Stocks fall as AI concerns rise: Weekly Market Recap

By Gerald Wong, CFA • 23 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Stocks fell this week as rising AI concerns weighed on market sentiment

Like many investors, I was watching Nvidia’s earnings this week.

But what really caught my attention was a comment from CEO Jensen Huang who reportedly said that if Nvidia had missed by “just a hair”, it would have felt like the whole world fell apart.

Thankfully, Nvidia delivered another strong set of results, and the world did not crumble.

Although judging by the market swings lately, some days it feels like it is wobbling a little. Volatility has returned, and concerns about an AI bubble are growing.

To help make sense of it, we spoke to a seasoned financial professional to find out how we can better cope with market volatility in our latest podcast. Here's what she shared:

- Focus on risk-adjusted returns, not just headline performance and yields

- Watch out for loss aversion so emotions do not guide decisions

It’s a helpful reminder that the best way to handle volatility is to stay diversified across asset classes and markets.

If you prefer safer options, we break down whether the latest SSB which offers a 10-year average return of 1.85% is worth applying for. This comes as the 6-month T-bill yield stays below 1.4% and banks continue cutting fixed deposit rates.

If you are looking for income, we also highlight three Singapore blue chips paying special dividends, and share whether DBS can continue to outperform UOB and OCBC with a dividend yield of 5.6%.

Amid the renewed volatility, I remind myself that markets will always rise and fall. What matters most is having a long-term plan and staying committed to it.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

☁️ AI worries

What happened?

Investor worries are growing over whether artificial intelligence (AI) investments will deliver profits that justify the massive spending behind them.

While much of the past AI spending was supported by strong cash flow, some companies are now spending more than their entire operating cash flow on data centre expansion.

At the same time, AI capital expenditure guidance continues to rise, with more firms turning to debt to finance this wave of investment.

What does this mean?

The overhang of concerns around AI overinvestment, heavy debt issuance, and stretched valuations has added renewed pressure on the stock market.

This came even as Nvidia delivered stronger-than-expected earnings, supported by robust demand for its AI chips.

The company also issued a healthy fourth-quarter revenue forecast that exceeded market expectations, although it was not enough to fully ease investor worries.

Why should I care?

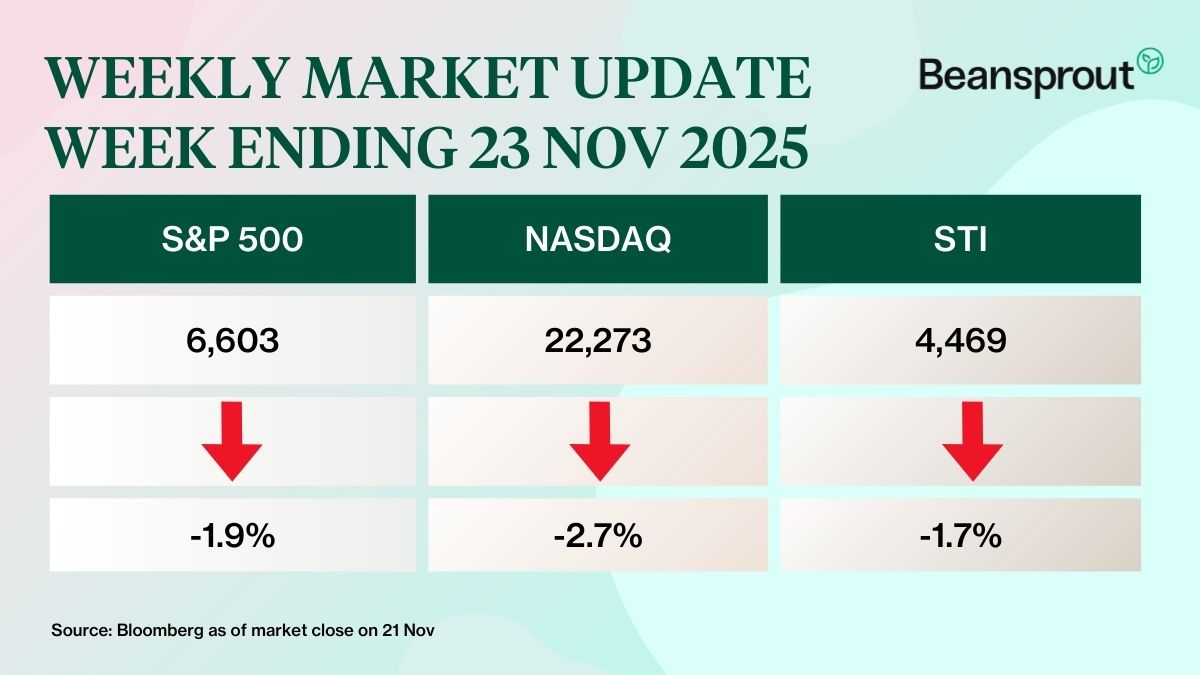

U.S. stocks ended the week lower, with the S&P 500 falling below its 50-day Simple Moving Average (SMA).

The pullback was led by tech names, particularly AI-related stocks and meme stocks, which saw the sharpest declines.

Singapore equities also slipped with weaker sentiment, although the Straits Times Index (STI) declined by a smaller extent compared to the S&P 500.

Losses were cushioned after the Ministry of Trade and Industry (MTI) raised Singapore’s economic growth forecast for 2025, and the Monetary Authority of Singapore (MAS) introduced additional measures to further revitalise the local market.

🚗 Moving This Week

- Singapore Airlines' (SIA) group passenger traffic grew 5.3% year on year in October, outpacing a 3.7% increase in passenger capacity. The two airlines carried around 3.6 million passengers in total, an 8.3% increase from a year ago. SIA’s passenger numbers rose 4.9% to about 2.4 million, while Scoot saw a 15.4% jump to 1.2 million passengers. Read more here.

- City Developments (CDL) reported a 48.7% decline in Q3 Singapore property sales value, weighed down by the absence of new launches. The group also revealed that it is in advanced discussions to sell Quayside Isle at Sentosa Cove. Read more here.

- Yangzijiang Shipbuilding announced that it has secured approximately US$2.2 billion in new orders so far this year, about 20% of the US$11.6 billion it won over the same period last year. Read more here.

- Hongkong Land reported that its Q3 FY2025 underlying profit fell 13% from a year earlier, mainly due to weaker contributions from its Hong Kong office portfolio and pre-opening costs for its prime projects in China. The group said its full-year outlook remains unchanged, with earnings expected to come in lower than the previous year. Read more here.

- ComfortDelGro announced a series of senior leadership changes, including the creation of a new group chief point-to-point mobility officer role. Derek Koh will step down as CFO in the new year and retire at the end of March, relinquishing his deputy CEO and chief corporate services roles. Christopher David White, currently group deputy CFO and head of investor relations, will take over as CFO. Liam Griffin, CEO of Addison Lee and head of point-to-point mobility in the UK, will assume the newly created mobility role. Read more here.

- Manulife US REIT (BTOU) has secured a 24-month lease renewal with its fifth-largest tenant, the US Treasury, covering about 120,000 sq ft of office space in Washington, DC. The government agency has been a key anchor tenant at the property since 2011 and accounted for 5.3% of Must’s total gross rental income as of Sep 30, according to the Reit. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

DBS offers a 5.6% dividend yield. Still a better buy than UOB and OCBC?

DBS' share price has continued to outperform UOB and OCBC after Singapore banks reported their 3Q25 results. We find out if DBS is still a better buy than UOB and OCBC.

🤓 What we're looking out for next week

- Tuesday 25 Nov 2025: Alibaba earnings

- Wednesday, 26 Nov 2025: CMC Invest x Beansprout Event: Build a Dividend Portfolio: Strategic Opportunities in the Singapore Market

- Thursday, 27 Nov 2025: The Edge Year End Investment Forum, US market closed

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments