Centurion Accommodation REIT in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 29 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about the Centurion Accommodation REIT in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside the Centurion Accommodation REIT.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:35 - Macro Update

- The S&P 500 and STI both experienced modest declines over the past week, with investors taking profits after comments from Federal Reserve officials signaled a cautious approach to rate cuts.

- Fed Chair Jerome Powell highlighted challenges from the weak labor market and noted that equity prices appear highly valued, which contributed to the pullback.

- Despite these warnings, market expectations remain optimistic, with investors still pricing in a high probability of rate cuts in October and December.

- Bond yields showed a slight rebound, with the US one-year government bond yield rising to 3.67% and Singapore T-bill yields edging up to 1.44%.

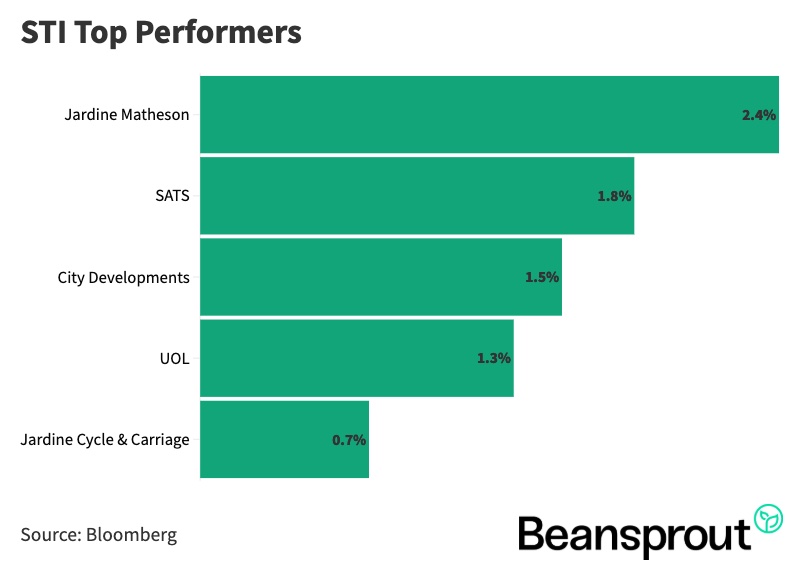

- Jardine group stocks and property developers were among the top performers, benefiting from optimism over lower rates and sector recovery.

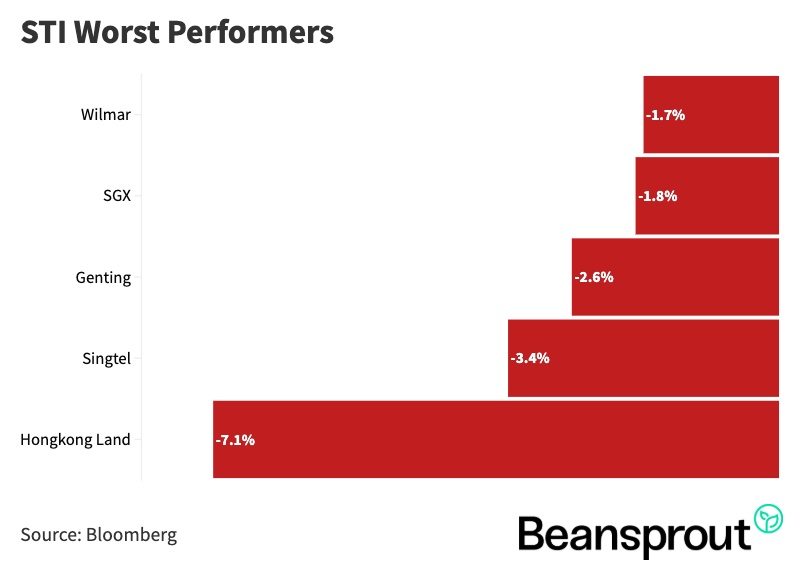

- On the downside, companies that had rallied strongly earlier, such as Hongkong Land, Singtel, and SGX, faced profit-taking and posted notable declines.

STI Top Performers:

STI Worst Performers:

Centurion Accommodation REIT

- Centurion Accommodation REIT, listed last week in Singapore, is a pure-play purpose-built accommodation REIT with an initial portfolio of 14 properties across Purpose-Built Workers Accommodation (PBWA) in Singapore and Purpose-Built Student Accommodation (PBSA) in the UK and Australia. With a forward purchase of one more Australian PBSA asset, the enlarged portfolio will be worth about S$2.1 billion.

- Occupancy rates are strong, at 97.9% for PBWA and 94.1% for PBSA, supported by positive rental reversions and high tenant retention. Market tailwinds include rising demand for foreign worker housing in Singapore (CAGR ~9.7% from 2024–2029) and student housing demand growth in the UK (~6.4% CAGR) and Australia (~6.8% CAGR).

- The REIT has low gearing of 21% at IPO, providing capacity for future acquisitions. The forward purchase of the new Australian PBSA asset, will rebalance the portfolio to about 64% PBWA and 36% PBSA.

- Based on the IPO price of S$0.88, the projected distribution yield is 7.5% for 2026 and 8.1% for 2027, which is higher than comparable peers such as CapitaLand Ascott Trust (6.6%), CDL Hospitality Trust (6.0%), and Far East Hospitality Trust (7.0%).

- Key risks include heavy reliance on two assets that together account for over half of projected 2027 income, as well as significant exposure to Westlite Toh Guan and Westlite Mandai (45% of portfolio value) with leaseholds of about 32–33 years. Another factor is the REIT’s choice to pay management fees in units; if this shifts to cash, it could reduce distributions.

Learn more about the Centurion Accommodation REIT here.

12:06 - Technical Analysis

- The Straits Times Index (STI) has been trending downwards since mid-September and is now testing its 50-day moving average around 4,262 points, which aligns closely with the lower Bollinger Band at 4,256 points, making this a key technical support level.

- Technical indicators suggest continued weakness: the MACD remains in negative territory and the RSI is below the neutral 50 mark, pointing to ongoing downward momentum.

- Historically, the STI rarely dips to the oversold RSI level of 30 except during major shocks, such as the US tariff announcement in April last year, meaning investors should not rely on such a trigger for re-entry.

- At present, neither the MACD nor RSI shows signs of a rebound, but a shift in their trajectory could indicate the start of recovery.

- In the near term, the STI may trade in a range, with support around 4,256–4,262 points and resistance near the all-time high of 4,375 points.

Learn more about the Straits Times Index (STI) here.

Dow Jones Industrial Average

- The Dow Jones Industrial Average (DJIA) saw its first negative week in about three weeks, largely due to profit taking after Fed Chair Jerome Powell remarked that equity markets appear slightly overvalued.

- The pullback was modest, with the index closing last Friday at 46,247 points, but gaining nearly 300 points on the day, suggesting that investors are starting to return in the short term.

- There were no major developments or alarming news driving the decline; it was mainly positioning ahead of the upcoming non-farm payroll data release.

- Technical indicators show mixed signals: the MACD is slightly negative to neutral, while the RSI is around 60, indicating healthy momentum and continued strength in the uptrend.

- The broader uptrend of the DJIA remains intact, and there is still potential for the index to retest its recent high of 46,714 points reached on 23 September.

S&P 500

- The S&P 500 reached a new all-time high of about 6,700 points on 23 September, which is now the key resistance level to watch.

- The index remains above its 20-day moving average, showing that the broader uptrend is still intact.

- The MACD reading is slightly negative to neutral, offering little directional signal at this stage.

- The RSI is at around 62, which reflects healthy momentum and remains below the overbought threshold of 70, leaving room for the rally to continue.

- In the near term, momentum could drive another test of the 6,700 level, with market direction likely influenced by the upcoming non-farm payroll data release on 3 October.

Nasdaq Composite Index

- The Nasdaq Composite reached a new all-time high of 22,801 points last Tuesday but saw a pullback mid-week before rebounding by about 100 points, or 0.44%, on Friday.

- While not at a clear support level, any move below the 20-day or 50-day moving average could present a potential buying opportunity.

- The MACD is slightly positive but has been losing strength over the past four sessions, indicating that momentum in the uptrend is slowing.

- The RSI stands at 63, suggesting healthy momentum and leaving room for further gains before reaching overbought levels.

- Despite recent pullbacks in some tech stocks, the overall uptrend for the Nasdaq is expected to remain intact in the near term, with the upcoming non-farm payroll data likely to influence the next move.

What to look out for this week

Mon, 29 Sep 2025: LionGlobal Short Duration Bond Fund (Active ETF SGD Class) listing

Wed, 1 Oct 2025: Singapore Savings Bond (SSB) application open

Friday, 3 Oct 2025: US nonfarm payrolls data

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments