Gold hits record highs. Can the rally continue?

Commodities

By Ng Hui Min • 18 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

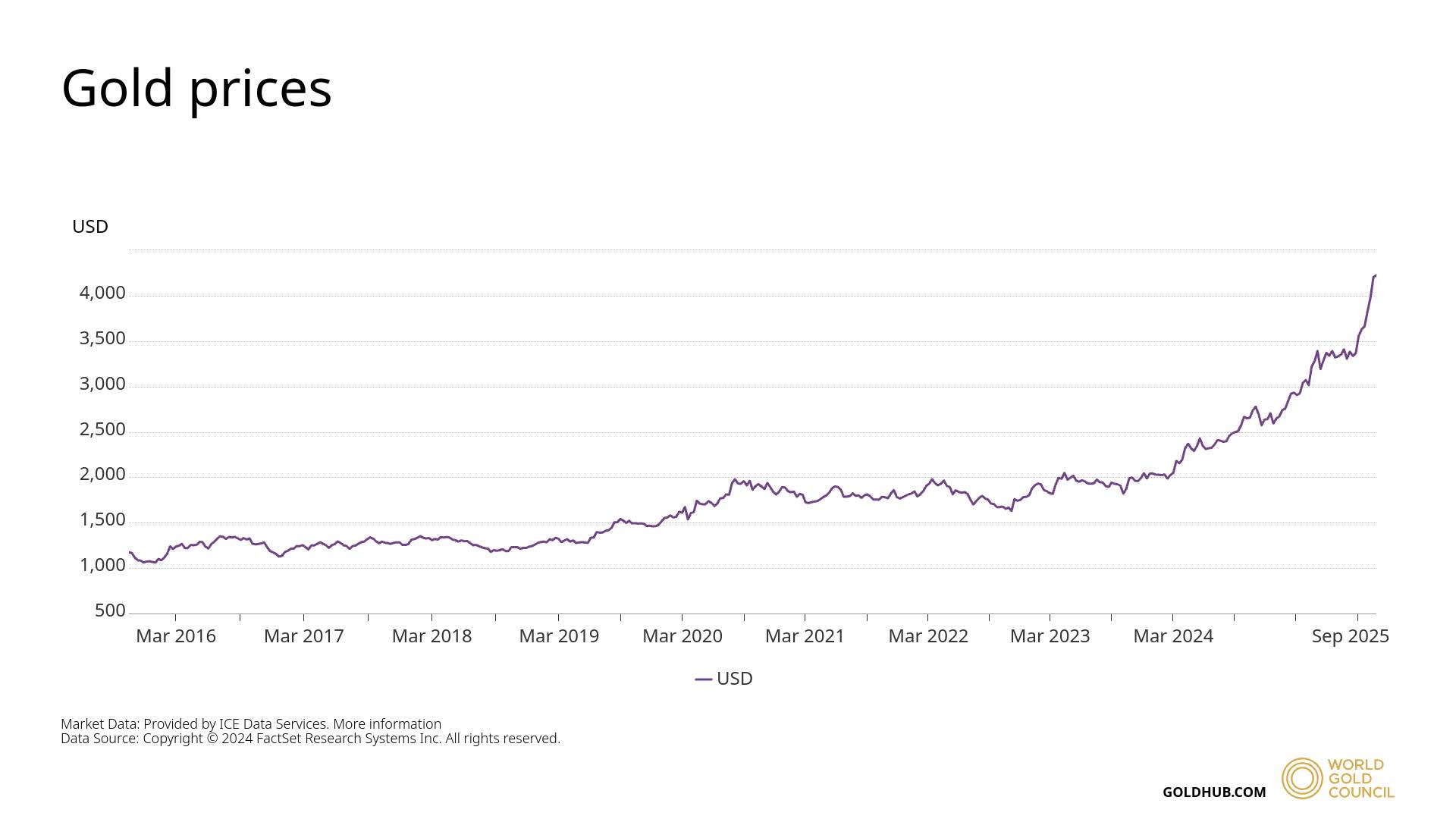

Recently, gold has reached an all-time high of above US$4,300 per ounce, doubling since end-Dec'23. We find out if the rally can continue

What happened?

Gold prices reached an all-time high of above US$4,300 per ounce recently.

It is now up 18.2% in the past month, 66.2% year-to-date and has more than doubled since end-Dec’23.

With these gains, gold became the first asset to hit US$30 trillion in market cap.

I saw discussions in the Beansprout community asking if the rally can continue.

Let us break down the key drivers of this historic run-up to find out if there may be more upside to gold prices ahead.

What is driving the rally in gold prices?

The rally in gold prices is driven by a combination of geopolitical risks, economic uncertainty, monetary policy expectations, and long-term structural demand.

#1 - Safe-haven demand amid uncertainty

Heightened geopolitical risks, from wars in the Middle East to the ongoing conflict in Ukraine, have sent investors scrambling for security.

Simmering US-China trade frictions have only reinforced this need for protection. At the same time, concerns over government debt burdens in the US and other developed economies, together with sticky inflation, have led to the “debasement trade.”

This reflects the loss of confidence in major fiat currencies, particularly the US Dollar, and has encouraged a rotation into hard assets such as gold.

Political risks in major economies, including the US government shutdown (now in its 13th day) and ongoing domestic turmoil in emerging markets, add further fuel to safe-haven demand.

#2 - Central Bank Accumulation

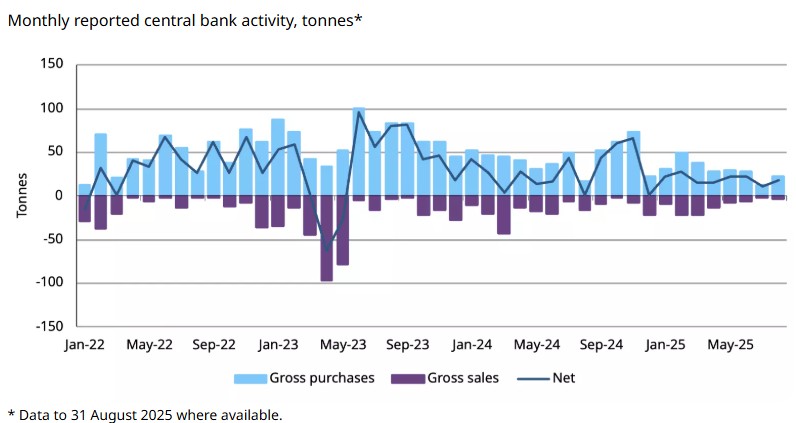

One of the most important structural drivers of this rally has been central bank demand.

Since the freezing of Russian foreign assets in 2022, central banks—especially those in emerging markets—have accelerated efforts to diversify their reserves away from the US Dollar.

Gold has emerged as the preferred vehicle, leading to record levels of official sector purchases.

This steady accumulation acts as a floor under prices and signals that the current rally is supported not just by short-term sentiment, but also by long-term strategic flows.

Central banks return to buying from in August

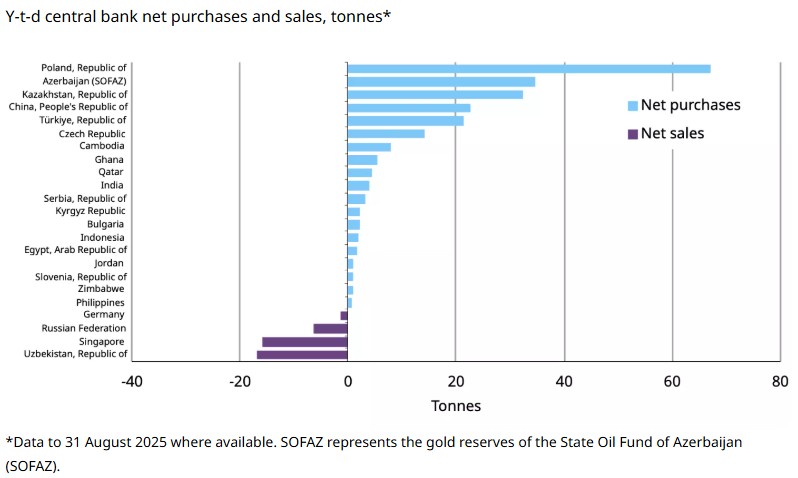

The National Bank of Poland remains the largest buyer year-to-date despite recent pause.

#3 - Risk of stagflation is another driver

Another factor to watch is the possibility of stagflation — a period where inflation remains high even as economic growth slows.

This is a particularly tricky environment for most asset classes.

Equities often struggle because corporate earnings come under pressure, while bonds lose value if central banks are unable to bring inflation down.

Gold, however, has historically performed well in stagflationary settings.

As an inflation hedge, it helps preserve purchasing power when fiat currencies weaken.

With growth faltering, central banks may hesitate to keep rates elevated for long, which keeps real yields low — a supportive backdrop for gold.

In addition, stagflation tends to fuel safe-haven flows, as investors seek protection against both economic stagnation and persistent inflation.

In short, if stagflation risks build, gold could continue to serve as one of the few assets that provides meaningful diversification when both stocks and bonds are under pressure.

#4 - Monetary Policy and Dollar Weakness

Another pillar of support comes from monetary policy.

With the US Federal Reserve now widely expected to pivot toward a rate-cutting cycle, the opportunity cost of holding gold has fallen.

Gold does not yield income, so lower interest rates make it relatively more attractive compared to bonds or cash.

In addition, a weaker US Dollar has boosted international demand for the metal, as it becomes cheaper in other currencies. The US Dollar Index is down 9.4% year-to-date, as of 16 October 2025.

The broader trend of de-dollarization—where countries and investors reduce reliance on the US Dollar in global trade and reserves—has further reinforced gold’s role as a store of value.

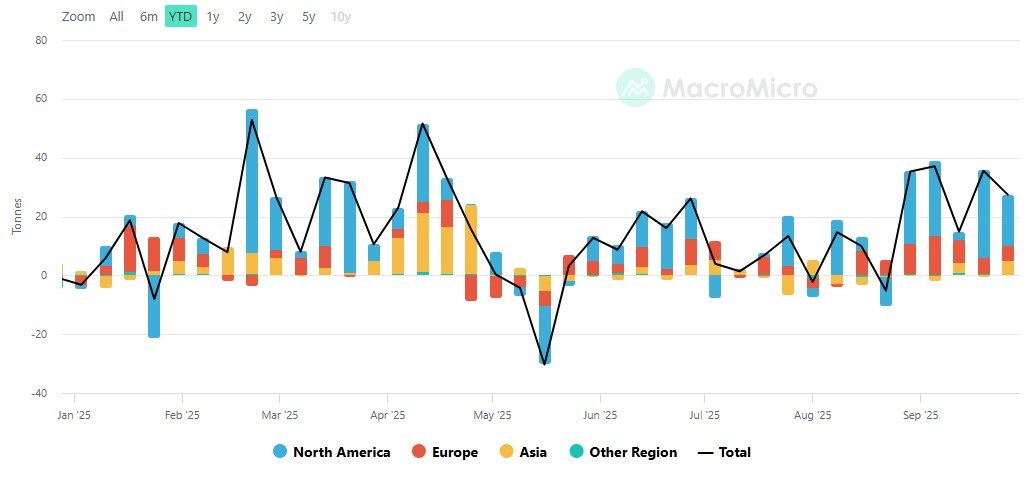

#5 - Investor Momentum and ETF Inflows

Finally, investor psychology has added a layer of momentum to gold’s advance.

Rising prices have attracted institutional and retail inflows alike, particularly into gold-backed Exchange-Traded Funds (ETFs).

Record levels of ETF subscriptions suggest that investors are piling into the rally for fear of missing out.

As seen in the chart below, global gold ETFs recorded their largest monthly inflow in September, resulting in the strongest quarter on record (US$26 billion).

At the same time, some market participants view gold as a hedge against a potential correction in the highly valued, AI-driven technology sector.

This mix of conviction buying and defensive positioning has provided additional support.

Will the rally in gold prices continue?

Even though the drivers of gold’s rally remain strong, there are several risks that investors should monitor.

A faster-than-expected rebound in the US Dollar could weigh on gold, especially if there is a repricing of Fed rate cut expectations and if other major economies lag behind the Fed in cutting rates.

Inflation trends will also matter — if price pressures ease sharply, demand for gold as an inflation hedge could fade.

If stagflation risks rise — with inflation staying high while growth slows — gold could prove especially valuable.

Unlike equities or bonds, which tend to suffer in that environment, gold has historically preserved purchasing power and benefited from safe-haven flows.

Low real yields and ongoing uncertainty would make it one of the few assets that can diversify effectively when traditional markets struggle.

Likewise, if central banks slow their pace of purchases after building reserves aggressively in recent years, one of the structural pillars of support could weaken.

On the political front, any de-escalation of geopolitical flashpoints might reduce safe-haven demand in the short term, even if underlying economic concerns persist.

Finally, gold’s volatility itself is something to watch; sharp moves are common, and investor positioning can swing sentiment quickly.

Gold prices have gone up for eight consecutive weeks, which is unusual but not unprecedented, and is very overbought on both daily and weekly timeframes.

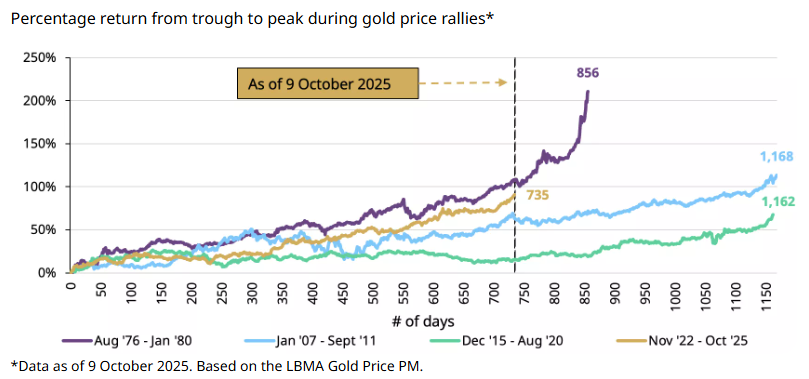

As seen in the chart below, previous major gold rallies have lasted on average 1,062 days.

What Would Beansprout Do?

The current gold rally is not just a short-term spike — it’s backed by momentum and structural drivers.

It reflects deep-seated anxieties about the global economy and politics, combined with strong and durable sources of demand.

That said, the run-up has been steep, and investors should be careful not to chase prices blindly.

We see gold primarily as a tool for diversification rather than speculation. How to buy gold in Singapore

Its most valuable role is as a portfolio stabiliser—an asset that tends to perform well during times of geopolitical stress, monetary easing, or financial instability.

This means it can reduce overall volatility and offer insurance against sudden shocks.

For most investors, a measured allocation to gold—rather than an outsized bet—can strike the right balance between participation in the rally and protection from potential pullbacks.

Timing also matters. After such a strong move higher, the risk of short-term corrections is real, especially if expectations for Federal Reserve easing shift or if the US Dollar stages a rebound.

Investors considering gold exposure might therefore find it prudent to stagger their entry over time rather than investing all at once.

If you are interested to buy gold, learn how to buy gold in Singapore here.

If you are keen to buy physical gold, find out how to buy physical gold from UOB with our step by step guide here.

To gain access to gold in a simple and low-cost way, find out the best gold ETF in Singapore here.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in gold ETFs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments