GXS Savings Account: Earn up to 1.30% p.a. interest

Savings Account

By Beansprout • 02 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Earn up to 1.30% p.a. with a GXS Savings Account and get up to S$192 cashback with the GXS Huat Campaign.

What happened?

When it comes to earning more on your cash savings, digital banks like GXS are often top of mind.

With the GXS Savings Account, you’ll earn a daily interest rate of 1.08% p.a. on the Main Account and 1.18% p.a. on its Saving Pockets on deposits of up to S$95,000 as of 2 February.

On top of that, GXS offers Boost Pockets that lets you lock in rates of up to 1.30% p.a. for fixed tenures of 1, 3, 8 or 12 months on deposits of up to S$85,000 as of 2 February 2026.

If you’re not yet familiar with the GXS Savings Account, here’s a closer look at what it offers, and whether it could be the right fit for your savings goals.

What is the GXS Savings Account?

The GXS Savings Account is a savings account offered by GXS, one of the digital banks licensed by the Monetary Authority of Singapore (MAS).

GXS is backed by a consortium consisting of Grab Holdings and Singtel. In case you’re still wondering, this explains its name GXS (or Grab x Singtel).

Since its launch in August 2022, all available GXS savings account slots were taken up within months.

According to the company, the waitlist registration for the GXS Savings Account has also grown by more than 2.5 times since March 2023.

GXS also started offering GXS FlexiLoan, the first unsecured term loan amongst banks in Singapore.

This allows customers to pay off their loan partially or in full without any early repayment fees and with the additional benefit of saving on interest payments.

GXS also introduced GXS Invest, which is a new product within the GXS app that allows you to invest fuss-free in a money market fund. Learn more about GXS Invest here.

What is the interest rate on the GXS Savings Account?

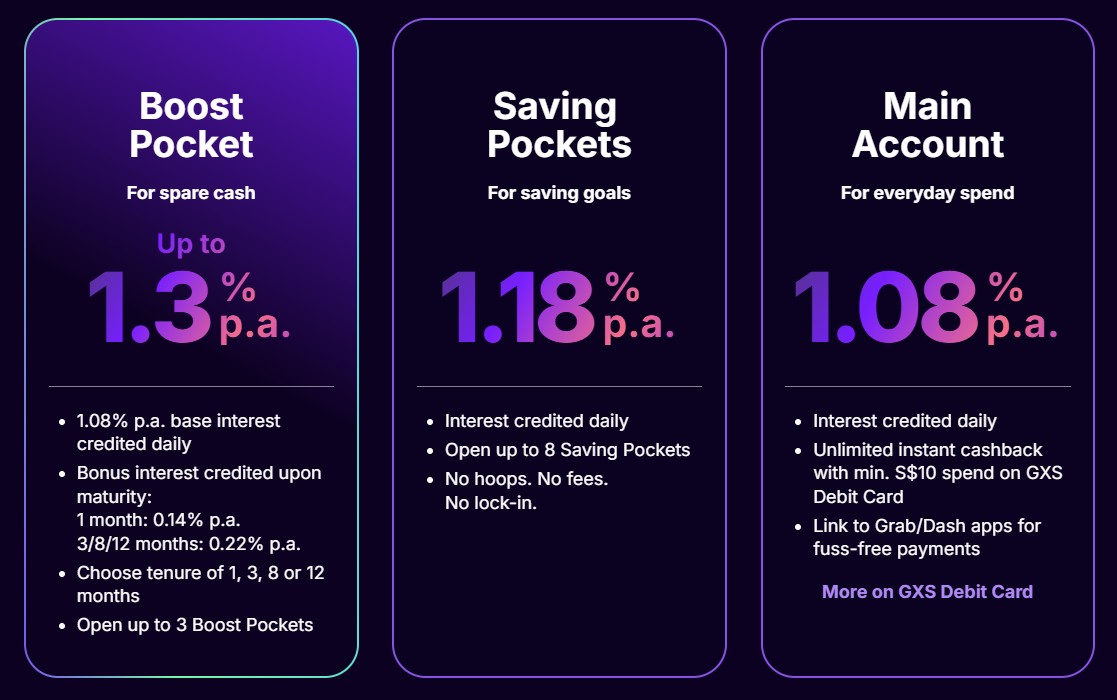

The Savings Account consists of the Main Account, Saving Pockets and Boost Pocket.

The GXS Main Account offers an interest rate of 1.08% p.a.

The GXS Saving Pockets offers an interest rate of 1.18% p.a. and you can open up to 8 Saving Pockets and deposit up to S$95,000.

It might also be worthwhile knowing that GXS credits interest to your account daily.

This means that you do not have to worry about losing out on the interest if you need to withdraw your savings at any point in time.

What is the interest rate on the GXS Boost Pocket?

GXS Bank (GXS) launched Boost Pocket to help GXS Savings Account customers grow their savings faster.

This allows customers with a GXS Savings Account to open a Boost Pocket through the GXS App.

The Boost Pocket carries a base interest rate of 1.08% p.a., which is credited daily.

It also has a bonus interest rate of up to 0.22% p.a. that will be applied if the Boost Pocket is held to the 1 month, 3 months, 8 months or 12 months maturity.

Bonus interest:

- 0.14% p.a. for 1 months

- 0.22% p.a. for 3, 8 or 12 months

This means that you can earn an interest rate of up to 1.30% p.a. for 1 month, 3 months, 8 months or 12 months through the GXS Boost Pocket.

Total interest rate earned:

- 1.22% p.a. for the 1 month tenure

- 1.30% p.a. for the 3, 8 or 12 months tenure

No penalty will be charged if funds are withdrawn before maturity and you will still earn the base interest rate of 1.08% p.a. up till the withdrawal date.

If you want to retain your savings in the Boost Pocket for an extended period, you can opt to roll it over for the same duration at the current interest rate applicable at the time of extension.

Funds in the Boost Pocket will automatically be transferred back to the Main Account once matured if not extended.

GXS customers have the flexibility to extend or withdraw their Boost Pocket at any time while it remains active.

Customers can fund the Boost Pocket with any amount starting from S$100.

You can open up to three Boost Pockets. This means that you can fund a maximum total of S$85,000 across all your Boost Pockets.

What are the latest GXS Bank promotions?

From 22 January 2026 to 28 February 2026, GXS Bank is celebrating the Chinese New Year with its GXS Huat Campaign!

Open a GXS Savings Account and deposit a minimum of S$5,000 into the 3-month Boost Pocket named “HUAT”. You’ll receive S$12 cashback for every S$5K deposited, on top of 1.3% p.a. interest.

Stack multiple deposits to earn up to S$192 cashback in total!

You can find out more about GXS latest promotion here.

How does GXS compare to MariBank and Trust Bank?

In case you’re wondering how does GXS compare to Trust Bank and MariBank, I've compiled them in the table below.

If you’re after a fuss-free way to grow your savings, GXS offers the highest base rate among the three digital banks at up to 1.30% p.a., though this applies only to deposits of up to S$95,000.

By comparison, Trust Bank’s Flex Plan can offer up to 2.5% p.a., but you’ll need to meet requirements such as salary crediting, investing, and referring a credit card customer.

| MariBank | GXS Bank | Trust Bank | |

| Savings account interest rate | 0.88% p.a. | Up to 1.30% p.a. | Up to 2.50% p.a. |

| Maximum deposit | S$100,000 | S$95,000 | Maximum deposit of S$1.2 million. Maximum interest rate of 2.50% only earned on Flex Plan with salary credit, investment and card referral. |

| Eligibility requirements |

|

|

|

| Benefits | 4.5% Cashback on overseas spend and 0.5% unlimited cashback with Mari Debit Card | Get 0.6% back in GrabCoins when you pay with your linked GXS Savings Account for eligible Grab transactions | Promotional discounts on FairPrice Group spending |

| Physical branches and ATMs | Nil | Nil | 20 ATMs islandwide |

| Source: Company websites as of 2 February 2026 | |||

What users may not like about GXS

#1 – Account limit of S$85,000 on Boost Pocket

Like I mentioned earlier, you can open a maximum of three Boost Pockets with a total deposit cap of S$85,000.

This means that even if you have a lot of savings, you will only be able to enjoy the promotional interest rate up to S$85,000 of deposits in your Boost Pockets.

The GXS Saving Pocket and Main Account can have a total maximum deposit of S$95,000.

To find out which other savings accounts allow you to earn a higher interest rate on your savings, check out our guide to the best savings account in Singapore.

#2 - Limited functions currently

As a newly launched digital bank, the functions that are available for customers are still fairly limited.

For example, you will not be able to deposit or withdraw cash from your savings account through any ATM in Singapore.

You will also not be able to set up GIRO arrangements to debit funds from your account to pay for your bills.

The full terms and conditions can be found here.

Is the GXS Savings Account safe?

GXS holds a banking license issued by the Monetary Authority of Singapore.

As shared earlier, it is backed by two names many of us are familiar with – Grab and Singtel.

Also, all deposits in GXS will be fully covered by the Singapore Deposit Insurance Corporation (SDIC) up to S$100,000 per depositor.

Final verdict on GXS

The GXS Savings Account allows you to earn an interest rate of 1.18% p.a. in a fuss-free way.

You just need to make sure your money is in the Saving Pockets rather than the Main Account.

You can also choose to lock in the rate of up to 1.30% p.a. for 1, 3, 8 or 12 months with Boost Pockets up to S$85,000.

The interest rate offered is higher than that offered by some other savings accounts such as Maribank that do not require you to jump through any hoops.

However, there are limited functions available to customers currently as a digital bank.

If you're looking for another fuss free option, the UOB Stash account can be one to consider as it has an effective interest rate of 1.50% p.a. on a S$100,000 balance.

Not to mention, there is also the UOB Leap of Fortune Savings Promotion, where you can earn up to S$340 in guaranteed cash.

To find out which savings account allows your money to work harder, check out our guide to the best savings account with highest interest rates in Singapore.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights on growing your wealth.

Find out which savings account allows you to earn the highest interest rate on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions