3 Singapore blue chip stocks with attractive dividend yields near 5%

Stocks

By Gerald Wong, CFA • 29 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Here’s 3 stocks listed in Singapore with attractive dividend yields to help boost your passive income amidst lower interest rates.

What happened?

Interest rates have been falling in the past few months.

As a result, I see more investors asking about Singapore blue chip stocks and REITs that can offer attractive dividend yields.

Recently, we shared 3 Singapore REITs with dividend yields above 5%,

We also featured blue chip stocks trading near record highs to find out if they offer attractive dividend yields.

However, with the rally we have seen in Singapore stocks, you may be wondering if there are other blue chip stocks and REITs that continue to offer dividend yields of around 5%, and yet are not trading at record highs.

In this article, we will look at three Singapore blue-chip stocks and REITs that offer attractive dividend yields, and consider how they might fit into an income portfolio.

3 Singapore blue chip stocks and REITs with dividend yield around 5%

#1 - United Overseas Bank Ltd (SGX: U11)

United Overseas Bank (UOB) is one of Singapore’s three major local banks, offering retail, corporate, and wealth management services across ASEAN.

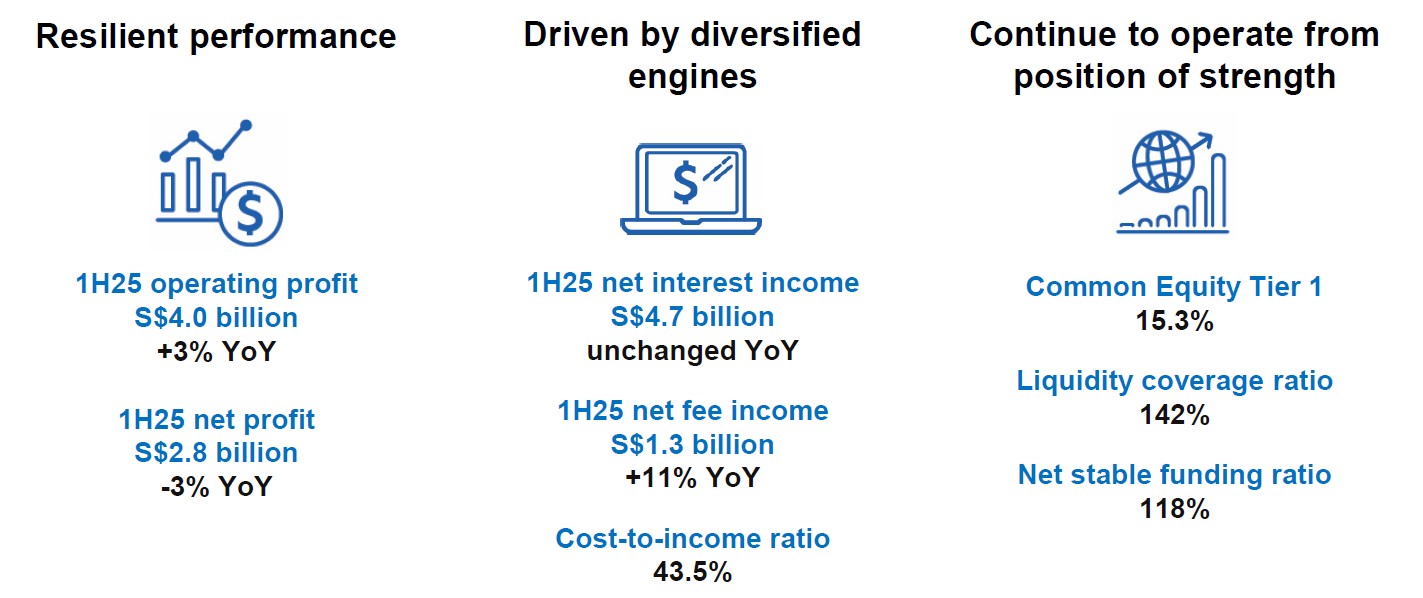

UOB reported a net profit of S$2.8 billion for the first half of 2025, down 3% year-on-year due to pressure on its net interest income.

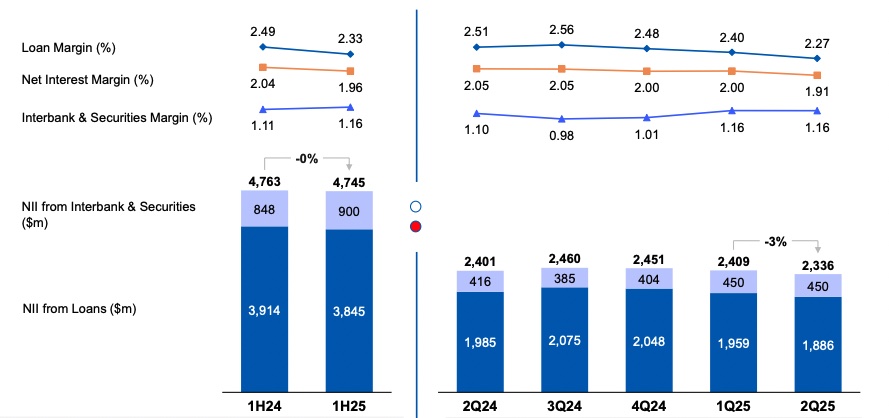

UOB's net interest margin declined to 1.91% in 2Q25 from 2.00% in 1Q25 and 2.05% in 2Q24 with lower interest rates.

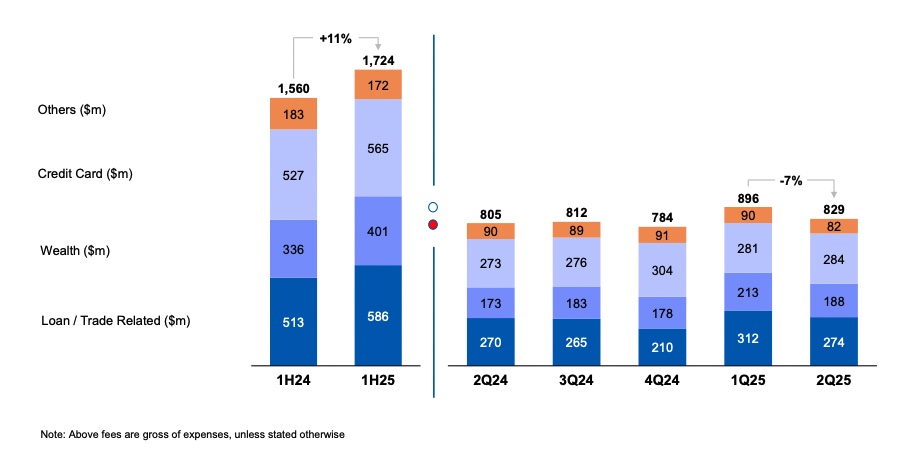

Despite the pressure on its interest income, UOB's overall earnings was supported by higher fee income. This was due to higher contributions from its wealth and card businesses.

Management of UOB expects its full year net interest margin to be around 1.85% to 1.9% in 2025, below the 1H25 margin of 1.96%.

However, earnings may be supported by high single digit fee income growth.

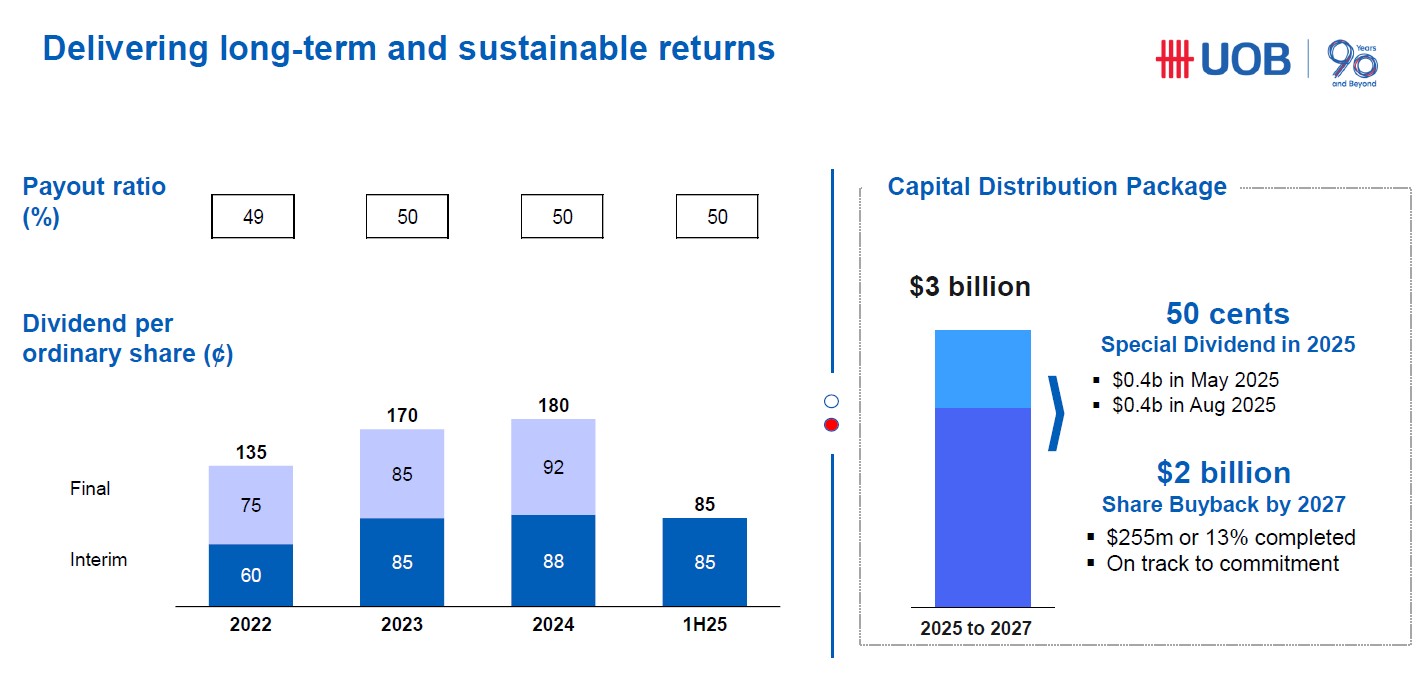

Shareholders had received a 50-cent special dividend over the past year as part of a one-off capital distribution package announced in FY2024.

For FY2025, UOB declared an interim ordinary dividend of 85 cents per share. With an annualised total dividend of S$1.70 per share for FY 2025, UOB offers a dividend yield of 4.9% based on the closing price of S$34.79 on 27 October 2025.

The bank also continued with its S$2 billion share buyback programme, with around 13% completed as of August 2025.

Find out how much dividends you may receive as a shareholder of UOB with the calculator below.

Related links:

- United Overseas Bank Ltd share price and analysis

- United Overseas Bank Ltd dividend history and dividend forecast

#2 - CapitaLand Ascendas REIT (SGX: A17U)

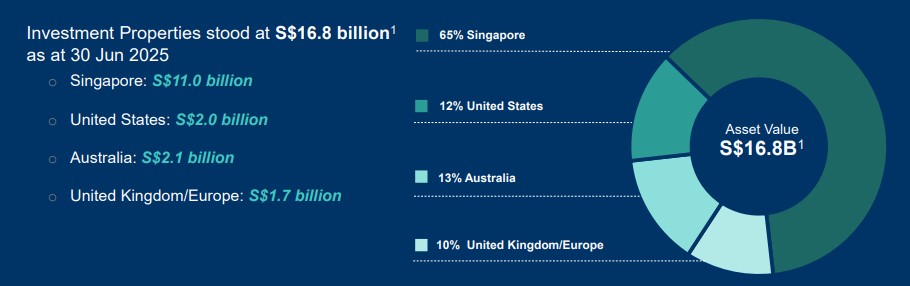

CapitaLand Ascendas REIT (SGX: A17U) is Singapore’s largest diversified industrial REIT, with a portfolio spanning business parks, logistics, high-spec industrial and life science properties.

It remains anchored in Singapore, which contributes the bulk of its income, while also holding assets in Australia, the US, and Europe.

Over the past two years, CapitaLand Ascendas REIT has maintained resilient performance with stable occupancy and consistent distributions despite a challenging rate environment.

CLAR continues to pursue capital recycling by divesting non-core assets and redeploying proceeds into higher-yielding opportunities.

It has divested a number of non-core assets in 1H 2025, realising approximately S$355.5 million in aggregate divestments, and reinvested approximately S$1.178 billion into redevelopment and acquisitions of assets.

Post-1H 2025, they have further announced S$350.1 million worth of acquisitions in the UK under the logistics portfolio.

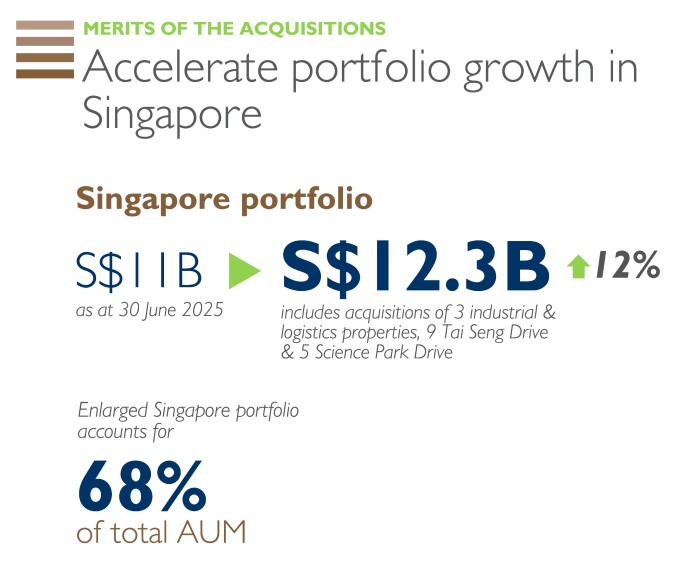

Earlier this month on 7 October 2025, the REIT announced the proposed acquisition of three more Singapore industrial and logistics properties for a total of S$565.8 million.

The properties include 2 Pioneer Sector 1, Tuas Connection, and 9 Kallang Sector, and were acquired at about a 3.9% discount to their latest valuations.

These assets are fully occupied with a weighted average lease expiry (WALE) of around 5.5 years and built-in rental escalations of 1% to 5% per annum.

Upon completion (expected around 1Q 2026), the acquisitions will raise the REIT’s Singapore portfolio to about S$12.3 billion, or 68% of total assets under management.

The manager estimates that the new assets will deliver an initial net property income (NPI) yield of about 6.4% before costs and 6.1% after costs.

The transaction is expected to be accretive to unitholders, improving the REIT’s overall portfolio yield and income resilience.

Operationally, the REIT reported a 1H 2025 distribution per unit (DPU) of 7.477 Singapore cents.

Based on its closing price of S$2.88 as of 27 October 2025, CLAR offers an annualised dividend yield of about 5.3%.

Find out how much dividends you may receive as a shareholder of CapitaLand Ascendas REIT with the calculator below.

Related links:

- CapitaLand Ascendas REIT share price and analysis

- CapitaLand Ascendas REIT dividend history and dividend forecast

#3 - Venture Corporation Ltd (SGX: V03)

Venture Corporation is a Singapore-based global technology solutions provider that designs, manufactures, and supplies high-value electronics and engineering products.

It serves customers in the life science, genomics, healthcare, and luxury lifestyle domains, among others.

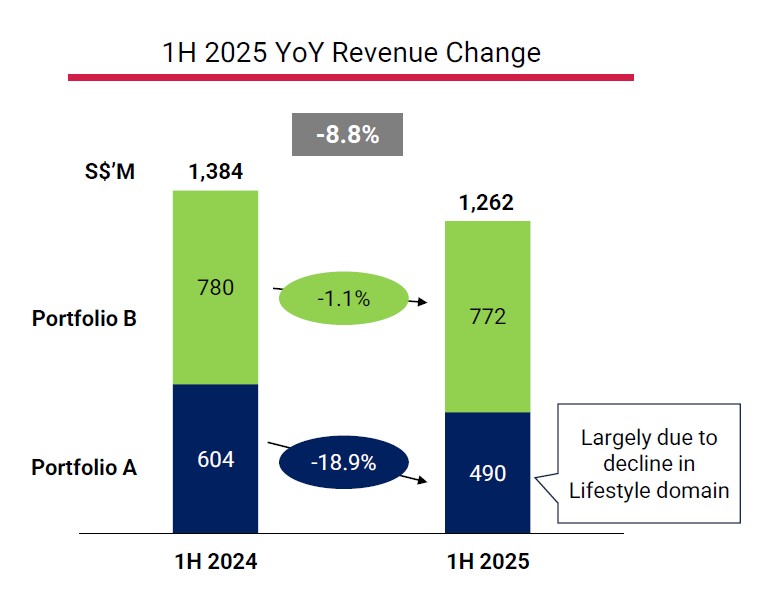

Venture's revenue fell 8.8% year-on-year to S$1.26 billion in the first half of 2025, largely due to a slowdown in the Lifestyle technology domain.

However, the company maintained a net margin of 9.0%, slightly higher than 8.9% a year earlier.

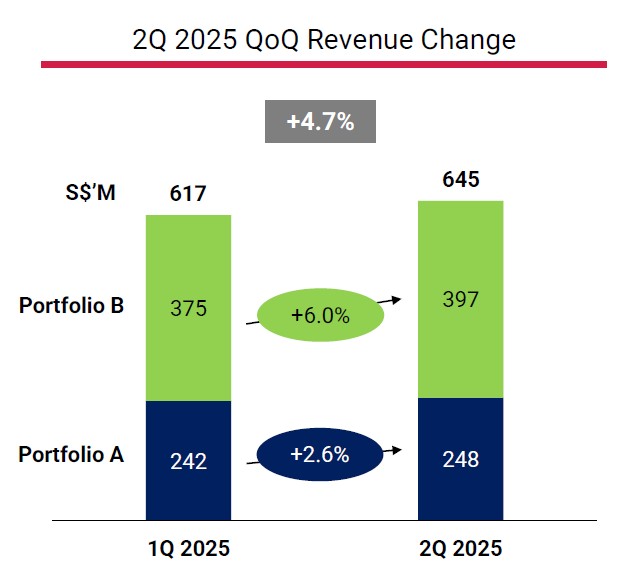

Sequentially, its 2Q 2025 revenue grew 4.7% quarter-on-quarter, supported by stronger contributions from the Semiconductor, Life Science, and Advanced Industrial segments.

Venture continued to generate solid cash flow, with S$149.8 million in operating cash flow for 1H 2025.

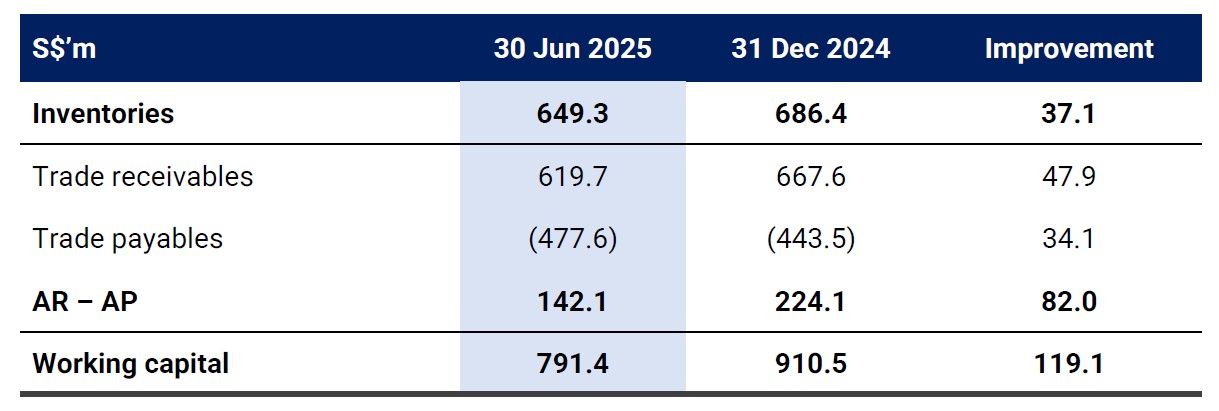

Its working capital improved by S$119.1 million, supported by lower inventories and better receivables management.

The group remains debt-free, with a net cash position of S$1.26 billion as at 30 June 2025, providing ample financial flexibility.

The company continues to sustain strong cash flow and returns to shareholders via dividends and buy-backs.

The group has commenced a share buy-back plan authorised to repurchase up to 14.38 million shares (~10% of issued capital) as at May 2025.

This move complements its steady dividend payout.

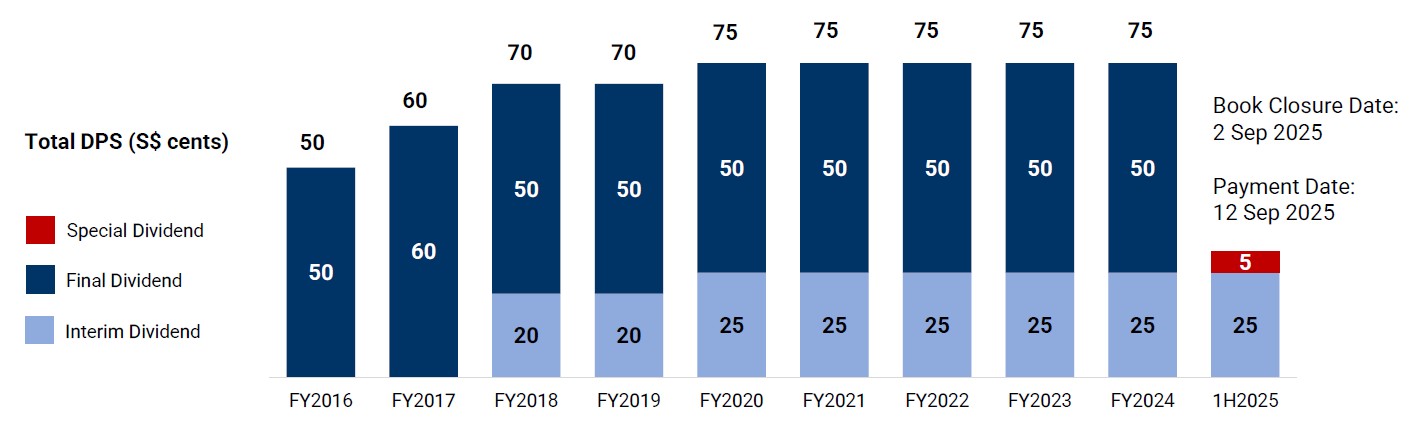

The company has paid an annual dividend of 75 cents per share since FY2021, throughout the pandemic and even amid the semiconductor downturn.

For 1H 2025, it declared a total dividend of 30 cents per share, comprising an interim dividend of 25 cents and a special dividend of 5 cents.

Assuming that Venture maintains its final dividend of S$0.50, the stock would offer a potential total dividend of S$0.80 in 2025.

Based on Venture's share price of S$15.00 as of 27 October 2025, Venture’s shares offer an annualised dividend yield of around 5.3%.

Find out how much dividends you may receive as a shareholder of Venture with the calculator below.

Related links:

- Venture Corporation Ltd share price and analysis

- Venture Corporation Ltd dividend history and dividend forecast

What would Beansprout do?

With interest rates trending lower, investors may find it useful to explore Singapore blue chip stocks and REITs as a way to earn higher dividend income compared to T-bills.

UOB, CapitaLand Ascendas REIT and Venture are blue chips with proven track records of weathering through economic slowdowns, and can potentially offer dividend yields that are higher than the latest 10-year Singapore government bond yield.

CapitaLand Ascendas REIT and Venture offer dividend yields of 5.3%, above UOB's dividend yield of 4.9%.

Looking at their recent performance, CapitaLand Ascendas REIT's distribution per unit was little changed in the first half of 2025 compared to the previous year.

However, UOB and Venture's earnings declined in the first half of 2025 compared to the previous year.

Venture kept its interim dividend unchanged compared to the previous year despite the earnings decline, and also announced a special dividend with its strong cash position.

On the other hand, UOB's interim dividend in the first half of 2025 was lower than the previous year, as it faces earnings pressure from lower net interest margin.

We will be looking out for the upcoming earnings of UOB and Venture to find out if they are able to drive an earnings improvement in the upcoming results.

For those looking to build a diversified dividend portfolio, you can screen for the best high dividend stocks here.

If you’d prefer broad exposure to the Singapore market, you can also consider learning more about the Straits Times Index (STI), which tracks the performance of Singapore’s largest blue chip companies.

[Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher, S$18 cash voucher, plus 2x6% p.a. interest boost on S$2,000 with Longbridge Cash Plus for 90 days (worth up to S$60) when you sign up for a Longbridge account via Beansprout and fund S$2,000. T&Cs apply. Learn more about the Longbridge promotion here.

Check out the best stock trading platforms in Singapore with the latest promotions to invest in Singapore blue chip stocks.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments