Singapore property sector in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 21 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about the Singapore Property Sector in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside the Singapore Property Sector.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:50 - Macro Update

- US equities rebounded strongly last week, with the S&P 500 up 1.7% to above 6,700, and the Nasdaq gaining 2.1%, led by renewed strength in tech stocks and easing macro concerns.

- Market sentiment improved after President Trump stated that high tariffs on Chinese goods were not sustainable, helping to ease trade tensions that had previously spooked investors.

- Fed Chair Jerome Powell’s comments highlighting downside risks to employment increased expectations of upcoming rate cuts, pushing the 10-year US Treasury yield below 4%, a key driver for equity gains and REIT strength globally.

- The US earnings season kicked off positively, with JP Morgan, Citigroup, and Wells Fargo all beating market expectations, providing further confidence in the resilience of corporate fundamentals.

- In the AI sector, optimism persisted after OpenAI announced a partnership with Broadcom to produce its first in-house AI chips, reinforcing momentum in the tech rally.

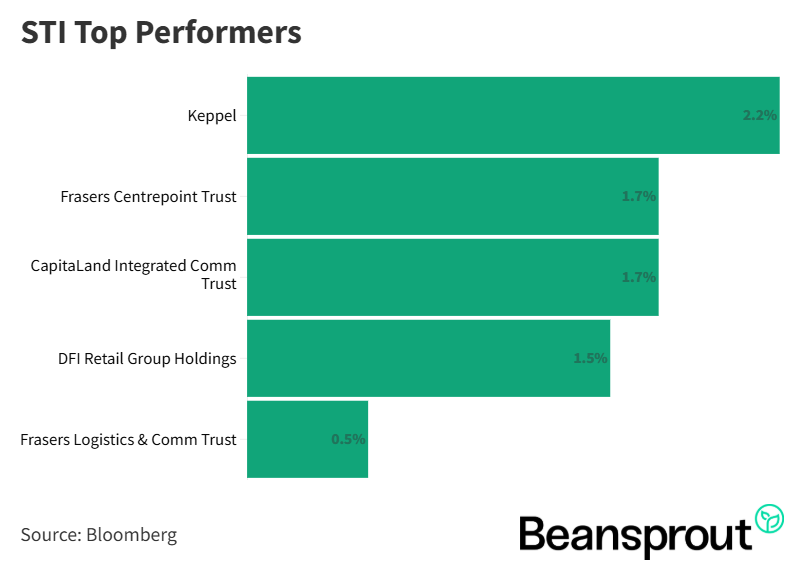

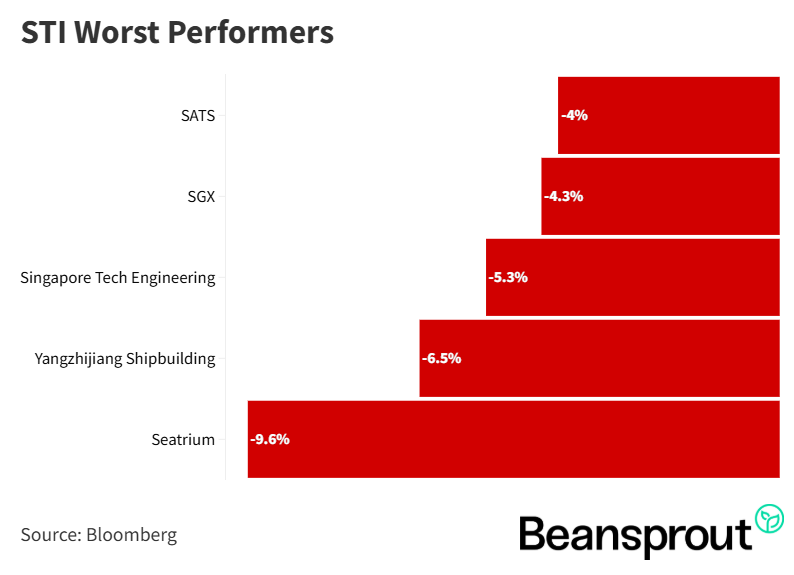

- In Singapore, the STI fell 2.2% as it caught up with prior US losses, but REITs like FCT and CICT rose 1.7% each amid lower bond yields and rate-cut optimism. Meanwhile, cyclical names such as Seatrium, Yangzijiang Shipbuilding, and SATS underperformed, with Seatrium still pressured by prior order cancellation news.

STI Top Performers:

- Keppel

- Frasers Centrepoint Trust

- CapitaLand Integrated Commercial Trust

- DFI Retail Group Holdings

- Frasers Logistics & Commercial Trust

STI Worst Performers:

Singapore Property Sector

- The Singapore property sector has regained strong momentum, with recent new launches achieving over 90% sell-through on opening weekends, reflecting robust underlying demand despite macro uncertainty.

- According to URA 3Q flash estimates, the private residential price index rose 1.2% QoQ, outpacing the HDB resale price index (+0.4%). The core central region (CCR) led gains with a 2.4% increase, followed by the rest and outside central regions, indicating sustained appetite for higher-end homes.

- Transaction activity strengthened notably — about 6,600 private units were sold by mid-September, already surpassing 2Q’s 5,000 units. PropNex projects 8,000–9,000 new private home sales for 2025 (the highest in three years), with resale volumes stable around 14,000–15,000 units and HDB resale volumes between 27,000–28,000.

- The recovery is largely supported by easing borrowing costs, as the SORA benchmark rate declined from ~3% to near 2% year-to-date, improving affordability and confidence for buyers.

- Developers such as GuocoLand (0.5× P/B) and UOL (0.6× P/B) still trade below book value despite solid price recoveries (e.g., UOL up from S$5 to ~S$8 YTD).

- On the agency front, PropNex shares have surged over 100% YTD, with valuations expanding to 21× P/E (versus a 10× historical average), reflecting optimism about sustained transaction momentum and earnings growth in Singapore’s housing market.

Read our analysis on the Singapore Property Sector here.

12:33 - Technical Analysis

- The Straits Times Index (STI) rebounded by over 1.3% on Tuesday after two consecutive weeks of decline, signaling a potential short-term bottom following support at the 50-day moving average (~4,312 points).

- Key support levels are at 4,312 (50-day MA) and 4,300, which previously acted as a double-bottom formation, while resistance lies near 4,474, the year-to-date high recorded in early October.

- Technical momentum indicators are showing early signs of recovery — the MACD’s negative reading is narrowing, suggesting a potential bullish crossover, which could open up a 90–100 point upside.

- The RSI has bounced off the neutral 50-point level, mirroring the behavior seen in late September where similar rebounds led to a renewed rally, reinforcing near-term market resilience.

- Structurally, the STI continues to exhibit an uptrend of higher highs and higher lows, indicating that the broader bullish trend remains intact despite recent corrections.

Learn more about the Straits Times Index (STI) here.

Dow Jones Industrial Average

- The Dow Jones Industrial Average rose 1.12% on Monday, extending last week’s rally and confirming that the uptrend remains intact, with the index now trading above its 20-day moving average at 46,706 points.

- Near-term resistance sits around 47,049 points, the recent high, giving about 50 points of upside before the Dow tests that level again.

- The market’s bullish tone persists despite recent headlines on regional bank bad loans, which appear to be isolated and not systemic. In fact, select regional banks, such as Zions Bank, rebounded roughly 2% overnight, signalling stabilising sentiment.

- The MACD remains slightly negative, though it is converging toward a potential bullish crossover, which could trigger a push to a new all-time high, particularly as US earnings season gains momentum.

- The RSI reading at 59 indicates healthy upward momentum, and a move above 60 would further strengthen the bullish setup, suggesting renewed buying pressure.

S&P 500

- The S&P 500 extended its rebound following the sharp selloff on 10 October, supported by a de-escalation in US-China trade tensions and renewed optimism after President Trump expressed confidence in reaching a trade deal by month-end.

- Trump’s softer tone, rejecting the idea of “100% tariffs” as a lose-lose scenario, helped ease market fears and reignited risk appetite, leading to strong gains in tech stocks, with Apple rising 3–4% overnight.

- The index is now approaching its year-to-date high at 6,764 points, just 10 points shy of resistance. If momentum continues, analysts project the S&P 500 could hit 6,800 soon, with some forecasting a 7,000-point target by year-end.

- Technical indicators have strengthened: the MACD has turned positive after crossing above the signal line, confirming the resumption of an uptrend, while the RSI climbing above 60 signals rising bullish momentum.

- The key support zone lies near 6,576 points, where the 50-day moving average and lower Bollinger Band converge — providing a strong technical floor if short-term pullbacks occur.

Nasdaq Composite Index

- The Nasdaq Composite Index remained the strongest performer among major US benchmarks, now trading roughly 100 points below its all-time high of 23,119, as investors continue rotating into big-cap tech names ahead of earnings.

- Market sentiment is highly optimistic, with traders pricing in another round of above-expectation results from the “Magnificent 7” tech giants, which have consistently driven index gains this year.

- The key support level sits near 22,257 points, aligned with the lower Bollinger Band, a level that has repeatedly triggered strong rebounds over the past two weeks, confirming strong buying support on dips.

- From a technical standpoint, the MACD’s negative reading is fading, signalling that recent pullbacks were short-lived corrections rather than a trend reversal, while the RSI has risen above 60, indicating renewed bullish momentum.

- Structurally, the Nasdaq continues to form higher highs and higher lows, showing that the uptrend remains intact despite transient headwinds from trade and banking headlines.

What to look out for this week

Monday, 20 October 2025: Singapore public holiday

Wednesday, 22 October 2025: Tesla Earnings, Mapletree Pan Asia Commercial Trust Earnings

Thursday, 23 October 2025: 6-month T-bill Auction, Frasers Centrepoint Trust Earnings

Friday, 24 October 2025: iFast Earnings, US CPI Data

Saturday, 25 October 2025: CPF Ready for Life Festival

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments