DBS offers a 5.6% dividend yield. Still a better buy than UOB and OCBC?

Stocks

By Gerald Wong, CFA • 22 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

DBS' share price has continued to outperform UOB and OCBC after Singapore banks reported their 3Q25 results. With a dividend yield of 5.6%, we find out if DBS is still a better buy than UOB and OCBC.

What happened?

DBS’ strong share price performance has caught the attention of many investors.

Recently, I shared that DBS is one of the blue chip stocks in Singapore which recently reached an all-time high, while continuing to offer a dividend yield of above 5.0%.

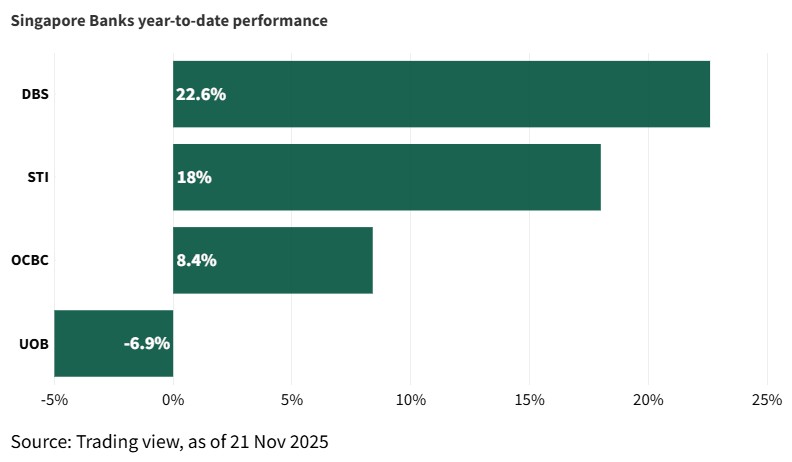

Its strong performance year-to-date gain of 23% has pushed DBS' market value above S$150 billion, reinforcing its position as the largest company listed on the SGX.

In contrast, UOB and OCBC's share prices have seen a very different trajectory. UOB’s share price has remained weak, down 6.9% year-to-date, while OCBC had started to narrow its gap with STI and DBS following the release of its 3Q25 results.

With DBS maintaining its lead and OCBC showing signs of turning the corner, I have seen questions in the Beansprout community if DBS still stands out fundamentally, or whether UOB and OCBC might now offer better value after their weaker share-price performance year-to-date.

To help you understand of the latest trends, I take a closer look at their financial metrics from 3Q25 results to understand how DBS compares to UOB and OCBC.

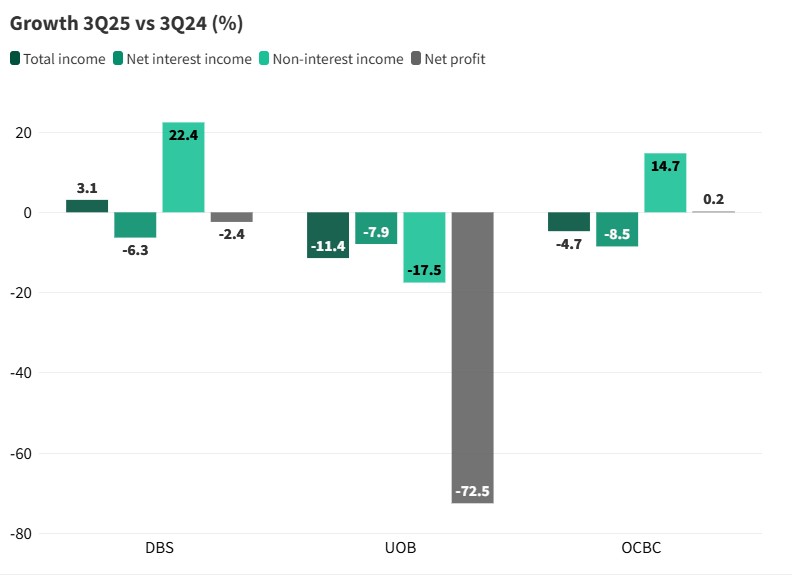

DBS and OCBC net profit was little changed, while UOB reported YoY decline

DBS reported 3Q25 net profit which was down 2.4% year-on-year (YoY), totalling S$2.95 billion, due to the impact of global minimum tax.

Net interest income was down 1.1% YoY, largely from the impact of lower Sora and Hibor, though was partially offset by balance sheet hedging and strong deposit growth.

Net fee income grew 22% YoY to a record SGD 1.36 billion. The increase was across the board and led by wealth management fees, which rose 31% YoY to SGD 796 million from growth in investment products and bancassurance.

UOB reported 3Q25 net profit of S$443 million, down 72.5% YoY, as the Group took proactive steps to build up pre-emptive general allowances to strengthen provision coverage amid ongoing macroeconomic uncertainties and sector-specific headwinds.

Net interest income fell 8% YoY to S$2.3 billion as margins continued to come under pressure in the lower-rate environment.

Net fee income also softened slightly, easing 2% to S$615 million. Although loan-related fees, wealth management and card spending continued to grow well, this was offset by higher card rewards expenses during the quarter.

Other non-interest income saw a sharper pullback, dropping 30% to S$518 million, mainly because trading and investment income came off the exceptionally strong levels recorded a year ago.

OCBC net profit of S$1.98 billion in 3Q25 was unchanged compared to the previous year, supported by higher non-interest income and lower allowances.

Net interest income came in at S$2.23 billion, down 9% from a year ago, as the bank’s net interest margin contracted by 34 basis points to 1.84% in a softer interest-rate environment.

This decline was partly cushioned by healthy 9% YoY growth in average assets. On the other hand, non-interest income provided a strong boost, rising 15% YoY to S$1.57 billion on the back of broad-based improvements across fees, trading and insurance income.

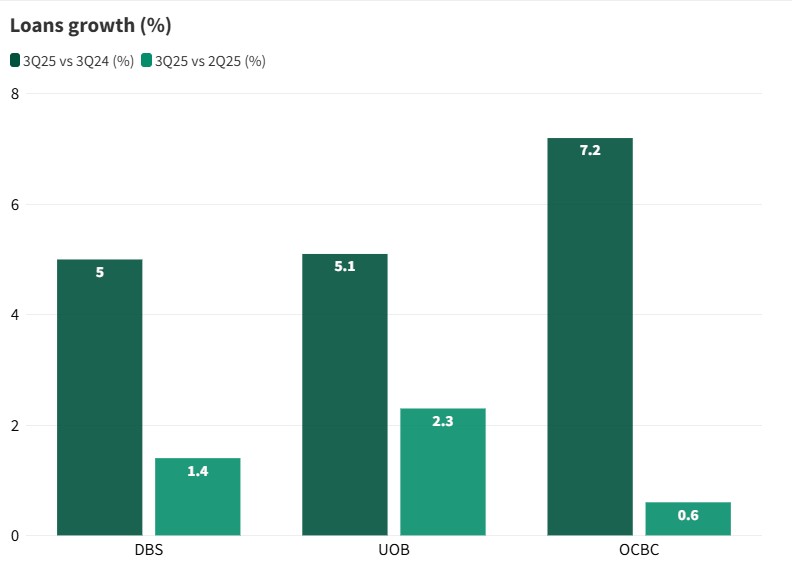

All three banks reported 5-7% loan growth YoY in 3Q25

Loan growth across the Singapore banks remained positive in 3Q25.

UOB and OCBC continued to lead, while DBS grew at a more modest pace.

UOB continued to see healthy demand from corporates and regional clients, helping it deliver a year-on-year loan growth of 5.1%.

On a year-on-year basis, OCBC remained the standout performer with a 7.2% expansion in its loan book — the fastest among the three banks. Strength came from Singapore mortgages and corporate lending across ASEAN markets.

DBS, meanwhile, delivered more moderate growth. Loans were up 5% year-on-year, supported by steady demand in non-trade corporate lending, including sectors such as TMT, data centres, logistics and private assets.

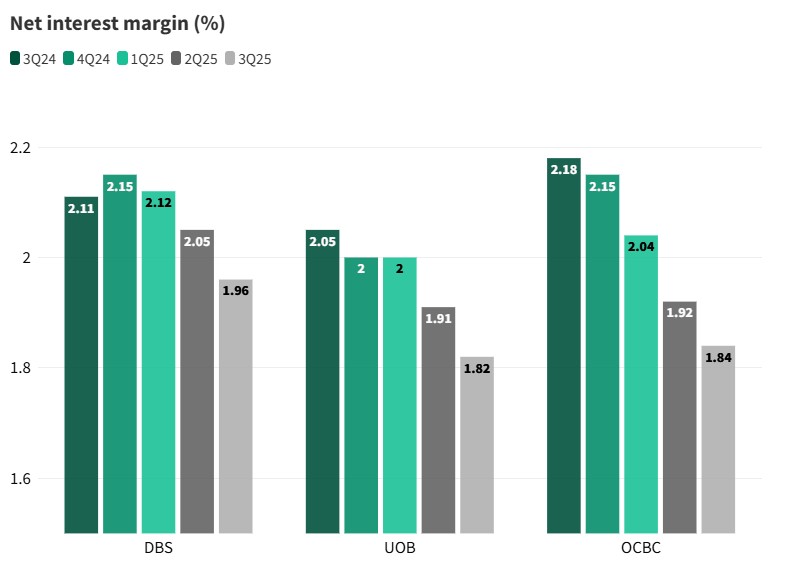

DBS saw more modest QoQ decline in net interest income compared to UOB and OCBC

Net interest income (NII) remained under pressure for all three banks in 3Q25, as the softening interest rate environment continued to weigh on margins.

DBS saw a modest decline in net interest income, falling 1.1% year-on-year, as its net interest margin slipped to 1.96%, down from above 2.20% in 3Q24.

While the margin contraction reflects broad-based rate cuts across Singapore and Hong Kong, DBS remained the least affected among the three banks.

Its large CASA base and strong deposit franchise helped cushion the pressure on funding costs, which allowed its NIM to hold up better relative to peers.

UOB experienced a sharper fall in NII, with net interest income down 7.9% year-on-year.

Its NIM declined to 1.82%, one of the steepest YoY drops in the sector, reflecting softer loan yields across the region and the earlier repricing of fixed deposits at higher rates.

The combination of lower margins and slower loan growth contributed to the weakness in interest income compared to 3Q24.

OCBC also saw a sizeable decline, with net interest income falling 8.5% year-on-year.

Its NIM fell to 1.84%, down from 2.18% a year ago, driven by lower asset yields in Singapore and Hong Kong.

Despite this, OCBC has managed to offset part of the decline through stronger non-interest income, which helped stabilise overall earnings for the quarter.

NIM compression remains the biggest earnings headwind for Singapore banks in 2025.

DBS and OCBC reported strong YoY growth in non-interest income

DBS delivered the strongest improvement, with non-interest income rising 22.4% year-on-year. The increase was broad-based, driven by significantly higher wealth management fees and stronger customer activity across investment products and bancassurance. The pickup in market volumes also supported treasury and trading income. This strong growth helped DBS offset the decline in net interest income from lower margins.

OCBC also reported solid year-on-year growth, with non-interest income rising 14.7%. The improvement came from fee income — including wealth and loan-related fees — as well as a recovery in insurance income after a softer performance last year. OCBC’s more diversified business mix again proved helpful, providing earnings stability even as NIMs fell sharply from a year ago.

In contrast, UOB saw non-interest income fall 17.5% year-on-year, reflecting weaker trading and investment income compared to the unusually strong levels in 3Q24. Fee income growth in areas such as cards and wealth was positive, but not enough to offset the declines in market-related income streams. This was a key reason why UOB reported the steepest YoY drop in net profit among the three banks.

Across the three banks, net interest income continued to make up a smaller share of total income in 3Q25, as margin compression weighed on NII and fee-related activities took on a more important role. Based on the latest quarter, NII accounted for between 58% and 67% of total income across DBS, UOB and OCBC.

At the same time, fee income is becoming an increasingly meaningful contributor, supported by rising customer activity and continued growth in wealth management.

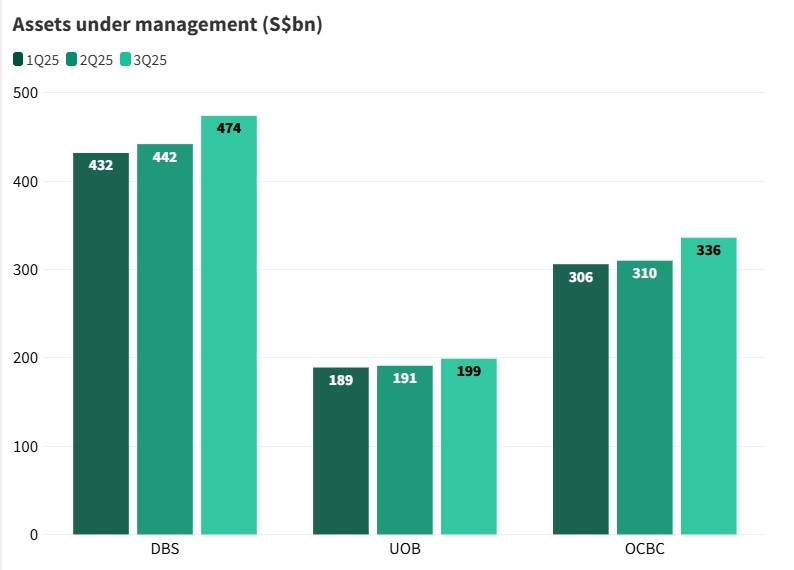

This trend is reinforced by the steady expansion in assets under management (AUM) across all three banks in 3Q25.

In terms of AUM growth, DBS once again led the sector, with AUM rising to S$474 billion in 3Q25, up from S$442 billion in 2Q25.

OCBC also reported solid growth, with AUM increasing to S$336 billion, reflecting stronger inflows into its wealth platform.

UOB saw a more modest increase, with AUM rising to S$199 billion.

The sustained rise in AUM — particularly at DBS and OCBC — suggests that fee income will continue to take a bigger share of total income over time, helping the banks reduce reliance on net interest margins in a lower-rate environment.

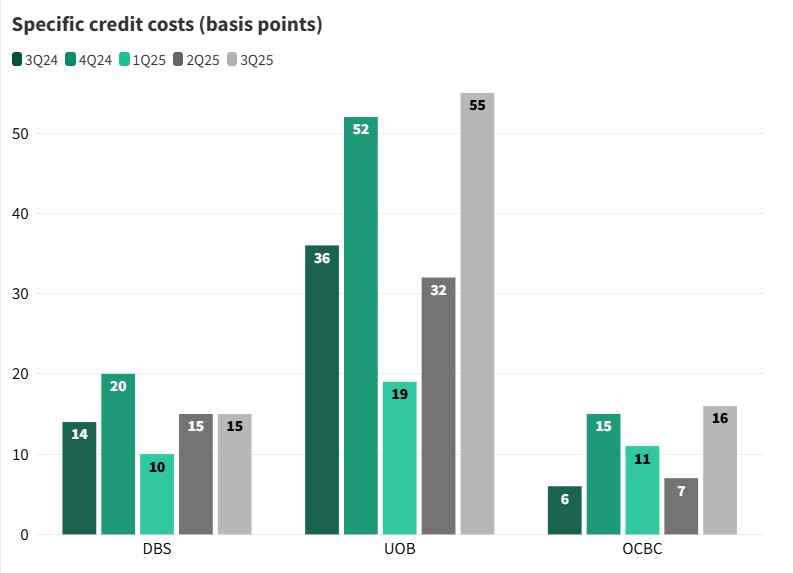

UOB saw an increase in credit costs

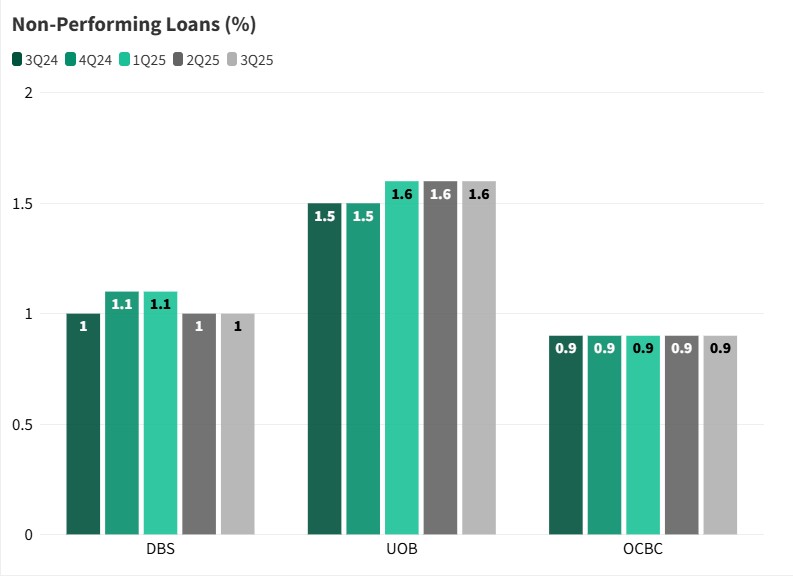

Asset quality across the three banks remained healthy in 3Q25, with non-performing loan (NPL) ratios staying stable and showing no signs of broad-based deterioration.

DBS maintained its disciplined credit stance, reporting specific credit costs of 15 basis points, unchanged from a year ago.

OCBC kept credit costs low, with specific credit costs rising modestly to 16 basis points compared to last year. The bank’s NPL ratio held steady at 0.9%, the lowest among the three.

UOB’s credit costs were significantly higher this quarter, mainly because the bank set aside an additional S$615 million in general allowances on a pre-emptive basis.

This large buffer was taken to strengthen the balance sheet against potential risks, including exposures to the real estate sector.

As a result, UOB’s specific credit costs rose to 55 basis points, making it the highest among the three banks this quarter.

The bank noted, however, that outside of this one-off provision, underlying asset quality remains stable and that total credit costs are expected to normalise following this exercise.

Dividends remain healthy

DBS proposed a S$0.15 Capital Return dividend and S$0.60 ordinary dividend for 3Q25, bringing 9M2025 dividend per share to S$2.25. 'Capital Return' dividend is set at 15 cents per share quarterly for the duration of 2025.

In the subsequent two years, it expects to pay out a similar amount of capital either through this or other mechanisms, barring unforeseen circumstances.

As UOB and OCBC announced dividends on a semi-annual basis, there were no announced dividends in 3Q25.

UOB declared S$0.85 in ordinary dividend in 1H2025, a decline from S$0.88 in 1H2024. Together with a previously announced special dividend S$0.25, this would bring total dividend per share in 1H2025 to S$1.10.

UOB also highlighted that despite the sizeable pre-emptive general allowance this quarter, its final dividend payment for 2025 will not be affected, as the additional provisions were taken to strengthen the balance sheet rather than signal any deterioration in underlying asset quality.

OCBC proposed S$0.41 ordinary dividend per share for 1H25, representing a payout ratio of 50%. This would represent a decline from the S$0.44 ordinary dividend per share for 1H24.

Despite the macro uncertainty, the banks remain committed to return excess capital via their announced share buyback programmes and capital return plans.

OCBC guides for 2025, while DBS and UOB look ahead to 2026

OCBC reaffirmed dividend payout ratio in 2025

OCBC remains cautiously optimistic heading into 2025.

Management expects net interest income to be lower by mid- to high-single digits, with NIM settling around 1.90% as rate cuts flow through.

This will be balanced by mid-single-digit loan growth, supported by regional trade flows and a resilient domestic mortgage book. Despite the softer NIM outlook, OCBC plans to keep its cost-income ratio in the low-40% range, while maintaining credit costs around 20 bps, signalling confidence in asset quality.

Fee income, especially from wealth management, is expected to continue gaining importance given OCBC’s strong AUM growth.

OCBC also reaffirmed a 60% total dividend payout ratio, alongside ongoing share buybacks, giving investors clarity on capital return for 2025.

DBS expects total income in 2026 to be broadly similar to 2025

Looking ahead to 2026, DBS expects total income in 2026 to be broadly similar to 2025, even though net interest income is projected to be slightly lower.

The impact from lower rates and a stronger SGD is expected to be cushioned by deposit growth and mid-teens wealth management expansion.

Non-interest income will be a key driver, with the commercial book expected to deliver high single-digit growth.

Cost discipline remains a priority, with the cost-income ratio staying in the low-40% range.

Specific provisions are assumed to normalise to 17–20 bps, and DBS reiterated that it has not seen signs of asset stress so far. Overall, DBS expects net profit in 2026 to be slightly below 2025, but sees resilience from its diversified fee engines.

UOB does not expect additional general provisions to affect its 2025 final dividend

UOB is entering 2026 after a year of proactive provisioning and capital strengthening.

Management emphasised that the additional general allowances taken in 2025 were pre-emptive rather than reactive, aimed at improving resilience and flexibility.

For 2026, UOB expects low single-digit loan growth, while NIM is projected to average 1.75% to 1.80%, reflecting a normalised rate environment.

Fee income is expected to be a strong contributor, with high single-digit to double-digit growth, led by cards and wealth management.

Operating costs will be kept in check with low single-digit growth, and total credit costs are projected at 25–30 bps — significantly lower than the elevated levels seen in 2025.

UOB also reiterated that the additional general provisions will not affect its 2025 final dividend, signalling confidence in capital strength.

What would Beansprout do?

DBS has continued to pull ahead in 2025, with its share price up 22.6% year-to-date. This would make DBS still the strongest performer among the three Singapore banks.

OCBC, on the other hand, has started to gain traction after its 3Q25 results, narrowing the performance gap with DBS and the STI.

Meanwhile, UOB’s share price remains weak this year as the market digests the large pre-emptive allowances booked in the quarter, even though underlying asset quality remains stable.

Looking at the fundamentals, DBS and OCBC both showed stronger YoY earnings resilience in 3Q25, supported by solid fee income growth and rising assets under management.

DBS, in particular, delivered record wealth-management fees, which helped offset the impact of margin compression. OCBC also benefitted from stronger non-interest income and healthier loan growth.

With the strong performance in the share price of DBS, it is now trading at a price-to-book ratio of 2.3x, after the price-to-book ratio of 1.2x for UOB and price-to-book ratio of 1.4x for OCBC.

The price-to-book valuations for all three Singapore banks are currently above their historical averages.

For income-seeking investors, DBS has been more generous in its dividend payout compared to OCBC and UOB.

Its quarterly dividend now stands at 60 cents, topped up by a 15-cent “Capital Return” dividend, bringing 9M25 payouts to S$2.25 per share.

If we include DBS’ capital return dividends, then DBS' dividend yield would be at 5.6%, based on its share price of $53.67 as of 21 November.

For OCBC, assuming a 60% payout ratio on consensus earnings forecast for 2025, it is expected to offer a total dividend of S$0.98 in 2025. This represents a dividend yield of 5.4% for OCBC, based on its share price of S$18.07 as of 21 November.

On the other hand, UOB is expected to offer a dividend yield of 5.0%, based on consensus forecasts and its share price of S$33.85 as of 21 November.

Despite the more elevated price-to-book valuation of DBS, its higher dividend yield may continue to make DBS more attractive compared to UOB and OCBC for income-seeking investors.

💰 [Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher, S$18 cash voucher, plus 12% p.a. interest boost on S$2,000 with Longbridge Cash Plus for 90 days (worth up to S$60) when you sign up for a Longbridge account via Beansprout and fund S$2,000. T&Cs apply. Learn more about the Longbridge promotion here.

Related links:

- DBS share price and share price target

- DBS dividend history and forecast

- OCBC share price and share price target

- OCBC dividend history and forecast

- UOB share price and share price target

- UOB dividend history and forecast

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in DBS, UOB and OCBC.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments