Keppel DC REIT Preferential Offering – What should unitholders do?

REITs

By Gerald Wong, CFA • 04 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The Keppel DC REIT preferential offering will offer entitled unitholders the right to buy 80 new units at S$2.24 each for every 1,000 units held.

What happened?

Singapore REITs have been more active with acquisitions recently.

In the past few months, we have seen CapitaLand Ascendas REIT expanding its Singapore portfolio, and CapitaLand Integrated Commercial Trust (CICT) buying CapitaSpring.

It seems like falling interest rates have opened the window for Singapore REITs to pursue growth opportunities through buying assets once again.

This has helped to boost the dividend yields offered by Singapore REITs to above the T-bill yields.

Recently, Keppel DC REIT has also announced the acquisition of a data centre in Japan, as well as a preferential offering to fund the purchase.

Let us dive deeper into the acquisition to find out how it may also help to lift Keppel DC REIT’s dividend yield, and if it is worthwhile applying for the preferential offering.

Acquisition of Tokyo Data Centre 3

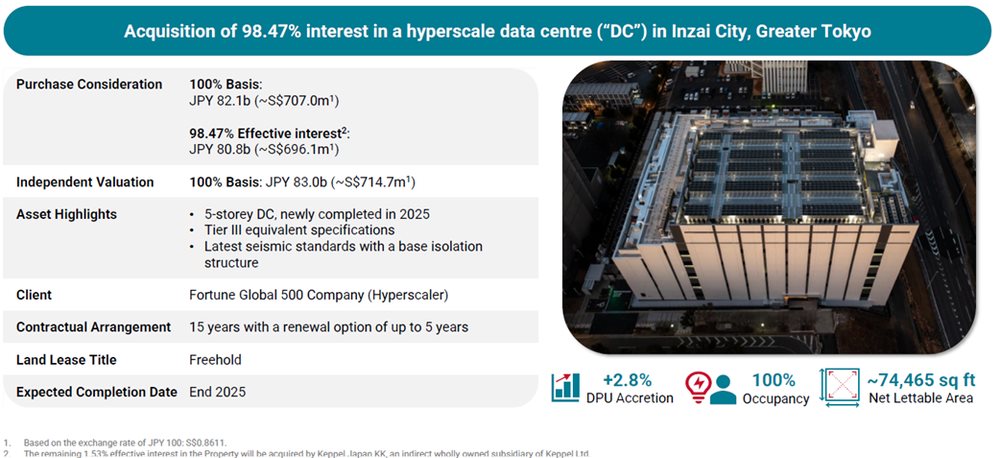

Keppel DC REIT (KDCREIT) and Keppel Ltd (Keppel) have jointly announced the acquisition of Tokyo Data Centre 3 from unrelated third-party vendors for a total purchase consideration of JPY 82.1 billion (approximately S$707.0 million).

Under the terms of the transaction, Keppel DC REIT will hold a 98.47% effective interest in the property, while Keppel will hold the remaining 1.53%.

Correspondingly, Keppel DC REIT will fund JPY 80.8 billion (approximately S$696.1 million) of the total purchase consideration.

The agreed price represents a 1.1% discount to the asset’s independent valuation of JPY 83.0 billion.

The transaction is expected to complete by end-2025.

About Tokyo Data Centre 3

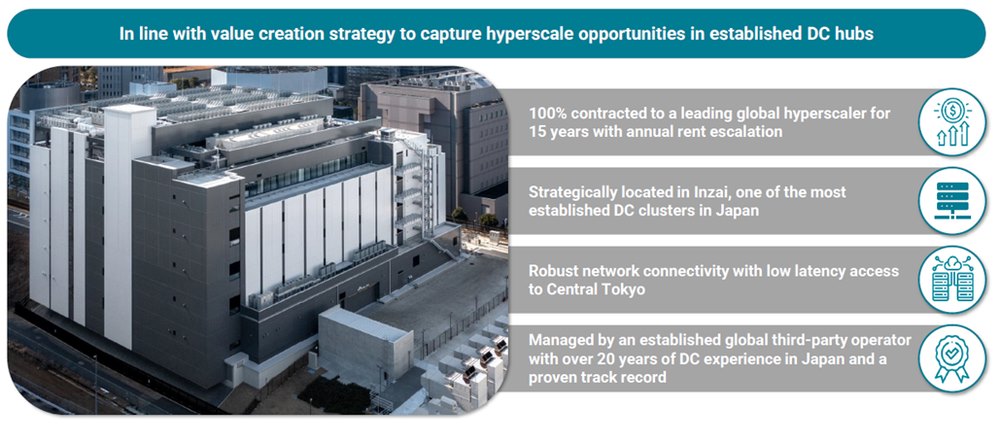

Tokyo Data Centre 3 is a freehold, newly constructed hyperscale data centre located in Inzai City, Greater Tokyo, one of Japan’s most established data centre clusters.

The asset is fully leased to a global hyperscaler under a 15-year agreement that includes built-in annual rent escalations.

Strategically positioned, the facility offers low-latency connectivity to central Tokyo.

The five-storey, Tier III-equivalent building has been developed to the latest seismic standards and is managed by a global operator with more than 20 years of operational experience.

Deepens presence in Japan

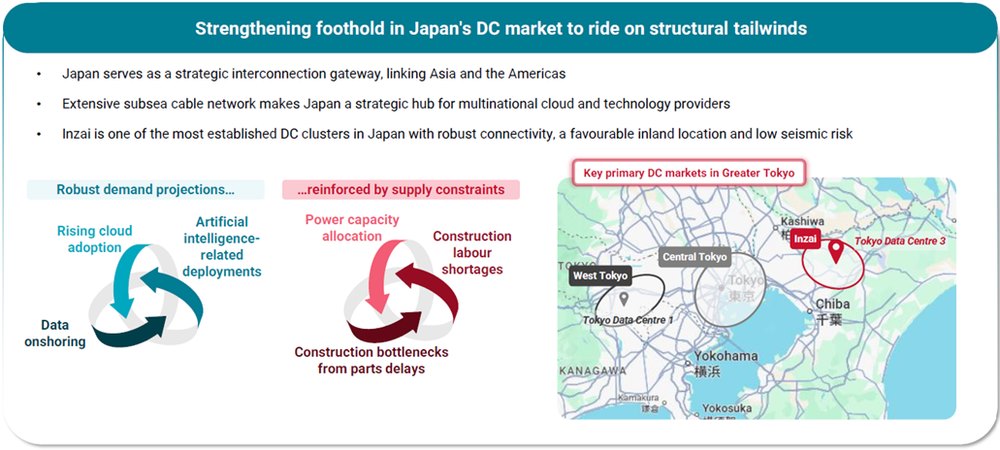

The acquisition will mark Keppel DC REIT’s second data centre investment in Japan, further expanding its footprint in one of Asia Pacific’s most established data centre markets.

Japan remains the largest data centre hub in the region (excluding China), supported by favourable demand-supply dynamics and its strong interconnectivity between Asia and the Americas.

The acquisition of Tokyo Data Centre 3 is expected to enhance Keppel DC REIT’s exposure to this high-growth market and strengthen its long-term position in Japan’s data centre industry.

Accretive to distribution per unit (DPU)

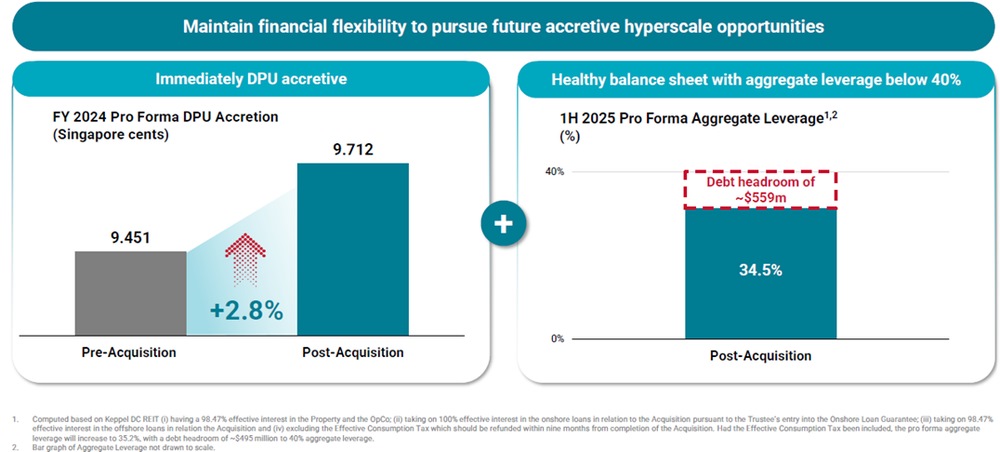

The transaction is expected to be yield accretive from completion.

On a pro forma basis, Keppel DC REIT’s FY2024 distribution per unit (DPU) would have risen by 2.8% to 9.712 cents.

Following the acquisition, the REIT’s aggregate leverage is estimated to increase from 30.0% to 34.5% as of 1H2025.

Despite the increase, the balance sheet remains healthy, with an estimated debt headroom of approximately S$559 million, providing financial flexibility for future opportunities.

Strengthen portfolio profile

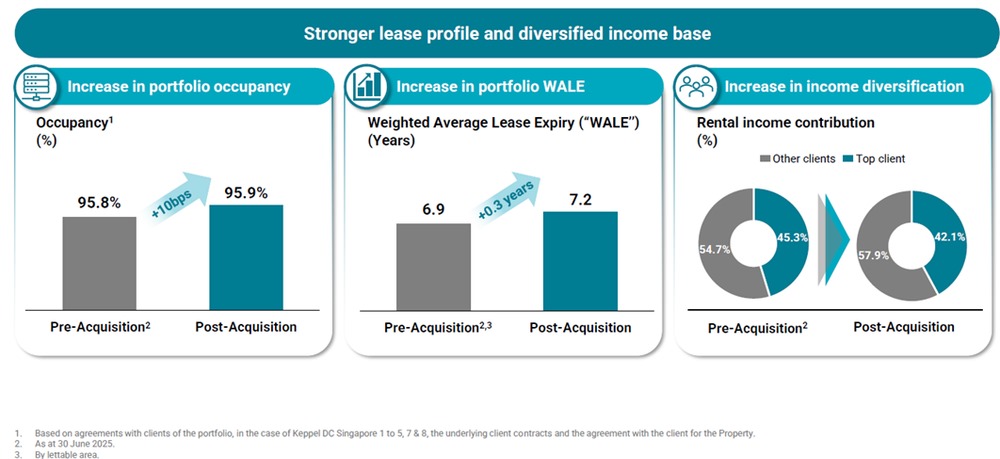

Following the acquisition, Keppel DC REIT will strengthen its lease profile and diversify its income base.

Portfolio occupancy will rise to 95.9%, compared to 95.8% at end-June 2025, while the weighted average lease expiry will extend to 7.2 years from 6.9 years.

Preferential offering launched on 3 October 2025

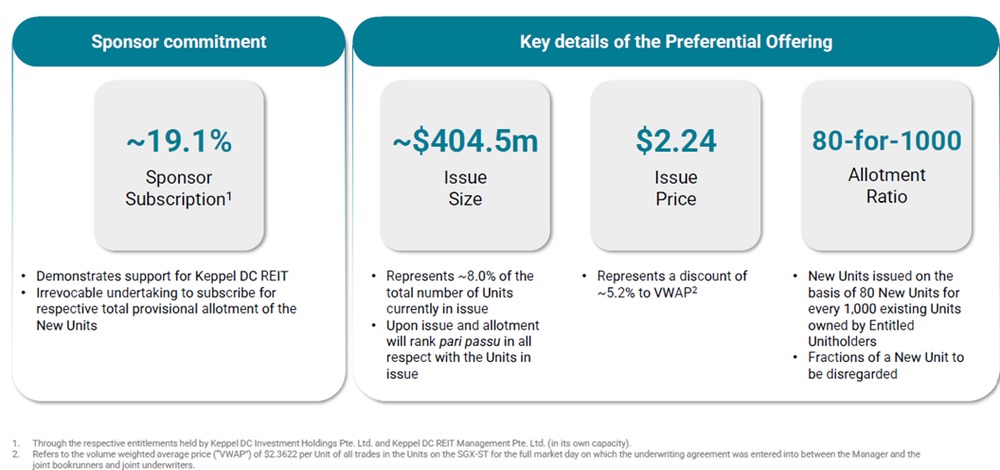

To fund part of the acquisition, Keppel DC REIT launched a non-renounceable preferential offering to raise S$404.5 million.

A total of 180.56 million new units will be issued at an offering price of S$2.24 per unit.

Entitled unitholders will be able to subscribe for 80 preferential units at S$2.24 each for every 1,000 units held.

What would Beansprout do?

Keppel DC REIT’s acquisition of Tokyo Data Centre 3 strengthens its position in Japan, one of Asia Pacific’s largest and fastest-growing data centre markets.

The freehold asset in Inzai City, Greater Tokyo, is fully leased to a global hyperscaler for 15 years with annual rent escalations.

The S$707 million acquisition is priced at a 1.1% discount to valuation and is immediately yield-accretive, with FY2024 pro forma DPU expected to rise by 2.8% to 9.712 cents.

The preferential offering issue price of S$2.24 represents a 6.7% discount to Keppel DC REIT’s share price of S$2.40 as of 2 October 2025.

In our view, the preferential offer presents an opportunity for existing unitholders to accumulate at a discount to the market price.

At the share of price of S$2.40, Keppel DC REIT offers a historical distribution yield of 4.2%.

Keppel DC REIT trades at a price-to-book valuation of 1.54x, based on its pro forma book value of S$1.56 (as of 31 December 2024).

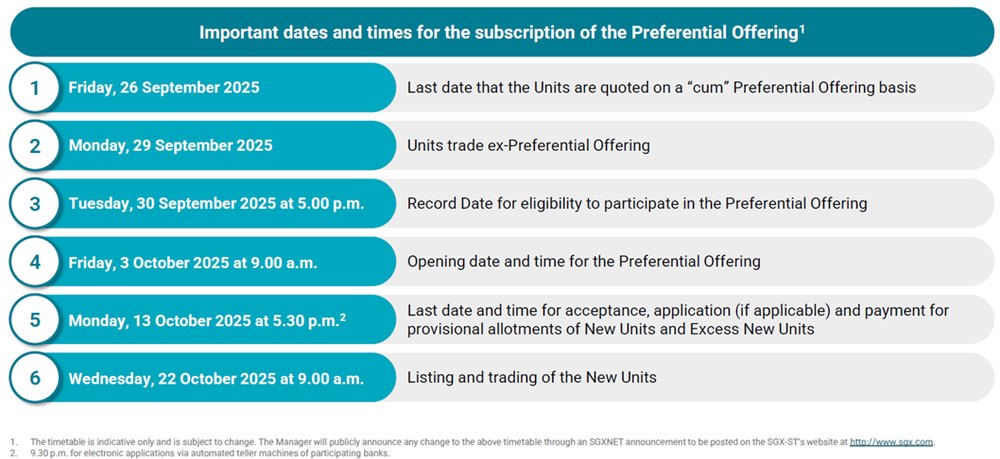

The offer opens on 3 October 2025 (9 a.m.) and closes on 13 October 2025 (5:30 p.m.).

To screen for Singapore REITs with lowest price-to-book valuation or highest dividend yield, check out our best Singapore REIT screener.

If you are new to investing in Singapore REITs, you can start to learn more about Singapore REITs here.

If you prefer diversification without picking individual REITs, you can also gain exposure through Singapore REIT ETFs.

[Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher, S$18 cash voucher, plus 2x6% p.a. interest boost on S$2,000 with Longbridge Cash Plus for 90 days (worth up to S$60) when you sign up for a Longbridge account via Beansprout and fund S$2,000. T&Cs apply. Learn more about the Longbridge promotion here.

Related links:

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Keppel DC REIT.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments