8 ways to invest your SRS to grow your retirement savings

Retirement

By Beansprout • 17 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Discover the best SRS investment options in Singapore for 2025. Compare fixed deposits, T-bills, ETFs, robo-advisors and more to grow your retirement funds.

What happened?

It’s the time of the year where more investors are looking at the Supplementary Retirement Scheme (SRS) once again.

After we shared how to unlock tax savings with the SRS earlier, I saw questions on “what should I actually invest my SRS money in?”

After all, leaving your SRS savings untouched and earning a return of 0.05% per year isn’t going to move the needle for our retirement savings.

That’s when I realised it was worth taking a closer look at how we can make our SRS funds work harder.

In this guide, we break down the different SRS investment options available, and explore how each one can help you grow your SRS savings more effectively, as well as go through the steps on how to go about it.

What is the Supplementary Retirement Scheme (SRS)?

If you are new to SRS, it is a voluntary savings scheme that encourages you to save for retirement while reducing taxable income.

It is basically a complementary scheme to the Central Provident Fund (CPF) system open to Singaporeans, PRs, or foreigners residing in Singapore.

This is done voluntarily and on top of your CPF Ordinary Account (OA) and CPF Special Account (SA) contributions.

The voluntary contributions made to your SRS account are eligible for tax relief, and the funds within your SRS account can be invested in a wide range of financial instruments such as stocks, unit trusts, and exchange-traded funds (ETFs).

If you are new to SRS in Singapore, learn more about it here.

Why invest my SRS funds?

One of the key benefits for using SRS is the tax relief when you top up to SRS.

For Singaporeans and PRs, you can claim up to $15,300 in income tax relief for every dollar you top up into your SRS.

For foreigners, you can top up to S$35,700 a year.

Since you are going to save the money for retirement anyway, why not take advantage of the tax savings while you are at it?

You can use our SRS Tax Savings Calculator to estimate how much tax you can save based on your income bracket and SRS contribution amount.

Just remember to do it before 31 December to enjoy the tax relief for the following year!

Do note that SRS funds do not grow on their own. SRS pays only 0.05% p.a. when left idle.

This is why many consider investing their SRS funds to potentially earn higher returns after you top up your SRS.

8 ways to invest your SRS to grow your retirement savings

There are various investment options available for you to invest the money in your SRS account.

Below are some of the SRS investment options to consider rather than keeping the monies idle in our SRS accounts.

- Singapore Dollar or Foreign Currency Fixed Deposits

- Singapore T-bills or Singapore Government Securities

- Singapore Savings Bonds

- Endowment Plans

- Singapore stocks and REITs

- SGX-Listed ETFs

- Money Market Funds or Bond Funds

- Equity funds tracking US and global equity indices

#1 – Singapore Dollar or Foreign Currency Fixed Deposits

One of the simplest options is to place your money in fixed deposits.

These are typically done directly with the bank that you opened your SRS account with. For instance, if you open your SRS account with DBS, then you can park it in a fixed deposit offered by DBS.

As of December 2025, most major banks offer rates between 1.00% and 1.41% for a 12-month period.

You can find the best fixed deposit rates in Singapore here.

You can also consider fixed deposits in foreign currency (e.g. USD).

Fixed deposits in foreign currency are are subjected to foreign exchange rate fluctuation. For example, you may incur losses if you put your money into USD fixed deposits, and should the USD weaken against the Singapore dollar.

As of December 2025, the best 6-month US Dollar fixed deposit rate we found was 3.90% p.a. offered by RHB, with a minimum deposit of US$50,000.

You can find the best USD Fixed Deposit Rates in Singapore here.

#2 – Singapore T-bills or Singapore Government Securities

Singapore Government Securities (SGS) and Treasury Bills (T-bills) are bonds issued and fully backed by the Singapore Government.

Singapore T-bills have a shorter maturity period of 6 or 12 months, compared to SGS bonds which have a maturity of 2 to 30 years.

In return for lending your money to the Government, you earn an interest payment as a bondholder. The yield you get in return depends on how long the bond matures.

The latest 6-month T-bill offered a yield of 1.41% in the auction on 4 December 2025, while the 1-year T-bill offered a yield of 1.35% in the auction on 15 October 2025.

Learn more about Singapore Treasury Bills (T-bills) here.

#3 - Singapore Saving Bonds (SSB)

Singapore Savings Bonds (SSB) provide you with a simple and low-cost way to generate safe returns.

The biggest difference between SSB and SGS is that SSB offers more flexibility for withdrawal. You don’t get penalized for wanting to withdraw early.

At the same time, if you hold an SSB for the long run, you may get a step-up interest rate every year. In other words, the longer your hold on to the Singapore Savings Bonds, the higher average interest rate you will receive.

The January issuance of the SSB offers a 1-year return of 1.33%, and average 10-year return of 1.99%.

Learn more about Singapore Savings Bonds (SSB) here.

#4 – Endowment Plans

You can use your SRS funds to buy Single Premium Endowment Plans. These are insurance savings plans where you pay a lump sum upfront.

Your funds are locked in for a set period (typically 2 to 3 years), after which you receive a guaranteed payout. They may also include basic insurance coverage, usually for death.

Find out more about Endowment plans here.

#5 - Money market funds or bond funds

If you are looking for a lower-risk option to park your SRS funds while waiting for investment opportunities, you can consider money market funds.

These are a specific type of unit trust that invests in short-term, low-volatility instruments such as bank deposits and high-quality corporate bills.

They aim to provide returns with minimal volatility because of their focus on stability and liquidity.

You can read our guide on the best money market funds here.

For potentially higher returns, you can look at bond funds.

These are also another type of unit trusts where a professional fund manager invests your money into a diversified basket of bonds.

Each bond fund has its own specific investment mandate.

For example, you can find a fund that invests primarily in high-quality, investment-grade bonds, while another might focus on higher-yielding Asian corporate bonds.

This allows you to choose a fund that aligns with your risk tolerance and income goals.

You can read our guide on how to select the best bond funds here.

#6 – Singapore stocks and REITs

If you prefer a hands-on approach, you can pick your own stocks and REITs listed on the Singapore Exchange.

You can easily get started by investing in blue-chip stocks in Singapore, including DBS, OCBC, UOB, SingTel and more.

You can learn more on investing in Singapore REITs here.

#7 - SGX-listed ETFs

Interest in ETF investing is gaining popularity amongst SRS investors.

According to SGX, the combined asset size of SGX ETF holdings directly held by SRS investors has grown 380% from December 2019 to October 2025.

ETFs provide instant diversification as they typically hold a basket of securities representing a particular index, sector, or asset class.

Also, ETFs are typically more cost effectively compared to actively managed unit trusts.

There are many types of ETFs listed on the SGX, such as REIT ETFs, STI ETF, Gold ETF, bond ETFs and more.

Learn more about investing your SRS funds in ETFs for growth and yield here.

Learn how to choose the best ETF as a SRS investor here.

#8 - Equity funds tracking US and global equity indices

Many investors ask if they can use their SRS funds to invest in major US companies or the broader global market.

While you cannot use SRS funds to buy US-listed shares like Apple or Tesla directly, you can still gain exposure through ETFs listed on the Singapore Exchange, or mutual funds available through digital wealth platforms.

For ETFs, the SPDR S&P 500 ETF (SGX: S27) is listed on the SGX and tracks the performance of the S&P 500 index. You can buy this ETF like buying a regular stock through any brokerage that supports SRS investing.

For mutual funds, the Amundi Prime USA Fund and Dimensional Global Core Equity Fund are popular options.

The Amundi Prime USA Fund offers exposure to major US giants. by tracking the Solactive GBS United States Large & Mid Cap Index.

For those seeking broader diversification beyond just the US, the Dimensional Global Core Equity Fund covers developed markets globally, including Europe and Japan.

Some digital wealth platforms also offer pre-built portfolios that offer exposure to global funds.

For example, Syfe offers the Syfe Core Equity100 SRS portfolio. This portfolio wraps several underlying funds, including the Amundi Prime USA and Dimensional Global Core Equity funds mentioned earlier. Learn more about SRS investing with Syfe here.

Which is the best SRS investment option in Singapore?

The best SRS investment option depends on three things: how long you have until retirement, how much volatility you can tolerate, and whether your priority is capital preservation or long-term growth.

Rather than trying to pick a single “best” product, it helps to understand how each option fits into your overall retirement plan.

| Option | Summary |

| SGD or foreign currency fixed deposits | Stability and short time horizon |

| Singapore T-bills or SGS | Stable income with government backing |

| Singapore Savings Bonds (SSB) | Stable income with government income and flexibility |

| Endowment plans | Guaranteed payouts over a fixed period |

| Money market funds or bond funds | Income with typically lower volatility than equity funds |

| Stocks and REITs | Long-term growth and income |

| SGX-listed ETFs | Diversification at low cost |

| US and global equity funds | Long-term global growth |

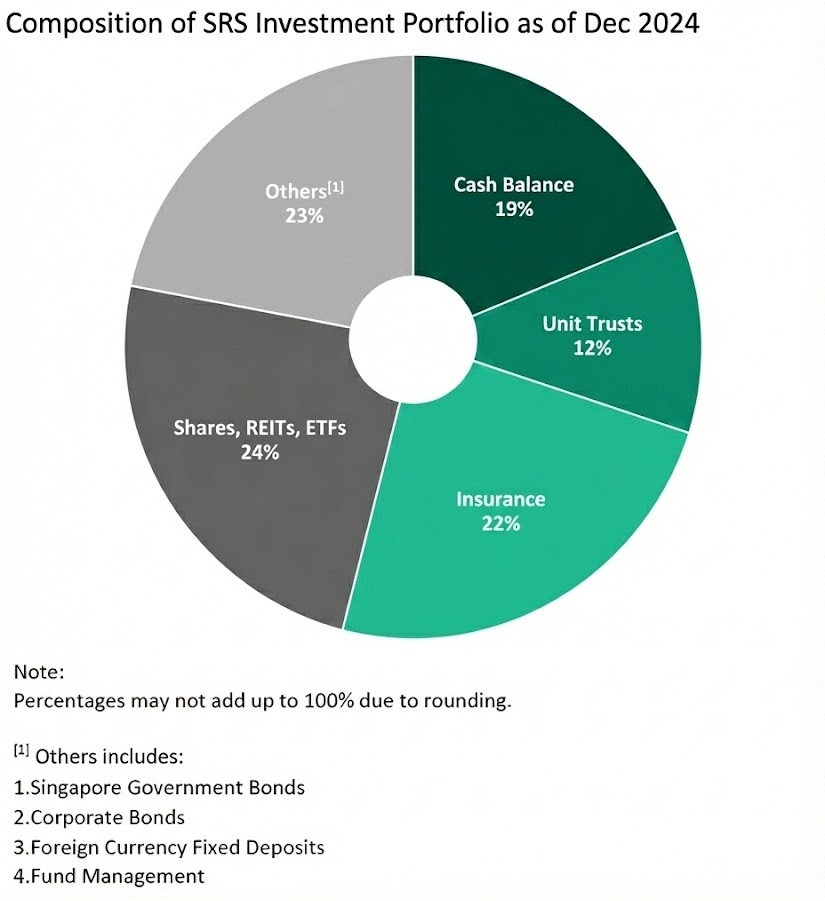

Shares, REITs and ETFs are the most popular option amongst SRS investors, representing 24% of all investments as of December 2024.

This is followed by insurance products, which represented 22% of all investments as of December 2024.

Close to 19% of all SRS funds are kept as cash, earning a return of just 0.05% p.a.

How to invest using SRS funds?

Now that we know what our investment options are, here is the step-by-step process for those who would like to use their SRS funds to invest in stocks or ETFs, mutual funds and unit trusts, as well as in digital wealth platforms.

#1 - Investing in stocks and ETFs

Step 1: Open an SRS-Eligible brokerage account

First, you need a brokerage account that supports SRS trading.

Many investors assume that if they open an SRS account with a specific bank, they must use that bank’s platform to invest. This is a common misconception. You are not restricted to the brokerage of the bank where your SRS account is held.

For example, even if your SRS account is with DBS, you can still use other brokerages such as: OCBC Securities, UOB Kay Hian, POEMS Cash Plus Account, FSMOne, Tiger Brokers to invest your SRS funds.

Step 2: Link your SRS account

Before you can trade, you must authorize the brokerage to pull funds from your SRS bank account.

Simply log in to your brokerage platform and link your SRS account by entering your SRS Operator (bank) and SRS Account Number.

The approval typically takes 1-2 business days.

Step 3: Select "SRS" when placing a trade

This is the most critical step.

When placing a trade, you must change the "Payment Mode" or "Settlement" option from "Cash" to "SRS".

If you forget this step, the trade will be executed using your cash funds instead.

Step 4: Ensure sufficient funds for settlement

Once the trade is filled, the brokerage will automatically request the funds from your SRS bank account.

You do not need to manually transfer cash to the brokerage.

However, you must ensure your SRS bank account has enough balance to cover both the trade amount and any transaction fees.

Compare the best online brokerage and trading platform in Singapore for SRS investing here.

#2 - Investing in mutual funds and unit trusts

Step 1: Choose a platform for unit trusts

Similar to stock investing, you can access mutual funds through online platforms like POEMS and FSMOne. These platforms allow you to pick and choose specific funds yourself.

Step 2: Update your payment details

Once you have an account, navigate to the "Account Settings" or "Bank Information" section of the platform.

You will need to link your SRS account here by entering your agent bank’s name (DBS, OCBC, or UOB) and your SRS account number.

This one-time setup authorizes the platform to deduct funds directly for your fund purchases.

Step 3: Select "SRS" as the funding source

When you search for a fund to buy, pay close attention to the order screen.

You must manually switch the payment mode from "Cash" or "CPF" to "SRS." If the fund is SRS-eligible, the system will process the order and the money will be deducted from your SRS balance automatically.

Compare the best SRS-eligible unit trust platforms here.

#3 - Portfolios through digital wealth platforms

If you prefer a hands-off approach, you can consider investing through digital wealth platforms.

These platforms offer pre-built portfolios that are managed for you, saving you the hassle of researching and selecting individual stocks or funds.

These platforms generally adopt a passive investing approach.

They build diversified portfolios using cost-effective instruments like ETFs or unit trusts to capture market returns over the long term.

Commonly known as robo-advisors, platforms such as Endowus, Stashaway, Syfe, and AutoWealth allow you to invest your SRS funds directly into these managed portfolios. Here is how to get started:

Step 1: Determine your portfolio

You will typically start by completing a questionnaire to determine your risk tolerance and financial goals. Based on your profile, the platform’s algorithm will recommend a personalised investment portfolio for you.

Be sure to select a portfolio that is specifically marked as "SRS" or eligible for SRS funding.

Step 2: Link your SRS account in-app

During the portfolio creation process, the app will prompt you to link your SRS account. You simply need to input your SRS operator and account number.

Unlike traditional brokerages, digital platforms often handle the backend linking almost instantly or guide you through a direct debit authorization.

Step 3: Fund the portfolio

Once linked, you can transfer funds directly within the app. The platform will communicate with your bank to pull the SRS funds, meaning you do not need to log in to your bank portal to make a manual transfer.

You can also set up recurring transfers if you wish to automate your SRS investing monthly.

Read more about the best robo-advisors in Singapore for SRS investing here.

What would Beansprout do?

With so many investment options, choosing the best product for your SRS portfolio can be challenging.

The best SRS investment option depends on three things: how long you have until retirement, how much volatility you can tolerate, and whether your priority is capital preservation or long-term growth.

If you are closer to retirement, SRS investment options such as fixed deposits, T-bill and SGSs, Singapore Savings Bonds, money market funds can offer stability.

If you have a long runway before retirement, growth-oriented options such as stocks and global equity funds can play a larger role in helping your SRS savings compound over time.

For investors looking for a balance between growth and stability, options such as bond funds, Singapore REITs and income-focused ETFs can offer a useful middle ground. They provide regular income while allowing participation in market returns without taking on full equity-level volatility.

For most investors, the goal is not to pick just one option, but to combine a few that balance growth, stability, and diversification within your SRS account.

If you are looking to get started in investing your SRS funds, you can start by finding the best platform for the products you want to invest in:

- Compare the best online brokerage and trading platform in Singapore for SRS investing here.

- Look for the best SRS-eligible unit trust platforms here.

- Find out the best robo-advisors for SRS investing here.

Regardless of which option you choose, the key is to start investing rather than leave funds earning just 0.05% p.a. Even small improvements in returns compound significantly over time.

Are there any ongoing promotions for SRS?

Tigers Brokers SRS Promotion: Receive ~S$20 worth of STI ETF shares (ES3.SI) when you link your SRS account and make your first trade. Learn more about Tiger Brokers’ SRS solutions here.

Syfe Promotion: Earn up to S$1,500 in fee credits when investing in SRS-eligible portfolios. Both new and existing users of Syfe are eligible for this promotion. Valid until 31 December 2025. Learn more about Syfe's SRS solutions here.

Endowus Promotion (New Users): Get S$100 in Endowus Fee Credits by investing at least S$1,000 (via Cash, CPF, or SRS). Valid until 31 December 2025. Learn more about Endowus' SRS solutions here.

Stashaway SRS Promotion (New Users): Get up to 12 months of management fee waivers and a +0.2% p.a. return booster on Simple Plus when you deposit fresh SRS funds. Learn more about Stashaway here.

OCBC SRS Promotion: Enjoy up to S$30 cash reward when you invest a minimum of S$15,000 of your SRS funds into eligible Unit Trusts via the OCBC app using the promo code “BYE25UT”. Valid until 31 December 2025. Learn more about OCBC 360 savings account here.

FSMOne Promotion: Receive up to S$200 worth of cash account credits when you invest SRS monies in Unit Trusts or ETFs. Valid from 1 Nov 2025 to 30 January 2026. Learn about FSMOne here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights on growing your wealth.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments