Singapore Savings Bond (SSB) 10-year return at 1.83%. Worth applying?

Bonds

By Gerald Wong, CFA • 25 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The latest issuance of the Singapore Savings Bond (SSB) has a 10-year average return of 1.83% per year. We share if it's worth applying for the SSB.

What happened?

I have received questions about how to earn a higher interest rate on our savings.

Recently, I compared T-bills vs fixed deposits vs savings accounts to park your cash in October 2025.

One option that I discussed was the latest issuance of the Singapore Savings Bonds (SSB), which has a 10-year average return of 1.83%.

This is higher than the latest 6-month T-bill yield and the best fixed deposit rates in Singapore, and makes it an attractive option to to earn passive income in Singapore.

In this article, I will be sharing more about the SSB to find out if its worthwhile applying for the current SSB or wait for the next one.

What to expect for the latest Singapore Savings Bonds (SSBs)

#1 – Latest SSB offers 10-year average interest rate of 1.83%

The latest SSB issuance offers a relatively attractive interest rate.

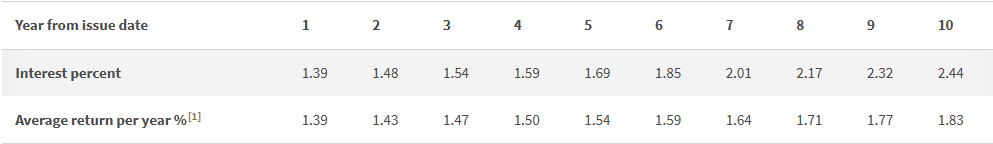

If you hold on to the SSB for 1 year, you will receive an average return of 1.39%.

If you hold on to the SSB for 10 years, you will receive an average return of 1.83% per year.

The 10-year average return of 1.83% is below the rate of 1.93% p.a. offered by the previous SSB.

The 1-year rate of 1.39% is close to the best 3 month and 6 month fixed deposit rate in Singapore.

#2 – SSB interest rate projected to stay at about 1.82%

For those new to the Singapore Savings Bond (SSB), it’s important to understand that SSB interest rates are closely tied to the yields of Singapore Government Securities (SGS).

Similar to T-bills, SGS are bonds issued by the Singapore government. But, they have a longer maturity of 2 years to 30 years.

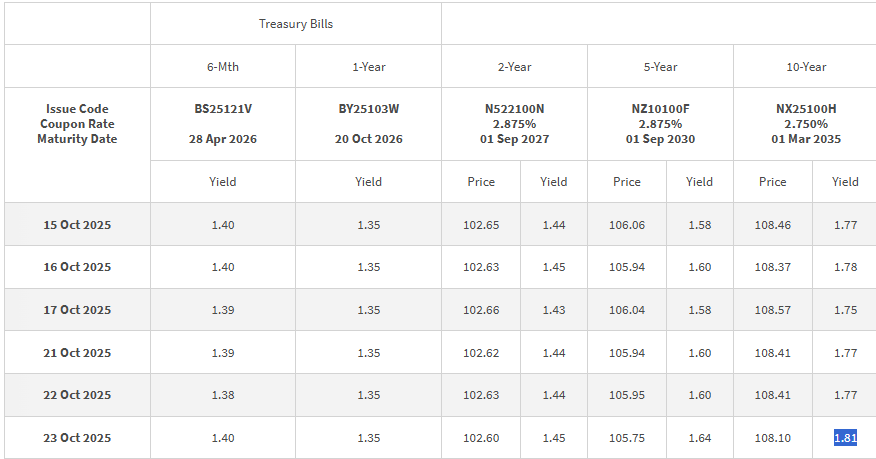

The interest rates on each SSB issuance are linked to the daily average SGS yields as published by MAS in the previous month.

This means that the average annual return from the SSB over a given period (e.g., 10 years) would broadly reflect the yield of a comparable SGS (e.g., the 10-year SGS), but with about a one-month lag.

In other words, the 10-year average return of the upcoming SSB will largely mirror the yield of the 10-year Singapore government bond or SGS observed this month.

As shown in the chart below, the 10-year SGS yield has continued to trend downward from May 2024 through to October 2025.

The ongoing decline reflects rising expectations of US Federal Reserve interest rate cuts, as well as rising demand for safe haven assets such as Singapore government bonds.

As of 23 October 2025, the closing yield on the 10-year Singapore government bond stood at approximately 1.81%.

This is close to the 10-year average return offered by the current SSB.

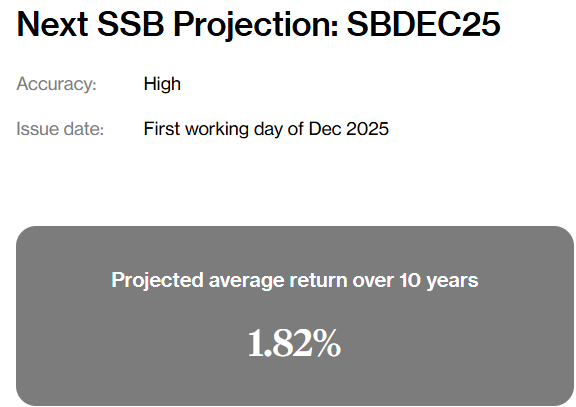

Based on the average yield observed in October, the 10-year average return for the next SSB is likely to be close to the current issuance.

As of 24 October 2025, our SSB interest rate projection estimates that the next SSB may offer a 10-year average return of approximately 1.82%.

This estimate is based on the average closing yield of the 10-year Singapore Government Bond recorded so far in October, assuming the yield remains steady at 1.81% for the rest of the month.

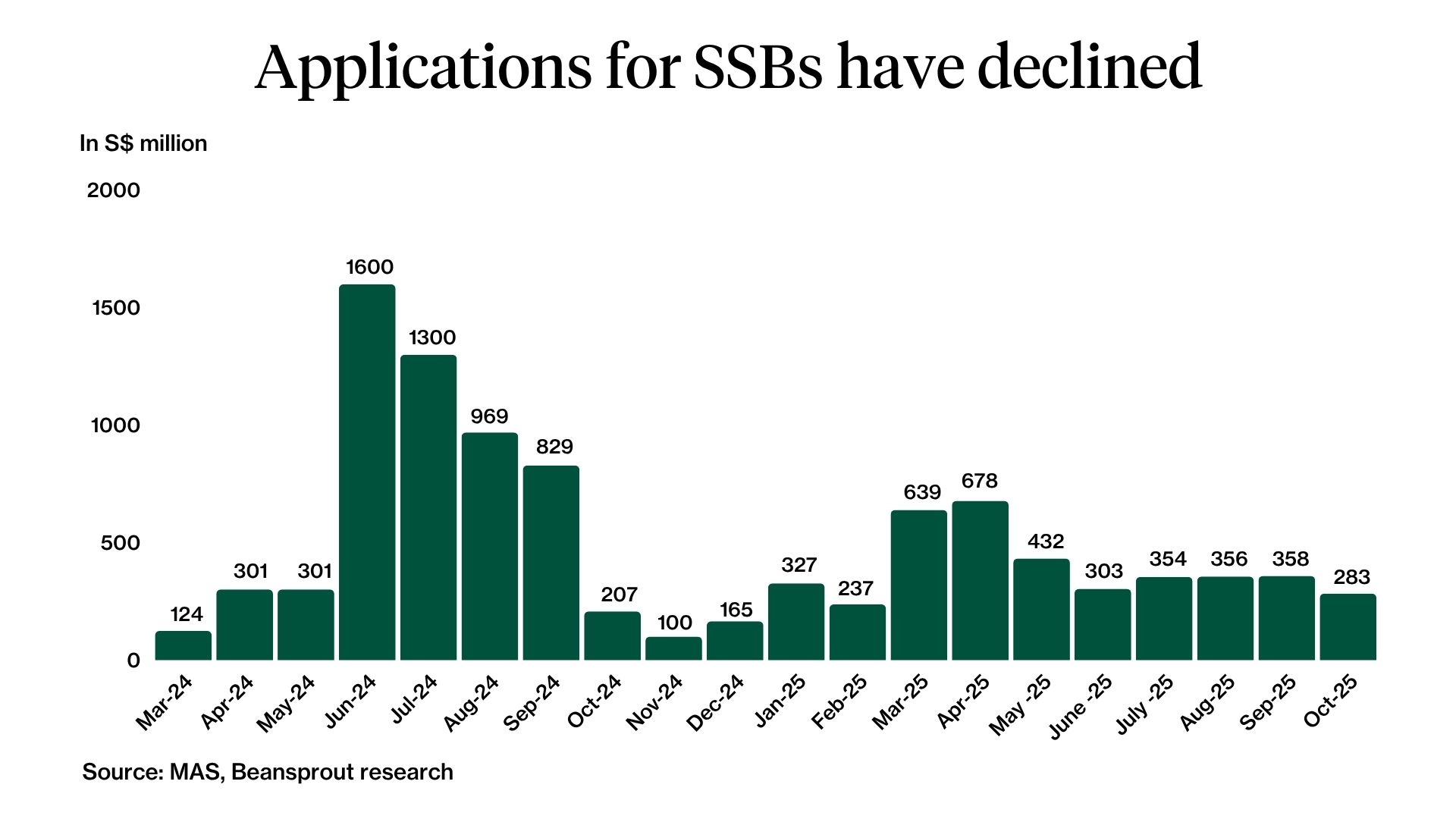

#3 – Demand for SSB fell in the latest issuance

Despite offering relatively attractive interest rates compared to T-bills and fixed deposits, demand for the October issuance of the SSB fell.

Applications amounted to S$283 million, a decrease from the S$358 million in September, and still below the S$432 million seen in the May issuance that offered a 10-year average return of 2.69%.

With an amount offered of S$400 million for the current SSB, investors may receive full allocation if demand remains muted.

What would Beansprout do?

The latest issuance of the SSB offers a 10-year average return of 1.83%.

With the 10-year average return on the next SSB projected to remain steady at about 1.82%, it might not make a significant difference whether apply for the current SSB rather than to wait for the next one.

The latest SSB also allows us to lock in a rate of 1.83% over 10 years, while having the flexibility to redeem prior to maturity.

I would consider the SSB mainly for the opportunity to lock in the yields for a period of up to 10 years, to mitigate the risk of interest rates falling further.

The 1-year rate of 1.39% is similar to the 6-month T-bill yield, and the best 6-month fixed deposit rate too.

If you are looking for the best place to park your savings, we compare SSBs to T-bills and fixed deposits to find out how to allow our spare cash to work harder.

For example, we were still able to find savings accounts in Singapore that offer an interest rate of above 1.39% p.a. For example, the DBS Multiplier promo allows new Multiplier customers to earn up to 2.5% p.a. on the first S$100,000.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

💰[Limited Offer Until 31 Oct] Get bonus S$50 FairPrice voucher within 5 working days, S$18 cash voucher, plus 2x6% p.a. interest boost on S$2,000 with Longbridge Cash Plus for 90 days (worth up to S$60) when you sign up for a Longbridge account via Beansprout. Stand a chance to win 1g gold bar (worth ~$220)! T&Cs apply. Learn more about the Longbridge promotion here.

To find out how much more interest you can potentially earn by swapping your previous bonds to the current, check out our SSB swap calculator.

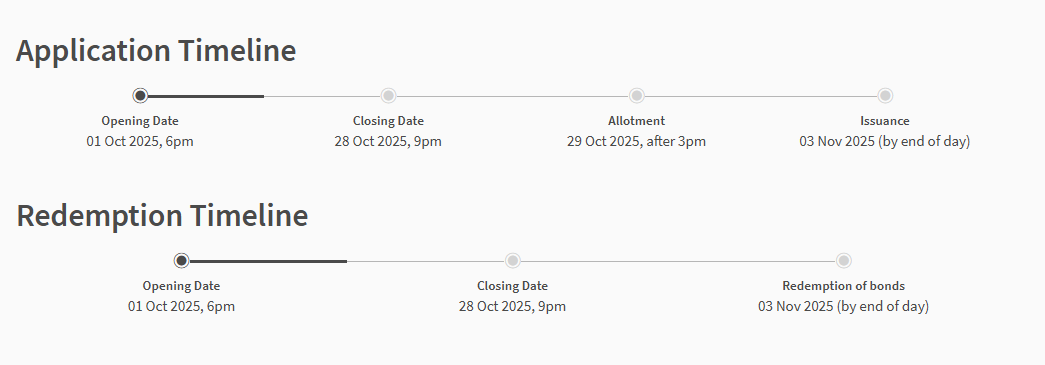

Application for the latest SSB will close at 9pm on 28 October (Tuesday). Redemption of SSBs will also close at 9pm on 28 October (Tuesday).

You can sign up for a email reminder to be reminded of future SSB closing dates.

Learn more about SSBs and how to apply for SSBs using our comprehensive SSB guide.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments