Keppel REIT in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 15 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about Keppel REIT in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside Keppel REIT.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

Macro Update

- Global equity markets delivered mixed performances, with the S&P 500 declining 0.6% and the NASDAQ falling 1.6%, dragged down by weakness in technology stocks following concerns over AI spending after Oracle’s earnings miss.

- In contrast, Singapore equities outperformed, with the STI gaining 1.2% to reclaim the 4,600 level, supported mainly by Jardine-related stocks and selective blue-chip strength.

- The US Federal Reserve delivered a 25 basis point rate cut as expected, marking its third consecutive cut, after resuming easing in the second half of 2025 following a pause earlier in the year.

- The Fed’s 2026 dot plot suggests only one additional rate cut next year, signalling a more cautious stance compared to market expectations, which still price in two potential cuts based on CME FedWatch data.

- Bond market expectations adjusted accordingly, as investors interpreted the Fed’s guidance as a slowdown in the pace of monetary easing despite continued policy support.

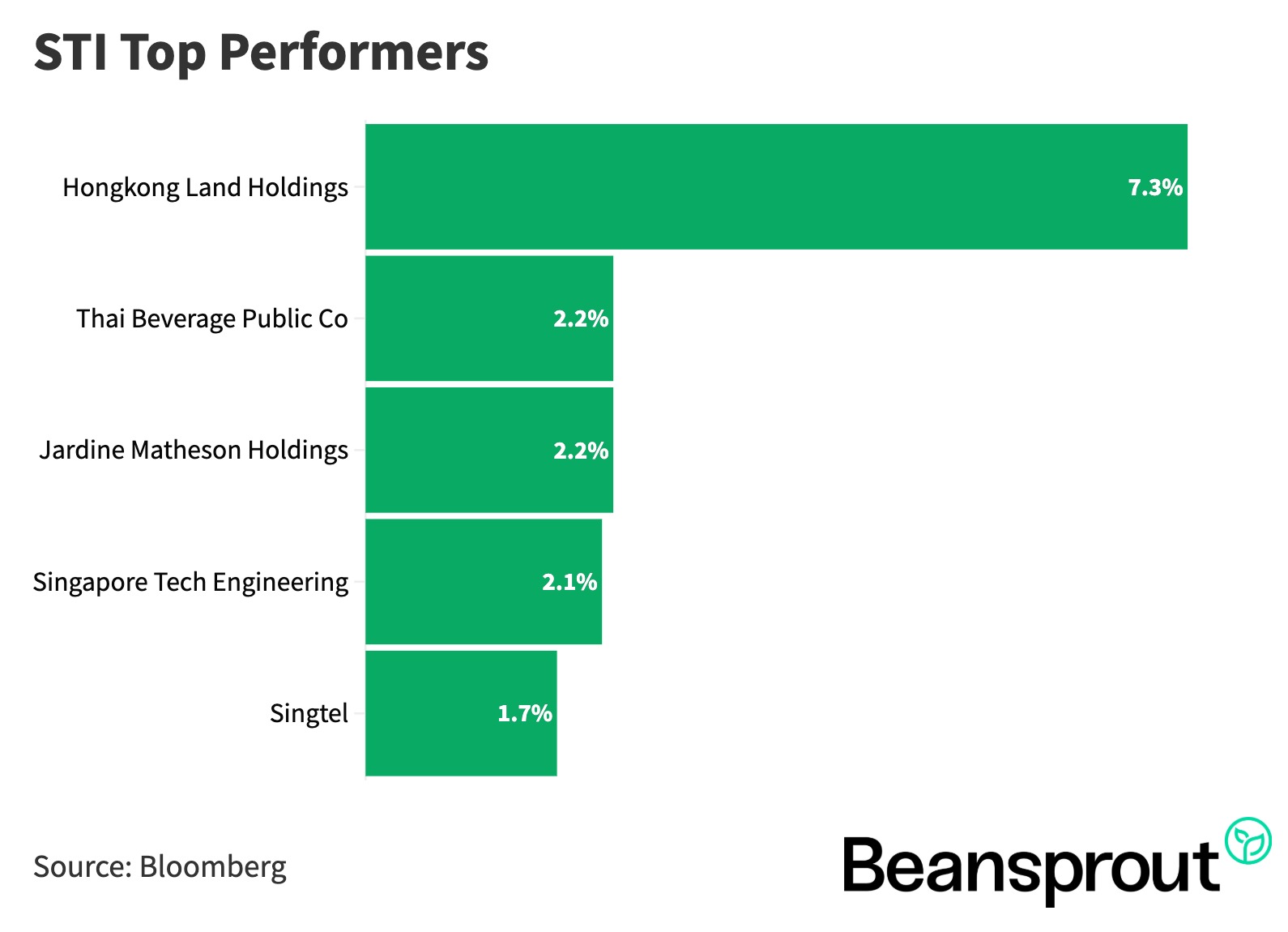

STI Top Performers:

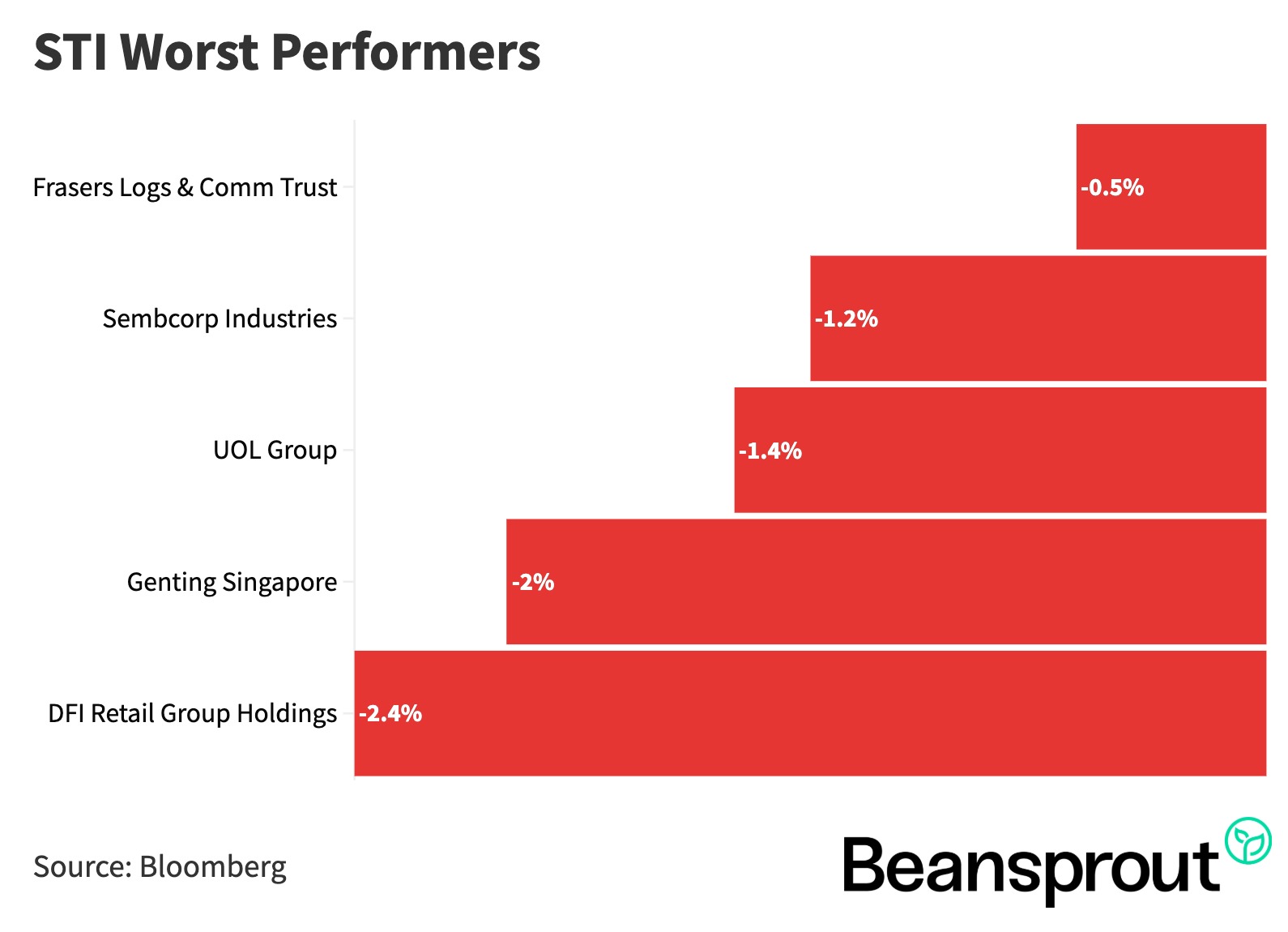

STI Worst Performers:

- Frasers Logistics & Commercial Trust

- Sembcorp Industries

- UOL Group

- Genting Singapore

- DFI Retail Group Holdings

Keppel REIT (SGX: K71U)

- Keppel REIT announced the acquisition of an additional one-third stake in Marina Bay Financial Centre (MBFC) Tower 3 from Hongkong Land, with a total acquisition cost of S$937.5 million.

- MBFC Tower 3 is a 46-storey Grade A office tower located in Singapore’s CBD, with committed occupancy of 99.5% and a tenant mix dominated by banking, financial services, legal and energy-related sectors.

- The agreed property valuation of S$1.45 billion represents about a 1% discount to independent valuation, with valuation per square foot broadly in line with comparable prime CBD assets.

- Passing rents at MBFC Tower 3 are approximately 10% below the Marina Bay average, providing potential upside as leases renew amid limited new office supply in the precinct.

- Following the acquisition, Keppel REIT’s Singapore exposure will rise from 75.8% to 79%, while total portfolio value increases from S$9.8 billion to S$11.2 billion.

- To fund the transaction, Keppel REIT announced a S$886.3 million preferential offering, issuing 23 new units for every 100 existing units at an issue price of S$0.96, a 6.8% discount to VWAP.

- The REIT manager expects a short-term dilution to DPU of 3.6% to 6.4%, while adjusted NAV per unit declines from S$1.24 to S$1.18, which weighed on the unit price post-announcement.

- Post-correction, Keppel REIT is trading at slightly below 0.8x price-to-book, with a dividend yield just under 6%, still above its historical average.

- Key dates for the preferential offering include the opening on 26 December, closing on 9 January, and listing of new units on 19 January.

Related Links:

What to look out for this week

- Tuesday, 16 December 2025: US non-farm payrolls data

- Wednesday, 17 December 2025: US retail sales data

- Thursday, 18 December 2025: US Core CPI data, Singapore 6 Month T-Bill Auction, Bank of Japan meeting

- Friday, 19 December 2025: Bank of Japan meeting

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments