3 Singapore REITs with dividend yields of above 5% (Oct 2025)

REITs

By Gerald Wong, CFA • 25 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We highlight three Singapore REITs that offer dividend yields of above 5%.

What happened?

Singapore REITs are back in focus.

Last month, we shared 3 Singapore REITs with dividend yields above 5%, featuring CapitaLand Ascendas REIT, Frasers Centrepoint Trust and Lendlease REIT.

This led some to wonder - are there any other REITs that offer dividend yields of above 5%?

After all, together with Singapore blue-chip stocks that offer attractive dividend yields, Singapore REITs are a popular option for investors in Singapore looking to earn passive income through regular distributions.

Let’s take a closer look at three Singapore REITs that have dividend yields above 5%, and find out if they may be worth adding to your watchlist.

3 Singapore REITs with dividend yields above 5%

The Mapletree group manages some of the largest and most well-known REITs in Singapore.

Here are three Mapletree REITs that are offering dividend yields above 5% - Mapletree Logistics Trust, Mapletree Industrial Trust and Mapletree Pan Asia Commercial Trust and how they compare.

#1 – Mapletree Logistics Trust (SGX: M44U)

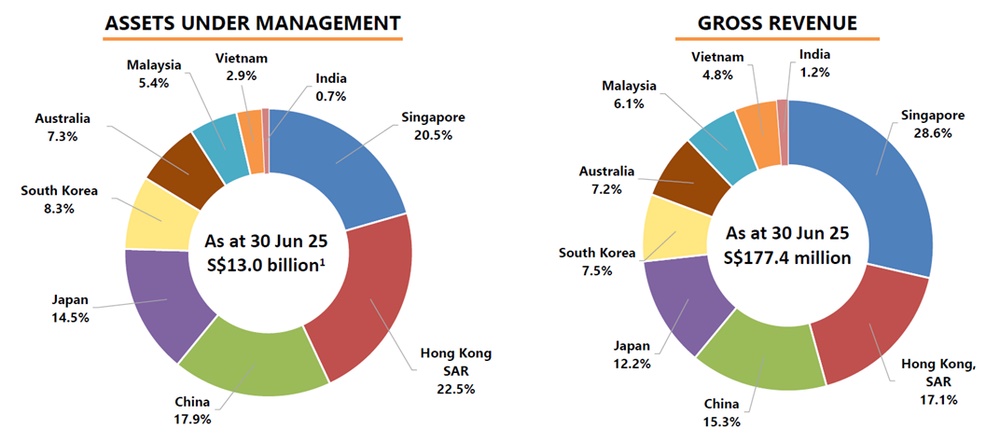

Mapletree Logistics Trust (MLT) manages a diversified portfolio of 174 properties consisting of logistics and industrial assets across Asia with an asset under management (AUM) of S$13.0 billion as at 13 October 2025.

In its first quarter ended June 2025, gross revenue fell 2.4% year-on-year to S$177.4 million, while net property income declined 2.1% to S$153.4 million, mainly due to weaker regional currencies and lower contributions from divested assets.

Portfolio occupancy stood at 95.7%, affected by the inclusion of the newly completed Mapletree Joo Koon Logistics Hub in Singapore, which had a 42.4% occupancy rate.

Excluding this asset, the portfolio occupancy would have been 96.3%.

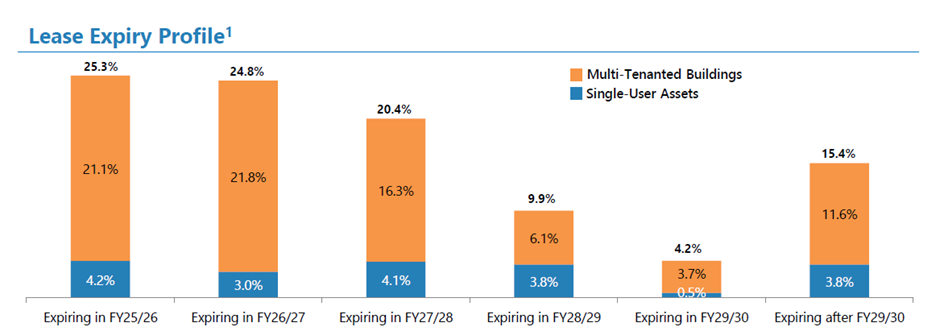

Its weighted average lease expiry (WALE) stood at about 2.7 years, while rental reversions were positive at +2.1%, or +2.8% excluding China, showing steady leasing demand across most markets.

Aggregate leverage increased slightly to 41.2%, up from 40.7% in the previous quarter, mainly due to currency movements.

About 84% of debt is hedged at fixed rates and 74% of income for the next 12 months is hedged into SGD, reflecting prudent risk management.

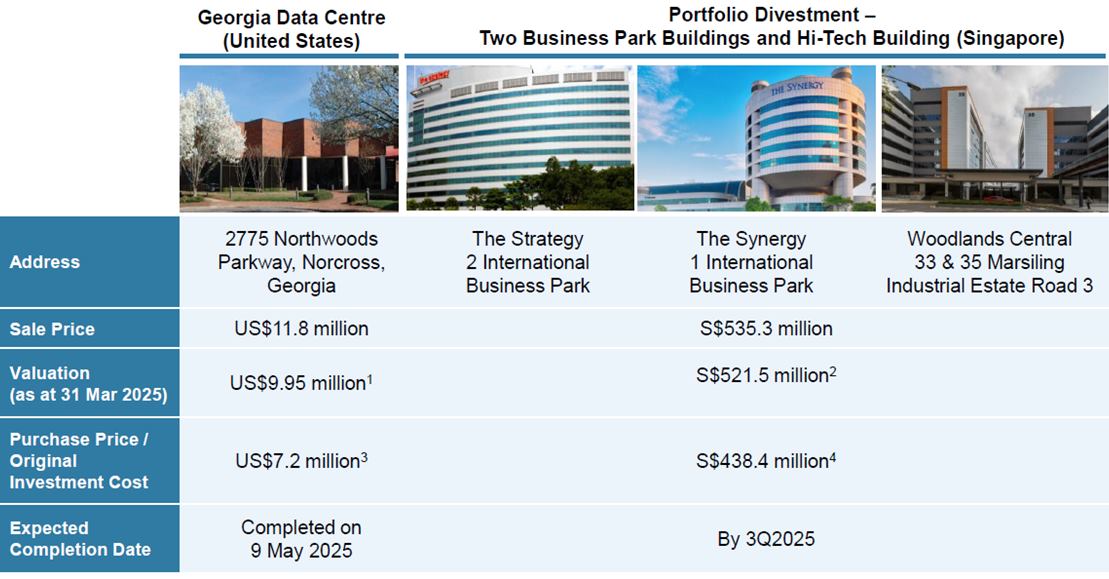

MLT continues to actively manage its portfolio, completing two divestments during the first quarter and two more after quarter-end.

These divestments achieved premiums ranging between 6% and 40% above valuation, freeing up capital for redeployment into higher-specification assets.

In October 2025, MLT completed the divestment of a logistics property in Australia. In August 2025, completed the disposal of its Yeoju facility in South Korea, both part of its ongoing portfolio-rejuvenation programme.

MLT’s first-quarter distribution per unit (DPU) fell by 12.4% year-on-year to 1.812 cents, mainly due to weaker regional currencies and the absence of one-off divestment gains.

Based on its closing price of S$1.30 as of 24 October 2025, MLT offers an annualised dividend yield of about 5.6%.

Find out how much dividends you may receive as a shareholder of Mapletree Logistics Trust with the calculator below.

Related links:

- Mapletree Logistics Trust (M44U) share price history and share price target

- Mapletree Logistics Trust (M44U) dividend history and dividend forecast

#2 – Mapletree Industrial Trust (SGX: ME8U)

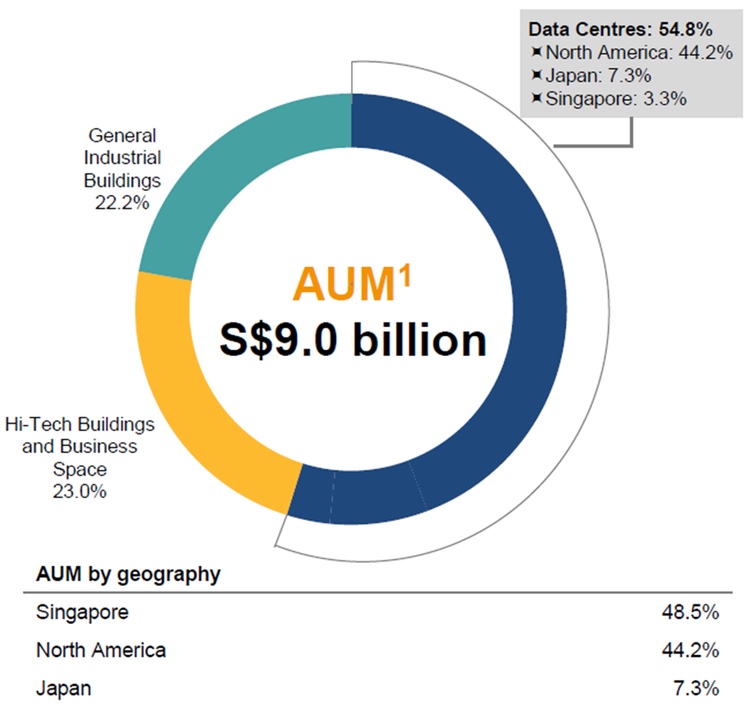

Mapletree Industrial Trust (MIT) owns a diversified portfolio of 140 properties worth about S$9 billion across Singapore, North America and Japan.

Data centres make up more than half of its asset value (54.8%), highlighting the trust’s focus on long-term growth areas such as AI and cloud computing.

In the latest quarter ended June 2025, Mapletree Industrial Trust reported net property income of S$133.6 million, up 0.8% year-on-year, driven by the new Tokyo acquisition, the completed Osaka Data Centre, and positive rental reversions of about 8.2% in Singapore.

Portfolio occupancy stood at 91.4% as of June 2025, with Singapore assets at 91.2% and overseas properties at 91.7%.

Mapletree Industrial Trust maintains a strong balance sheet, with around 80% of debt hedged at fixed rates and an interest coverage ratio of 3.9 times. However, management expects some pressure from higher hedging costs as existing swaps reprice over FY25/26.

Recent divestments of three Singapore industrial assets and a data centre in Georgia have also helped to unlock value and improve financial flexibility.

DPU came in at 3.27 cents in the first quarter ended June 2025, down from 3.43 cents in the same period last year, due to the absence of divestment gains and higher finance costs.

Based on its closing price of S$2.18 as of 24 October 2025, MIT offers an annualised dividend yield of about 5.9%.

Find out how much dividends you may receive as a shareholder of Mapletree Industrial Trust with the calculator below.

Related links:

- Mapletree Industrial Trust (ME8U) share price history and share price target

- Mapletree Industrial Trust (ME8U) dividend history and dividend forecasts

#3 – Mapletree Pan Asia Commercial Trust (SGX: N2IU)

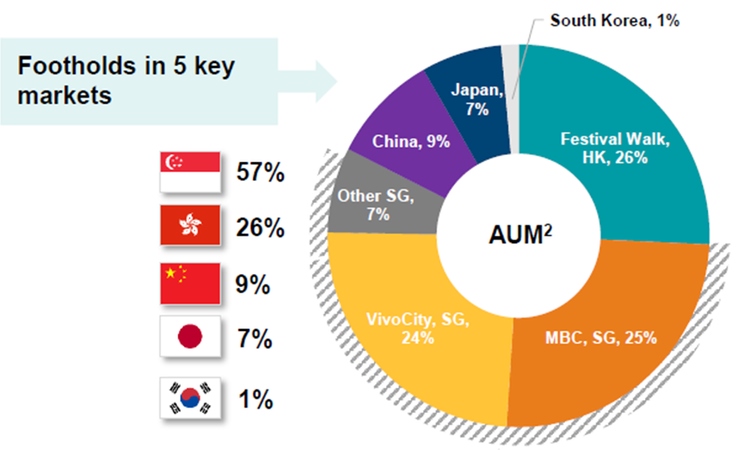

Mapletree Pan Asia Commercial Trust (MPACT) is a flagship commercial REIT listed in Singapore, managing a S$15.7 billion portfolio of properties across five key markets — Singapore, Hong Kong, China, Japan and South Korea.

Its portfolio includes assets such as VivoCity, Mapletree Business City and prime commercial properties across Asia.

Singapore remains its core base, contributing 57% of assets under management after the latest Japan property divestments.

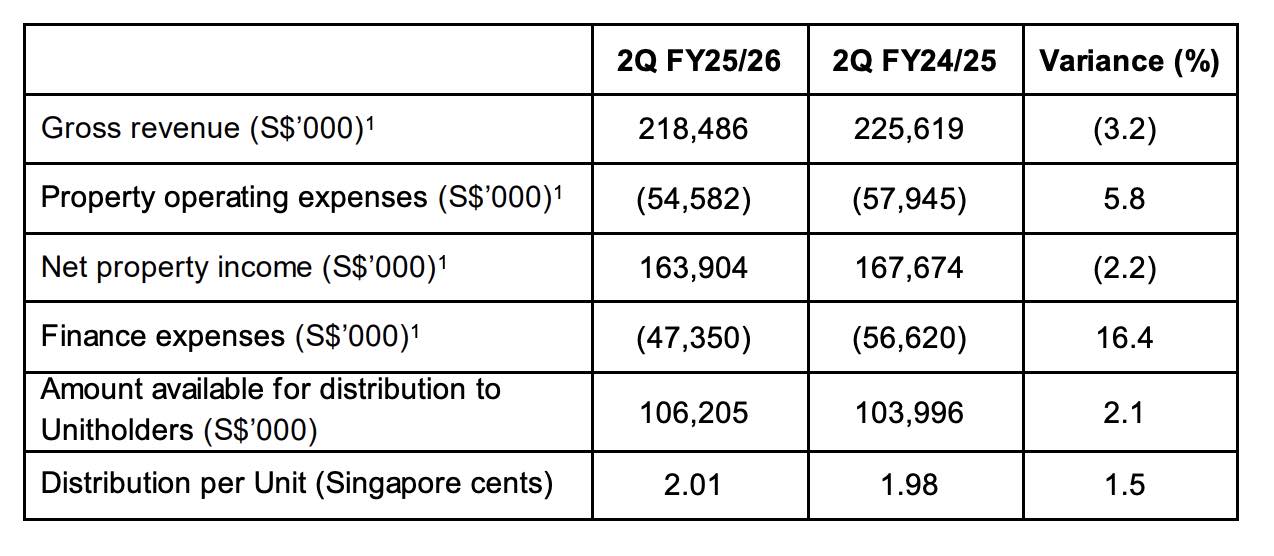

In the quarter ended September 2025 (2Q FY25/26), Mapletree Pan Asia Commercial Trust's net property income fell 2.2% year-on-year to S$164 million due to lower contributions from overseas properties as well as strength in the Singapore dollar.

VivoCity continued to perform well, with net property income up 7.7% year-on-year despite downtime from asset enhancement initiatives at basement 2.

VivoCity had an occupancy rate of 100% as at 30 September 2025, lifting the portfolio occupancy of Mapletree Pan Asia Commercial Trust to 88.9%.

However, occupancy for its overseas properties was lower. The occupancy rate for its Japan properties fells to 73.9% from 76.8% in June, while the occupancy rate for its China properties remained low at 86.3%.

Management has kept its leverage ratio moderate at 37.6%, with 78% of borrowings on fixed rates. Recent divestments of two Japan office properties have helped to improve its balance sheet.

Mapletree Pan Asia Commercial Trust's average debt cost fell to 3.23%as at 30 September from 3.32% as at 30 June 2025 and 3.56% as at 30 September 2024, reflecting lower interest rates.

As a result, Mapletree Pan Asia Commercial Trust's finance expense fell 16.4% year on year to S$47.35 million in 2Q FY25/26.

Mapletree Pan Asia Commercial Trust announced a distribution per unit (DPU) of 2.01 cents in 2Q FY25/26, up 1.5% year-on-year.

While net property income dipped with the contribution from overseas assets, this was offset by the sharp decline in finance expenses.

Based on its closing price of S$1.47 as of 24 October 2025, Mapletree Pan Asia Commercial Trust offers an annualised dividend yield of about 5.5%.

Find out how much dividends you may receive as a shareholder of Mapletree Pan Asia Commercial Trust with the calculator below.

Related links:

- Mapletree Pan Asia Commercial Trust (N2IU) share price history and share price target

- Mapletree Pan Asia Commercial Trust (N2IU) dividend history and dividend forecasts

What would Beansprout do?

The share prices of Mapletree Logistics Trust, Mapletree Industrial Trust, and Mapletree Pan Asia Commercial Trust have fallen in the past few years, as their distributions have come under pressure from persistently high interest rates and currency headwinds.

However, dividend yields offered by Singapore REITs are looking more attractive with Fed rate cuts.

The three REITs offer a dividend yield of 5% and above, which is higher than the latest 10-year Singapore government bond yield.

| REIT | AUM | Forecast Dividend Yield | Gearing | Occupancy | Key Sector |

|---|---|---|---|---|---|

| Mapletree Logistics Trust (M44U) | S$13.3b | 5.6% | 41.2% | 95.7% | Logistics |

| Mapletree Industrial Trust (ME8U) | S$9.1b | 5.9% | 40.1% | 91.4% | Industrial/Data centres |

| Mapletree Pan Asia Commercial Trust (N2IU) | S$15.7b | 5.5% | 37.6% | 88.9% | Office/Retail |

| Source: Company’s websites and investor presentations as of October 2025, forecast dividend yield based on consensus forecast for current fiscal year | |||||

Among the three, Mapletree Industrial Trust offers the highest dividend yield at around 5.9%. This is likely due to investor concerns about its declining distribution per unit with its significantly exposure to the North Ameircan datacentre market.

Comparing the three REITs, Mapletree Pan Asia Commercial Trust (N2IU) has the largest exposure to Singapore which makes up 57% of its portfolio. This is expected to increase further to 61% with its recent divestment of Japanese assets.

It also encouraging to see that Mapletree Pan Asia Commercial Trust's distribution per unit has started to recover in the most recent quarter, supported by lower financing costs. This may help investors to gain more confidence about the forecasted dividend yield of 5.5% for Mapletree Pan Asia Commercial Trust.

On the other hand, we will be looking out for the upcoming earnings of Mapletree Logistics Trust and Mapletree Industrial Trust, to find out if there may also be some stabilisation in their distributions.

To screen for Singapore REITs with lowest price-to-book valuation or highest dividend yield, check out our best Singapore REIT screener.

If you are new to investing in Singapore REITs, you can start to learn more about Singapore REITs here.

If you prefer diversification without picking individual REITs, you can also gain exposure through Singapore REIT ETFs.

💰[Limited Offer Until 31 Oct] Get bonus S$50 FairPrice voucher within 5 working days, S$18 cash voucher, plus 2x6% p.a. interest boost on S$2,000 with Longbridge Cash Plus for 90 days (worth up to S$60) when you sign up for a Longbridge account via Beansprout. Stand a chance to win 1g gold bar (worth ~$220)! T&Cs apply. Learn more about the Longbridge promotion here.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Singapore REITs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments