Singapore Next 50 Indices - Explore opportunities beyond blue chips

Stocks

By Gerald Wong, CFA • 12 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

SGX has launched the iEdge Singapore Next 50 Indices that track the next tier of large and liquid mainboard companies beyond the 30 constituents of the Straits Times Index (STI).

What happened?

Singapore stocks have performed exceptionally well in 2025.

As of 12 January 2026, Singapore’s benchmark Straits Times Index (STI) has gone up by around 24% over the past one year.

We previously recapped the top 3 blue-chip stocks as well as 3 top-performing Singapore blue-chip REITs in 2025.

We have then also looked into the mid-cap space and highlighted 5 best performing Singapore Next 50 stocks that saw more gains compared to blue chips in 2025.

The increased visibility may potentially be driven by the launch of iEdge Singapore Next 50 Index last year which was aimed to track listed companies that are not constituents of the Straits Times Index (STI).

This follows the announcement of the S$5 billion Equity Market Development Programme (EQDP), where MAS will invest with selected fund managers with a strong focus on Singapore stocks, investing in a range of companies and not just index component stocks.

Let us find out more about the newly launched iEdge Singapore Next 50 Index, including its key constituents, and how you can gain exposure to the index.

What are the iEdge Singapore Next 50 indices?

The iEdge Singapore Next 50 indices were created to give investors a clearer view of opportunities beyond Singapore’s 30 largest listed companies, which make up the Straits Times Index (STI).

They track the performance of the next tier of large and liquid companies on the SGX Mainboard, essentially the “next in line” after the blue chips. There are two versions of the index:

- iEdge Singapore Next 50 Index

- iEdge Singapore Next 50 Liquidity Weighted Index

Both aim to highlight this broader market segment and provide visibility into companies that might one day grow into the STI.

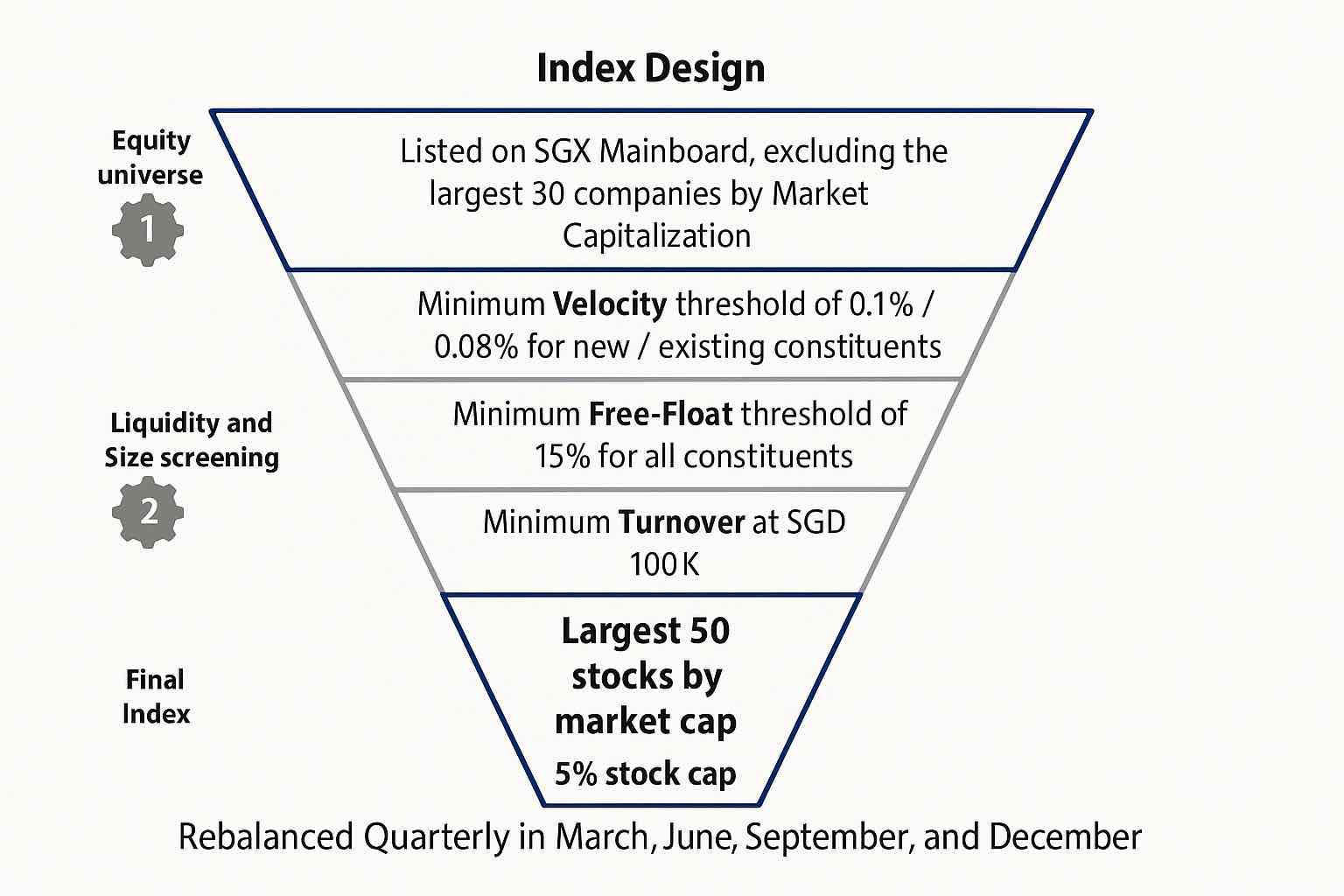

To be included, companies must meet several requirements:

- Listed on the SGX Mainboard (excluding the largest 30 companies by market cap)

- Minimum market cap of SGD 100 million

- Minimum trading turnover of SGD 100,000

- At least 15% free float

- Meet minimum trading velocity thresholds

From this screened universe, the largest 50 stocks by market cap are selected, with a cap of 5% per stock.

The indices are rebalanced quarterly in March, June, September, and December.

Following its December 2025 quarterly rebalancing, which took effect at the market open on 22 December 2025, the index saw several changes to its composition.

| Addition/Inclusions | Removal/Exclusions |

| Golden Agri-Resources Ltd | Nanofilm Technologies International Ltd |

| Yangzijiang Maritime Development Ltd | Samudera Shipping Line Ltd |

| Centurion Accommodation REIT | Aztech Global Ltd |

The next rebalancing is scheduled for March 2026.

Which stocks are in the iEdge Singapore Next 50 indices?

There are 50 stocks in the iEdge Singapore Next 50 indices.

Each constituent is subject to a 5% weighting cap at rebalancing.

However, due to strong price performance between rebalancing periods, several top holdings may drift above this threshold.

As of 31 December 2025, the stocks with the largest weighting on the iEdge Singapore Next 50 index are Keppel Infrastructure Trust, Suntec REIT, ComfortDelgro, CapitaLand Ascott Trust, NetLink Trust, Keppel REIT.

The stocks with the largest weighting on the iEdge Singapore Next 50 Liquidity Weighted index are ComfortDelgro at 5.1% and iFast at 5.3% weight respectively. Other leading constituents, including Suntec REIT (4.5%), Yangzijiang Maritime Development (4.5%), and UMS Integration Ltd (4.5%), remain positioned near this maximum weighting.

| Name | Sector | Next 50 Weight | Next 50 Liquidity Weights |

|---|---|---|---|

| Keppel REIT | REITs | 5.6% | 4.4% |

| Suntec REIT | REITs | 5.2% | 4.5% |

| ComfortDelgro | Industrials | 5.1% | 5.1% |

| CapitaLand Ascott Trust | REITs | 5.0% | 3.5% |

| NetLink NBN Trust | Telecommunications | 4.9% | 2.9% |

| Keppel Infrastructure Trust | Non-Energy Materials | 4.4% | 1.6% |

| Golden Agri-Resources Ltd | Consumer cyclicals | 3.9% | 1.2% |

| Parkway Life REIT | REITs | 3.8% | 2.4% |

| Sheng Siong | Consumer Non-Cyclicals | 3.7% | 3.1% |

| CapitaLand India Trust | REITs | 3.5% | 1.6% |

| iFAST Corporation | Financials | 3.4% | 5.3% |

| ESR-REIT | REITs | 3.3% | 1.7% |

| Lendlease REIT | REITs | 2.9% | 2.7% |

| Yangzijiang Maritime Development Ltd | Financials | 2.7% | 4.5% |

| Centurion Accommodation REIT | REITs | 2.2% | 3.9% |

| NTT DC REIT | REITs | 2.1% | 3.7% |

| AIMS APAC REIT | REITs | 2.1% | 1.2% |

| Yangzijiang Financial | Financials | 1.9% | 4.2% |

| Singapore Post | Industrials | 1.9% | 2.4% |

| SIA Engineering | Industrials | 1.9% | 2.0% |

| First Resources | Non-Energy Materials | 1.9% | 2.0% |

| CapitaLand China Trust | REITs | 1.9% | 1.1% |

| Starhill Global REIT | REITs | 1.8% | 0.5% |

| Raffles Medical Group | Healthcare | 1.7% | 0.9% |

| UMS Integration | Technology | 1.7% | 4.5% |

| Olam Group | Consumer Non-Cyclicals | 1.6% | 1.2% |

| Starhub | Telecommunications | 1.4% | 0.7% |

| CDL Hospitality Trust | REITs | 1.4% | 0.8% |

| UOB-Kay Hian | Financials | 1.4% | 1.1% |

| CSE Global | Energy | 1.2% | 2.7% |

| Digital Core REIT | REITs | 1.2% | 1.0% |

| Far East Hospitality Trust | REITs | 1.2% | 0.4% |

| Riverstone | Consumer cyclicals | 1.0% | 2.0% |

| Boustead Singapore | Industrials | 1.0% | 0.8% |

| Hong Leong Asia | Industrials | 0.8% | 2.1% |

| Yanlord | Financials | 0.8% | 1.4% |

| Food Empire Holdings | Consumer Non-Cyclicals | 0.9% | 1.2% |

| Frencken Group | Technology | 0.9% | 3.6% |

| Sasseur REIT | REITs | 0.8% | 0.4% |

| China Aviation Oil (Singapore) | Energy | 0.8% | 1.0% |

| PropNex | Financials | 0.6% | 1.5% |

| Centurion | Financials | 0.6% | 1.7% |

| China Sunsine Chemical Holdings | Non-Energy Materials | 0.6% | 0.3% |

| Geo Energy Resources | Energy | 0.6% | 1.7% |

| SBS Transit | Industrials | 0.5% | 0.2% |

| Wee Hur | Financials | 0.5% | 2.2% |

| Pan-United | Non-Energy Materials | 0.5% | 0.4% |

| COSCO Shipping International Singapore | Industrials | 0.4% | 0.2% |

| BRC Asia | Non-Energy Materials | 0.4% | 0.1% |

| Source: SGX as of 31 December 2025 | |||

Which sectors have a more significant weighting in the iEdge Singapore Next 50 indices?

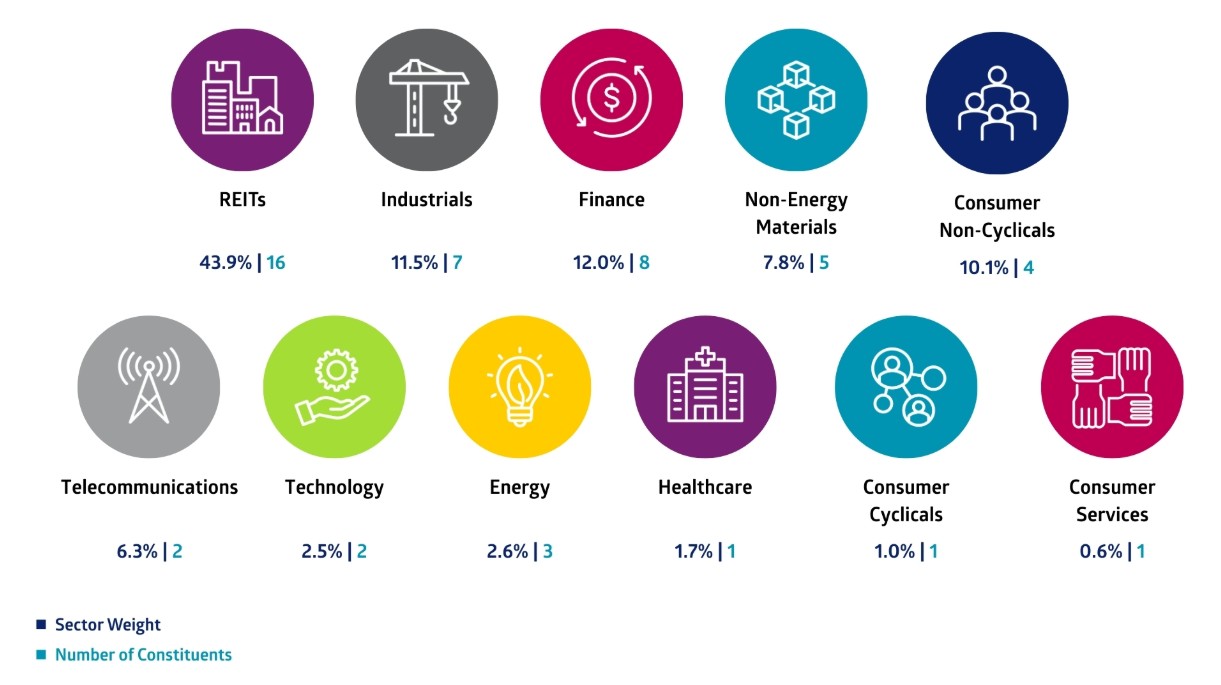

As can be seen from the list above, Singapore REITs make up a significant portion of the iEdge Singapore Next 50 indices.

Of the 50 stocks in the iEdge Singapore Next 50 indices, 16 are Singapore REITs, 7 are industrials and 8 are in the finance sector.

Based on our estimates, Singapore REITs would make up about 46.49% of the total weight of the iEdge Singapore Next 50 index, and 40.43% of the total weight of the iEdge Singapore Next 50 Liquidity index.

This is followed by the Industrials sector, which would make up about 10.69% of the total weight of the iEdge Singapore Next 50 index, and 10.66% of the total weight of the iEdge Singapore Next 50 Liquidity index.

Lastly, the Financials sector would make up about 9.86% of the total weight of the iEdge Singapore Next 50 index, and 6.14% of the total weight of the iEdge Singapore Next 50 Liquidity index.

How has the iEdge Singapore Next 50 Index performed?

As of 31 December 2025, the iEdge Singapore Next 50 index has delivered an average return of 5.76% per year over the past 10 years, falling short of the Straits Times Index (STI), which returned 9.34% per year.

Performance has been even weaker for the iEdge Singapore Next 50 Liquidity Weighted index, which posted a 10-year return of 3.79% per year.

Between 2015 and 2024, the STI outperformed the iEdge Singapore Next 50 indices in 5 out of 10 years.

That said, there have been bright spots. The iEdge Singapore Next 50 indices have at times pulled ahead of the STI.

Most notably, the iEdge Singapore Next 50 indices outperformed the STI by at least 15% in 2019.

In 2025, the iEdge Singapore Next 50 index gained 27.03%, and the Liquidity Weighted index rose 27.42%, both on par with STI’s 28.6% gain.

| Year | iEdge Singapore Next 50 Index (i) | iEdge Singapore Next 50 Liquidity Weighted Index (ii) | Straits Times Index (iii) | Outperformance Vs STI (i)-(iii) | Outperformance Vs STI (ii)-(iii) |

|---|---|---|---|---|---|

| 2015 | -8.5% | -11.1% | -11.2% | 3% | 0% |

| 2016 | 0.5% | -10.2% | 3.8% | -3% | -14% |

| 2017 | 21.6% | 17.6% | 22.1% | -1% | -5% |

| 2018 | -13.3% | -17.1% | -6.4% | -7% | -11% |

| 2019 | 24.1% | 27.7% | 9.4% | 15% | 18% |

| 2020 | -5.0% | -1.6% | -8.1% | 3% | 7% |

| 2021 | 16.7% | 19% | 13.6% | 3% | 5% |

| 2022 | -11.2% | -13.8% | 8.4% | -20% | -22% |

| 2023 | 4.6% | 5.3% | 4.8% | 0% | 1% |

| 2024 | -0.9% | -6.2% | 23.5% | -24% | -30% |

| 2025 | 27.0 | 27.4 | 28.6 | -1.6% | -1.2% |

| 6 Months | 19.2% | 20.7% | 19.8% | -0.6% | 0.9% |

| 3 Year Ann. | 9.8% | 8.2% | 15.4% | -5.6% | -7.2% |

| 5 Year Ann. | 6.7% | 5.4% | 13.3% | -6.7% | -7.9% |

| 10 Year Ann. | 5.8% | 3.8% | 9.3% | -3.6% | -5.6% |

| Source: SGX as of 31 December 2025 | |||||

What is the objective of the iEdge Singapore Next 50 indices?

The iEdge Singapore Next 50 indices were created to broaden the investment universe in Singapore by tracking 50 of the most liquid and sizable companies beyond the Straits Times Index (STI).

Their key objectives are:

- Enhancing market engagement – Provide new benchmarks for investors and fund managers, helping to draw more attention and liquidity to the wider market.

- Spotlighting mid-cap companies – Increase visibility for quality but often overlooked names, which can in turn attract greater institutional and retail interest.

- Broadening investment options – Pave the way for ETFs or funds that make it easier and more cost-effective to gain diversified exposure beyond the STI.

- Revitalising capital markets – Support SGX’s efforts, alongside initiatives like the S$5 billion EQDP, to boost vibrancy and diversify investor interest.

Can you buy the iEdge Singapore Next 50 indices?

At this point, getting exposure to the iEdge Singapore Next 50 index is not as straightforward as many investors might hope.

There isn’t yet a Singapore ETF or mutual fund that tracks the index, which means those keen to mirror its performance would need to buy the individual stocks one by one.

For most retail investors, this can be time-consuming and costly, and may limit how quickly the index attracts meaningful participation.

For the index to reach its full potential, the next step would be for product issuers to roll out investment vehicles such as ETFs that track it directly.

Having such products available would make it much easier, and more cost-effective, for investors to gain diversified exposure to the broader Singapore equity market through a single purchase.

What would Beansprout do?

By expanding the investable universe to 50 mid-cap names, the new indices bring attention to companies that may have been overlooked.

However, these stocks tend to be smaller and less liquid than STI constituents, which means higher volatility and liquidity risks.

If you are keen to gain exposure to the index, it is important to first understand how these indices differ from the Straits Times Index (STI), and whether they suit your investment objectives and risk appetite.

For now, you can’t buy into the iEdge Singapore Next 50 indices directly, as no ETFs or mutual funds track them yet.

If you are looking to gain broad Singapore equity exposure, you can do so through an STI ETF or Singapore mutual fund.

Learn more about the STI ETF and how to choose the best STI ETF for your portfolio.

Check out Beansprout guide to the best stock trading platforms in Singapore with the latest promotions to invest in the STI ETF.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments