Keppel REIT preferential offering to raise stake in MBFC Tower 3. What should unitholders do?

REITs

By Gerald Wong, CFA • 11 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Keppel REIT has announced the acquisition of an additional one-third interest in Marina Bay Financial Centre Tower 3, as well as a preferential offering to fund the purchase.

What happened?

As interest rates continue to trend lower, Singapore REITs have been buying up assets.

Recently, Keppel DC REIT acquired a Japan data centre, CapitaLand Ascendas REIT expanded its Singapore portfolio, and CapitaLand Integrated Commercial Trust (CICT) acquired CapitaSpring.

It appears that Singapore REITs are pursuing growth opportunities through acquisitions once again.

Following a recent acquisiiton of a suburban shopping mall in Sydney, Australia, Keppel REIT announced that it will buy a one-third stake in Marina Bay Financial Centre (MBFC) Tower 3.

Keppel REIT has also announced a preferential offering to fund the acquisition.

Let us dive deeper into the acquisition to find out how it may impact Keppel REIT’s dividend yield.

Keppel REIT buys one-third stake in MBFC Tower 3

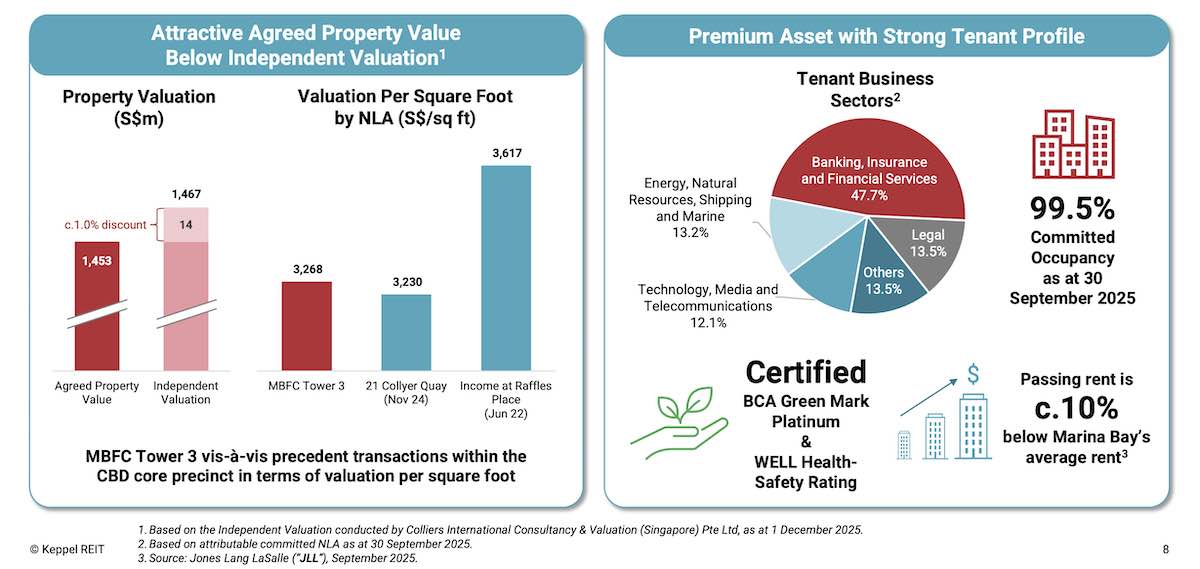

Keppel REIT is acquiring another one-third interest in MBFC Tower 3, raising its total stake to two-third, for S$1,453 million.

The purchase price represents S$3,268 per square feet and 1.0% discount to independent valuation.

The total acquisition cost, S$937.5 million, will be mainly funded by proceeds from a preferential offering announced concurrently.

MBFC Tower 3 is a 99-leasehold premium grade A office asset that forms part of Marina Bay Financial Centre integrated development.

The remaining one-third ownership is held by DBS Bank Ltd, who is also the anchor tenant of MBFC Tower 3.

Of the purchase consideration of S$937.5 million, 94.5% of this will be funded from the rights issue and the remaining 5.5% will be funded by debt.

The transaction is expected to complete by 31 December 2025.

Post transaction, Keppel REIT will own two-third stake in MBFC Tower 3.

MBFC Tower 3 has a high committed occupancy of 99.5%

MBFC Tower 3 is a 46-storey premium Grade A office tower, with a leasehold tenure of 99 years commencing from 8 March 2007, with 80.2 years remaining as at the date of this announcement.

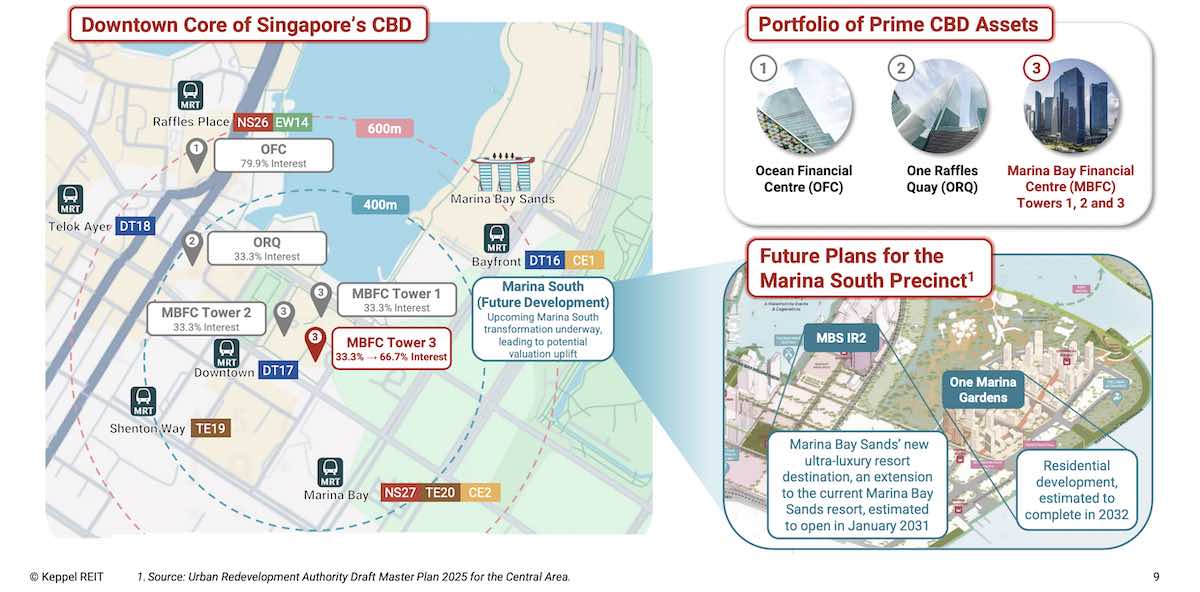

It forms part of the Marina Bay Financial Centre integrated development, which includes three office towers, two residential towers, and Marina Bay Link Mall. The Property is anchored by DBS Bank Ltd.

It is directly connected to Downtown Mass Rapid Transit Station and in close proximity to Bayfront, Marina Bay, Raffles Place, Shenton Way and Telok Ayer MRT stations, ensuring excellent accessibility.

MBFC Tower 3 has a high committed occupancy of 99.5 percent as at 30 September 2025.

Its tenant profile is anchored by DBS, providing income stability and reinforcing the resilience of the portfolio.

The remaining space is leased to a diversified mix of blue-chip tenants across financial services, legal, technology and media sectors.

As at 30 September 2025, MBFC Tower 3 has a weighted average lease expiry (WALE) of 3.5 years by both attributable committed gross rent and NLA.

Passing rent is about 10% below Marina Bay’s average of S$13.49 psf as at 30 September 2025, presenting potential for rental upside and opportunity for future income growth.

Acquisition will expand Keppel REIT’s presence in Core CBD, Marina Bay Area

This acquisition deepens Keppel REIT’s presence in the Marina Bay financial district, increasing its stake in the property to two-thirds upon completion.

With ongoing development in the precinct — particularly the Marina Bay South project — and the Singapore Government’s continued push to strengthen the city’s role as Asia’s financial gateway, the property is well-positioned to benefit from the district’s long-term growth trajectory.

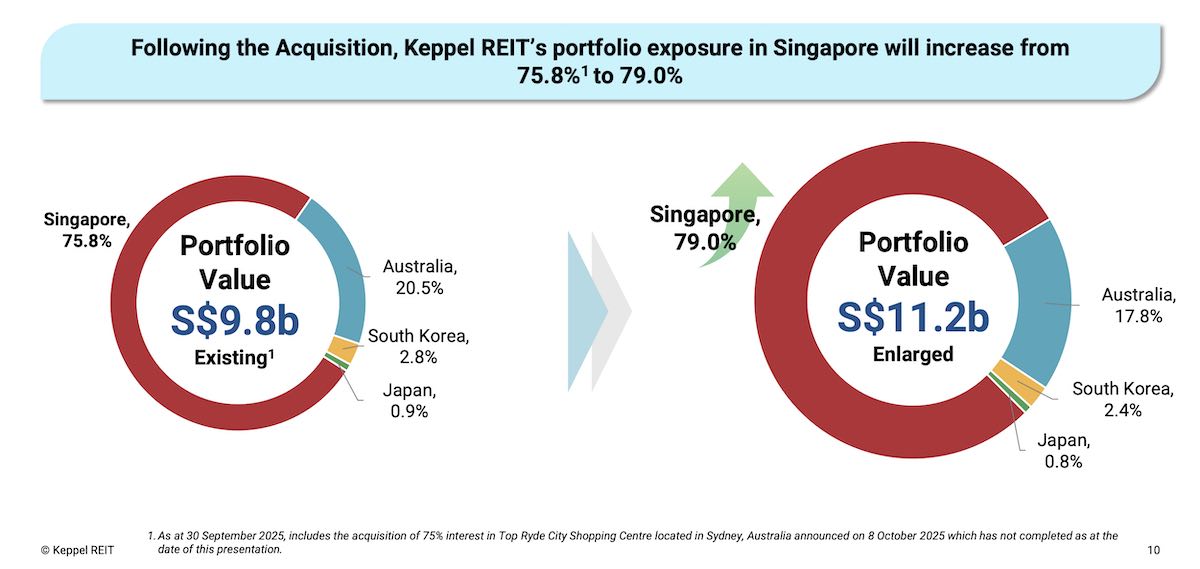

Post-Completion, Keppel REIT’s portfolio exposure in Singapore will increase from 75.8% to 79.0%, reinforcing its status as a leading landlord of prime office buildings in the Singapore CBD.

Keppel REIT is confident on Singapore’s prime office sector

Keppel REIT is committed to grow the portfolio of Grade A commercial assets.

Supportive macro conditions, including improving business confidence across key sectors, easing inflation and a more stable global backdrop, are encouraging firms to expand or relocate.

A lower interest rate environment also helps, reducing funding costs for investors and making it more attractive for companies to secure new or larger office space.

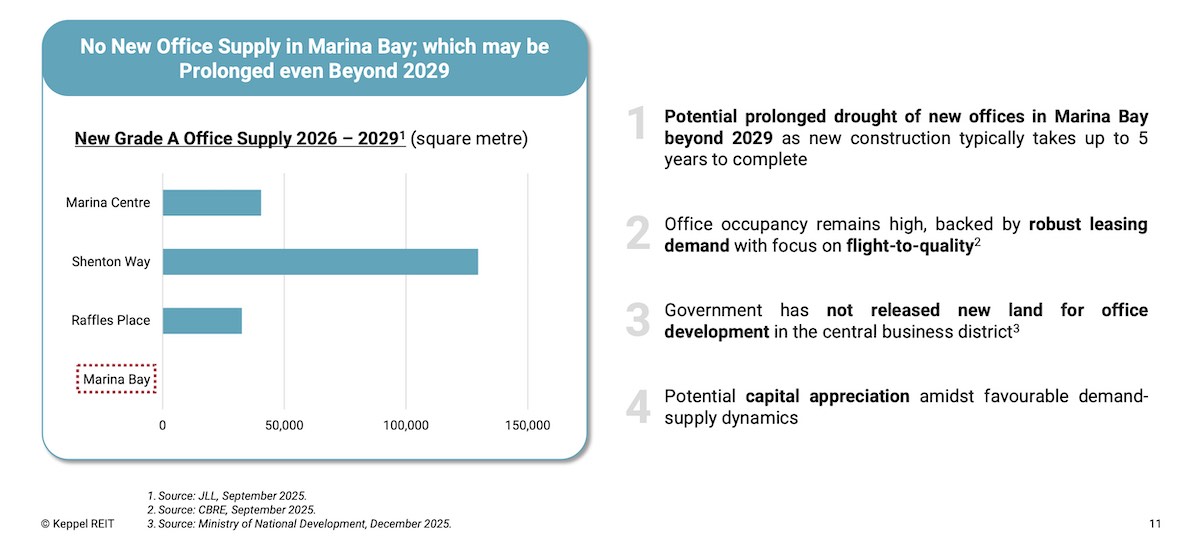

According to CBRE Research, average vacancies for core CBD Grade A office properties have tightened from 6.6% (in 3Q 2024) to 5.1% (in 3Q 2025).

There are no new office projects expected in the Marina Bay area between 2026 and 2029, resulting in prolonged supply constraints

Preferential offering to fund acquisition

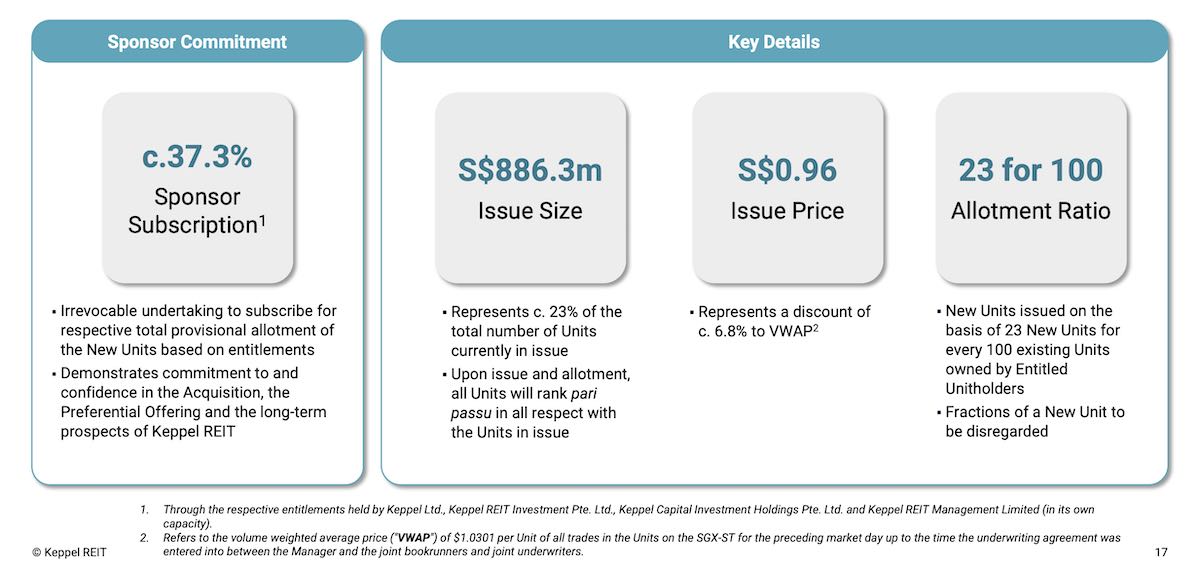

Keppel REIT announced that 94.5% of the total acquisition cost will be funded from an underwritten non-renounceable preferential offering.

The preferential offering set to issue 923.19 million new units at S$0.96 per unit, raising gross proceeds of approximately S$886.3 million.

Entitled unitholders will be able to subscribe for 23 preferential units at S$0.96 each for every 100 units held.

The issue price of S$0.96 represents a 6.8% discount to Keppel REIT's last traded share price of S$1.03 as of 10 December 2025.

At the share of price of S$0.96, Keppel REIT trades at a price-to-book valuation of 0.81x, based on its pro forma book value of S$1.18 (as of 31 December 2024).

Preferential offering expected to be dilutive to distribution per unit (DPU)

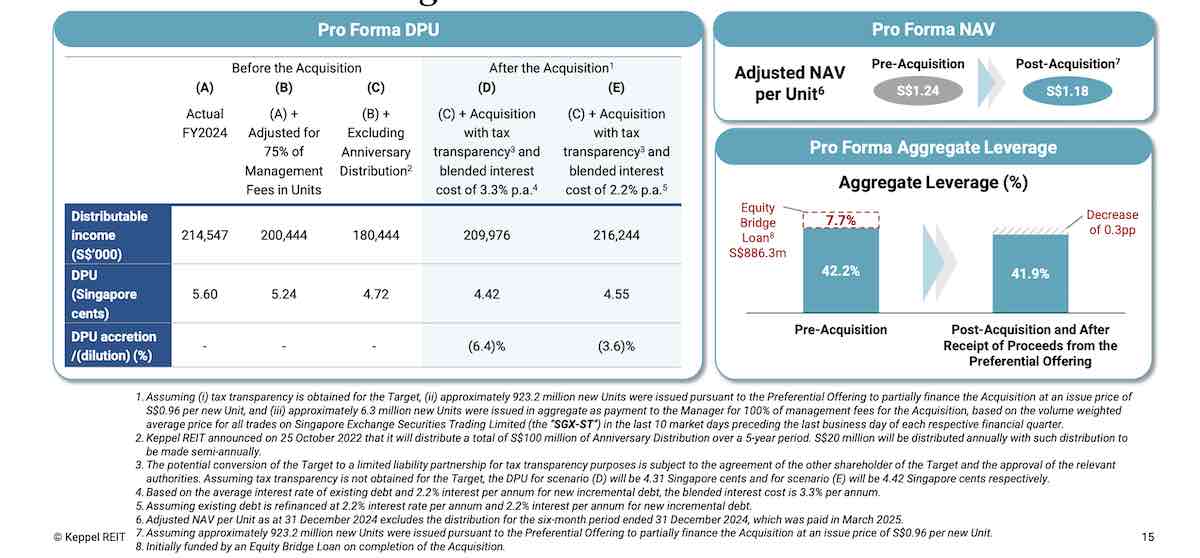

Depending on the blended interest cost, Keppel REIT expects the transaction to be dilutive to Distribution per unit by 3.6% to 6.4%.

In terms of Net asset value basis, the proforma adjusted NAV per unit will decrease to S$1.18 from S$1.24 as at 31 December 2024.

Following the acquisition, the REIT’s aggregate leverage is estimated to decrease slightly from 42.2% to 41.9% as of 30 September 2025.

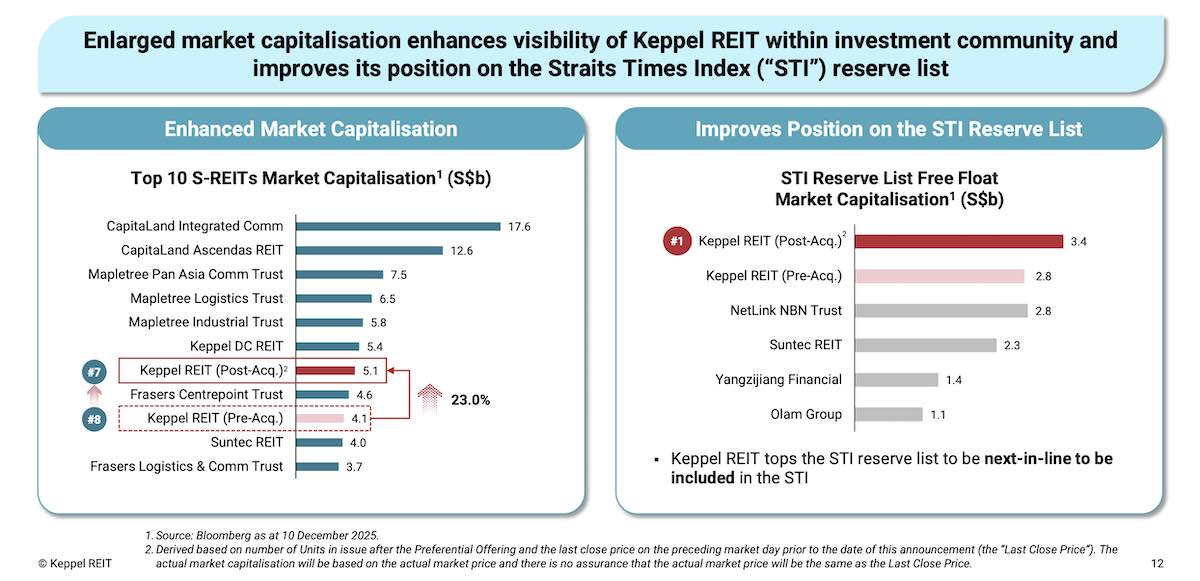

The preferential offering undertaken to partially fund the acquisition will increase Keppel REIT’s market capitalisation by expanding the unit base by approximately 23%.

The enlarged float is expected to improve trading liquidity over time. A larger market capitalisation will also enhance Keppel REIT’s visibility among investors.

With a higher free-float market cap following the offering, the REIT could potentially strengthen its position on the Straits Times Index reserve list.

What would Beansprout do?

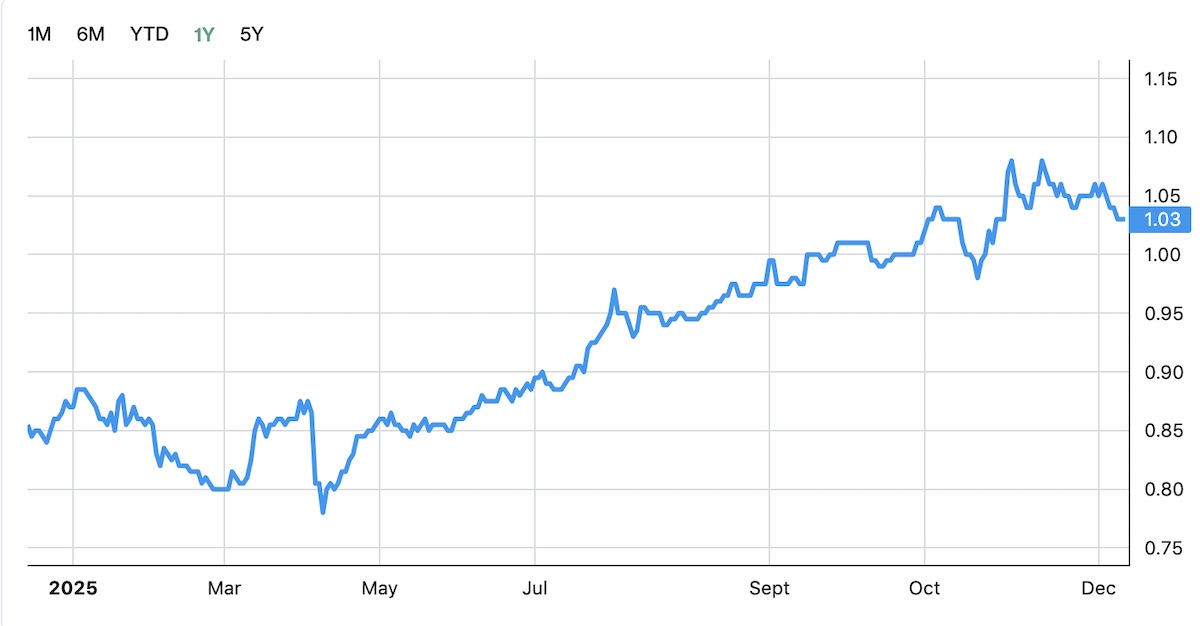

Keppel REIT is one of the best-performing Singapore REITs year-to-date, with a share price gain of 18.4% so far this year.

In our view, this likely reflects increased optimism towards the Singapore REITs sector with lower interest rates, as well as improving fundamentals in Singapore office sector.

According to the management of Keppel REIT, the acquisition of an additional one-third ownership in MBFC Tower 3 is in line with Keppel REIT's focus to grow its premium Grade A office portfolio, and will further strengthen its positioning in the Core CBD, Marina Bay area.

With passing rent at 10% below Marina Bay's average, the asset presents potential for rental upside and opportunity for income growth.

To fund the acquisition, Keppel REIT has announced a preferential offering.

Entitled unitholders will be able to subscribe for 23 preferential units at S$0.96 each for every 100 units held.

The issue price of S$0.96 represents a 6.8% discount to Keppel REIT's last traded share price of S$1.03 as of 10 December 2025.

Unlike most REIT acquisitions which tend to boost their distributions, the transaction is expected to be dilutive to Distribution per unit by 3.6% to 6.4%, depending on the blended interest cost.

This may lower Keppel REIT's dividend yield from 5.4% currently, which is close to its historical average.

The transaction will also lower Keppel REIT's adjusted NAV per unit to S$1.18 from S$1.24 as at 31 December 2024. This may bring its P/B valuation higher from 0.84x currently, which is above its historical average P/B ratio.

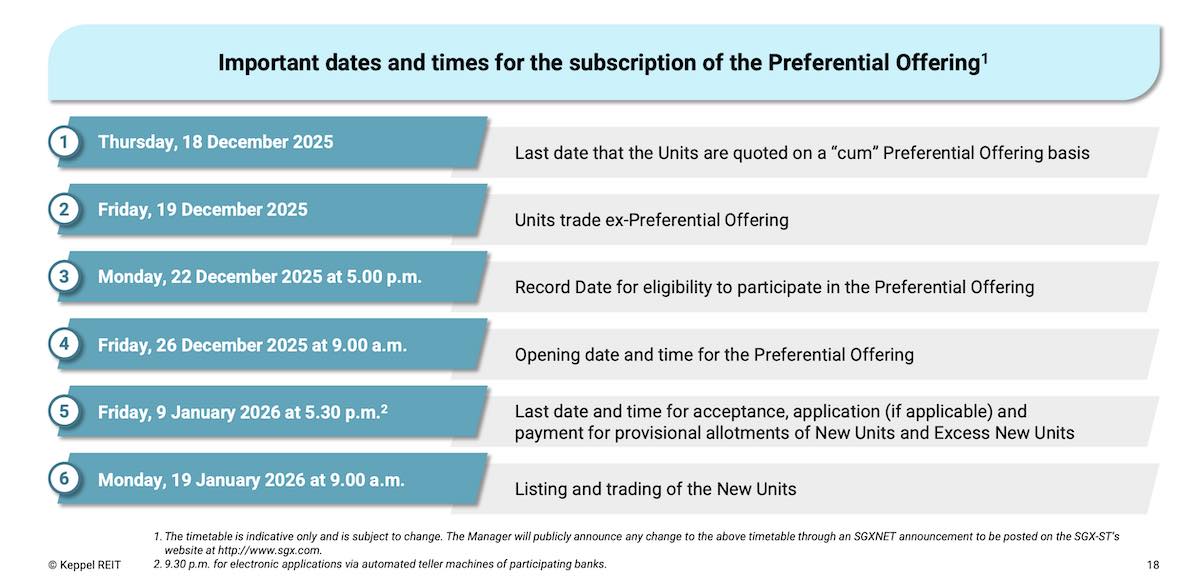

For existing unitholders who would like to apply for the preferential offering, the offer opens on 26 December 2025 (9 a.m.) and closes on 9 January 2026 (5:30 p.m.).

Recently, we shared that Singapore REITs are likely to benefit from falling interest rates.

To screen for Singapore REITs with lowest price-to-book valuation or highest dividend yield, check out our best Singapore REIT screener.

If you are new to investing in Singapore REITs, you can start to learn more about Singapore REITs here.

If you prefer diversification without picking individual REITs, you can also gain exposure through Singapore REIT ETFs.

Related links:

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Keppel REIT.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments