T-bill yield rises and tech stocks rebound: Weekly Market Recap

By Gerald Wong, CFA • 21 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The Singapore 6-month T-bill yield moved higher while tech stocks bounced

As I was walking along Orchard Road taking in the Christmas lights this week, a familiar question came up in my mind: what’s really happening in retail?

Beyond the headlines about rising rents, it was clear that performance is uneven. Some malls and stores were buzzing, while others looked much quieter. It reminded me that the retail story is rarely one-size-fits-all.

That’s exactly what we unpacked in our recent podcast conversation with Ervin Yeo from CapitaLand Investment. We went beyond the headlines on rising rents, struggling F&B businesses, and mall performance, to understand what’s really driving Singapore’s retail landscape.

As investors, this is a useful reminder that we often need to look past the surface and focus on fundamentals.

The same applies to the Singapore stock market. Despite concerns about an economic slowdown and the perception that it’s a “boring” market, Singapore stocks have performed strongly this year. We explore what’s driving the rally, and why investors may want to reconsider Singapore stocks as part of their portfolios.

As we head towards the end of the year, we also take a look at upcoming CPF contribution changes in 2026. If you’ve already decided to contribute to your SRS, we dive into SRS investment options, including ETFs that can be bought using SRS funds.

Finally, there was some good news for investors parking their funds in T-bills. The latest auction saw yields bounce to 1.48%, edging above the best fixed deposit rates. We also find out if it is worthwhile applying for the current SSB which offers a 10-year average return of 1.99% per year or wait for the next issuance.

As the year winds down and the festive season sets in, it’s a good reminder that investing, like life, is about looking beyond the surface and focusing on what really matters.

Amid the lights and celebrations, it’s a nice time to pause, reflect, and reset. May this season bring not just joy, but also clarity as you plan for the year ahead.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🤓 Mixed economic signals

What happened?

The U.S. economy sent mixed signals this week.

U.S. employers added 64,000 jobs in November, beating expectations of around 45,000 and marking a sharp rebound from the 105,000 jobs lost in October.

However, the unemployment rate rose to 4.6%, its highest level in more than four years.

Inflation data was more encouraging. U.S. consumer price inflation cooled unexpectedly in November, with the CPI rising 2.7% year on year, below market expectations of around 3.1%.

What does this mean?

The cooler-than-expected inflation print was welcomed by investors, with stocks bouncing following the release.

Sentiment was further supported by strong earnings from semiconductor maker Micron Technology, which helped improve confidence around AI-related stocks.

Why should I care?

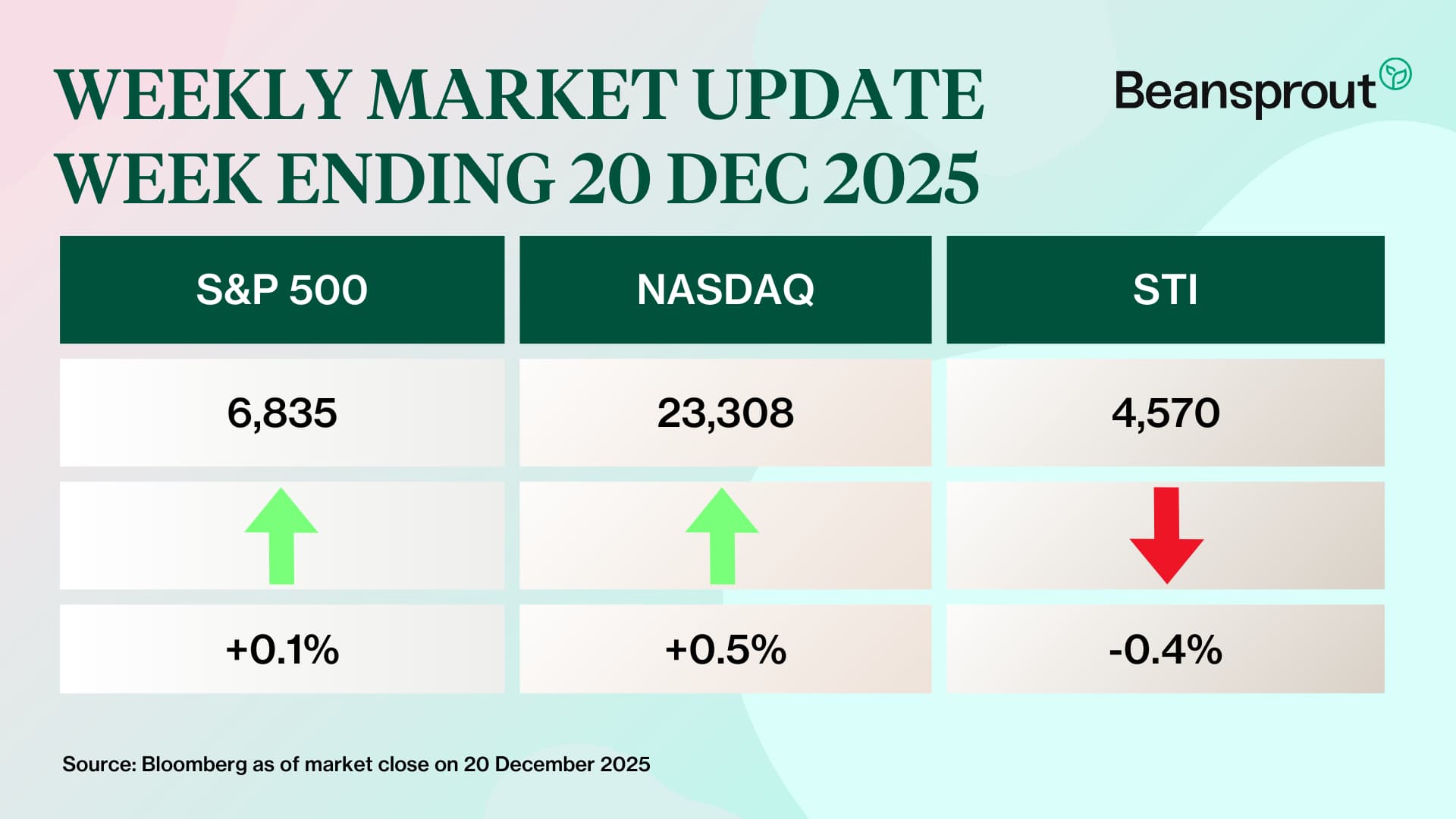

U.S. markets were mixed, with the S&P 500 largely flat, while the Nasdaq Composite edged up.

In Singapore, the Straits Times Index (STI) ended weaker amid profit-taking in Jardine-related names, with Jardine Matheson declining by 3.9% and Hongkong Land declining by 3.5%.

This was partly offset by gains in property stocks, with City Developments rising 8.7%, CapitaLand Investment up 2.3%, and UOL gaining 2%.

🚗 Moving This Week

- Singapore Airlines (SIA) Group reported 2.6% year-on-year growth in passenger traffic in November, slightly outpacing the 2.2% increase in passenger capacity across SIA and its low-cost arm Scoot. Read more here.

- Keppel’s connectivity division has agreed to sell its remaining stakes in two data centres to Keppel DC Reit for S$50.5 million in cash. The divestment covers Keppel’s 10% interest in Keppel DC Singapore 3 and 1% stake in Keppel DC Singapore 4, with the transactions expected to be completed by Q1 2026. Read more here.

- Developers in Singapore sold just 325 new private homes (excluding ECs) in November, a sharp pullback from the exceptional surge seen a month earlier. Sales plunged 86.6% month on month from 2,424 units in October, the year’s monthly high, and were 87.3% lower year on year. Analysts attributed the slowdown largely to the lack of major new launches during the month.

- A mixed-use site at Hougang Central attracted three bids when its tender closed on Tuesday (Dec 16), with a CapitaLand–UOL joint venture submitting the top offer of S$1.5 billion, or S$1,179 per sq ft per plot ratio. The bids exceeded analysts’ expectations of S$800 to S$1,000 psf ppr for the 4.7-hectare site, which will be developed into an integrated project featuring 835 homes and more than 430,000 sq ft of commercial space. Part of the development will sit above Hougang MRT station and be integrated with a bus interchange.

- Unitholders of Manulife US Reit (MUST) have approved a broadened investment mandate, allowing the Reit to expand beyond the US office sector and invest outside the United States. About 83% of unitholders backed the resolutions under the “Growth and Value Up” plan, enabling MUST to invest in industrial, living and retail assets in the US and Canada. The approval also triggers master restructuring agreement concessions from lenders, giving the Reit more time to meet its minimum asset sale targets. Read more here.

- OUE Reit has secured a S$100 million unsecured loan facility, its manager said in a Friday (Dec 12) filing. The funds will support capex, working capital, and general corporate needs, and may also be used to refinance existing unsecured loans and cover related fees. No details on the loan’s maturity were disclosed. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

4 reasons to invest in Singapore now

Singapore’s market hit new highs amid major economic transformation. Explore the growth drivers, income potential, and why investors are paying attention now.

🤓 What we're looking out for next week

- Tuesday, 23 December 2025: US Prelim GDP data

- Thursday, 25 December 2025: Christmas Day

- Friday, 26 December 2025: SSB application closing date

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments