Gold near record highs. How to invest easily in Singapore

ETFs

Powered by

By Gerald Wong, CFA • 08 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

With gold trading near record highs, learn how to invest in gold easily in Singapore through SPDR Gold Shares ETF.

This post was created in partnership with SGX. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

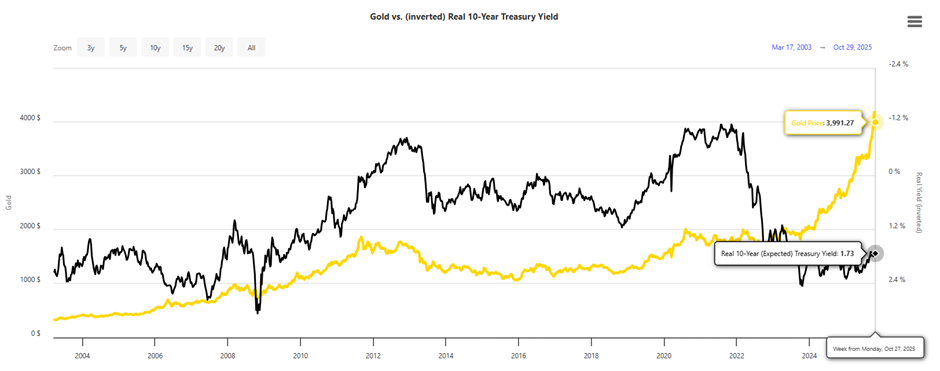

Gold prices recently hit a new record high.

Gold crossed US$4,000/oz again as of 31 October 2025, as more investors turned to safe-haven assets amid global uncertainty and expectations of further interest rate cuts.

I’ve previously shared how to buy gold in Singapore, and introduced gold ETFs as a simple way to gain exposure to gold.

In this article, I’ll take a closer look at one of the most popular gold exchange-traded funds (ETF), the SPDR Gold Shares ETF (SGX: O87 / GSD).

What is the SPDR Gold Shares ETF?

The SPDR Gold Shares ETF is a passive exchange-traded fund (ETF) that tracks the price of gold.

It lets you invest in gold without having to buy or store any physical bars yourself, and you can trade it just like a stock through a brokerage account.

The SPDR Gold Shares ETF is one of the world’s largest and most recognised gold ETFs managed by State Street Global Advisors.

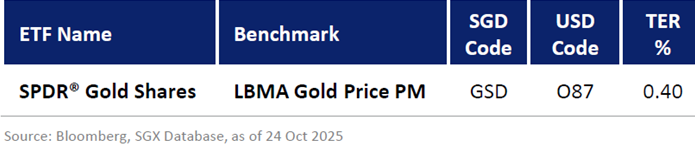

It is listed on the Singapore Exchange (SGX) and seeks to track the performance of the LBMA Gold Price PM, after taking into account management fees.

| Performance (USD) | ||

|---|---|---|

| NAV (%) | LBMA Gold Price PM (%) | |

| Cumulative Performance | ||

| 1 Month | 11.52 | 11.55 |

| 3 Months | 16.25 | 16.36 |

| 6 Months | 22.56 | 22.80 |

| Annualized Performance | ||

| 1 Year | 44.89 | 45.45 |

| 3 Years | 31.23 | 31.74 |

| 5 Years | 14.72 | 15.17 |

| 10 Years | 12.67 | 13.12 |

| Since Inception (11/18/2004) | 10.45 | 10.89 |

| Source: SPDR Gold Shares Fact Sheet, as of 30 September 2025. Performance is calculated on a net-of-fees return basis in USD terms on a NAV-to-NAV (single pricing) basis. | ||

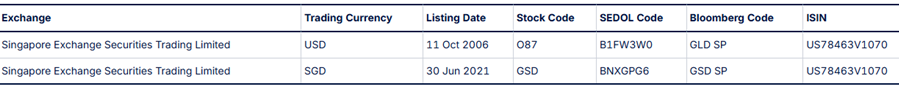

Investors in Singapore can trade it in two currencies: USD-denominated units (SGX: O87) and SGD-denominated units (SGX: GSD)

| Fund information | ||

|---|---|---|

| Stock Code | O87 | GSD |

| Bloomberg Ticker | GLD SP | GSD SP |

| ISIN | US78463V1070 | US78463V1070 |

| SEDOL | B1FW3W0 | BNXGPG6 |

| Trading Currency | USD | SGD |

| Inception Date | 11/18/2004 | 11/18/2004 |

| SGX Listing Date | 10/11/2006 | 06/30/2021 |

| Source: SPDR Gold Shares Fact Sheet, as of 30 September 2025 | ||

Each share of the ETF represents fractional ownership in physical gold bars held in secure vaults by HSBC Bank plc and JPMorgan Chase Bank, N.A.

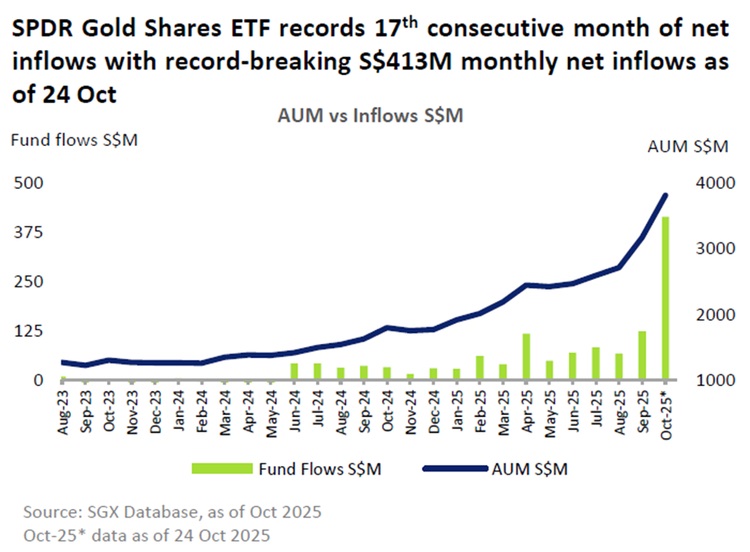

As of 24 October 2025, the SPDR Gold Shares ETF remains the largest ETF on SGX with AUM reaching S$3.8 billion.

It has seen steady buying interest for 17 straight months.

Key features of the SPDR Gold Shares ETF

#1 – Accessibility

As it is listed on SGX, you may buy or sell the SPDR Gold Shares ETF just like any stock through any local brokerage.

You can start with as little as one unit of the ETF, which means a smaller investment amount compared with buying physical gold.

This gives you fractional ownership of the underlying gold held by the fund.

As of 30 October 2025, one unit of the SPDR Gold Shares ETF (SGX: GSD) would cost around S$470.

This offers liquidity and convenience for investors who prefer not to deal with the hassle of managing physical gold.

The SPDR Gold Shares ETF is also eligible under the CPF Investment Scheme (CPFIS) and SRS, giving investors another way to gain direct exposure to physical gold.

#2 – Low cost

The ETF has a total expense ratio of 0.40%.

This covers all management and custody costs, so there are no extra hidden fees.

You also do not need to pay for storage or insurance, unlike when buying physical gold. This makes it more affordable than buying physical gold.

Overall, it is one of the cost-effective ways to invest in gold.

#3 - Exposure to physical gold

Each share is fully backed by allocated gold bars stored in secure vaults.

Unlike gold mining company ETFs, the SPDR Gold Shares ETF performance depends purely on gold prices, not business operations or profits.

The SPDR Gold Shares ETF closely tracks the spot price of gold, which makes it a simple, passive, and transparent way to get exposure to gold as an asset class.

#4 – SGD denominated trading option

The SPDR Gold Shares ETF is listed on the Singapore Exchange (SGX) and can be traded in two currencies, USD and SGD.

The SGD-denominated version (GSD) is useful for investors based in Singapore who prefer to avoid foreign currency exposure and currency conversion fees.

What are the risks of the SPDR Gold Shares ETF?

The SPDR Gold Shares ETF offers easy access to gold, but investors should also understand the potential risks.

#1 – Gold price fluctuations

While gold can help diversify a portfolio, it is still subject to market conditions.

Gold prices can fluctuate due to factors such as US interest rate movements, inflation expectations, or shifts in investor sentiment.

During risk-on periods or when bond yields rise, gold may underperform relative to equities.

#2 – Tracking error

While SPDR Gold Shares ETF aims to mirror gold prices closely, slight differences may arise due to fees and other operational costs.

#3 – No income generation

The SPDR Gold Shares ETF does not pay dividends or interest, so potential returns come purely from price movements.

Investors seeking regular income may need to complement this with other investment assets.

What would Beansprout do?

Gold has hit record highs as investors seek safe haven assets amid geopolitical uncertainty.

If you are looking to gain exposure to gold, the SPDR Gold Shares ETF provides a simple solution.

It combines accessibility, low cost, and direct exposure to physical gold within a regulated framework.

It is listed on SGX, backed by physical gold, is SRS-eligible, and CPF-OA approved.

For Singapore investors, the SGD-denominated units (GSD) may offer a practical way to invest without worrying about currency conversion.

Still, gold should not be viewed as a way to speculate on short-term price movements.

It is important to keep in mind that it does not generate any regular income and is subject to price fluctuations.

Hence, it may be considered as part of a balanced portfolio. As with any investment, proper allocation is key.

Learn more about SPDR Gold Shares ETF here.

Explore other Exchange Traded Funds (ETFs) in Singapore here.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in SGX ETFs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Disclaimers and Important Notice

Please refer to the Fund's prospectus for the full list of risk disclosures of the Fund.

Past performance is not indicative of future performance.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

1 comments

- Kupusamy • 09 Nov 2025 04:20 AM

- Beansprout • 26 Jan 2026 08:52 AM