2 CPF matching grants that could boost your savings

Retirement

By Gerald Wong, CFA • 19 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn how CPF matching grants such as the Matched Retirement Savings Scheme (MRSS) and the Matched MediSave Scheme (MMSS) can help boost your savings, who qualifies, and how to maximise these schemes.

What happened?

Several CPF changes took effect in 2026.

Earlier, we highlighted six key updates that may affect you, including the increase in the CPF monthly salary ceiling and higher CPF retirement sums.

Among these changes are enhancements to the Matched Retirement Savings Scheme (MRSS) and the introduction of the new Matched MediSave Scheme (MMSS).

With these updates, it is worth taking a closer look at how CPF matching grants can help strengthen long term retirement and healthcare savings.

In this article, we explain how MRSS and MMSS work, who qualifies, and how these schemes support your financial security over time.

What is the Matched Retirement Savings Scheme MRSS?

The Matched Retirement Savings Scheme was introduced to help senior Singaporeans with lower CPF balances build up their retirement savings.

Under MRSS:

- The government matches eligible cash top-ups dollar for dollar.

- The matching grant is capped at S$2,000 per year.

- There is a lifetime matching cap of S$20,000.

- The matching grant is credited to the recipient’s Retirement Account (RA) or Special Account (SA) depending on age.

The scheme primarily targets Singapore Citizens with lower retirement savings, including seniors who may not have had the opportunity to accumulate sufficient CPF balances during their working years.

With the recent updates, more individuals are expected to qualify under the revised criteria.

By increasing Retirement Account (RA) balances, MRSS can lead to higher CPF LIFE payouts in later years, strengthening retirement income over time.

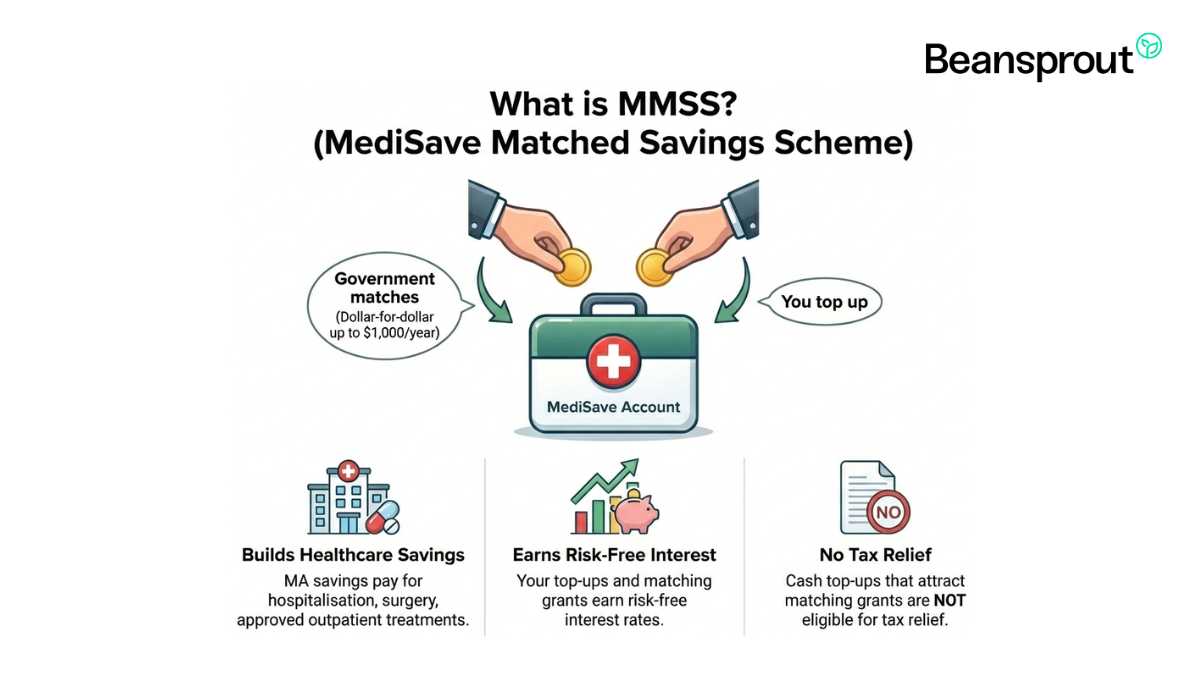

What is the Matched MediSave Scheme MMSS?

The Matched MediSave Scheme is a new initiative introduced in 2026 aimed to strengthen healthcare savings.

Under MMSS:

- Eligible cash top-ups to the MediSave Account are matched dollar for dollar.

- The matching grant is capped at S$1,000 per year.

- Matching grants are credited directly into the recipient’s MediSave Account.

- The scheme runs for a defined period.

MMSS is designed for Singapore Citizens aged 55 to 70 with lower MediSave balances, subject to income and property criteria.

By matching voluntary cash top-ups, MMSS increases the buffer available for healthcare expenses, insurance premiums and future medical needs.

How are eligibility and matching grants determined?

Eligibility for MRSS and MMSS is assessed by CPF Board based on criteria such as:

- CPF retirement or MediSave balances

- Income conditions

- Property ownership conditions

- Age requirements for MMSS

Eligible members do not need to submit a separate application for matching grants. CPF Board assesses eligibility automatically, and matching grants are credited once qualifying top-ups are made within the relevant year.

Annual caps apply separately to MRSS and MMSS.

| Eligibility Factor | MRSS | MMSS |

| Purpose of eligibility test | Based on adequacy of retirement savings | Based on adequacy of healthcare savings |

| Age requirement | Singapore Citizens aged 55 and above Singaporeans with disabilities below age 55 may qualify | Singapore Citizens aged 55 to 70 inclusive |

| CPF balance threshold | Retirement Account savings below the current Basic Retirement Sum of that year. In 2026, those with Retirement Account, Ordinary Account and Special Account savings below S$110,200 qualify. | MediSave Account savings below half of the current Basic Healthcare Sum of that year. In 2026, those with MediSave savings below S$39,500 qualify. |

| Income condition | Average monthly income not exceeding S$4,000 | |

| Property ownership condition | Must not own more than one property | |

| Property annual value condition | Must reside in a property with Annual Value of S$21,000 or below | |

| Source: CPF | ||

What could the long-term impact of the matching grants be?

The impact of matching grants can be significant over time.

For example:

- An eligible individual receiving the full S$2,000 annual MRSS matching grant for 10 years would accumulate S$20,000 in government grants alone, excluding CPF interest.

- Under MMSS, receiving the full S$1,000 annual match for five years would result in S$5,000 in additional MediSave savings before interest.

Since CPF balances earn risk-free interest, the combined effect of matching grants and compounding can meaningfully strengthen long-term retirement and healthcare adequacy.

Key Differences Between MRSS and MMSS

Although both schemes provide dollar-for-dollar matching grants, they support different aspects of retirement planning and objectives.

While both schemes provide matching support, MRSS strengthens retirement income through higher Retirement Account balances and potentially higher CPF LIFE payouts. MMSS enhances MediSave balances to support healthcare expenses in later life.

| Feature | MRSS | MMSS (New) |

| Objective | Boost retirement savings for seniors with lower CPF balances and Singaporeans with disabilities | Boost healthcare savings for seniors with lower CPF balances |

| Year of commencement | 2021 | 2026 |

| Who benefits | Singapore Citizens aged 55 and above with Retirement Account savings below the current Basic Retirement Sum of that year. In 2026, those with Retirement Account, Ordinary Account and Special Account savings below S$110,200 qualify. Singaporeans with disabilities below age 55 with OSA savings below the current Basic Retirement Sum also qualify. | Singapore Citizens aged 55 to 70 inclusive with MediSave Account savings below half of the current Basic Healthcare Sum of that year. In 2026, those with MediSave savings below S$39,500 qualify. |

| Eligibility criteria | Must not own more than one property. Must reside in a property with Annual Value of S$21,000 or below. Must have an average monthly income not exceeding S$4,000. | Same property and income criteria apply. |

| Matching grant | Up to S$2,000 per year, subject to a lifetime cap of S$20,000. | Up to S$1,000 per year. |

| Tax relief treatment | Cash top-ups that qualify for the matching grant do not qualify for personal income tax relief. Cash top-ups that do not attract the matching grant may qualify for personal tax relief of up to S$16,000 per year. | Same tax treatment applies. |

| Crediting account | Retirement Account or Special Account (RA/SA) | MediSave Account (MA) |

| Who can make top-ups | Yourself, your loved ones, employers or members of the community including caregivers | Yourself, your loved ones, employers or members of the community including caregivers |

| Source: CPF | ||

What would Beansprout do?

MRSS and MMSS increase the value of voluntary CPF top-ups by providing dollar-for-dollar matching grants for eligible individuals.

For those who qualify, the matching grants provide an immediate uplift to CPF balances before interest is taken into account.

At the same time, eligibility criteria, annual caps and lifetime limits mean that the level of support differs across members. The schemes are targeted at those with lower CPF balances and are not universal benefits.

From a retirement planning perspective, CPF remains a core pillar of income in later years, particularly through the balances accumulated in the Retirement Account and eventual CPF LIFE payouts.

Understanding how top-ups affect your Retirement Account and how they interact with retirement sum benchmarks helps provide clearer context on their long-term impact.

Matching grants under MRSS directly strengthen retirement balances, while MMSS enhances MediSave savings that support healthcare needs during retirement. Together, they help to build retirement adequacy and security.

Beyond matching grants, there are other ways to grow your CPF savings to build a stronger retirement foundation.

You can learn more about cash top-ups to your CPF Special Account and transferring your Ordinary Account funds to your Special Account here.

CPF members may also use a portion of their Ordinary Account or Special Account funds to invest under the CPF Investment Scheme (CPFIS), which requires opening a CPF Investment Account. Learn more about CPF Investment Scheme here.

Apart from CPF, other retirement planning tools such as the Supplementary Retirement Scheme can complement CPF savings.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments