MariBank Savings Account: Earn 0.88% p.a. on your cash

Savings Account

By Beansprout • 01 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

MariBank has lowered its Savings Account rate to 0.88% p.a. as of December 2025. Find out how this change affects your returns and if it’s still worth keeping your cash there.

With competitive interest rates and a straightforward, no-frills approach, MariBank has become a popular option for savers looking to earn more on their idle cash without the need for complicated account conditions or minimum spending requirements.

As of 1 December 2025, the interest rate on MariBank's Mari Savings Account stands at 0.88% p.a.

Let’s take a closer look at MariBank and whether it’s still worth setting up a savings account with them.

What is MariBank?

Owned by Shopee’s parent Sea Group Ltd, MariBank has been progressively rolling out its digital banking services since the third quarter of 2022.

MariBank is a digital bank which currently offers the Mari Savings Account for individual customers, as well as the Mari Business Account and Mari Business Loan for corporate customers.

What is the interest rate on MariBank Savings Account?

MariBank offers the Mari Savings Account that provides customers with an interest rate of 0.88% p.a. as of 1 December 2025.

You will be able to earn this interest rate with no minimum deposit required, no salary crediting, and no minimum spending necessary.

The interest earnings are credited to your account daily, calculated based on the previous day’s balance.

There are no transfer fees and fall-below fees for the Mari Savings Account.

What users may like about the Maribank savings account

#1 - Fuss-free way to earn interest of 0.88% per annum

The key benefit of MariBank is that you do not have to jump through hoops to earn the interest rate of 0.88% p.a.

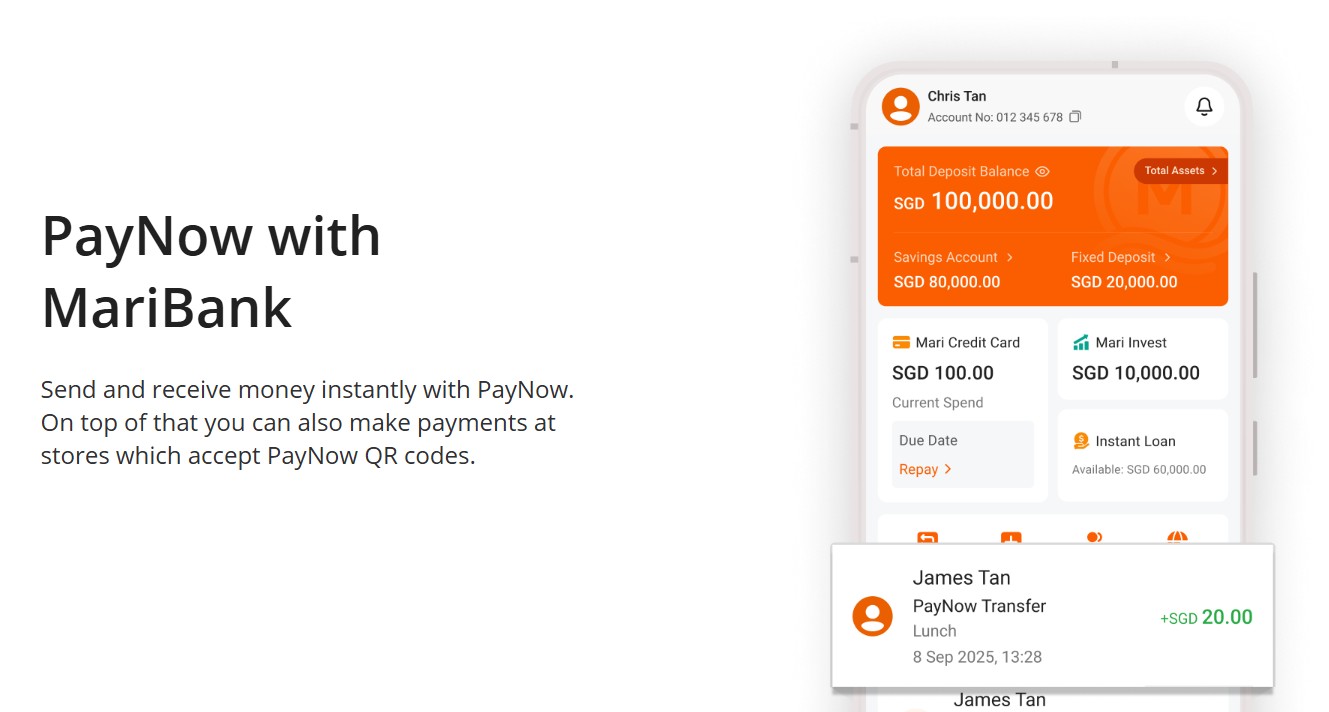

On top of that, you can also use PayNow to send and receive money instantly with your MariBank savings account.

#2 – Account limit raised to S$100,000

Apart from the 0.88% p.a. interest rate, MariBank has also raised the maximum deposit of the Mari Savings account to S$100,000.

This would be inline with the increase in deposit insurance (DI) coverage to S$100,000 per depositor from April 2024.

This means that even if you have a lot of savings, you will only be able to enjoy the interest rate of 0.88% p.a. up to S$100,000 of deposits.

If you have more than S$100,000 of savings, you can check out our guide to the best savings account in Singapore to find out which other savings account allows your money to work harder.

#3 - MariBank Debit Card: Earn Cashback with No Minimum Spend or Fees

MariBank offers the Mari Debit Card, which is automatically issued when you open a Mari Savings Account.

The card lets you spend directly from your savings account with no annual fee and no minimum spend required.

You can also earn unlimited cashback: 0.5% on local spend and up to 4.5% on foreign-currency spend, making it useful for everyday purchases and travel.

#4 - Access to Mari Invest to earn a potentially higher yield

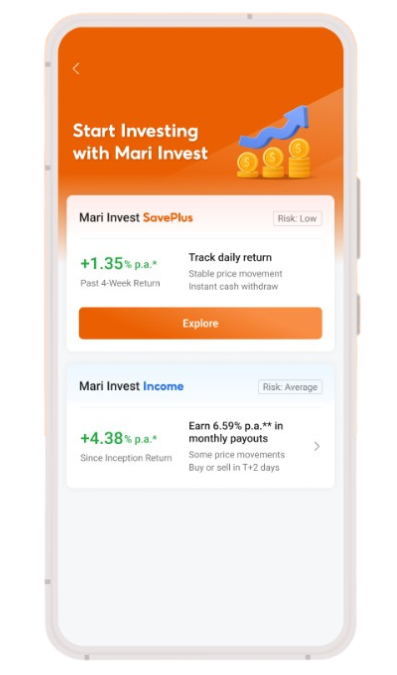

Apart from the Mari Savings Account, MariBank also offers Mari Invest as a low risk way to earn higher projected returns.

Mari Invest is a cash management account which offers access to investment products including the Lion-MariBank SavePlus fund.

Mari Invest aims to provide higher projected returns compared to SGD fixed deposits and greater flexibility in managing your cash.

What I like about Mari Invest is that you can invest from as little as S$1.

You can also receive your cash instantly if your withdrawal is within the current limit of S$10,000 per investor daily, subject to availability.

However, do note that as an investment product, returns are not guaranteed, and historical returns are not indicative of future performance.

Also, the annual management fee of the Lion-MariBank SavePlus Fund was raised to 0.25% p.a. from the launch promotional rate of 0.125% p.a.

This is higher than the expense ratio of the Fullerton SGD Cash Fund of 0.15% p.a.

To learn more about how Mari Invest compares to other cash management accounts, read our guide to the best cash management accounts in Singapore.

What users may not like about MariBank

#1 - Limited functions currently

As a newly launched digital bank, MariBank currently has fairly limited product offering for customers.

MariBank has no physical bank branches or ATMs located in Singapore.

How does MariBank compare to GXS Bank and Trust Bank

In case you’re wondering how does MariBank compare to GXS bank and Trust Bank, I've compiled them in the table below.

MariBank's interest rate of 0.88% p.a. is lower than the interest rate offered by GXS Savings Account without any additional requirements.

Trust Bank offers a higher interest rate of up to 2.50% p.a., but you’ll need to meet requirements such as salary crediting, investing, and referring a credit card customer.

| MariBank | GXS Bank | Trust Bank | |

| Savings account interest rate | 0.88% p.a. | 1.08% p.a. with Main account Up to 1.38% p.a. with Boost Pockets | Up to 2.50% p.a. |

| Maximum deposit | S$100,000 | S$95,000 | Maximum deposit of S$1.2 million. Maximum interest rate of 2.50% only earned on Flex Plan with salary credit, investment and card referral. |

| Eligibility requirements |

|

|

|

| Benefits | 4.5% Cashback on overseas spend and 0.5% unlimted cashback with Mari Debit Card | Earn 2% back in GrabRewards points for eligible overseas transactions on the Grab app with GXS Debit Card | Promotional discounts on FairPrice Group spending |

| Physical branches and ATMs | Nil | Nil | 20 ATMs islandwide |

| Source: Company websites as of 1 December 2025 | |||

Is MariBank safe?

MariBank holds a banking license issued by the Monetary Authority of Singapore.

It is backed by Sea Limited, which many might be familiar with as it is the tech company behind Shopee.

Also, all Singapore dollar deposits in MariBank Savings Account will be fully covered by the Singapore Deposit Insurance Corporation (SDIC) up to S$100,000 per depositor.

What are the eligibility requirements for the MariBank Savings Account?

The eligibility criteria for opening the Mari Savings Account is to be a resident in Singapore and at least 18 years of age.

MariBank now accepts foreigners with valid passes to open a Mari Savings Account.

The full terms and conditions of the Mari Savings Account can be found here.

You can also find the frequently asked questions here.

How do I sign up for the MariBank Savings Account? A step-by-step guide to opening a MariBank Savings Account

MariBank is now open to the public, and we were able to set up a MariBank Savings Account without being a selected Shopee user.

You can open an account with these steps:

Step #1 - Download the MariBank app from the Apple App Store, Google Play Store, or Huawei AppGallery

Search for maribank in the Apple App Store, Google Play Store, or Huawei AppGallery, and download the app.

Step #2 - Register for a MariBank account with a valid Singapore mobile number

You can register using a valid Singapore mobile number, or choose to continue with your Shopee/Apple account.

You will then be asked to create a password. The password must be 8-16 characters long, including both alphabets and numbers.

Once you have signed up, you will be able to apply for a MariBank Savings Account using your SingPass.

Step #3 - Open a Mari Savings Account digitally with Singpass Myinfo

Next, apply for a Savings Account using your SingPass.

You will be asked to put in additional details, such as your occupation and annual income.

Once your application has been approved, you will receive a notification.

What would Beansprout do?

The interest rate of 0.88% p.a. offered by MariBank is now lower than the GXS Savings Account, which is offering an interest rate of up to 1.38% p.a..

However, the maximum deposit amount of S$100,000 is higher than that of GXS, which is S$95,000.

If you're looking for another fuss free option, the UOB Stash account can be one to consider as it has an effective interest rate of 1.50% p.a on a S$100,000 balance. Not to mention, there's the UOB Leap of Fortune Savings Promotion, where you can earn up to S$380 in guaranteed cash.

To find out which savings account allows your money to work harder, check out our guide to the best savings account with highest interest rates in Singapore

If you are interested in opening a Maribank account to access Mari Invest, you can learn more about choosing the best cash management account with our comprehensive guide.

Join Beansprout's Telegram group to get the latest insights on savings, investing and retirement planning.

Find out which savings account allows you to earn a higher interest on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions