Stocks rally to all-time highs: Weekly Market Recap

By Gerald Wong, CFA • 14 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Stocks rally to new highs while bond yields fall further

This week’s Money Diary features Vanessa, who left her six-figure corporate job in healthcare consulting to build her own skincare brand.

Like Vanessa, I also left the corporate world to start Beansprout. What I found refreshing was her view that while money matters, it's not everything. It shouldn't get in the way of enjoying time with family, or creating experiences that truly matter.

It’s a reminder we often come back to: our financial goals should be shaped around the kind of life we want to live. For some, it may be leaving a comfortable job to pursue a dream. For others, it may simply mean having greater peace of mind, and that’s perfectly fine.

With the 6-month T-bill yield falling to its lowest level since early 2022, we explore where you can park your cash by comparing fixed deposits, savings accounts, and the latest Singapore Savings Bond (SSB).

We also take a closer look at the LionGlobal Short Duration Bond Fund (Active ETF SGD Class), Singapore’s first active bond ETF and the first listed share class of an existing fund.

And don’t miss our upcoming webinar on 16 September, where we’ll share how you can earn regular income with a resilient bond portfolio. I look forward to seeing you at the event.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

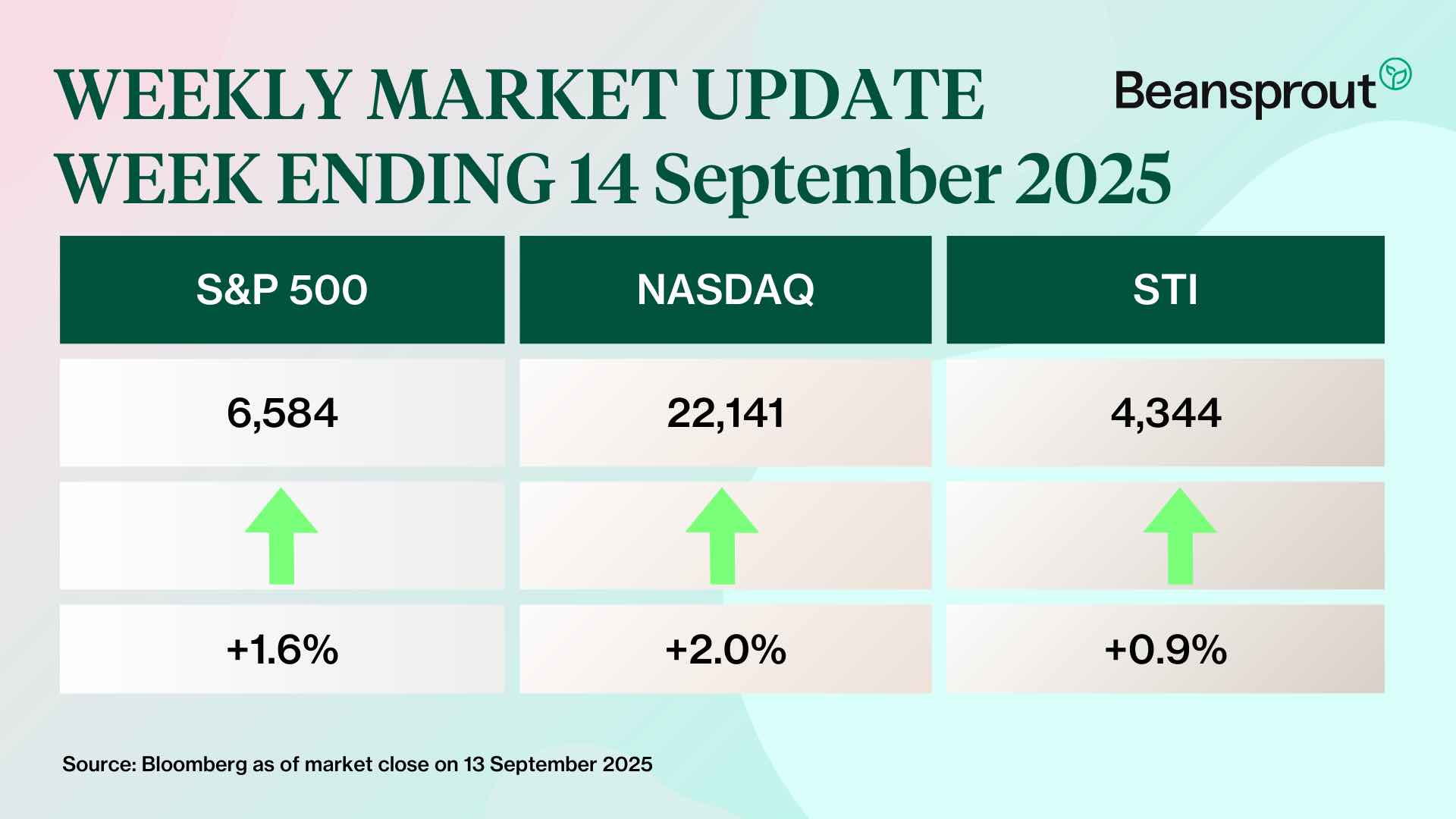

🚀 Record highs

What happened?

US consumer prices climbed 2.9% in August from a year ago, matching market expectations but slightly higher than July’s 2.7% increase.

Core CPI, which strips out food and energy costs, rose 3.1% over the same period.

What does this mean?

With inflation coming in as expected, investors are confident that the Fed will cut interest rates at its upcoming meeting on 16–17 September.

According to the CME FedWatch Tool (as of 13 Sep 2025), markets are almost certain of a rate cut.

There’s even a 7% chance that the Fed could move more aggressively with a larger 0.50% cut.

Why should I care?

The S&P 500 climbed to a new record high as confidence in upcoming Fed rate cuts lifted sentiment.

Tech stocks got an extra boost from the ongoing excitement around artificial intelligence (AI), with Oracle’s strong guidance upgrade adding to the momentum.

In Singapore, the Straits Times Index (STI) also hit a fresh high, supported by gains in REITs as bond yields eased. This was led by CapitaLand Integrated Commercial Trust and CapitaLand Ascendas REIT.

🚗 Moving This Week

- SGX will be launching an index that tracks listed companies that are not constituents of the Straits Times Index (STI), as part of efforts to showcase its broader equity market. STI, the benchmark index for Singapore’s stock market, is made up of the 30 largest companies by market capitalisation. Read more here.

- UOL has entered into an agreement to sell Kinex, a retail mall, for US$375 million. According to the company, the divestment is an opportunity to “unlock the value of its investment in Kinex”, and is part of the group’s ongoing strategy to reconstitute its property portfolio. Read more here.

- APAC Realty has announced that it is proposing a 1-for-5 bonus issue of new ordinary shares to reward shareholders as part of celebrating its eighth year of listing on the SGX Mainboard. Subject to approval, entitled shareholders will receive one fully paid bonus share for every five ordinary shares held, says APAC Realty. Read more here.

Alibaba Investment, a subsidiary of Chinese e-commerce giant Alibaba Group, sold off 151.3 million shares in SingPost for S$64.4 million on Tuesday (Sep 9). The transaction lowers its stake in SingPost to 4.61% from 11.33% previously.

Centurion Corporation shareholders have voted overwhelmingly in favour for the planned listing of Centurion Accommodation REIT at its EGM held on Sept 10. The new REIT’s portfolio will include 14 assets comprising five purpose-built worker accommodation (PBWA) assets in Singapore, eight purpose-built student accommodation (PBSA) assets in the UK and one PBSA asset in Australia.

Apple unveiled its iPhone 17 lineup on Sep 9, featuring its thinnest smartphone ever. Apple kept iPhone prices unchanged from 2024’s equivalent models, and is positioning ultra-thin design rather than larger screens as its new premium selling point.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Where to park your cash for higher yield? T-bills vs Fixed Deposit vs SSB (September 2025)

We share the best ways to earn a yield on your cash through fixed deposits, Singapore T-bills, SSBs and money market funds.

🤓 What we're looking out for next week

- Tuesday, 16 September 2025: Riverstone Ex-Dividend, US Retail Sales Data, SGX Academy webinar: Attractive, Adaptable, Affordable: Triple A Magnetism of A Short Duration Bond ETF – Presented by Lion Global Investors

- Thursday, 18 September 2025: US FOMC Meeting

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments