Here's what to expect for the T-bill auction on 25 September

Bonds

By Gerald Wong, CFA • 20 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

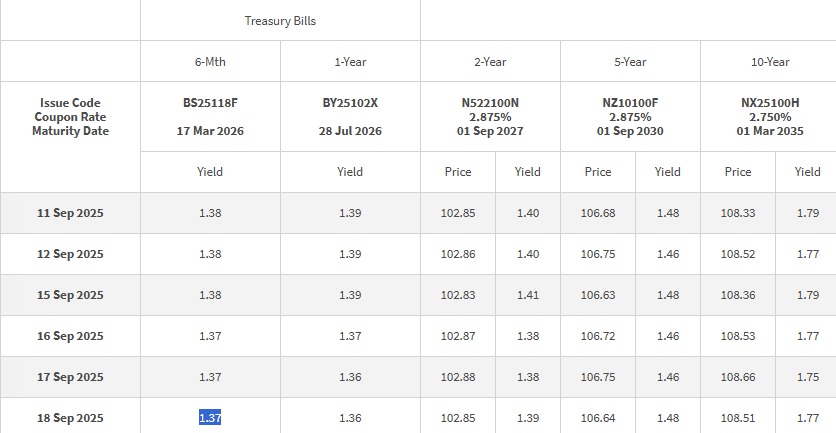

The closing yield on the 6-month Singapore T-bill was at 1.37% on 18 September 2025.

What happened?

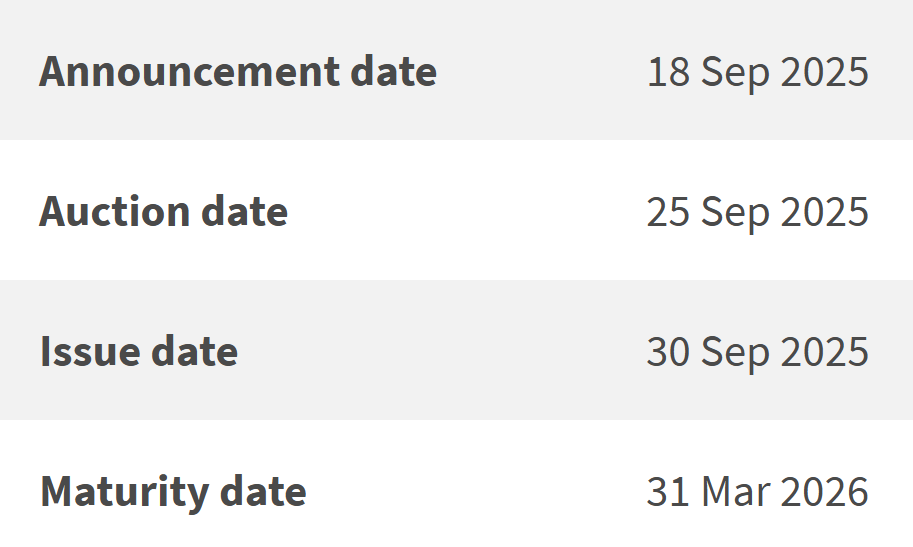

The next 6-month Singapore T-bill auction (BS25119Z) will be on 25 September 2025.

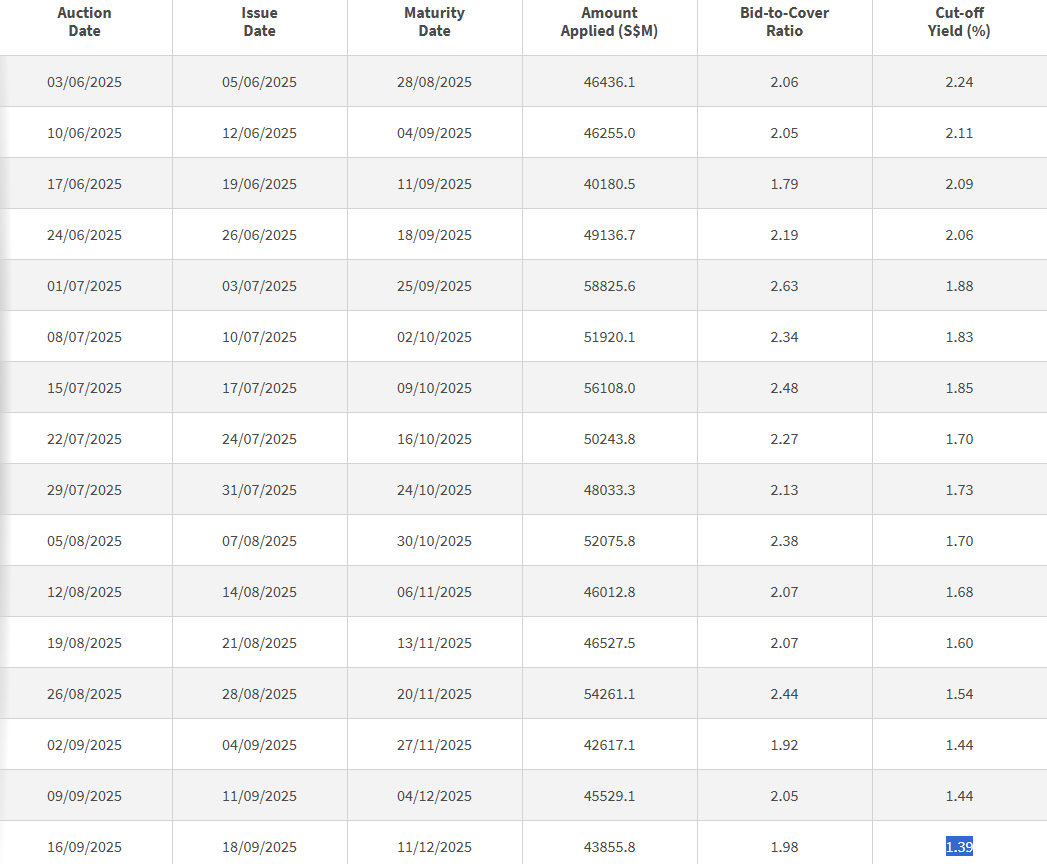

The cut-off yield for the most recent 6-month Singapore T-bill declined even further to 1.38%, the lowest since early 2022. We have also seen fixed deposit rates falling in Singapore.

Many investors have been using Singapore T-bills as a way to generate passive income, so you might be wondering whether it’s worth applying for this latest auction.

In this post, I’ll walk you through some of the latest indicators to help us gauge what the upcoming cut-off yield might be, and if its still be worthwhile applying for the T-bills.

Here's what to expect for the Singapore T-bill auction on 25 September

#1 – US bond yields steepens on both ends

The 10-year US government bond yield has bounced slightly to 4.13% as of 18 September 2025, after dipping to about 4.0% in anticipation of interest rate cuts by the US Federal Reserve.

This week, the US Federal Reserve cut its benchmark interest rate by 0.25% (25 basis points) as expected, while Fed officials projected two further rate cuts in 2025.

Reflecting the rate cut, the 1-year US government bond yield fell further to 3.64% as of 18 September 2025.

#2 – Singapore bond yields have dipped slightly

The 10-year Singapore government bond yield was at 1.77% as of 18 September 2025, representing a further dip from 1.85% as of 06 September 2025.

Yields have fallen and are now close to their lowest levels in recent years, reflecting heightened US rate cut expectations.

The closing yield on the 6-month T-bill was 1.37% on 18 September 2025, which is close to the cut-off yield of 1.38% in the previous T-bill auction on 11 September.

The yield on the 3-month MAS bill can also give an indication of the yields for shorter-maturity Singapore government bonds.

The cut-off yield was at 1.39% in the auction on 16 September 2025, below the yield of 1.44% in the auction on 9 September 2025.

#3 – Issuance size lower than the previous auction

The issuance size of the upcoming 6-month Singapore T-bill is $7.7 billion, below the previous auction size of $7.8 billion.

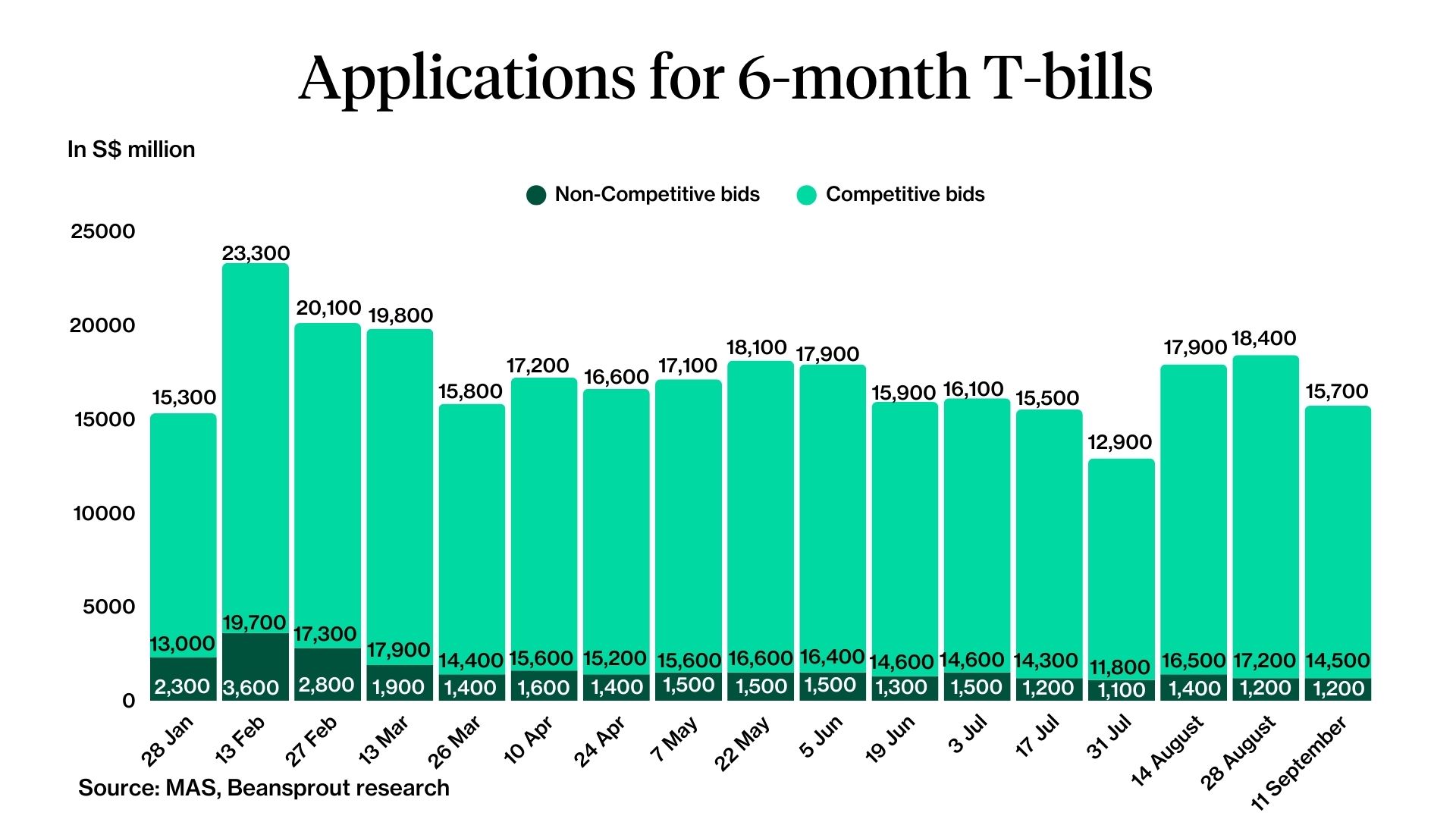

We saw a decrease in the amount of T-bill applications to S$15.7 billion in the auction on 11 September 2025 from S$18.4 billion in the auction on 28 August 2025.

If demand stays unchanged compared to the previous auction, the lower amount of T-bill issued may cause the cut-off yield to remain under pressure in the upcoming auction.

What would Beansprout do?

The closing yield on the 6-month Singapore T-bill was at 1.37% on 18 September 2025, close to the cut-off yield in the previous auction.

The closing yield on the 6-month Singapore T-bill is also close to the best 6-month fixed deposit rate of 1.40% p.a.

One of the ways to secure a potentially higher yield is to consider the Singapore Savings Bonds (SSB), which offers a 1-year return of 1.56% and average annual return of 1.93% over 10 years, while having the flexibility to redeem prior to maturity.

The closing yield on the 6-month Singapore T-bill would also be below the interest rates currently offered by the best savings accounts in Singapore.

You can compare between T-bills and fixed deposits and Singapore Savings Bonds to find the best place to park your cash in September 2025.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

Singapore REITs may also benefit from lower interest rates, and offer a higher dividend yield compared to the T-bill. Learn more about our outlook for Singapore REITs here.

The 6-month Singapore auction will be held on 25 September (Thursday). We would need to put in our cash applications for the T-bills by 9 pm on 24 September (Wednesday).

Applications for the T-bills using CPF-OA will close 1-2 business days before the auction date, and the dates differ across the three local banks.

- Applications for T-bills online using CPF OA via DBS close at 9pm on 24 September (Wed). Read our step-by-step guide to applying via DBS.

- Application for T-bills online using CPF OA via OCBC close at 9pm 24 September (Wed). Read our step-by-step guide to applying via OCBC

- Applications for T-bills online using CPF OA via UOB close at 9pm on 23 September (Tues). Read our step-by-step guide to applying via UOB.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments