI ETF. You can check out our Singapore ETF guide to find one that fits your needs.

If you’d rather not pick individual ETFs, a robo-advisor could help you get started with a diversified portfolio easily.

The tools are out there. And as Jalyn discovered, financial freedom isn’t just about hitting a number. Rather, it’s about what that number makes possible.

It might be worthwhile thinking - what could financial freedom unlock for you?

Gerald, Founder of Beansprout

⏰ This Week In Markets

🚀 Stocks rally on strong earnings and mild inflation

What happened?

Core inflation in the US rose by 0.2% in June, coming in below market expectations for a 0.3% increase.

This marks the fifth consecutive month of softer-than-expected inflation data, reinforcing hopes of a potential shift in the Federal Reserve’s interest rate stance.

What does this mean?

Despite earlier concerns that tariffs from the U.S.-China trade war might push prices higher, inflation has stayed contained in recent months.

At the same time, corporate earnings in the U.S. have shown resilience.

Major banks such as JPMorgan Chase and Citigroup delivered better-than-expected second-quarter results, while leading consumer names like Netflix also exceeded analyst forecasts.

This points to continued strength in the economy despite trade tensions.

Why should I care?

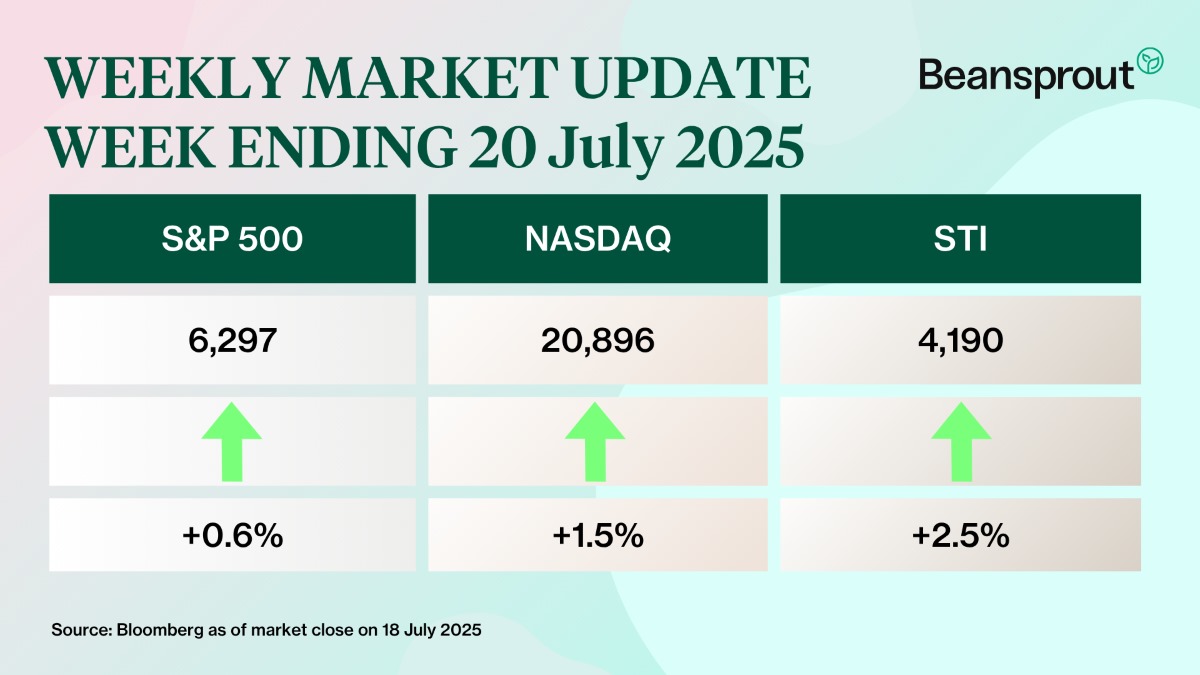

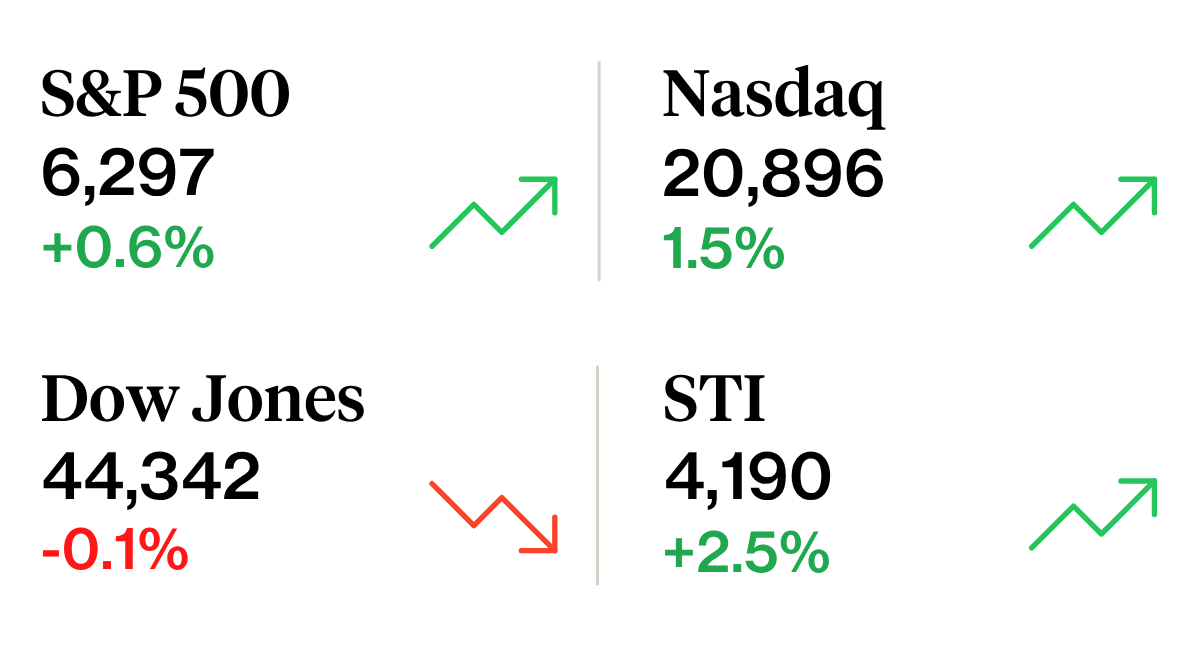

The S&P 500 and Nasdaq closed at record highs during the week, supported by strong corporate earnings and encouraging economic data.

In Singapore, the Straits Times Index (STI) extended its rally for a fourth straight week, driven by gains in Seatrium, which jumped 12.5%.

Read our interview with Seatrium’s CEO to understand how he is driving the company’s transformation to a global engineering brand.

🚗 Moving This Week

- City Developments rose more than 6 per cent on Wednesday (Jul 16), after the company said that Philip Yeo will retire from his position as a non-independent non-executive director on Jul 31. He had backed executive chairman Kwek Leng Beng in his boardroom battle against his son, chief executive officer Sherman Kwek earlier this year. Read more here.

- Wilmar will acquire a 20% stake in a unit of India’s Adani Enterprises for 108.74 billion rupees ($1.62 billion). Wilmar says that the acquisition will be funded from internal sources as well as bank borrowings. Read more here.

- ST Engineering is selling its stake in its broadband joint venture SPTel to Seraya Partners. The sale will result in a one-off gain of around $80 million based on its carrying value for SPTel of around $65 million. Read more here.

- Singapore Airlines (SIA) achieved a passenger load factor of 87.7% for June 2025, up 0.6 percentage points from 87.1% in June 2024. SIA Group attributes the increase to the start of the summer travel season and the mid-year school holidays in Singapore. Read more here.

- Frasers Logistics & Commercial Trust (FLCT) is selling 357 Collins Street in Melbourne for A$195.3 million, or $164.1 million. The selling price is a 0.6% premium to the property's June 1 independent valuation of A$191 million. FLCT estimates it will book net proceeds of $159.3 million. Read more here.

- Frasers Hospitality Trust has received approval-in-principle from the Singapore Exchange to delist, once the privatisation scheme becomes effective and binding. Read more here.

- Centurion Corp has entered into agreements for the proposed listing of its new real estate investment trust (Reit) – named Centurion Accommodation Reit – which is slated for the mainboard of the SGX. The Reit will cover income-generating assets in the purpose-built worker accommodation (PBWA), purpose-built student accommodation (PBSA), and other long-stay lodging segments globally, excluding Malaysia.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Where to park your cash for higher yield? T-bills vs Fixed Deposit vs SSB (July 2025)

We share the best ways to earn a yield on your cash through fixed deposits, Singapore T-bills, SSBs and money market funds.

🤓 What we're looking out for next week

- Monday, 21 July: CSOP iEdge S-REIT Leaders Index ETF ex-dividend

- Wednesday, 23 July: Digital Core REIT, Mapletree Logistics Trust, OUE REIT, Alphabet, and Tesla earnings

- Thursday, 24 July: Frasers Centrepoint Trust, Suntec REIT earnings, Singapore 1-Year T-bill Auction

- Friday, 25 July: Keppel DC REIT earnings

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments