Gold near all time high. Is there still opportunity to trade?

Trading

By Nicole Ng • 11 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Gold broke past US$4,000. Learn how to use gold futures to hedge risk, capture opportunities, and navigate market volatility.

What happened?

Gold prices have skyrocketed this year, setting a record high at US$4,300 per ounce.

In recent weeks, gold has pulled back slightly, but even after the dip, prices remain above the US$4,000 level, and there is continued discussion about gold in the Beansprout community.

We've shared before about how to buy gold in Singapore, and introduced gold ETFs as a simple way to gain exposure to gold.

Whether you’re a seasoned trader or simply looking to diversify your portfolio, you might be asking, with elevated prices, is there still opportunity to trade gold?

This is where gold futures can play a key role, allowing you to express your market view on gold with flexibility and leverage.

In this article, I’ll unpack what gold futures are, how they can fit into your trading strategy, and what to keep in mind as you navigate the gold market.

Why consider gold futures?

Gold futures allow me to gain exposure to gold prices without having to physically hold or store the metal, meaning I can avoid the added costs of storage, insurance, and administration that come with owning physical gold.

In essence, gold futures are contracts that let me buy or sell gold at a predetermined price on a future date.

Traded on major exchanges within the CME Group, the world’s largest derivatives marketplace, these contracts offer high liquidity, transparency, and global accessibility.

Here’s how gold futures compare with other gold instruments:

| Instrument | Leverage | Liquidity | Considerations |

| Spot Gold | No | Medium | Storage, insurance, admin fee |

| Gold ETFs | No | High | Management fees |

| Gold CFDs | Yes | High | Spread / Commission, counterparty risk |

| Gold Futures | Yes | Very high | Margin & trading fees |

I could use gold futures in several ways, depending on my outlook and goals.

For instance, I could use gold futures to capture quick price movements, hedge against inflation, currency depreciation, or market downturns, or to gain exposure to potential long-term appreciation in gold prices.

| Type of gold instrument | SPDR Gold ETF | Micro Gold Futures | 1OZ Futures |

| Initial investment amount | $5,000 | $5,000 | $2,500 |

| Amount of gold notional equivalent | 2 oz | 40 tr oz, equivalent to four Micro Gold contracts | 20 tr oz, equivalent to 20 1OZ futures contracts |

| Value of a $50 move in gold | $100 | $2,000 | $1,000 |

| Return on investment | 2.0% | 40% | 40% |

| Source: Beansprout, example assumes margin requirement of 5% and price of gold at $2,500 per troy ounce. Exchange margin requirements are variable. | |||

According to Charu Chanana, Chief Investment Strategist at Saxo Markets, “Singapore investors are increasingly using gold futures as a multi-purpose tool — for hedging against macro and geopolitical shocks, and for diversifying away from concentrated exposure to U.S. assets and AI-driven equity themes.”

This growing interest reflects how investors are viewing gold not just as a crisis hedge, but as an active component of a well-balanced portfolio.

Because these contracts are highly liquid and standardised, they offer me a transparent and cost-effective way to participate in the gold market — whether I’m trying to take advantage of short-term volatility or strengthen my overall portfolio.

With their leverage advantage, I can control larger positions with relatively less capital. Combined with nearly 24-hour trading access, gold futures give me the agility to respond quickly to global market events and adjust my positions efficiently.

If you prefer more flexibility when trading gold, you could also explore gold options. Unlike futures, options don’t lock you into a trade.

They simply give you the right, but not the obligation, to buy or sell gold at a specific price before the contract expires at a known, upfront cost, typically called the premium.

In other words, you can participate in gold’s price moves while keeping your potential loss limited to the premium you pay.

Finding the fit: Various gold contract sizes

Gold futures come in a variety of contracts, each designed to suit different types of traders and investment strategies.

The most commonly traded contracts include MGC, GC, and 1OZ gold futures.

Each type of gold futures contract comes with different margin requirements, expiration dates, and tick sizes, allowing traders to select the one that best fits their risk tolerance and trading goals.

| Type | 1-Ounce Gold (1Oz) | Micro Gold Futures (MGC) | Gold Futures (GC) | What’s the Difference? |

| Contract Size | 1/100 of Gold | 1/10 of Gold | 100oz | Choose the right size for you. 1OZ futures allow for the most precise trading yet with the smallest required capital to start trading. If you’re looking for more exposure, consider MGC or GC |

| Approximate Notional Value | $4,000 | $40,000 | $400,000 | |

| Tick Size | 0.25 per troy ounce = $0.25 | 0.10 per troy ounce = $1.00 | $0.1 per troy ounce = $10.00 | All contracts tick in the same increment, adjusted by the contract size. No confusing operational nuance between the contracts to consider |

| *Based on gold price of $4,000 per ounce - Gold value changes daily Source: CME Group | ||||

Chanana notes, “The introduction of micro gold contracts has made access far more flexible, allowing investors to scale positions and manage margin efficiently — a key driver behind the broader retail adoption we’re seeing.”

With micro contracts, even smaller traders can participate in gold markets with better risk control and flexibility.

Practical strategies for trading gold futures

#1 - Safe-haven tactical allocation

In times of market turbulence, like during the US–China trade war, I could use gold futures as a tactical hedge against equity volatility, instead of buying physical gold, which can be costly and harder to offload.

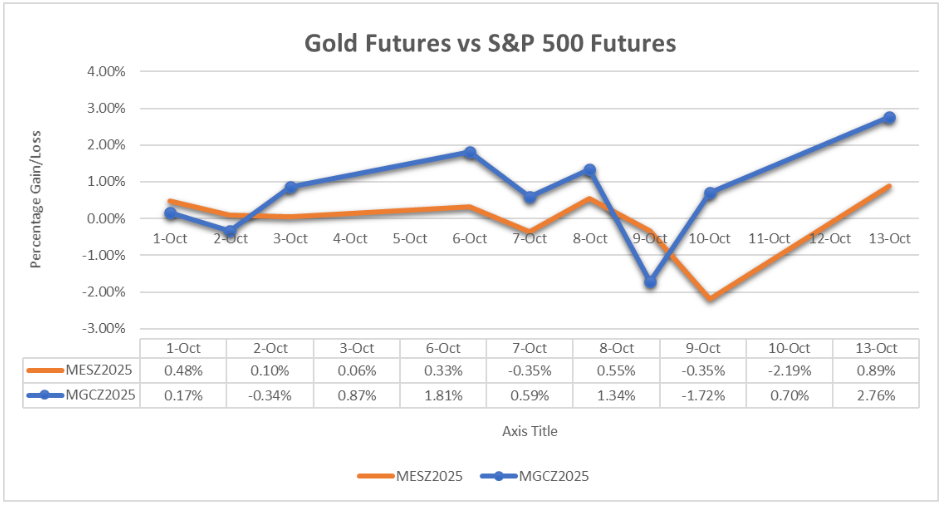

For example, adding two MGCZ2025 (December Expiry) contracts at a price of 3,886.8 on 1 October 2025 and holding for two weeks until 14 October 2025, would have outperformed the S&P 500 Futures, MESZ2025 (December Expiry) over the same period.

Source: CME Group, as of 14 October 2025

As illustrated in the chart above, the S&P 500 experienced modest declines amid global tariff tensions, while gold prices remained resilient.

As of 14 October, the two MGCZ2025 positions entered would have an unrealised profit of approximately US$4,884, based on the market open price of 4,131.

This gain helps offset potential losses in my equity futures holdings and highlights gold’s effectiveness as a tactical safe-haven allocation.

#2 - Hedging against inflation

Similarly, I can establish a longer-term position to hedge against inflation, given the uncertainty surrounding the effects of tariffs and potential rate cuts while US inflation remains elevated.

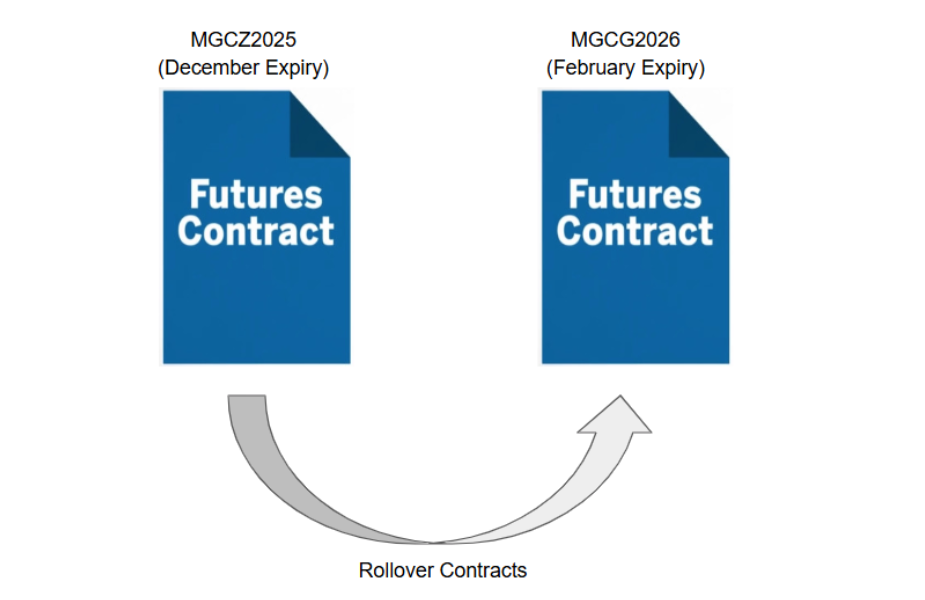

For example, I could choose to roll over my MGCZ2025 (December Expiry) positions at the end of the month if I decide to maintain my inflation hedge after reviewing upcoming inflation data.

Rolling over involves closing the existing position and opening a new one in a later-dated contract, such as MGCG2026 (February Expiry) or MGCJ2026 (April Expiry).

This approach extends my exposure to gold without taking physical delivery and allows continued participation in potential price gains over the longer term.

#3 - Speculating on short-term price moves

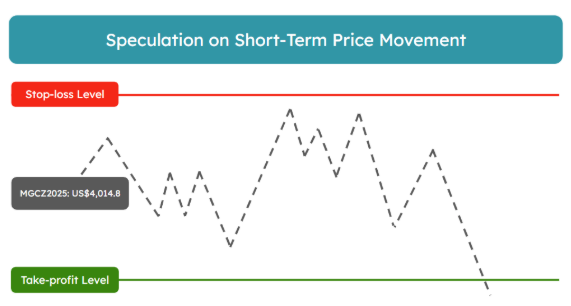

Finally, there is the strategy of speculating on short-term price movements.

As gold prices reach all-time highs, short-term pullbacks may occur on certain days.

As Chanana observes, “Elevated prices above US$4,000 an ounce and ongoing uncertainty around U.S. rates have led to more short-term trading and hedging strategies, with clients rotating between long and short exposures to capture volatility rather than simply buying dips.”

This active approach reflects how investors are navigating today’s volatile gold market, using futures to trade both sides of price swings.

Using futures, I could take a short position in MGCZ2025 (December Expiry) on 9 October, following news regarding the US–China trade war.

This would allow me to trade on an intraday basis, potentially profiting if gold prices decline, while taking advantage of market volatility without holding physical gold.

This approach provides flexibility to capitalise on market fluctuations without owning physical gold, but it also carries higher risk due to leverage and volatility.

Therefore, I always emphasise that it is important to set clear entry and exit points, as well as stop-loss levels, to manage risk effectively.

Understanding the risks of trading gold futures

#1 - Event risk

Gold prices are highly sensitive to geopolitical tensions, central bank policies, and macroeconomic data releases.

Events such as unexpected interest rate changes, conflicts, or shifts in inflation expectations can cause sharp price movements.

If I am trading on leverage, these sudden swings can magnify both my profits and losses, making risk management essential.

#2 - Risk management for gold price volatility

Because the gold market can move swiftly and unpredictably, especially during periods of financial stress or in reaction to major news events, you should plan your entry and exit points, set stop-loss orders, and avoid overexposure.

Discipline in position sizing and trade timing isn’t just about managing risk — it’s what separates a confident trader from one who loses sleep over market volatility.

What would Beansprout do?

Gold futures offer investors and traders a versatile way to gain exposure to gold’s price movements without holding physical metal.

They can be used as a hedge against inflation, a safe-haven during market uncertainty, or a tool for short-term trading, providing flexibility, leverage, and high liquidity.

However, the potential for amplified gains comes with increased risk due to the use of leverage, making disciplined risk management, informed decision-making, and the use of educational resources essential.

If you are new to futures, it helps to start with the basics on how futures work, including leverage and margin, in our futures guide.

If your goal is portfolio risk management, our hedging with futures article explains how to think about exposure, position sizing, and when rolling a hedge may be necessary.

If you are comparing instruments for downside protection, our guide on using futures and options to protect profits explains the trade-offs, using the S&P 500 as an example.

If you also want context on how futures are used outside commodities, our US index futures guide provides a reference point on the main equity index contracts and risk controls, which can help when thinking about gold alongside the rest of your portfolio.

Check out free learning materials available on the CME Group website to deepen your understanding of gold futures and practice trading using the CME Trading Simulator.

With a well-planned strategy and disciplined execution, investors can effectively participate in the opportunities that gold futures offer in today’s dynamic market.

Disclaimer

Any information provided in this article is meant purely for informational and investor education purposes and should not be relied upon as financial or investment advice, or advice on corporate finance.

This article is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to purchase any financial product or subscribe or enter any transaction. This article also does not take into account your personal circumstances, e.g. investment objectives, financial situation or particular needs and shall not constitute financial advice. You should consult your own independent financial, accounting, tax, legal or other competent professional advisors.

The information provided in this article are on an “as is” and “as available” basis without warranty of any kind, whether express or implied. Beansprout does not recommend any particular course of action in relation to any investment product or class of investment products. No information is presented with the intention to induce any person to buy, sell, or hold a particular investment product or class of investment products.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments