Singtel in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 08 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about Singtel in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside Singtel.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:55 - Macro Update

- The S&P 500 rose 0.3% while the Nasdaq climbed 1.1%, boosted by strong rebounds in Alphabet and Apple. Singapore’s STI gained 0.9% to a new all-time high of 4,307 points.

- US jobs data for August came in weak, with June figures revised into negative territory for the first time in years, highlighting labor market weakness and fueling hopes for rate cuts.

- Market expectations for a September Fed rate cut surged, with nearly 90% pricing in a 25bps cut and some investors even anticipating a 50bps cut. Further cuts are expected in October and December.

- US 10-year Treasury yields fell sharply to about 4.1% from 4.3% last week, while Singapore’s 10-year yield declined to 1.85% from above 3% at the start of the year.

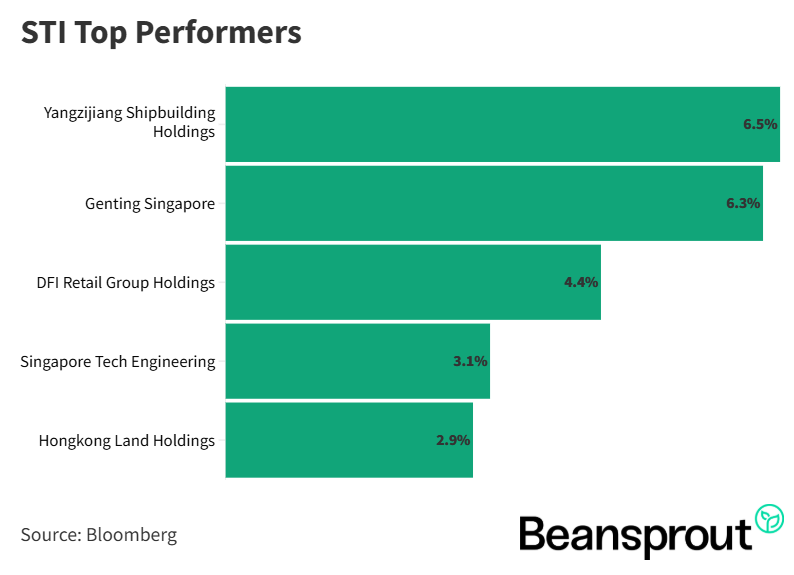

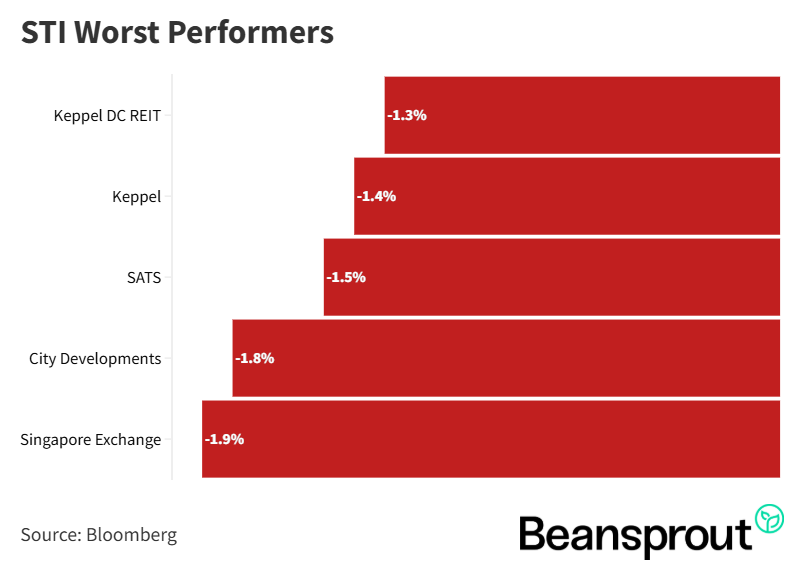

- On the equities front, Yangzijiang Shipbuilding outperformed after securing sizable orders, while SGX and City Developments saw profit-taking following recent strong rallies.

STI Top Performers:

- Yangzijiang Shipbuilding

- Genting Singapore

- DFI Retail Group Holdings

- Singapore Tech Engineering

- Hongkong Land Holdings

STI Worst Performers:

Singtel

- Singtel has been a strong STI driver in 2025, with its share price rising from about $3.20 at the start of the year to $4.40 currently, supported by solid operating momentum and investor confidence.

- At its recent investor day, management reaffirmed progress on the Singtel 28 strategy, with operating profit growing around 10% year-on-year in 1Q FY26, helped by margin improvements and cost savings.

- Capital recycling remains a core lever, with $4 billion already realized out of a $9 billion target. This underpins a $2 billion inaugural share buyback program and provides flexibility for future growth investments.

- Underlying net profit grew 11% in FY25 to $2.5 billion, and the positive trend has continued into FY26. Dividends rose to 17 cents per share in FY25 (including 4.7 cents value realization dividend), marking the fourth consecutive year of growth and more than doubling payouts since FY2021.

- Growth drivers extend beyond its core telco operations (Singtel and Optus) to include NCS and its expanding data center business, alongside stable contributions from regional associates.

- Singtel raised its FY25 dividend to 17 cents per share, including a 4.7-cent value realization dividend, marking the fourth consecutive year of growth.

- With a healthy $4.3 billion cash balance, strong asset recycling pipeline, and consistent dividend growth, Singtel is positioning itself as a resilient cash flow generator while unlocking shareholder value through dividends and buybacks.

Related links:

11:09 - Technical Analysis

- The Straits Times Index (STI) broke out of its earlier range-bound consolidation to set a new all-time high at 4,320 last Friday, and is holding above 4,300 in early-week trading.

- Key support lies around 4,191–4,194, where the lower Bollinger Band and 50-day moving average converge, while 4,250 acts as the pivot level to watch.

- MACD has turned slightly positive in recent sessions, though its flat trajectory suggests a mild uptrend rather than a strong breakout.

- RSI stands at 67, nearing overbought levels, signaling that a technical pullback may occur before the next leg higher.

- Overall, the index is expected to continue trending near the upper Bollinger Band, with support at 4,200 and resistance around 4,300+.

Learn more about the Straits Times Index (STI) here.

Dow Jones Industrial Average

- The Dow hit a new all-time high of 45,770 last Friday following the US non-farm payroll release but later closed lower, reflecting growth concerns over inflation worries.

- Current trading remains within Bollinger Bands, with the upper bound at 46,014 and lower bound at 44,147, while the 50-day moving average at 44,638 serves as the first key support.

- MACD turned negative after the weak payroll data, reinforcing expectations of a range-bound setup pending further macro clarity.

- RSI is neutral at 57, indicating mild positive momentum but no immediate breakout signals.

- Near-term, the Dow is likely to oscillate between 44,600 support and 46,000 resistance, awaiting direction from upcoming CPI and PPI data.

S&P 500

- The S&P 500 reached a fresh all-time high of 6,532 last Friday before easing to close near 6,481, up 0.6% for the week.

- Despite September’s historically weak seasonality, the strong start suggests downside may be limited, potentially setting the stage for a year-end rally.

- The 20-day moving average at 6,444 and lower Bollinger Band around 6,350–6,367 provide solid support levels for accumulation.

- MACD has shown slight negative readings over the past two weeks but without significant deterioration, consistent with consolidation.

- RSI at 58 remains above neutral, suggesting that while range-bound action continues, the uptrend is intact with upside capped at 6,532 resistance.

Nasdaq Composite Index

- The Nasdaq set a new all-time high of 21,878 last week before retreating to 21,700, supported by the 20-day moving average at 21,510.

- Stronger support sits near 21,000, where the 50-day moving average (21,066) and lower Bollinger Band (21,147) converge.

- MACD has stayed negative for two weeks, reflecting ongoing macro concerns and heightened volatility in tech-heavy names.

- RSI is neutral at 59, but the 14-day RSI trend is pointing lower, adding pressure on momentum.

- A Fed rate cut in September could act as a catalyst for renewed upside, but absent that, risks skew toward a pullback to 21,000 support before another advance.

What to look out for this week

- Monday, 8 September 2025: CapitaLand India Trust Ex-Dividend

- Tuesday, 9 September 2025: OUE Ex-Dividend

- Wednesday, 10 September 2025: US CPI Data

- Thursday, 11 September 2025: Singapore 6-month T-bill Auction

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments