4 Singapore blue chip stocks near record highs. Are dividends still attractive?

Stocks

By Gerald Wong, CFA • 12 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Here are 4 Singapore’s blue-chip stocks trading close to all-time highs. We find out if their dividend yields remain attractive with the rally in their share prices.

What happened?

Singapore’s stock market has been on a strong upward trend.

The Straits Times Index (STI) continued its rally in October 2025, and recently reached a new record high of above 4,400.

Just two weeks ago, I highlighted 3 Singapore REITs with dividend yields of above 5% and 3 Singapore blue chip stocks with dividend yields of above 5%.

More recently, I’ve noticed several blue-chip counters hitting new all time highs, and there’s been growing discussion within the Beansprout community about these stocks.

In this article, we will look at four Singapore blue chip names that are nearing new highs and find out if they continue to offer attractive dividends yields.

4 Singapore blue chip stocks near record highs. Are dividends still attractive?

#1 - DBS Group Holdings (SGX: D05)

DBS is Singapore’s largest bank by market capitalisation and offers a comprehensive range of banking, insurance, and investment services to both individuals and corporations.

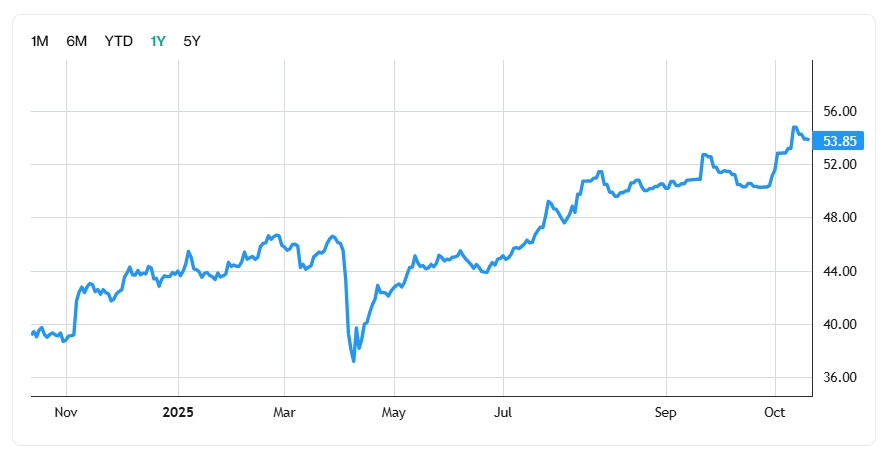

With a 23% gain year-to-date, DBS’ shares recently hit a new all time high of S$54.80.

DBS also became the first company in Singapore to exceed S$150 billion in market capitalisation.

DBS reported steady profit growth in 2Q 2025, with net profit rising around 1% year-on-year to S$2.82 billion, while 1H 2025 net profit was largely flat at S$5.72 billion.

Their total income grew around 5% year-on-year on the back of strong fee income, treasury customer sales and improved markets trading.

The bank maintained a return on equity of 17%, reflecting continued efficiency in capital deployment.

While net interest income stabilised as funding costs remained elevated, non-interest income provided an important boost.

Management guided that non-interest income and fee-related businesses will remain key earnings drivers as interest margins stabilise.

Overall, DBS continues to demonstrate earnings resilience and consistent shareholder returns.

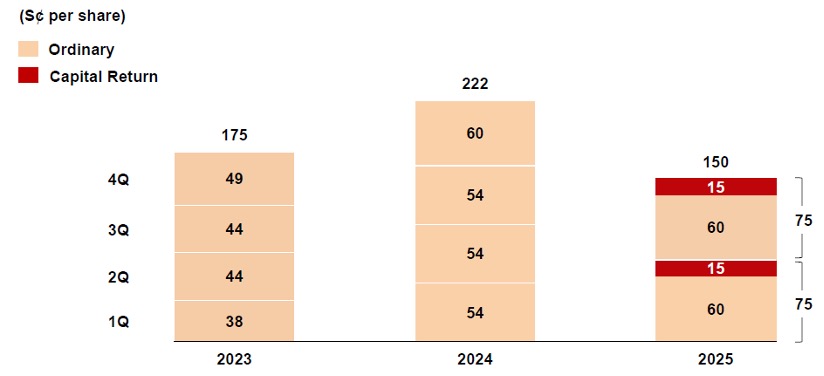

DBS declared an ordinary dividend of S$0.60 per share for 2Q 2025 and a special capital return dividend of S$0.15, bringing total 1H 2025 dividends to S$1.50 per share.

Annualising the quarterly dividend payout of S$0.75 per share translates to a dividend yield of about 5.5%, based on the current share price of S$54.08.

This remains above DBS’s historical average dividend yield of 5.0%.

Related Links:

- DBS Group Holdings Ltd price history and share price target

- DBS Group Holdings Ltd dividend forecast and dividend yield

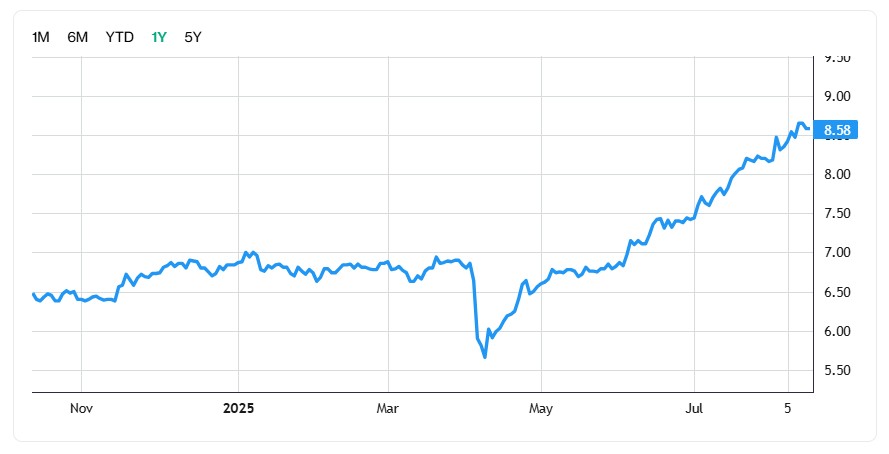

#2 - ST Engineering (SGX: S63)

Singapore Technologies Engineering, or ST Engineering, is a technology and engineering firm that serves the aerospace, smart city, and defence sectors.

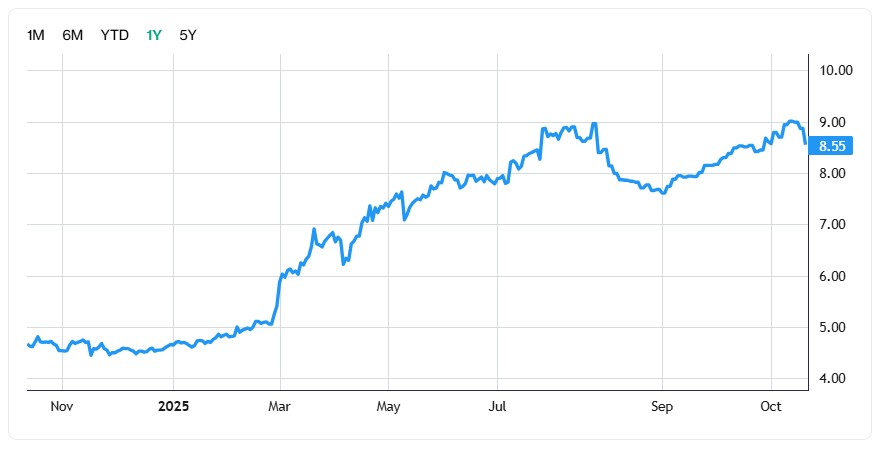

With a gain of 93.3% year-to-date, ST Engineering's shares recently hit an all time high of S$9.03.

ST Engineering reported a robust performance in the first half of 2025, supported by broad-based growth across its key segments.

1H2025 revenue climbed 7% year-on-year to S$5.9 billion, with all three of the group’s segments recording year-on-year revenue growth.

The Defence & Public Security (DPS) segment contributed the largest share of growth with a 12% increase in revenue to S$2.6 billion and a 13% rise in EBIT to S$367 million.

The Commercial Aerospace division also performed steadily, with revenue up 5% to S$2.35 billion and EBIT up 18%, reflecting higher engine maintenance, repair and overhaul (MRO) activity and cost efficiencies.

It is also investing in new infrastructure, including a greenfield airframe maintenance facility in Ezhou, China.

With these expansions in place, the company plans to hire over 300 new engineers and technicians to support expanding aircraft maintenance capacity.

Meanwhile, the Urban Solutions & Satcom segment posted flat revenue growth but achieved a 32% increase in EBIT due to a more favourable margin mix and cost savings.

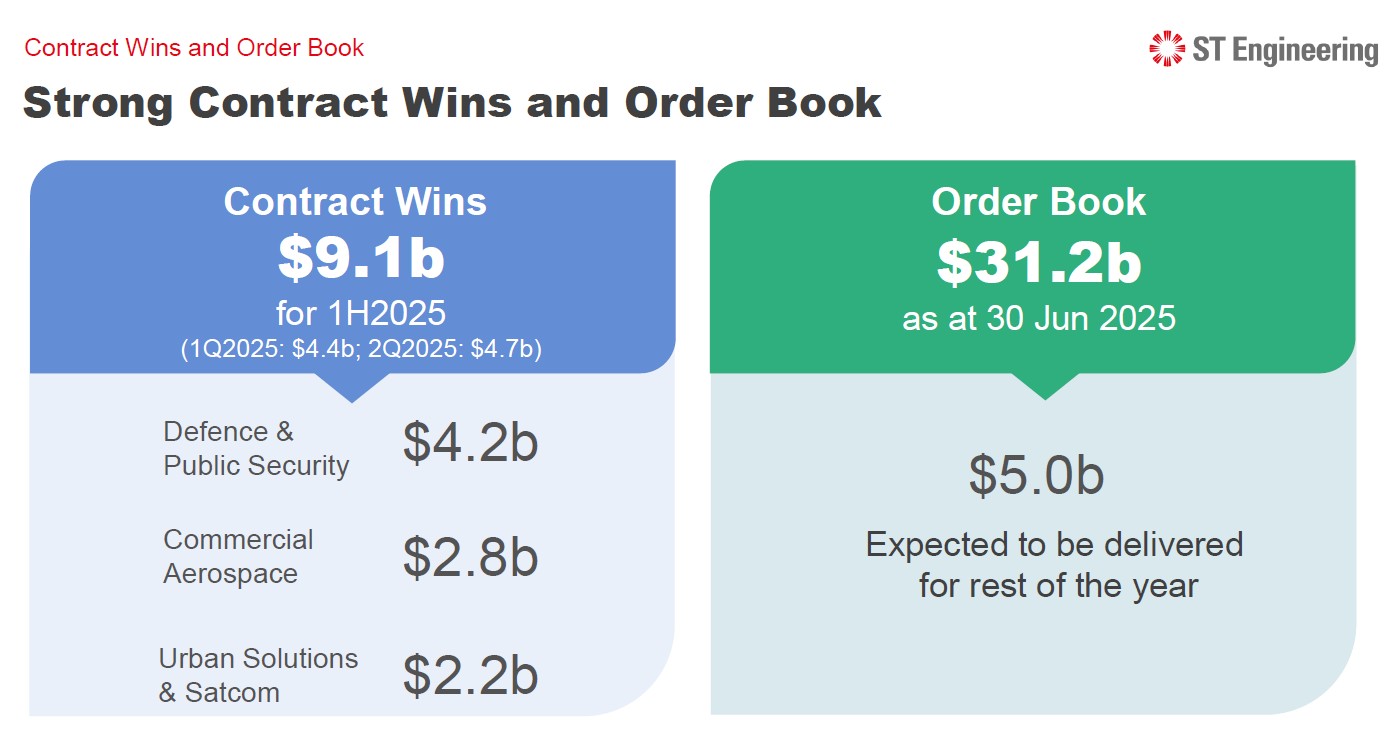

The group continued to log impressive contract wins of S$9.1 billion for 1H2025, as shown below.

Contract wins in the second quarter alone reached S$4.7 billion, spanning defence and public security, commercial aerospace and smart city solutions.

These order wins have grown STE’s order book to S$31.2 billion, of which S$5.0 billion will be delivered for the remainder of 2025.

On the capital management front, the group continued to deleverage, reducing total borrowings to S$5.5 billion and maintaining a solid credit rating (Aaa by Moody’s, AA+ by S&P).

An interim dividend of S$0.04 per share was declared, bringing its 1H2025 dividend to S$0.08 per share.

At its recent Investor Day in May 2025, ST Engineering announced that it plans to propose an increase in the total dividend in FY2025 to 18.0 cents per share, comprising:

- Interim dividend of 4.0 cents per share for each of the first three quarters

- Final dividend of 6.0 cents per share, subject to shareholder approval at the 2026 AGM

Following the recent share price gains, ST Engineering’s FY2025 dividend yield is expected to be around 2.1% based on the current price of S$8.51.

Related Links:

- ST Engineering Ltd price history and share price target

- ST Engineering Ltd dividend forecast and dividend yield

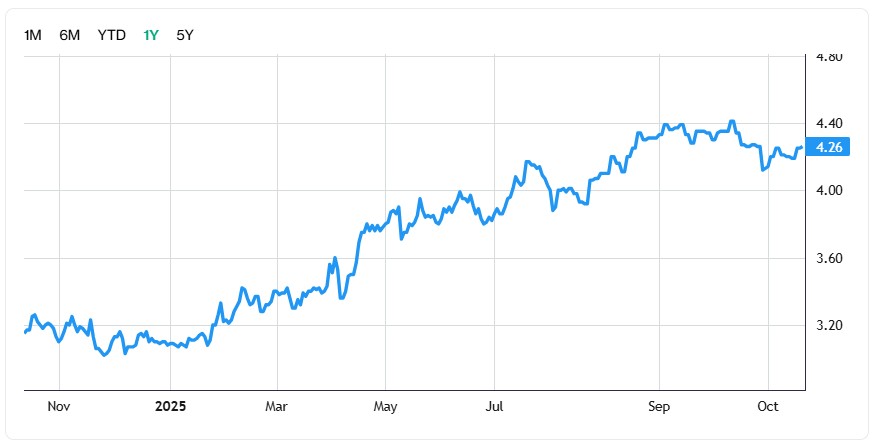

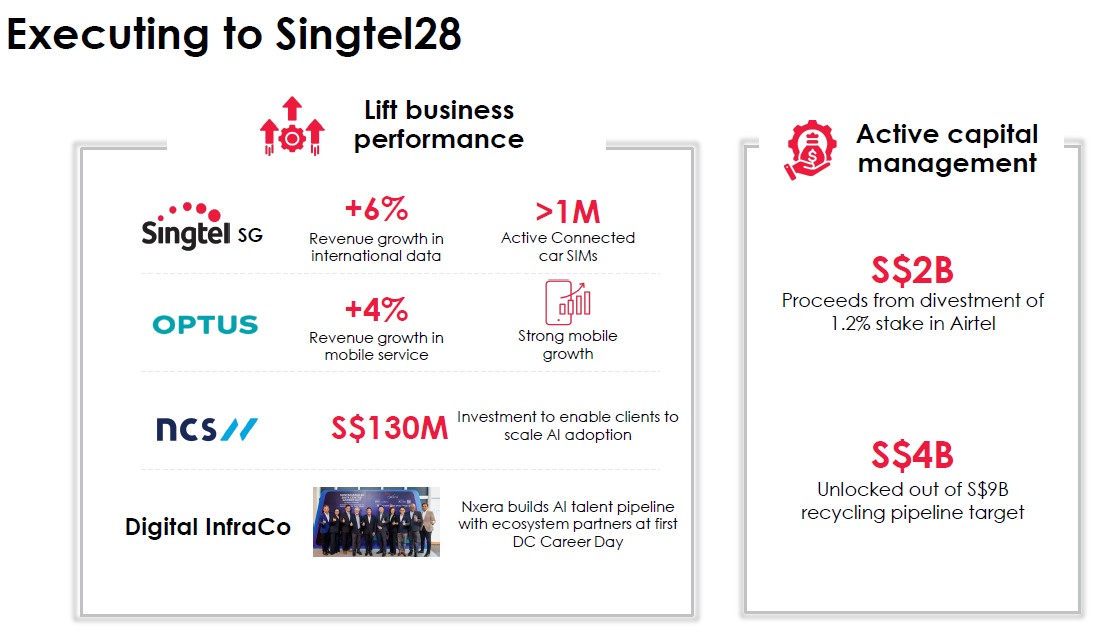

#3 - Singtel (SGX: Z74)

Singtel is a leading communications technology group in Asia, providing an extensive range of telecommunications and digital services to consumers and enterprises.

Shares of the telco operator hit their all time high of S$4.45 recently and are up 35.6% year-to-date.

Singtel delivered a strong start to FY2025/26, with underlying net profit up 14% to S$686 million in the quarter ended 30 June 2025, driven by Optus, NCS and regional associates Airtel and AIS.

Revenue was stable at S$3.39 billion despite a weaker Australian Dollar, while EBITDA rose 5% on a constant-currency basis.

Optus revenue was up 4% year-on-year and EBIT surging 36% on higher mobile customer base, improved average revenue per user (ARPU), and disciplined cost management.

Singtel’s Singapore operations delivered a steady performance with EBIT rising 2% year-on-year to S$235 million, supported by a stronger enterprise segment and resilient consumer business.

NCS achieved 4% year-on-year growth in revenue and 22% year-on-year increase in EBIT driven by its Gov+ business with a healthy project pipeline.

Digital InfraCo’s revenue fell 2% year-on-year to S$107 million in Q1 FY2026, mainly due to lower contributions from project-based satellite deployment services. However, EBIT grew, supported by lower depreciation and utilities expenses from its Nxera data centre operations.

The division continues to scale up its regional data centre capacity toward over 200MW by end-2026, positioning it for the growing demand in AI and cloud infrastructure.

The group’s regional associates remained an important earnings contributor, led by strong results from Airtel and AIS.

Singtel also recognised a one-off gain of S$2.2 billion, mainly from the partial divestment of its Airtel stake and the Intouch-Gulf Energy merger, bringing net profit to S$2.88 billion.

Looking ahead, management expects its Nxera data centre business in Thailand and Singapore to be a key growth driver in FY2026, alongside continued execution of its Singtel28 transformation plan.

Also, the ongoing capital recycling initiatives, with $4 billion already realised out of a $9 billion target, and S$2 billion share buyback has been helping to enhance shareholder value.

In addition, the group raised its FY2025 dividend to S$0.17 per share, which includes a S$0.047 special value realisation payout.

Based on the current share price of S$4.30, this translates to a historical dividend yield of about 4.0%.

Related Links:

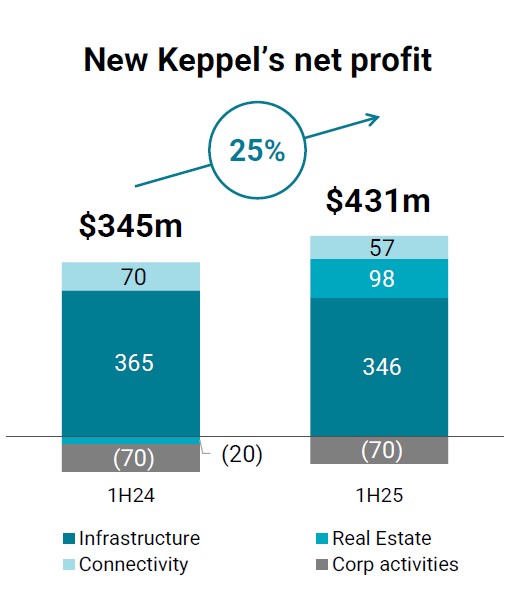

#4 - Keppel Limited (SGX: BN4)

Keppel is a Singapore-based global asset manager and operator with businesses spanning infrastructure, real estate, and connectivity.

Keppel’s share price recently reached an all-time high of S$9.34, bringing year-to-date gains to about 34.6%.

In the first half of 2025, Keppel reported a net profit of S$431 million, up 25% year-on-year, supported by steady contributions from its infrastructure, real estate, and connectivity divisions.

The group achieved an annualised ROE of 15.4%, driven by recurring income of S$444 million, and continued progress on its asset-light transformation strategy.

In August 2025, Keppel announced the sale of M1’s telecom business to Simba Telecom for an enterprise value of S$1.43 billion.

The divestment is expected to unlock nearly S$1 billion in net cash and allow Keppel to focus on higher-growth digital infrastructure and connectivity assets such as data centres and subsea cables.

Keppel’s future performance will hinge on how well it reinvests its capital into new growth areas while continuing to streamline and divest its older businesses.

Keppel plans to grow its fund under management (FUM) from S$91 billion to S$100 billion by 2026, while continuing to sell older or non-core businesses worth about S$14.4 billion by 2030.

Its strong balance sheet and clearer strategic direction may support its ongoing transition into a global asset manager and operator.

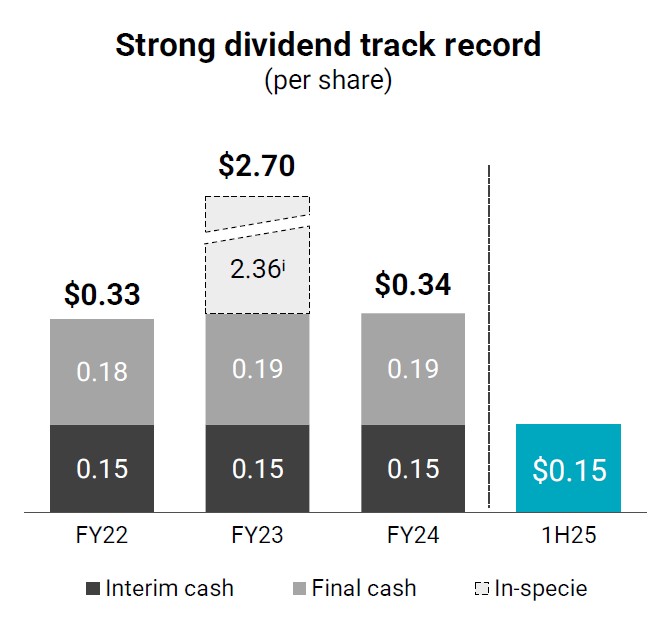

In terms of returns to shareholders, Keppel had launched a S$500 million share buyback programme and declared an interim dividend of 15 cents per share in 1H25.

Based on its FY24 dividend payout of S$0.34 per share, Keppel's historical dividend yield is about 3.7%, based on the current share price of S$9.23.

Find out how much dividends you can potentially receive as a shareholder of Keppel with the calculator below.

Related Links:

What would Beansprout do?

These four blue-chip stocks have demonstrated their resilience, delivering solid earnings performance in recent quarters.

Investors have taken notice, driving their share prices near all time highs.

For investors focusing on dividends to earn their passive income, these stocks still offer varying levels of yield.

DBS currently provides the highest annualised dividend yield at around 5.5%, followed by Singtel which offers a historical dividend yield of 4.0%.

Following the significant share price gains, Keppel offers a more modest historical dividend yield of 3.7%, while ST Engineering has an even lower dividend yield of 2.1%.

While DBS’s yield remains close to its historical average, the dividend yields of Keppel, ST Engineering and Singtel have dipped below their usual levels with the rally in their respective share prices.

Among the four, DBS may stand out for those looking for blue chip stocks that continue to offer an attractive dividend yield.

If you’d like to identify other Singapore stocks with attractive dividend yields above 3% and potential upside to analyst targets, you can explore our Singapore dividend stocks screener.

If you’d prefer broad exposure to the Singapore market, you can also consider learning more about the Straits Times Index (STI), which tracks the performance of Singapore’s largest blue chip companies.

Check out the best stock trading platforms in Singapore with the latest promotions to invest in Singapore blue chip stocks.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments